The Trader’s Guide to the Difference Between Bid and Ask Prices

Let's get one thing straight: the difference between the bid and ask price is simple on the surface, but it's the engine running the entire market. The bid price is the most a buyer is ready to pay for something. The ask price is the least a seller is willing to take for it. That gap between them? That's the spread, and it's the fundamental cost of doing business in trading.

Breaking Down Bid and Ask Prices

Think of any financial market as a massive, ongoing auction. You have buyers constantly shouting out their bids, while sellers are putting up their offers (or asks). The constant dance between these two sides is what gives us the live, two-sided market quote you see on your screen.

Trying to trade without understanding this is like walking into that auction blindfolded. You have to know that the bid is the highest price buyers are offering, and the ask is the lowest price sellers will accept. The spread is simply the market's built-in transaction fee. If you'd like to dig deeper, you can find more detailed research about the mechanics behind it all.

Getting a handle on this dynamic isn't optional. Here's why:

- It dictates your entry and exit prices. When you hit "buy" on a market order, you're paying the higher ask price. When you sell, you're getting the lower bid price. Period.

- It's an instant cost. The second your trade is filled, you're already in the red by the size of the spread.

- It's a clue about market health. A wide spread can signal low liquidity or high volatility, while a tight spread suggests the opposite.

Bid vs Ask At a Glance

This simple buyer-seller relationship is the bedrock of all trading. That spread is what you pay for the convenience of immediate execution, a service often provided by market makers who stand ready to take the other side of your trade. For a more exhaustive look, check out this in-depth piece on the https://www.colibritrader.com/difference-between-ask-price-and-bid-price/.

To make it crystal clear, here’s a quick table breaking down the core differences.

| Characteristic | Bid Price | Ask Price (or Offer Price) |

|---|---|---|

| Perspective | Buyer's | Seller's |

| Action | What a buyer is willing to pay. | What a seller is willing to accept. |

| Market Order Fill | Your "Sell" order executes at the bid. | Your "Buy" order executes at the ask. |

| Price Relation | Always lower than the ask price. | Always higher than the bid price. |

The bid-ask spread isn't a flaw in the system; it's a feature. It compensates liquidity providers for the risk they take in ensuring there is always a buyer for your sell order and a seller for your buy order.

To get a complete definition and context, the glossary entry on the Bid Ask Spread is an excellent resource. Truly grasping this concept is the first real step toward executing trades with precision and keeping your trading costs in check.

How the Spread Reveals Market Liquidity and Volatility

The bid-ask spread is far more than just a simple transaction cost. I like to think of it as a dynamic, real-time barometer of a market’s health. The size of this gap gives you instant insight into two of the most critical market characteristics: liquidity and volatility. Once you learn how to read the spread, you'll find it much easier to gauge risk and spot stronger trading opportunities.

A tight spread, where the bid and ask prices are practically hugging each other, is the hallmark of a highly liquid market. It tells you there's a massive volume of buyers and sellers all fighting for a piece of the action, making it easy to execute trades quickly and at predictable prices. Just think of a monster stock like Apple (AAPL), where millions of shares change hands every single day.

On the flip side, a wide spread is a major red flag, signalling low liquidity or even illiquidity. With fewer participants in the game, there's a much larger gap between what buyers are willing to pay and what sellers are demanding. This is common with thinly traded small-cap stocks or less common assets, where just finding a counterparty for your trade can be a challenge—and a costly one at that.

Reading the Market's Mood

The spread doesn't just sit still; it reflects the constant tug-of-war between supply and demand. Experienced traders pay close attention to its every move because these shifts can often precede significant price action.

- Widening Spreads: When you see the gap between the bid and ask prices growing, it often means volatility or uncertainty is ramping up. This frequently happens right before major economic news or during a sudden market shock, as market makers widen the spread to protect themselves from the increased risk.

- Narrowing Spreads: Conversely, a tightening spread suggests that liquidity is coming back into the market and volatility is calming down. This usually signals a more stable and predictable trading environment where buyers and sellers are in strong agreement on price.

A trader who ignores the spread is like a sailor who ignores the weather. A tight spread suggests calm seas and smooth sailing, while a wide, choppy spread warns of potential storms ahead where your trade could get tossed around by slippage.

Have you ever wondered why buying a stock instantly costs you more than selling it? That's the bid-ask spread in action. If a stock's bid is $19.50 and the ask is $20.00, that $0.50 spread represents a huge 2.50% transaction cost on a $20 trade. This is a common scenario for illiquid assets but almost unheard of for blue-chip stocks.

Practical Implications for Traders

Understanding this dynamic is absolutely crucial for managing your trades. A wide spread means you're paying higher transaction costs and facing an increased risk of slippage—that frustrating moment when your order gets filled at a worse price than you expected. For short-term traders, this can quickly chew through any potential profits.

By simply taking a moment to assess the spread before you enter a trade, you can steer clear of illiquid markets where execution is poor. My advice is to focus on assets with tight, stable spreads. This dramatically improves your odds of entering and exiting at the prices you actually want. To get a better handle on these market mechanics, you might be interested in our guide on what market liquidity is and why it matters. This knowledge will help you filter for high-quality setups and stay out of treacherous market conditions.

Where Do Bid and Ask Prices Come From? The Role of Market Makers

The bid-ask spread isn't some random market quirk; it’s a core feature created by specialized financial firms known as market makers. Think of these firms as the essential gears in the market machine. Their entire business model is built on that small gap between the bid and ask prices.

Market makers have one critical job: to provide liquidity. They do this by constantly quoting two prices: a price they're willing to buy at (the bid) and a price they're willing to sell at (the ask). This ensures that you can almost always find someone to take the other side of your trade, right when you want to place it.

But offering this instant service is a risky business. When a market maker buys an asset from you at the bid price, there's no guarantee they can immediately sell it to another trader at the higher ask price. The market could flash against them in a heartbeat, leaving them holding a losing position.

Getting Paid for Taking Risks

To make up for this constant risk, market makers capture the spread. It’s essentially their fee for standing ready to facilitate trades, no matter what the market is doing. This isn't just about covering potential price moves; it also shields them from a trickier problem called adverse selection.

Adverse selection is what happens when a market maker ends up trading with someone who knows more than they do. Imagine a trader has inside information that a stock is about to tank. They'll rush to sell their shares, and the market maker might be the one unknowingly buying that position just moments before it plummets in value.

The bid-ask spread is the market maker’s primary defense. By setting the ask higher than the bid, they build a buffer that helps absorb losses from trading against better-informed players and compensates them for providing liquidity to the rest of us.

This isn't just a practical reality; it's a cornerstone of market theory. Foundational research, like the 1985 Glosten-Milgrom model, showed that the spread is a direct result of this information asymmetry. The model proved that even a completely risk-neutral market maker must set a spread to avoid being consistently picked off by traders who have an informational edge. You can discover more insights about this foundational market model and what it means for how prices are formed.

What This Means for Your Trading

Once you understand the role of market makers, you'll see the market differently. The spread is no longer just a transaction cost; it's the price you pay for immediate liquidity. It's also a direct signal of the risks these professional liquidity providers are facing.

When you see a wide spread, you’ll now know it signals higher perceived risk—either from wild volatility or the potential for informed traders lurking. It’s a warning sign to be extra careful. This insight into the mechanics behind the bid-ask spread is a huge step toward trading with a more professional mindset.

How Bid and Ask Prices Affect Your Trade Execution

Understanding the difference between the bid and ask price is one thing, but seeing how they actually impact your trades is where it really clicks. The type of order you use fundamentally changes your relationship with the spread. It’s a constant tug-of-war between prioritizing speed or price, and that choice can make a huge difference to your entry and exit points.

The two workhorses of trade execution are market orders and limit orders. A market order is basically telling your broker, "Get me in or out now at the best price available." A limit order, on the other hand, says, "Get me in or out, but only at this specific price or a better one." This distinction is critical because it dictates exactly how your trade interacts with the live bid and ask prices.

Market Orders: Instant Execution at a Cost

When you place a market buy order, you’re looking for immediate execution. You want in, and you want in now. The market obliges by matching you with the lowest available ask price. Conversely, if you hit the market sell button, you'll be filled at the highest available bid price.

This means with a market order, you always "cross the spread." It's the built-in cost for the convenience of getting your trade filled instantly.

- When Buying: You will always pay the higher ask price.

- When Selling: You will always receive the lower bid price.

Let’s say a stock is quoted at Bid $100.00 / Ask $100.05. If you place a market buy order, you're getting filled at $100.05. If you place a market sell order, you're out at $100.00. That $0.05 gap is the spread—the price you pay for immediate access to the market.

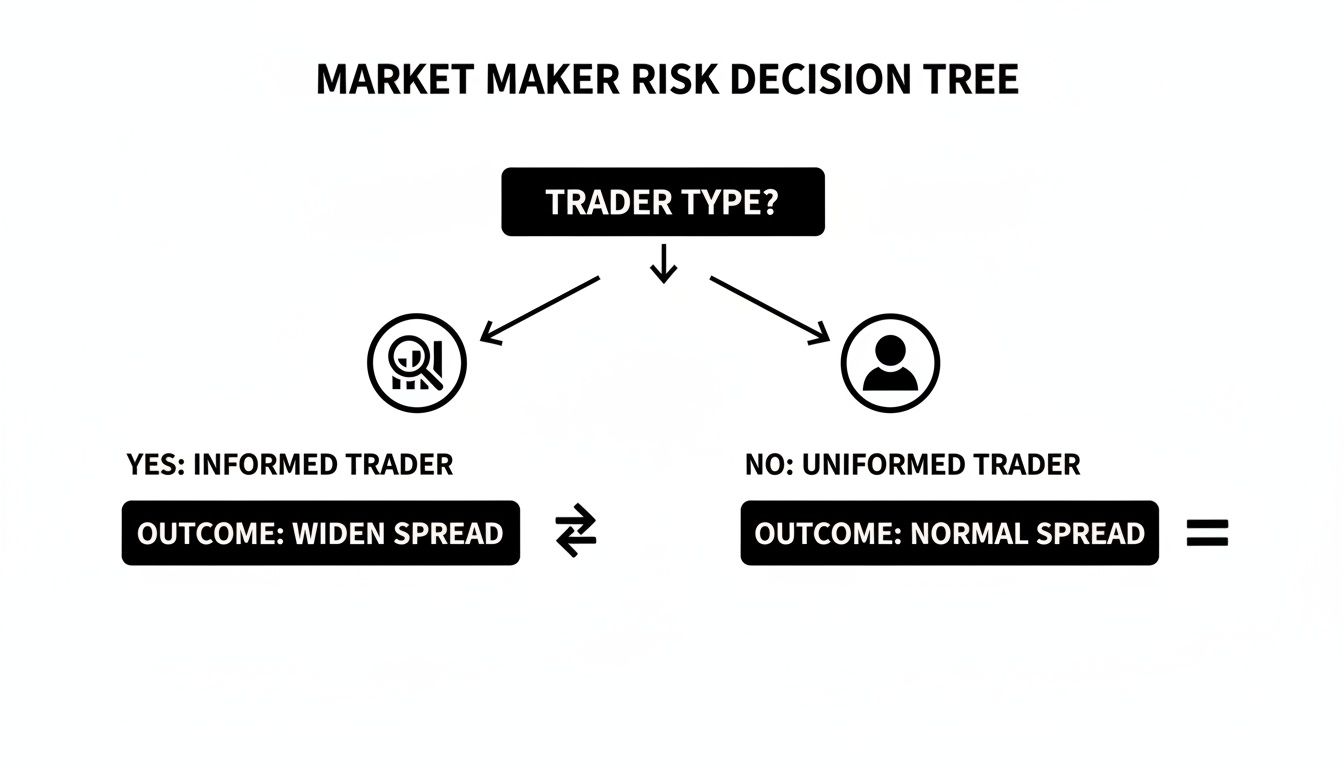

Market makers, the entities providing this liquidity, are constantly adjusting these spreads. They widen or tighten them based on who they think they're trading against, as this decision tree shows.

As you can see, if a market maker suspects they are dealing with an "informed" trader (someone who might have superior information), they widen the spread to protect themselves. This is their primary defense mechanism against adverse selection.

Limit Orders: Precision Over Immediacy

Limit orders put you firmly in control of your execution price. You get to name your price, and the market has to come to you. A buy limit order will only execute at your specified price or lower, and a sell limit order will only fill at your price or higher.

By using a limit order, you refuse to cross the spread. Instead, you place your order inside the order book—often between the bid and ask—and wait. This gives you price control but completely sacrifices the guarantee of execution.

Let's stick with our Bid $100.00 / Ask $100.05 example.

Instead of buying at the market ask of $100.05, you could place a buy limit order at $100.02. Your order now sits patiently on the books, waiting for a seller to come down and meet your price. You avoid paying the full spread, but the big risk is that the price moves higher and your order is left behind, completely unfilled.

For a deeper look into how these order types play out in different market conditions, our guide on the strategic differences between a market order vs a limit order is a great next step.

So, what's the verdict? It's a classic trading trade-off. Market orders guarantee you get into the trade, but they expose you to slippage—the risk of getting a worse price than you saw on your screen, especially in volatile markets. Limit orders guarantee your price but come with the very real risk of missing the trade entirely if the market never touches your level.

To make this even clearer, let's break down how each order type interacts with the bid and ask.

Order Type Execution vs Bid and Ask Prices

The table below summarises how your choice of order determines your execution price relative to the spread.

| Order Type | How It Executes | Price Filled | Key Consideration |

|---|---|---|---|

| Market Buy | Instantly matches the lowest seller. | At the current Ask price. | You pay the spread for immediate execution. |

| Market Sell | Instantly matches the highest buyer. | At the current Bid price. | You pay the spread for immediate execution. |

| Buy Limit | Waits for a seller to meet your price. | At your specified price or lower. | Execution is not guaranteed. |

| Sell Limit | Waits for a buyer to meet your price. | At your specified price or higher. | Execution is not guaranteed. |

Each order type has its place in a trader's toolkit. The key is knowing which one to use based on the market conditions and your trading objectives—whether that's getting in at any cost or getting in only at the right cost.

Applying Spread Analysis to Your Trading Strategy

Knowing what the bid-ask spread is and how it works is one thing, but the real skill comes from applying that knowledge to your live trades. The spread isn't just a simple transaction cost; think of it as a dynamic signal, a subtle hint about the ongoing tug-of-war between supply and demand, especially around critical price levels. Learning to read these signals can seriously level up your entries and help you sidestep some painful mistakes.

If you're an active trader, you need to be watching how the spread behaves near key support and resistance. These are the battlegrounds where buyers and sellers really dig in, and the spread often whispers who has the upper hand. For example, if you see the spread narrowing as the price drops toward a known support level, that's a clue. It suggests buyers are getting more aggressive, which could validate the strength of that support.

On the flip side, what if the spread suddenly blows out as prices push up against a resistance zone? That's a warning shot. It might mean market makers are getting nervous, sensing a spike in volatility or a simple lack of conviction from the bulls. This one tiny detail could be the difference between nailing a breakout and getting caught in a nasty fakeout.

Interpreting Spread Behavior in Real Time

Looking at the relationship between price action and the spread gives you a much deeper layer of market context. You stop just seeing candlestick patterns and start understanding the order flow dynamics creating those patterns. This extra layer of analysis helps you filter your trades, focusing only on the high-quality setups with a better chance of working out.

Here’s a quick guide on what to watch for:

- Confirming Strength: A tightening spread near a key level you're monitoring is a great confirmation signal. It tells you liquidity is solid and that both sides are actively engaged, more or less agreeing on the current value.

- Signaling Weakness: A wide or jumpy spread near your potential entry point is a big red flag. It screams uncertainty or low participation. This is your cue to be extra cautious—or maybe just stay on the sidelines until things calm down.

By making spread analysis a part of your routine, you're no longer just reacting to price. You're starting to anticipate it. You're essentially taking the market's pulse, which is an edge that most retail traders completely miss.

While analyzing the bid-ask spread offers a direct view of the market's micro-structure, a complete strategy also benefits from a wider perspective. For instance, some traders find value in learning how to monitor competitor prices to understand broader competitive dynamics, which complements specific trade analysis.

A Pre-Trade Checklist for Spread Assessment

To put this into practice, get into the habit of checking the spread before you even think about hitting the buy or sell button. It literally takes seconds, but it can save you from ugly slippage and poorly timed entries.

Run through this simple checklist before every trade:

- Assess the Current Spread Size: Is it tight or wide for this asset at this time of day? A $0.01 spread on a high-volume stock is business as usual, but a $0.50 spread is a clear sign to proceed with caution.

- Observe Its Stability: Is the spread holding steady, or is it jumping all over the place? Erratic, frantic spreads often come right before sharp, unpredictable price moves.

- Compare to Key Levels: How does the spread react as the price gets close to your entry point near support or resistance? Watch for that confident tightening or a hesitant widening.

By consistently applying this kind of analysis, you'll start making more informed, professional-level decisions. It's a simple way to ensure you're only putting your capital to work when the conditions are truly stacked in your favor.

Frequently Asked Questions About the Bid Ask Spread

To really cement your understanding of the bid and ask, let's go through some of the most common questions that pop up for traders. Getting these points straight will help you apply what you've learned with a lot more confidence.

Why Does the Bid Ask Spread Change During the Day?

The bid-ask spread isn't some fixed number; it’s alive, constantly reacting to the ebb and flow of market supply and demand. Its size is always changing, mostly because of three things: liquidity, volatility, and the time of day.

During the busiest market hours, like when the London and New York forex sessions overlap, liquidity is pouring in. Millions of buy and sell orders are flying around, which ramps up the competition between market makers. To win your business, they have to tighten their spreads.

On the flip side, spreads get wider when things get choppy, like right before a big economic news announcement. When prices are jumping around erratically, market makers are taking on more risk, so they widen the spread to protect themselves. You'll also see wider spreads outside of the main trading hours when fewer people are active, making the market less liquid.

Can I Always Buy at the Bid Price or Sell at the Ask Price?

Nope, it’s the other way around. This is one of the fundamental rules of the market: you buy at the ask and you sell at the bid. The bid price is the most a buyer is willing to pay right now, so if you want to sell to them, that’s the price you get.

Likewise, the ask price is the lowest price a seller is willing to accept. If you want to buy instantly, you have to meet their price. You can’t just decide to buy at the lower bid price because that price isn't for you—it’s for sellers. The only way to get a price inside the spread is to use a limit order and patiently wait for the market to come to you.

How Does the Spread Impact My Profitability as a Trader?

The spread is a direct, unavoidable cost of doing business in the markets. Every single time you open and close a trade, you have to make up the cost of the spread just to get back to zero. For short-term traders, this cost can seriously eat into profits.

Imagine a stock has a spread of $0.10. If you buy 100 shares, your position is instantly $10 in the red the moment you open it. The price has to move $0.10 in your favour just for you to break even. If you trade frequently, these costs add up fast and can easily be the difference between a profitable strategy and a losing one.

Think of the spread as a hurdle you have to clear on every single trade. The wider the spread, the higher the hurdle, and the more the price needs to move in your favor before you can start making a profit.

What Is a Wide or Tight Spread?

Whether a spread is considered "wide" or "tight" is all relative. It completely depends on what you're trading. Context is everything.

Tight Spread: For a super liquid stock like Apple (AAPL), a spread of $0.01 is perfectly normal and tight. For major currency pairs like EUR/USD, a spread of less than one pip is standard. This tells you there's a ton of trading activity and transaction costs are low.

Wide Spread: For a small-cap stock that isn't traded as much, a spread of $0.25 or even more might be common. A wide spread is a red flag for low liquidity and higher risk, making it more expensive and trickier to get in and out of trades.

As a rule of thumb, always glance at the spread for the specific asset you're trading before you enter a position. What’s considered tight for one market could be gigantic for another. This simple check can save you from unexpectedly high trading costs and slippage.

At Colibri Trader, we teach you how to analyze these essential market details, focusing on pure price action to build consistent trading habits. Our approach helps you navigate any market condition without relying on confusing indicators. Discover your trading potential by visiting us at https://www.colibritrader.com.