A Guide to Forex Account Management

Ever heard of forex account management? In a nutshell, it's when you give a professional trader or a firm the green light to manage your currency trading account for you. Think of it like hiring a portfolio manager, but one who lives and breathes the fast-paced world of foreign exchange.

This kind of service is really for investors who want a piece of the forex action but just don't have the time, the deep expertise, or maybe even the desire to be glued to the charts all day.

Understanding Forex Account Management

Let's be real. The global currency market is a beast. It runs 24 hours a day, five days a week, and the constant swings demand a ton of vigilance, market knowledge, and a rock-solid strategy. For most people with jobs, families, and other commitments, that's just not in the cards.

This is exactly where forex account management steps in.

Instead of you spending years trying to master technical analysis and risk management (and likely losing money along the way), you hand those reins over to someone who's already been through the trenches. You still own your account and your funds, but the manager gets permission to execute trades based on their proven strategies. It’s a partnership, really—your capital, their expertise.

The Core Goal of Management Services

At its heart, professional management is all about aiming for consistent, long-term growth while keeping a very close eye on risk. This isn't about "get-rich-quick" fantasies or rolling the dice on high-risk gambles. It’s about bringing a structured, disciplined, and emotion-free approach to trading that, frankly, most individual traders struggle with.

The manager’s job is to navigate the market's ups and downs with a clear plan, protecting your capital when things get choppy and jumping on good opportunities when they pop up.

A service like this is built on a few key pillars:

- Expertise: You're tapping into a professional's years of experience, research, and hard-won strategies.

- Time-Saving: It frees you up from the screen. You can focus on your career, family, or whatever else matters to you, without having to constantly watch the market.

- Emotional Discipline: A good manager trades based on data and a plan, not fear or greed. This alone removes one of the biggest roadblocks for retail traders.

The real magic of a managed account isn't just the potential for profit. It's the application of disciplined, professional risk management—that's the one thing that truly separates the pros from the rest.

Who Is This Service For?

While it sounds great, this isn't a one-size-fits-all solution. It's a particularly good fit for a certain kind of investor.

You might be the perfect candidate if you're a busy professional with capital you want to put to work but have zero time for active trading. It’s also a great option for investors who are new to forex and want to get involved without going through that steep, and often very expensive, learning curve.

Ultimately, a managed account service acts as a bridge. It connects your investment capital to the forex market, using professional expertise as the vehicle. The idea is to find a manager whose skills and strategy align with your financial goals, creating a relationship that’s all about sustainable growth for your account. Once you get this fundamental concept, you can start to figure out if it’s the right move for your portfolio.

How Managed Forex Accounts Actually Work

One of the first questions traders ask is, "How can someone trade my account without actually having my money?" It's a great question, and the answer gets to the heart of what makes modern account management so secure.

Specialized technology creates a fire-proof wall between the manager's trading authority and your actual capital. This setup makes it impossible for a manager to ever touch your funds for a withdrawal. Your money stays safely in an account under your name and your control.

Think of it like being part of a professionally-led convoy. The lead car is the manager's master account—it decides when to accelerate, when to brake, and which turns to take. You're in your own car, following every move instantly and proportionally, but you never hand over the keys. You're always in the driver's seat of your own capital.

This is all made possible by sophisticated allocation technology built into the broker's platform. The two most common systems you'll hear about are PAMM and MAM.

The Role of PAMM and MAM Systems

PAMM stands for Percentage Allocation Management Module. With a PAMM setup, all investor accounts are linked to a single master account that the manager trades. The system doesn't physically pool the money; it just keeps a perfect ledger of everyone's proportional share.

When the manager places a trade, the PAMM software automatically slices that position and distributes it across all the linked accounts based on their percentage of the total capital. So, if your account represents 5% of the manager's total fund, you'll get exactly 5% of the profit or loss from every single trade. It's clean, simple, and completely transparent.

MAM, which means Multi-Account Manager, kicks things up a notch with more flexibility. A MAM system can do everything a PAMM can, but it also gives the manager more granular control. For example, they could assign different leverage settings to different investors or allocate certain higher-risk trades only to accounts that have opted in for that strategy. This makes MAMs a great fit for managers working with a diverse client base.

At their core, both PAMM and MAM systems are built on one crucial principle: the separation of control and ownership. The manager has the authority to execute trades, but you always retain full ownership and final say over your funds. You can add money, withdraw it, or close the account whenever you choose.

You're Always in the Loop

This entire framework is designed to give you, the investor, total transparency. You’re not just sending your funds into a black box and hoping for the best. Far from it.

You can log into your brokerage account at any time and see exactly what's happening in real-time. Most platforms give you a dashboard showing:

- Open and Closed Positions: Watch every trade as it's executed and completed.

- Account Equity: Keep an eye on your account balance as it fluctuates with the market.

- Performance Metrics: Get a clear view of key stats like profit, loss, and drawdown.

This hands-off yet in-control approach is gaining a lot of traction. Brokers are making it more accessible than ever, with some offering managed services for minimum deposits as low as $5 and others starting at $200. These accounts often give you access to 40 to 70+ currency pairs and work on a profit-sharing model. This is a huge plus because it means the manager only makes money when you do—their success is directly tied to yours. To learn more, check out this overview of forex account management services.

Ultimately, these systems foster a secure, accountable partnership. The manager is incentivized to perform at their best, and you maintain complete oversight and control of your capital. It's a win-win.

Comparing Different Forex Management Models

When you dive into forex account management, you’ll quickly realize it’s not a one-size-fits-all proposition. Every model is built around different levels of investor involvement, risk appetite, and capital requirements.

Choosing the right one feels like picking a vehicle for a journey. A sports car might thrill you on an open road, but it won’t handle a weekend getaway with the family.

Models differ in three key areas: control, risk sharing, and start-up costs. Understanding each dimension helps match your expectations to real-world offerings.

- Level Of Control: From fully hands-on to fully passive.

- Risk Allocation: Who manages drawdowns and position sizing.

- Minimum Capital: From hundreds to tens of thousands of dollars.

The primary distinction lies in how your funds are traded and how much influence you retain. Some setups let you steer the ship; others let you ride along.

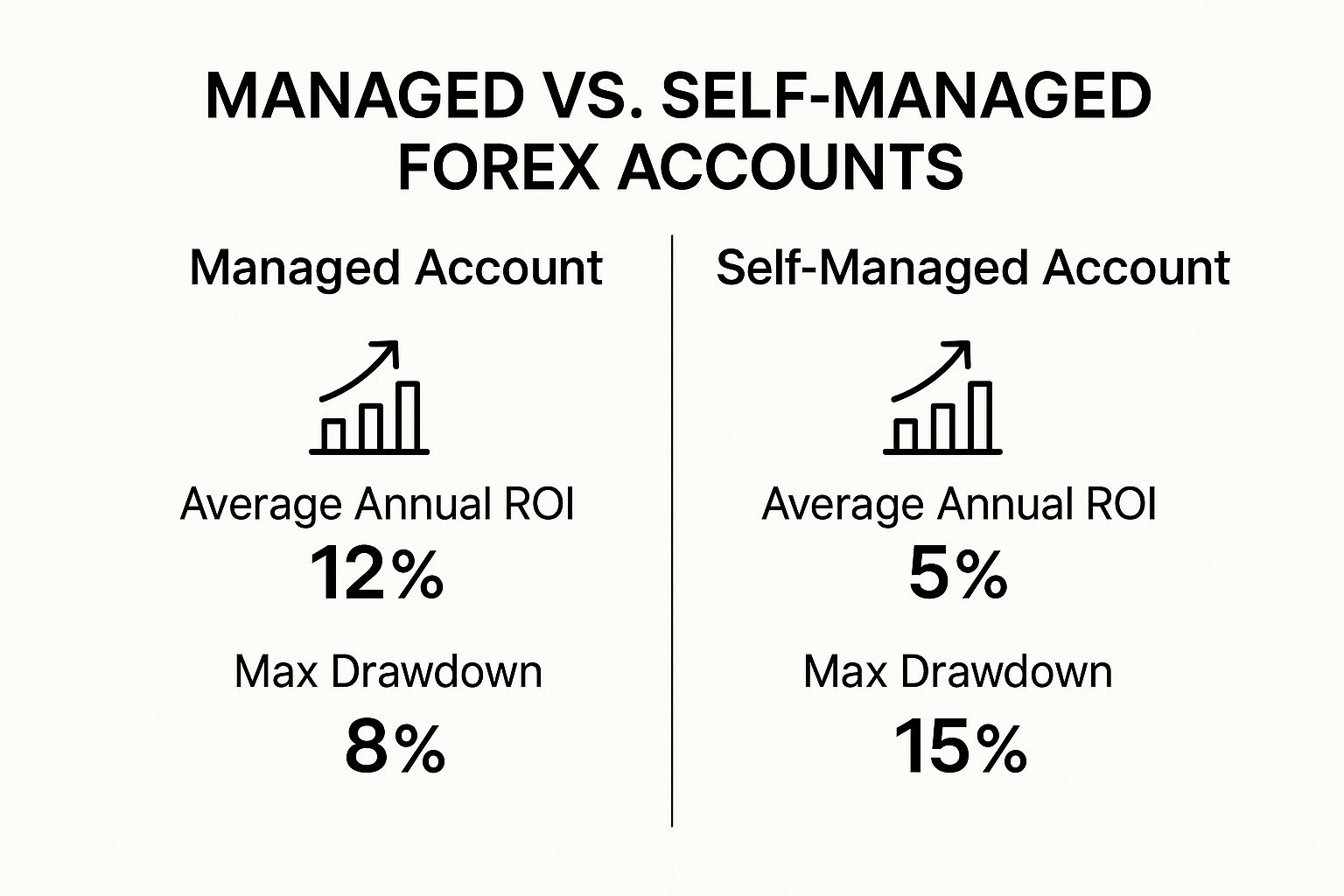

In practice, managed accounts tend to cap drawdowns—sometimes around 4% monthly—while self-directed traders can experience swings of 10% or more. That balance between preservation and performance is often the manager’s focus.

Individually Managed Accounts

An individually managed account is the bespoke option. It’s like hiring a private chef to cook exactly what you enjoy. Here, the manager crafts a strategy just for your goals.

Because only your account (or a handful) is traded, the plan can adapt in real time. Expect detailed reports, full transparency, and a strategy aligned with your risk profile.

- Custom Positioning: Manager adjusts trades based on your directives.

- Real-Time Reporting: Daily or monthly P&L snapshots.

- Minimum Capital: Often starts at $50,000 or higher.

Pooled Management Systems: PAMM and MAM

PAMM (Percentage Allocation Management Module) and MAM (Multi-Account Manager) are the industry workhorses. Picture a guided tour: everyone follows the same expert itinerary.

Your funds join a master pool, and profits and losses are distributed based on your share. This model brings seasoned managers within reach of everyday capital.

- Lower Entry Point: Sometimes just $500.

- Automated Allocation: Profits/losses split automatically.

- Common Strategy: Less customization, but a proven approach.

Many brokers (e.g., MetaTrader 4) support both PAMM and MAM accounts, making it easy to onboard. You can dive deeper into trading styles by reading the 7 forex trading strategies every trader must know.

The core trade-off between individual and pooled accounts is personalization versus accessibility. One model is a tailored suit, and the other is a high-quality, off-the-rack option that suits most people well.

Forex Signal Services

Signal services sit at the other end of the spectrum—hands-off strategy but hands-on execution. You subscribe to alerts, then manually place orders in your own account.

This approach gives you full control and usually comes at a low monthly subscription. However, it demands your time; missing a single alert can swing your results wildly.

- Control: You decide when and how to execute.

- Cost-Effective: Flat monthly fee vs. performance-based charges.

- Responsibility: You’re on the hook for timing and order entry.

Here’s a side-by-side snapshot of how the models compare.

Forex Management Service Models Compared

| Service Type | How It Works | Typical Fee Structure | Best For |

|---|---|---|---|

| Individually Managed | Manager trades one-on-one, crafting a unique plan for your funds. | Performance Fee + Management Fee | High-net-worth investors seeking bespoke strategies. |

| PAMM/MAM | Your capital joins a pooled master account and shares a common strategy. | Performance Fee (Profit Share) | Investors with smaller capital looking for professional management. |

| Signal Service | You get trade alerts and execute them yourself in your account. | Monthly Subscription Fee | DIY traders who want expert ideas but retain full control. |

Each model brings a different mix of involvement, cost, and flexibility. Think about your priorities—drawdown limits, reporting frequency, and capital access—before you commit.

Ultimately, the best forex account management model depends entirely on your personal circumstances. Consider your available capital, how much time you can commit, and whether you prefer a bespoke strategy or a proven, scalable one.

How To Evaluate A Forex Account Manager

Choosing a forex account manager is probably the most important decision you'll make in this entire process. Don't think of it as just picking a service; it's more like hiring a key executive for your financial future. Their skill, discipline, and honesty will directly impact your investment.

You absolutely have to look past the flashy marketing and promises of sky-high returns. The real proof of a manager's ability is in the data—specifically, their verified track record and how they handle risk. This calls for some serious due diligence, where you put on your investigator hat and hunt for hard evidence of consistent, disciplined performance.

Analyze The Verified Track Record

Past performance isn't a crystal ball for future results, but it's the most honest resume you're going to get. A simple PDF or a spreadsheet of numbers just won’t do. Any legitimate manager must provide a third-party verified track record, typically through platforms like MyFXBook or FX Blue.

These services plug directly into the manager’s brokerage account, pulling real-time data that can't be faked. This verification is your guarantee that the numbers are real. Look for a track record that covers at least two to three years. This shows you how they handled different market cycles, not just a lucky hot streak.

When you're digging through their history, look for consistency. A manager who delivers a steady 1-3% monthly return with low volatility is often a much safer bet than someone who hits a 20% gain one month only to lose 15% the next. Consistency is the hallmark of a solid, repeatable strategy.

Scrutinize The Maximum Drawdown

If the track record shows the potential upside, the maximum drawdown shows you the potential pain. This one number tells you the biggest drop the account has ever taken from a peak to a low, shown as a percentage. It's the most direct measure of how much risk the manager is really taking.

A low drawdown, usually under 15%, points to a conservative strategy focused on protecting your capital. A high drawdown of 30% or more signals a high-risk approach. While it might promise bigger returns, it could also vaporize a huge chunk of your account.

Your personal comfort with risk has to match the manager's maximum drawdown. If the idea of your account dropping by 25% would give you sleepless nights, a manager with a 30% drawdown history is the wrong choice, no matter how good their returns look on paper.

Assess Their Trading Strategy And Philosophy

The numbers are only half the story. You also need to understand how the manager gets their results. Any true professional should be able to clearly explain their trading philosophy and methods. You don’t need a PhD in technical analysis, but you should grasp the basics.

Get ready to ask some direct questions:

- What's your core trading methodology? (Is it price action, algorithms, swing trading?)

- How do you manage risk on every single trade? (What's your typical stop-loss size? How do you determine position size?)

- In what market conditions does your strategy thrive? (Trending markets, ranging markets?)

- What’s your plan for unexpected market shocks?

Their answers should be clear, confident, and make logical sense. If they get vague or try to hide behind overly complex jargon, that's a major red flag. A great manager has a defined process they follow religiously, just like a pilot running through a pre-flight checklist. To get an idea of what a structured approach looks like, you can see how to make a forex trading plan in 10 steps and check if their process has similar discipline.

Verify Regulatory Compliance And Transparency

Finally, don’t skip the fundamentals of legitimacy and communication. Is the manager or their firm regulated by a respectable financial authority? It isn't always a requirement, depending on where they are, but regulation adds a crucial layer of security and oversight.

Transparency is equally vital. A good manager provides regular reports, is available to answer your questions, and is open about both the wins and the losses. This ongoing conversation is what builds the trust you need for a successful partnership, ensuring your chosen forex account management professional is truly on your side.

Understanding Risk In Managed Forex Accounts

Let's get one thing straight from the very beginning: forex trading, no matter who is doing it, involves risk. Anyone who tells you about a "risk-free" strategy is selling a fantasy. The goal of professional forex account management isn't to get rid of risk—that’s just not possible—but to manage it smartly, systematically, and without emotion getting in the way.

Imagine a seasoned sea captain steering a ship through unpredictable waters. He can't control the weather or stop a storm from brewing. But what he does have is the skill, the tools, and the discipline to navigate through it, protecting his cargo—your capital—from being lost at sea. At its heart, this is about one thing: capital preservation.

This discipline is built on a foundation of non-negotiable risk management rules applied to every single trade. Amateurs often bend these rules or ignore them completely, but for a professional, they are the bedrock of a long and successful trading career.

Core Risk Management Techniques

Great risk management is a blend of art and science. It combines cold, hard math with a deep, intuitive feel for how the market behaves. A manager's number one job is to make sure that no single trade—or even a string of bad trades—can blow up an account.

This is where a few key practices come into play:

- Disciplined Stop-Loss Orders: Before a manager even thinks about clicking the "buy" or "sell" button, they know exactly where they'll get out if the trade goes south. This stop-loss is a pre-defined, acceptable loss that keeps a small mistake from turning into a financial disaster.

- Calculated Position Sizing: A pro never just throws a random amount of money at a trade. They meticulously calculate the position size based on the account's total equity and the stop-loss distance. This ensures that any single loss only risks a small, controlled percentage of the capital, typically 1-2%.

- Positive Risk-to-Reward Ratio: Professionals hunt for trades where the potential upside is much bigger than the potential downside. They often look for a 2:1 or 3:1 ratio, meaning they aim to make at least two or three times what they're risking on that particular trade.

When you put these techniques together, you create a powerful mathematical edge. Think about it: even if a manager is only right half the time, having a positive risk-to-reward ratio means the account can still grow over the long run. This is what separates professional trading from gambling.

The Psychological Advantage

Beyond the spreadsheets and technical rules, the biggest value a manager offers is psychological steel. The vast majority of retail traders fail not because their strategies are bad, but because they get caught in the emotional whirlwind of fear and greed. They hang onto losing trades for way too long, hoping for a miracle, or they cash out winning trades too early, terrified of giving back profits.

A professional manager operates with a data-driven mindset, completely detached from the market's emotional highs and lows. Every decision is rooted in a tested plan and statistical probability, not a gut feeling or the latest market hype.

This emotional discipline is non-negotiable in a market as massive and volatile as forex. With daily trading volumes exploding from $6.6 trillion in 2019 to an estimated $8 trillion by 2025, the opportunities are enormous. But so are the risks. Studies consistently show that somewhere between 72% and 84.6% of retail traders lose money. Professional management provides the rigid framework needed to survive and thrive in this incredibly competitive arena. You can find more stats that highlight the market's challenges and opportunities.

Ultimately, a complete approach means understanding all the small details that can impact a trade's outcome, like overnight interest charges. You can dive deeper into this topic by reading our guide on what is swap in forex trading. It’s this total commitment to detail that builds a strong defense against the market's inherent uncertainty.

Setting Realistic Performance Expectations

It’s easy to get swept up by “double-your-money” pitches, but real forex account management behaves more like a long-distance climb than a 100-meter dash. You want steady, measured progress—not adrenaline-fueled sprints.

When you team up with a manager, success comes from setting expectations you can live with. Even top-tier systems hit rough patches. A small loss in one month simply reflects the market’s natural pulse—it doesn’t signal the end of the road.

Over several quarters or a full year, you should see an upward trajectory in your equity curve. That patient, big-picture perspective is what turns investors into strategic partners rather than hopeful speculators.

How To Read Performance Reports

Your manager should deliver detailed, periodic reports. Skimming the profit figure is tempting—but real clarity lies in the underlying data.

Key Metrics That Matter:

- Maximum Drawdown: Tracks the deepest fall from a peak to the next trough. A 10% drawdown points to cautious risk-taking; 30% leans aggressive.

- Profit Factor: Total gains divided by total losses. A number above 1.5 usually marks a favorable balance between winners and losers.

- Win/Loss Ratio: The percentage of profitable trades. A high win rate can deceive if your profit factor is weak—you could win 80% of trades and still end up in the red.

A true partnership thrives on informed patience. Your role isn’t to micromanage each entry and exit but to confirm the strategy remains in sync with your goals.

Conducting Productive Check-Ins

Routine, focused conversations keep everyone on the same page. Skip the “Why did we lose that one trade?” trap and zoom out to the strategy level.

Three Questions to Drive the Discussion:

- Has your core trading approach shifted recently?

- How have you adapted to current market volatility?

- Are the original risk limits still comfortable?

By keeping the dialogue forward-looking and process-oriented, you reinforce trust and realistic outcomes. That’s how your forex account management relationship stays profitable—and, importantly, stress-free.

Frequently Asked Questions

When you start digging into professional forex account management, a lot of practical questions pop up. Let's tackle some of the most common ones head-on to give you some clarity.

What’s a Realistic Minimum Investment?

The starting capital for a managed forex account can be all over the place. You'll see some platforms advertising super low entry points, but for a serious, professionally managed service, you should be thinking in the range of $2,000 to $5,000.

Anything less, and a manager just doesn't have enough room to maneuver. That amount of capital allows them to properly diversify trades and apply solid risk management without getting dangerously over-leveraged. For the more exclusive, individually managed accounts offering custom-tailored strategies, the minimums often jump way higher, sometimes to $50,000 or more.

How Are the Management Fees Typically Structured?

This is where forex management really differs from traditional investing. Most services don't charge a flat fee. Instead, they operate on a performance-based model, often called a "profit share" or "performance fee." This is great because it puts the manager's interests directly in line with yours.

The most common setup you'll find is the high-water mark model:

- Performance Fee: The manager takes a percentage, usually between 20-35%, but only from new profits.

- High-Water Mark: This is a crucial feature. It ensures you never pay fees twice on the same gains. Fees are only charged when your account balance pushes past its previous all-time high.

Think about how powerful this is: the manager only makes money when you make money. If your account takes a hit, they have to work to recover all those losses and push your balance to a new peak before they see another dime.

How Can I Verify a Forex Manager Is Legitimate?

This is where you have to do your homework—it's absolutely critical. To protect your investment, you need to verify the credibility of anyone you're considering. A legitimate professional will have no problem being transparent and providing solid proof of their track record.

Here’s a simple checklist to guide you:

- Demand a Third-Party Verified Track Record: Don't just take their word for it. Insist on seeing a performance history verified by a trusted, independent platform like MyFXBook. This confirms the results are real and haven't been cherry-picked or manipulated.

- Check Their Regulatory Status: While not every manager is required to be regulated in every country, oversight from a reputable financial body adds a huge layer of security and accountability. It shows they're serious.

- Seek Out Independent Reviews: Dig around on neutral platforms or trading forums. What are other clients really saying about them? Pay attention to comments on their performance, communication, and overall experience.

Taking these steps is the best way to filter out the noise and partner with a trustworthy pro for your forex account management needs.

Ready to stop guessing and start trading with a clear, proven strategy? At Colibri Trader, we teach traders how to master price action and achieve consistent results without relying on confusing indicators. Explore our action-based programs today and build the skills to trade with confidence.