8 Different Type of Traders: Which Style Suits You in 2025?

Finding Your Trading Identity: Which Market Approach Fits Your Life?

The financial markets offer vast opportunity, but profit demands more than wishful thinking. A winning approach hinges on choosing one of the different type of traders that aligns with your personality, schedule, and risk comfort. Many traders struggle because they pick a style that clashes with daily routines. This introduction will guide novices, intermediates, and seasoned pros toward the right fit from the start.

In this listicle, we break down eight primary trading styles: Day Trader, Swing Trader, Position Trader, Scalp Trader, Algorithmic Trader, News Trader, Options Trader, and Momentum Trader.

What You Will Learn

- Clear definitions and key traits for each trader type

- Timeframes and trade durations matched to your lifestyle

- Risk profiles and capital requirements for smarter planning

- Tools and setups ideal for each trading approach

- Real-world scenarios illustrating each style in action

- Entry and exit techniques specific to your chosen method

- Practical next steps to build and test your strategy

- Resource recommendations to hone your skills efficiently

By the end, you’ll have clear next steps tailored to your preferred timeframe and risk profile. You can then begin building a trading routine that fits your schedule and goals with confidence.

1. Day Trader

Among the different type of traders, the day trader is perhaps the most well-known, often depicted as a high-energy individual glued to multiple screens. The core principle of day trading is straightforward: all positions are opened and closed within a single trading day. This approach means no overnight risk from market-moving news that can occur after hours, but it demands intense focus and rapid decision-making during the market session.

Day traders capitalize on intraday price fluctuations, leveraging technical analysis, chart patterns, and real-time news catalysts to execute multiple trades. They thrive in highly liquid markets like major stocks (e.g., TSLA, AAPL), popular ETFs (e.g., SPY), and major currency pairs (e.g., EUR/USD), where they can enter and exit positions quickly without significantly impacting the price.

Core Strategy and Implementation

A day trader's success hinges on identifying predictable intraday patterns and executing with precision. For instance, a common strategy is trading a stock’s reaction to a major news event, like an earnings announcement or an FDA approval for a biotech company. The trader would use Level 2 data to gauge buying and selling pressure and technical indicators like VWAP (Volume Weighted Average Price) to determine optimal entry and exit points, all within a few hours.

Actionable Insight: Instead of monitoring the entire market, successful day traders often focus on mastering the behavior of just 2-3 specific stocks or assets. This specialization allows them to develop an intuitive feel for an asset's typical volatility, volume patterns, and reactions to market news.

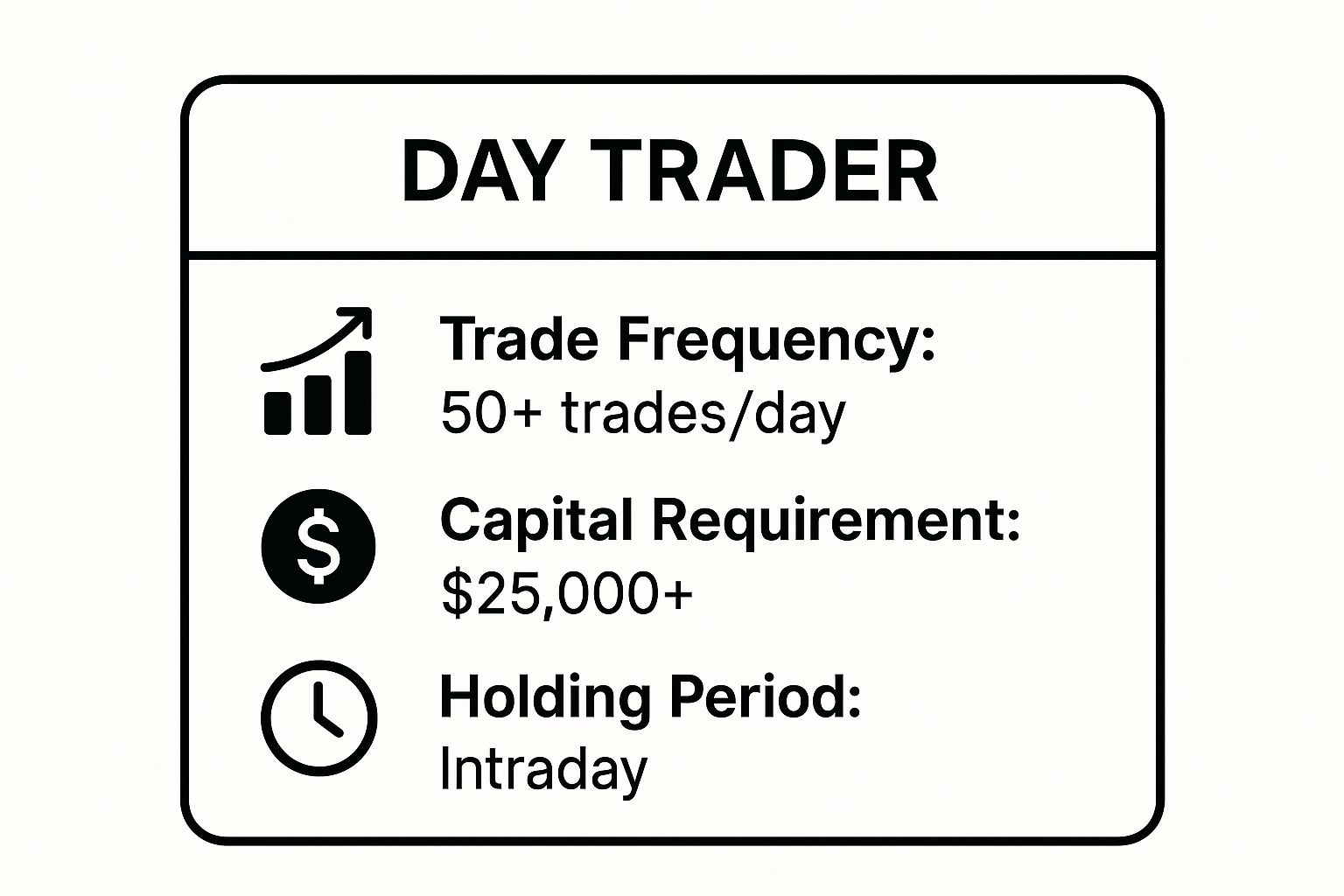

This quick reference infographic summarizes the essential metrics that define the day trading style.

As the data highlights, day trading is a high-frequency activity that requires significant capital, primarily due to the Pattern Day Trader (PDT) rule in the U.S., which mandates a minimum account balance of $25,000 for those executing four or more day trades in five business days.

Who is Day Trading Best For?

Day trading is best suited for individuals who can dedicate several hours of uninterrupted focus during peak market hours. It requires a disciplined, analytical mindset and the emotional resilience to handle both rapid gains and losses without deviating from a strict trading plan. This style is ideal for those who are decisive, technologically savvy, and thrive in a fast-paced, high-stakes environment.

2. Swing Trader

Falling between the high-intensity day trader and the long-term investor, the swing trader is another common type of trader. Their goal is to capture market "swings" that play out over several days to a few weeks. This style requires less screen time than day trading, as decisions are made on higher timeframes, making it a popular choice for those with other commitments.

Swing traders blend technical analysis with fundamental catalysts to identify assets poised for a significant move. They operate in the same liquid markets as day traders but focus on daily or weekly chart patterns rather than minute-by-minute fluctuations. This approach allows them to ride a trend for more substantial gains while still actively managing their positions.

Core Strategy and Implementation

A swing trader’s strategy revolves around identifying a strong trend and entering at a point of consolidation or a minor pullback. For example, a trader might notice an energy stock forming a "bull flag" pattern on the daily chart during a period of rising oil prices. They would enter a long position as the price breaks out from the flag, placing a stop-loss order below the recent low and setting a profit target near the next major resistance level, aiming to hold the trade for five to ten days. For those debating between short-term and medium-term strategies, exploring a detailed comparison can be enlightening; you can learn more about day trading vs. swing trading on colibritrader.com.

Actionable Insight: Successful swing traders maintain a "watchlist" of 10-20 stocks with strong fundamentals and high liquidity. They wait patiently for a specific technical setup, like a moving average crossover or a breakout from a key level, rather than forcing trades in suboptimal conditions.

This disciplined patience allows them to enter trades with a higher probability of success, capitalizing on market momentum without being exposed to overnight risk for extended periods.

Who is Swing Trading Best For?

Swing trading is ideal for individuals who want to actively participate in the markets but cannot commit to full-time monitoring. It suits patient, methodical traders who are comfortable holding positions overnight and can manage the associated risks. This style is an excellent fit for those who enjoy combining technical chart analysis with broader market narratives and fundamental drivers.

3. Position Trader

Of the different type of traders, the position trader operates with the longest time horizon, effectively bridging the gap between active trading and passive investing. Their approach is rooted in a "buy and hold" philosophy, but with a strategic plan for entry and exit. Positions are held for months or even years, aiming to capture substantial moves driven by major economic trends and fundamental shifts.

Position traders largely ignore the day-to-day market noise, focusing instead on the big picture. Their decisions are based on in-depth fundamental analysis, macroeconomic data, and long-term secular trends. They might take a position in an entire sector poised for growth, like renewable energy, or a currency backed by a strengthening economy. Success relies on patience and conviction in their initial thesis.

Core Strategy and Implementation

A position trader's strategy is built on identifying and acting on long-term narratives. For example, recognizing the multi-year trend of digital transformation, a trader might buy a basket of leading technology stocks and hold them through various market cycles. They would analyze company earnings, market share, and long-term growth potential, using monthly or even yearly charts to time their entry and avoid buying into a major downtrend.

Actionable Insight: Instead of tight stop-losses, position traders use wide stops or a "time stop," where they re-evaluate the position if it hasn’t performed as expected after a predetermined period, like six months. This prevents them from being shaken out by normal market volatility while keeping their core investment thesis intact.

This method requires less screen time than other trading styles but demands significant upfront research and emotional fortitude to ride out market corrections.

Who is Position Trading Best For?

Position trading is ideal for patient individuals with a strong analytical mind who prefer a macro, big-picture view of the markets. It suits those who do not have the time to monitor markets daily but are willing to conduct thorough research to build a high-conviction portfolio. This style is best for traders with a long-term mindset, a higher tolerance for drawdown, and the discipline to stick with their strategy through periods of underperformance.

4. Scalp Trader

Among the different type of traders, the scalp trader operates on the shortest possible timeframe, aiming to profit from minimal price changes. Often considered the most intense form of trading, scalpers execute dozens or even hundreds of trades daily, holding positions for mere seconds to minutes. Their goal is not to catch large market moves but to accumulate small, consistent profits by exploiting the bid-ask spread and immediate order flow.

Scalp traders require extreme focus, lightning-fast reflexes, and a deep understanding of market microstructure. They thrive in environments with high liquidity and volatility, such as major forex pairs (e.g., EUR/USD during the London/New York overlap), stock index futures (e.g., ES, NQ), or highly traded stocks like AAPL and TSLA, where they can enter and exit large positions without causing significant price slippage.

Core Strategy and Implementation

A scalp trader's strategy is built on speed and volume. For instance, a scalper might watch the Level 2 order book and time & sales tape for a highly liquid ETF like SPY. Noticing a large buy order absorbing all sell offers at a specific price, they might quickly buy shares, anticipating a small pop of a few cents. They would then sell their position almost immediately as soon as that small upward move occurs, often using hotkeys for near-instantaneous order execution.

Actionable Insight: Successful scalpers treat trading as a game of probabilities and execution, not prediction. They develop rigid, mechanical entry and exit rules based on order flow dynamics and don't get emotionally attached to any single trade. The focus is on a high win rate with small, repeatable gains.

This approach minimizes market exposure but magnifies the importance of low commissions and fast execution, as transaction costs can quickly erode the small profits from each trade.

Who is Scalp Trading Best For?

Scalp trading is best for highly disciplined, decisive individuals who can handle immense pressure and make split-second decisions without hesitation. It demands unwavering concentration and the ability to process vast amounts of data quickly. This style is suitable for traders who are technologically proficient, have access to direct market access brokers, and possess the mental stamina to remain focused for extended periods. It is not for the faint of heart or those who prefer a more relaxed trading approach.

5. Algorithmic Trader

In the modern landscape of different type of traders, the algorithmic trader represents the fusion of finance and technology. Instead of relying on manual execution, these traders use computer programs and complex mathematical models to make and execute trading decisions. This method allows for the analysis of massive datasets and trade execution at speeds unattainable by humans, removing emotion from the decision-making process.

Algorithmic traders, often called "algo traders" or "quant traders," operate across all timeframes. Their strategies can range from simple, rule-based systems (e.g., "buy if the 50-day moving average crosses above the 200-day moving average") to sophisticated artificial intelligence and machine learning models that adapt to changing market conditions. This approach is prevalent in institutional finance, with firms like Citadel Securities and Renaissance Technologies pioneering its use.

Core Strategy and Implementation

The success of an algorithmic trader is rooted in a well-defined, testable, and automated strategy. For example, a statistical arbitrage algorithm might simultaneously monitor hundreds of correlated stock pairs, like Coca-Cola and PepsiCo. When the historical price relationship between them deviates beyond a certain threshold, the algorithm automatically buys the underperforming stock and shorts the outperforming one, betting on their eventual price convergence.

Actionable Insight: Before deploying any capital, an algorithmic trader must rigorously backtest their strategy against historical data. However, it's crucial to avoid "over-optimization," where a model is tuned so perfectly to past data that it fails to perform in live, unpredictable market conditions. Always test on out-of-sample data.

Some of the most sophisticated strategies fall under the umbrella of high-frequency trading, where trades are executed in microseconds to capture tiny price inefficiencies.

Who is Algorithmic Trading Best For?

Algorithmic trading is best suited for individuals with a strong background in mathematics, statistics, and computer programming. It demands a highly analytical, systematic, and patient mindset, as developing and refining a profitable algorithm can take months or even years. This style is ideal for tech-savvy individuals who prefer a data-driven approach to markets and are skilled at translating a trading thesis into functional, automated code.

6. News Trader

Among the different type of traders, the news trader specializes in capitalizing on the volatility created by significant information releases. Their strategy revolves around acting on economic data, earnings reports, political events, and other market-moving announcements. These traders understand that new information can cause rapid, often predictable, price swings, creating brief but lucrative opportunities for those prepared to act decisively.

News traders operate on very short timeframes, from seconds to hours around an event. They focus on assets that are highly sensitive to new information, such as currency pairs during central bank announcements (e.g., USD/JPY during a Federal Reserve rate decision), pharmaceutical stocks on FDA approval news, or technology giants like AAPL during product launches or quarterly earnings calls.

Core Strategy and Implementation

A news trader’s success depends on speed, preparation, and interpretation. For example, when the U.S. Non-Farm Payrolls report is released, a forex trader will have a plan to either buy or sell EUR/USD based on whether the data significantly beats or misses analyst expectations. They will already have their trading platform open, order types decided, and stop-loss levels calculated to execute the moment the numbers are public, aiming to capture the initial price spike.

Actionable Insight: Effective news traders don't just react; they prepare. They use economic calendars to anticipate events and study historical price action from similar past announcements. This preparation helps them predict the likely direction and magnitude of a price move, allowing them to place orders with greater confidence.

Who is News Trading Best For?

News trading is best suited for individuals who can think and act quickly under pressure. It requires a deep understanding of macroeconomic principles and how specific data points impact different asset classes. This style is ideal for traders who are highly organized, stay constantly informed about global events, and have the discipline to follow a pre-defined plan in a highly volatile, fast-moving environment. A calm temperament is essential to avoid emotional decisions when the market moves explosively.

7. Options Trader

Among the different type of traders, the options trader operates in a unique world of derivatives, using contracts that offer immense flexibility beyond simply buying or selling an asset. An options contract grants the holder the right, but not the obligation, to buy or sell an underlying security at a predetermined price (the strike price) on or before a specific date. This structure allows traders to profit from price direction, changes in volatility, and the passage of time.

Options traders utilize a vast playbook of strategies to achieve different goals, from making speculative bets on market direction to generating steady income or hedging an existing stock portfolio. They operate in markets for options on stocks (e.g., MSFT, GOOGL), ETFs (e.g., SPY, QQQ), and even futures. Their edge comes from understanding how variables like time decay and implied volatility impact an option's price.

Core Strategy and Implementation

An options trader’s success depends on matching the right strategy to a market thesis. For example, if a trader believes a stock will remain within a specific price range over the next month, they might implement an iron condor. This multi-leg strategy involves selling both a call spread and a put spread, allowing the trader to collect a premium upfront and profit as long as the underlying asset’s price stays between the two short strikes. The trader must understand the "Greeks" (Delta, Gamma, Theta, Vega) to manage the position's risk and profit potential effectively.

Actionable Insight: New options traders should start by selling covered calls on stocks they already own. This simple income strategy involves selling a call option against 100 shares of a stock, generating immediate premium income while defining an exit price. It’s a practical way to learn the mechanics of options with a defined and manageable risk profile.

These contracts provide a powerful toolkit for traders who want more ways to express a market view than just going long or short. Learn more about common options trading strategies.

Who is Options Trading Best For?

Options trading is best suited for strategic, analytical thinkers who enjoy managing multiple variables simultaneously. It requires a deeper understanding of market mechanics than direct stock trading and a commitment to continuous learning. This style is ideal for traders who want to generate income, hedge existing positions, or make highly leveraged bets with a defined risk. It appeals to those who are detail-oriented, patient, and proficient in risk management.

8. Momentum Trader

Among the different type of traders, the momentum trader operates on a simple yet powerful principle: an object in motion stays in motion. This trader identifies assets with a strong existing price trend and rides that momentum for as long as it lasts. The core belief is that powerful trends, whether upward or downward, are likely to continue in the short to medium term due to investor psychology and institutional flows.

Momentum traders hunt for stocks, commodities, or currencies that are already making significant moves, often hitting new highs or lows. They use technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) to confirm the strength of a trend and identify optimal entry points. This approach requires accepting higher entry prices in exchange for the probability that the trend will persist.

Core Strategy and Implementation

A momentum trader’s strategy is to buy high and sell higher. For example, if a tech company's stock breaks out of a long-term consolidation pattern on high volume after a positive earnings surprise, a momentum trader would enter a long position. They are not trying to catch the bottom; they are joining a party that has already started. They would then use a trailing stop-loss to lock in profits as the price continues to rise, only exiting when momentum shows clear signs of fading.

Actionable Insight: Instead of looking for undervalued assets, successful momentum traders focus on stocks showing high relative strength compared to the broader market (e.g., the S&P 500). Using a relative strength scanner can quickly identify the strongest-performing stocks in the strongest sectors, which are prime candidates for momentum trades.

This strategy is about capitalizing on herd mentality and market psychology. The key is to have a disciplined exit plan to avoid being caught when the trend inevitably reverses.

Who is Momentum Trading Best For?

Momentum trading is well-suited for individuals who are comfortable with higher volatility and are not afraid to enter a trade that has already moved significantly. It requires a keen eye for chart patterns, a strong understanding of technical indicators, and the psychological discipline to follow trends without letting fear of missing out or fear of a reversal dictate decisions. This style is ideal for traders who are patient enough to wait for strong trends to emerge but decisive enough to act quickly when they do.

Trader Types Comparison Overview

| Trading Style | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Day Trader | High – Requires advanced skills and discipline | High – $25,000+ capital, advanced tech | Potential for quick, intraday profits | Full-time traders capitalizing on daily price moves | No overnight risk, profits in volatile markets |

| Swing Trader | Moderate – Combines technical & fundamental | Moderate – $5,000-$25,000 capital | Medium-term gains capturing price swings | Part-time traders aiming for multi-day to weeks holds | Flexible time commitment, lower transaction costs |

| Position Trader | Low to Moderate – Focus on fundamentals | Moderate – $10,000+ for diversification | Long-term growth and compound gains | Investors focusing on months to years holding periods | Low time commitment, less affected by market noise |

| Scalp Trader | Very High – Extremely fast decision-making | Very High – $50,000+ capital, fast execution | Many small, rapid profits daily | Traders targeting ultra-short price movements | Minimal per-trade risk, consistent daily income |

| Algorithmic Trader | Very High – Programming and quant skills | Very High – Tech, data, $10,000+ retail or millions institutional | Consistent, emotion-free execution at high speed | Automated trading across multiple markets/systems | Removes emotions, 24/7 operation, backtesting support |

| News Trader | Moderate – Requires fast reaction & analysis | Moderate – $5,000-$25,000 depending on approach | Profits from volatility around news events | Traders exploiting scheduled and unscheduled news | Clear catalysts, predictable timing, large profit potential |

| Options Trader | High – Complex strategies and Greeks knowledge | Low to Moderate – $2,000-$10,000 capital | Gains from diverse market conditions, defined risk | Traders seeking leverage, hedging, or income strategies | Leverage, hedging, profits in any market condition |

| Momentum Trader | Moderate – Technical indicator reliant | Moderate – $5,000-$15,000 capital | Returns from following strong price trends | Traders focusing on trends from minutes to months | Trades with market direction, high win probability |

Choosing Your Path to Trading Mastery

Navigating the financial markets successfully begins with a critical act of self-discovery. Throughout this guide, we've explored the diverse ecosystem of trading, from the high-frequency precision of Scalp Traders to the long-term vision of Position Traders. We've dissected the methodologies of Algorithmic Traders, the reactive strategies of News Traders, and the unique risk-reward profiles of Options Traders. Each path offers a distinct set of opportunities and challenges.

The most crucial takeaway is that there is no universally superior trading style. The best approach is the one that aligns seamlessly with your individual circumstances. A strategy that brings immense success to a disciplined day trader might lead to ruin for a patient swing trader with a full-time job. Understanding the different type of traders is the first step; understanding yourself is the second, and arguably more important, one.

Aligning Strategy with Your Trader Profile

To find your fit, you must honestly assess several key personal factors:

- Time Commitment: How many hours can you realistically dedicate to the markets each day or week? A scalper needs to be glued to their screen, while a position trader might only check in a few times a week.

- Psychological Resilience: Can you handle the stress of rapid, small losses as a scalper, or do you have the patience to hold a position through market fluctuations for months at a time?

- Risk Tolerance: Your comfort with potential financial loss will heavily influence your strategy. High-leverage styles like scalping carry different risks than the slow-and-steady approach of position trading.

- Analytical Preference: Do you enjoy deep, fundamental analysis, or do you prefer to react to the pure, unadulterated movement of price on a chart?

A Universal Foundation: Price Action

While the timeframes and tactics vary, a common thread can unite these different type of traders: a mastery of price action. At Colibri Trader, we advocate for a trading philosophy that cuts through the noise of lagging indicators and complex fundamental reports. By focusing on the raw language of the market-what buyers and sellers are doing right now-you build a versatile and powerful skill set.

This price-action-centric approach can be adapted to any style. A day trader can use it to identify intraday supply and demand zones, while a swing trader can use the same principles on a daily chart to spot multi-day reversal patterns. It provides a robust, adaptable foundation for making consistent, high-probability trading decisions, regardless of the path you ultimately choose. Your journey to trading mastery isn't about learning every strategy; it's about selecting one that fits you and mastering a core skill set that will serve you within that framework.

Ready to build a solid foundation that works for any trading style? Discover the power of a simplified, price-action-based approach with Colibri Trader. Our professional trading course is designed to equip you with the essential skills to read the market and trade with confidence. Learn more at Colibri Trader.