Difference Between Stop and Limit Order: Key Guide

The real difference between a stop and a limit order boils down to one simple trade-off: price control versus execution priority.

A limit order guarantees you get your desired price (or better), but it doesn't guarantee your trade will actually go through. In contrast, a stop order is all about getting the trade executed, but it offers no guarantee on the final price. Which one you choose depends entirely on what’s more important for that specific trade.

Understanding The Key Concepts

When you place a trade, you're essentially giving your broker a set of precise instructions on how to handle your money. Stop and limit orders are two of the most fundamental instructions you can give. They’re your main tools for managing entries, exits, and most importantly, risk.

These orders go a step beyond a simple "market order" (which just tells your broker to buy or sell right now at whatever the current price is). Instead, they add specific conditions that have to be met before any transaction happens.

Knowing which one to use is crucial. Picking the wrong one can mean missing out on a great opportunity or, even worse, taking an unexpected loss.

- A Limit Order is your tool for precision. You use it when you want to enter or exit a position at a very specific price—or a better one if the market offers it.

- A Stop Order is your safety net. It’s primarily a risk-management tool designed to protect an existing position from spiraling losses.

These two order types are the absolute bedrock of disciplined trading. You can learn more about the wider world of order types and other trading essentials in our in-depth guide: https://www.colibritrader.com/forex-basics-order-types-margin-leverage-lot-size/.

Quick Comparison Stop Orders vs Limit Orders

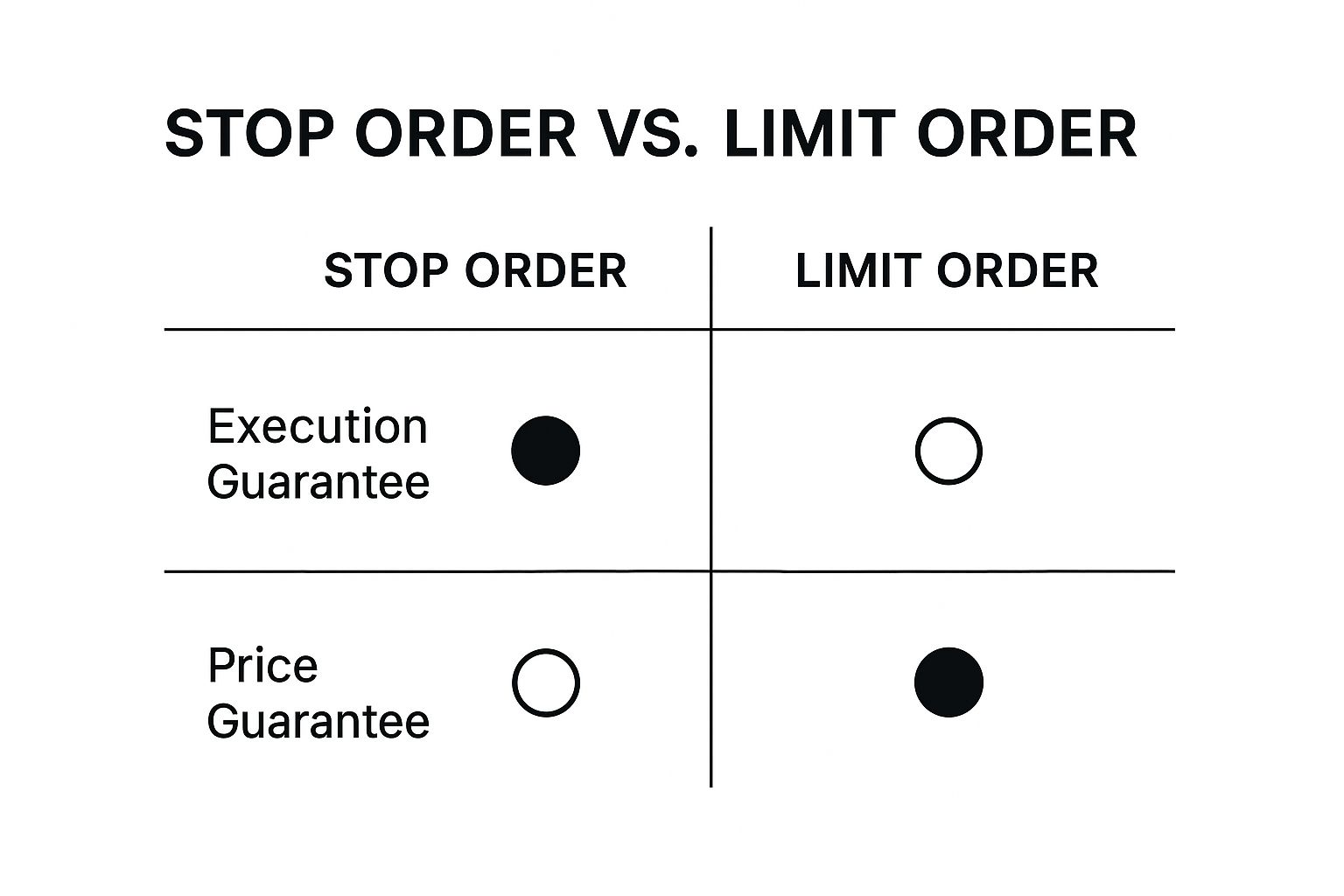

To make things crystal clear, this table gives you a quick side-by-side look at the core differences between stop and limit orders.

| Attribute | Limit Order | Stop Order |

|---|---|---|

| Primary Goal | Price Control (get a specific price or better) | Risk Management (trigger a trade to limit losses) |

| Execution Guarantee | No—only fills if the market reaches your price | Yes—becomes a market order once triggered |

| Price Guarantee | Yes—will not fill at a worse price than specified | No—can execute at a price different from the stop price |

| Visibility | Visible on the order book, adding to liquidity | Invisible to the market until the stop price is hit |

The strategic use of limit orders is deeply ingrained in how markets function. Old data from 1994-1995, looking at the 100 largest S&P 500 stocks, showed that limit orders were a huge factor in price discovery. Traders were constantly adjusting their price points to get their trades filled.

This shows their proactive nature—traders set their price and simply wait for the market to come to them, fully accepting the risk that the trade might never execute at all.

How Limit Orders Give You Price Control

If you want absolute control over your trade's execution price, the limit order is your go-to tool. It's a direct instruction to your broker to buy or sell an asset only at a specific price or better. This gives you total authority over your entry and exit points, which is the core difference between this and other order types.

Let's say a stock is trading at $55, but your analysis tells you it's a better buy closer to $50. You can set a buy limit order at $50. This order just sits there, inactive, until the market price actually drops to $50 or lower. Only then will it execute. You're guaranteed to pay no more than your limit price.

The same logic applies in reverse for selling. If you're holding that same stock and want to lock in profits once it hits $60, you place a sell limit order at $60. Your trade only goes through if the price climbs to $60 or higher, making sure you get your target price—or an even better one.

The Trade-Off: Certainty of Execution

So, what's the catch? The biggest drawback of a limit order is that there's no guarantee it will ever be filled. The market might simply never reach your price, leaving your order sitting unexecuted. This means you could completely miss a trading opportunity if the price moves away from your limit and doesn't come back.

A limit order prioritizes price over certainty. You get the exact transaction cost you want, but you accept the risk that the trade may never happen. This is the fundamental difference between a stop and limit order.

This dynamic is perfect for patient traders who refuse to compromise on their entry or exit prices. It's a strategic decision to make the market come to you, rather than chasing a moving price and potentially overpaying or selling for less than you planned.

Market Dynamics and Liquidity

Limit orders aren't just passive instructions waiting on the sidelines; they are an active part of the market's structure because they provide liquidity. When you place a limit order, it shows up in the exchange's order book, signaling your intent to buy or sell at that level to everyone else.

High-frequency market data shows just how wild this gets. Limit orders can be placed and pulled in milliseconds as algorithms and traders react to new information. This is a world away from a stop order, which stays hidden until triggered and then consumes liquidity by becoming a market order. You can find more on the complex behavior of limit orders in major stock indices if you want to go down that rabbit hole.

Ultimately, when you use a limit order, you become a "price maker," adding depth to the market. This makes it the ideal choice for situations where:

- You can afford to wait: Your strategy doesn't require immediate action, so you can wait for the market to meet your terms.

- Price is everything: Getting in or out at a specific level is more critical to your plan than simply getting the trade done now.

- You're trading less liquid assets: For assets with wide bid-ask spreads, a limit order is crucial for preventing slippage and paying a much higher price than you expected.

How Stop Orders Protect Your Capital

Where a limit order gives you precision, a stop order offers you protection. You should think of it as your first line of defense against a sudden, nasty loss, especially when the market gets choppy. It's an instruction that just sits there, dormant, until the price hits your specified "stop price." The second that happens, it instantly flips into a market order and executes at whatever the next available price is.

This is all about risk management, which is the key difference between a stop and limit order. The most common way traders use this is with a stop-loss order, designed to automatically cap the downside on a trade. It takes the emotion right out of the equation, forcing you to exit with discipline when a trade starts going against you.

Let’s say you buy a stock at $100 a share, thinking it’s heading up. To protect your capital, you could place a sell-stop order at $95. If the stock unfortunately takes a dive and touches $95, your order kicks in immediately and sells your shares.

The Reality of Slippage

Now, while this sounds simple, there's a crucial catch you need to know about: slippage. When your $95 stop price gets triggered, your order becomes a market order. In a fast-moving or gapping market, the next price you can actually sell at might not be $95. It could be $94.90, $94.50, or even lower if the price is in a freefall.

A stop order guarantees you get out, but it doesn't guarantee the price you get out at. This is the fundamental trade-off. You sacrifice price certainty for the assurance that you will exit a losing position and prevent a small loss from becoming a big one.

This feature is absolutely essential for any trader who puts risk containment above everything else. By setting a stop-loss, you define your maximum acceptable loss on a trade before you even enter it. Learning to set this level correctly is a skill in itself. For traders looking to really nail this down, understanding how to set a stop-loss effectively is a vital step toward consistent trading.

Types of Stop Orders

While the sell-stop (or stop-loss) is the one everyone knows, there are other variations that serve different strategic purposes.

- Sell-Stop Order: This is the classic stop-loss. You place it below the current market price on a long position, and its job is to limit your losses if the price falls.

- Buy-Stop Order: Placed above the current market price, this is often used to jump into a new long position on a breakout. It can also be used to limit losses on a short position (acting as a buy-stop loss).

Ultimately, a stop order is your automated risk manager. It works tirelessly in the background, executing your pre-defined exit plan without hesitation and ensuring a small, manageable loss doesn't spiral into a catastrophic one. This makes it an indispensable tool for any serious trader.

Comparing Order Execution and Market Impact

Okay, so we've covered the basic definitions. But the real difference between a stop and a limit order only clicks when you see how they actually behave in a live, fast-moving market. Their execution mechanics and how they hit the market are fundamentally different, and that affects everything from your final price to whether your strategy stays under the radar.

The first big distinction is how they show up on the exchange's order book.

Limit orders are completely transparent. The moment you place one, it’s publicly displayed for every other market participant to see. This adds to what traders call market depth and liquidity—it signals to everyone else that there's buying or selling interest at that specific price.

Stop orders, on the other hand, are invisible until they're activated. Your broker holds onto them privately, and they only get sent to the exchange once the market price actually hits your trigger point. This stealthy approach can be a huge strategic advantage, as it stops other traders from seeing your exit point and trying to trade against you.

The Execution Guarantee Dilemma

Here’s the most critical difference, and it comes down to the moment of execution. Each order type gives you a guarantee, but you can only pick one: a price guarantee or an execution guarantee. You can't have both.

This is the core trade-off every trader has to make.

As you can see, a stop order is all about getting your trade done, whatever the cost. A limit order is about getting the price you want, even if it means the trade never happens.

A limit order promises to execute only at your limit price or a better one. If the market never touches your price, your order just sits there, unfilled. You get absolute control over your price, but there's zero guarantee of execution.

A stop order, once triggered, becomes a market order. Its only job is to get you in or out of the market as fast as possible at the very next available price. This gives you a high guarantee of execution, but you get absolutely no price protection.

To really nail this down, here's a side-by-side look at the key features.

Feature-by-Feature Breakdown: Stop Order vs. Limit Order

| Feature | Limit Order | Stop Order |

|---|---|---|

| Primary Goal | Price Control: Execute at a specific price or better. | Risk Management: Get out of a position quickly if the market moves against you. |

| Execution Certainty | Low. Only fills if the market reaches your limit price. | High. Converts to a market order once triggered, prioritizing execution over price. |

| Price Certainty | High. You are guaranteed to get your limit price or better. | Low. The execution price can be significantly different from your stop price (slippage). |

| Market Visibility | Visible. Displayed on the public order book, adding to liquidity. | Invisible. Held by your broker and hidden from the market until the stop price is hit. |

| Best For | Entering positions with precision, taking profits at specific targets. | Protecting against losses (stop-loss), entering trades on breakouts. |

| Risk Factor | The order might never be filled, leaving you out of a move or stuck in a position. | Slippage. In volatile markets, your actual fill price could be far worse than expected. |

This table shows there’s no "better" order—only the right order for the right job. Your choice depends entirely on whether price or execution is more important for that specific trade.

Navigating Volatility and Slippage

This difference really comes into focus during extreme volatility or when a market gaps overnight. Let’s walk through a classic scenario. Imagine a stock closes the day at $50, and you've placed a stop-loss order at $49 to protect your long position. Overnight, some terrible news breaks, and the stock opens the next morning at $45.

Your $49 stop order is triggered instantly at the open. But remember, it immediately turns into a market order. It executes at the best price available at that moment, which might be $45 or even lower if the selling pressure is intense. The $4 difference between your stop price ($49) and your execution price ($45) is what we call slippage. This is the risk you accept with a stop order—you get out, but maybe not at the price you hoped for.

A triggered stop order is a blunt instrument designed for immediate action, not precision. It prioritizes exiting a position over securing a specific price, making it a powerful tool for risk management in unpredictable markets.

Now, let's replay that same scenario, but this time you have a sell limit order at $49. The market gaps down and opens at $45. What happens? Nothing. Your limit order will not execute. Why? Because its instruction is to sell only at $49 or higher. Since the market price is way below that, the order just sits there, inactive.

In this case, the limit order saved you from selling at a terrible price, but it also left you holding a position that is now deep in the red. Which of these outcomes is "better" is entirely down to your strategy and risk tolerance, and it perfectly highlights the crucial difference between a stop and limit order.

Choosing the Right Order for Your Strategy

Figuring out whether to use a stop or limit order isn’t about picking the “better” one. It’s about matching the right tool to what you need to accomplish on a specific trade. It all boils down to one simple question: What matters more to you right now—price or execution?

Your answer immediately tells you which order to use. It's the most critical distinction to grasp.

If your priority is absolute price control, the limit order is your go-to. You use it when you have a very specific entry or exit price in mind and you're not willing to budge. This is the classic approach for patient traders who are happy to let the market come to their level.

But if risk management and the certainty of getting out are your main concerns, the stop order is the only choice. Think of it as your safety net, automatically exiting a trade to make sure a small loss doesn’t spiral into a big one.

Situational Use Cases

To make this crystal clear, let's walk through a few real-world scenarios where one order type is the obvious winner.

- For the Value Investor: A value investor has their eye on a stock they believe is a steal at $120, but it’s currently trading at $135. They’ll place a buy limit order at $120 (or even a bit lower). This guarantees they only get in at their predetermined discount—they will not overpay.

- For the Breakout Trader: A trader notices a stock creeping up to a major resistance level at $50. To jump on the momentum, they might place a buy-stop order at $50.10. This ensures they get into the trade the second the breakout happens, prioritizing getting on board over haggling on the entry price.

- For Taking Profits: You're holding a stock that has rallied to $75, and your target is $80. You'd set a sell limit order at $80. This makes sure you lock in your gains at your target price or, if you're lucky, even better.

- For Protecting Capital: In that same trade, you also want to protect your gains from a sudden drop. You place a sell-stop order (your stop-loss) at $70. If the price falls to that level, the order triggers and sells your position. You're prioritizing the exit to cap your losses, even if the final sale price slips a bit. This is a cornerstone of smart trading, and it's even more effective when you apply proven price action tips that work.

The core difference is intention. Limit orders are proactive tools for setting price targets. Stop orders are reactive tools designed for defense and capturing momentum.

The Hybrid Approach: The Stop-Limit Order

For traders who want a bit of both worlds, there’s the stop-limit order. This clever hybrid combines features from both order types. It uses a stop price to trigger the order, but once it’s active, it becomes a limit order instead of a market order.

For instance, you could set a stop price at $95 with a limit price of $94.50. If the stock tumbles and hits $95, your sell order activates. However, it will only fill if a buyer is willing to pay $94.50 or higher.

This gives you more control over your exit price than a standard stop order, but it comes with a major trade-off: in a fast-moving market, your order might not execute at all. Empirical reviews show that traders who use technical analysis tools like RSI and Bollinger Bands to set their stop and limit prices achieve much better results. In fact, traders who adjust their stop parameters based on market trends can slash their losses by 15-20% compared to those using static stops.

Common Questions About Stop and Limit Orders

Once you get the theory down, the real learning begins when you start placing orders. It’s totally normal to have questions about how stop and limit orders actually behave in live market conditions. Getting these answers straight is what builds the confidence to use them the right way.

A question I hear a lot is whether a stop order can fill at a better price than you set. The answer is yes, though it doesn't happen often. Since a stop order turns into a market order the second it’s triggered, it just grabs the next available price. Sometimes, that price could be in your favor.

But let's be real—the main job of a stop-loss is to protect you from things going south. You should always be planning for the possibility of negative slippage, not hoping for a lucky break.

Can a Limit Order Fill Partially?

Absolutely. Partial fills are extremely common with limit orders, especially if you're trading a larger size. Let’s say you place a buy limit order for 100 shares at $50. The price might dip, touch your level just long enough to fill 40 shares, and then bounce away.

What happens then? Your order for the remaining 60 shares just sits there, active and waiting. If the price comes back down to $50 or lower, it will try to get you the rest. This is a critical point: a limit order is never guaranteed to execute in full, even if the price technically hits your number.

The core difference here is that a stop order is an all-or-nothing event. It's about immediate action. A limit order is a patient, sometimes piecemeal, process that cares about price and nothing else.

This distinction is fundamental to understanding them. A stop order is a trigger for an urgent "get me out now" command. A limit order is more like setting a net, patiently waiting to catch shares only at the exact price you’re willing to pay.

Which Order Type Is Better for Volatile Markets?

There is no single "better" order for a wild market. It completely depends on what you're trying to accomplish. Each one has a very specific job when prices are flying around.

- For Protection: A stop order is your go-to for managing risk in a volatile market. It’s designed to get you out of a losing trade fast, even if it means accepting some slippage. The priority is preventing a small loss from turning into a disaster.

- For Entry: A limit order can be great for getting into a volatile market, but only if your strategy is to catch a pullback (buy limit) or a spike (sell limit). It stops you from chasing a runaway price and paying way too much.

Here's the trade-off. In a fast market, the risk with a limit order is that the price blows right past your level and you never get filled. The risk with a stop order is that slippage can be severe, giving you a much worse fill than you expected. Knowing which risk you're willing to take is key to trading in chaos.

Why Did My Stop Order Not Trigger at the Exact Price?

This one trips up a lot of traders, and it almost always comes down to the bid-ask spread. For a sell-stop order to trigger, it’s not the chart price but the bid price that must drop to your level. For a buy-stop, the ask price has to rise to it.

Most charts you look at show the last traded price. It's entirely possible for that price to pass right through your stop level while the actual bid or ask price never quite touches it. The result? Your order is left sitting there, untriggered. Always keep the spread in mind when you set your stops.

At Colibri Trader, we teach you how to master these essential tools using pure price action, giving you the confidence to trade in any market condition.