Master Decision Making Under Uncertainty: Proven Strategies

Let’s be honest: Decision making under uncertainty is just a fancy way of saying you have to choose a path when you don't know what’s going to happen. It's the core challenge of being a trader, but it also pops up in business and everyday life, forcing us to act with incomplete information.

If you can get good at this, you start to see all that ambiguity not as a threat, but as a real strategic advantage.

Unpacking the Challenge of Uncertainty

Think of it like this: you’re captaining a ship sailing through a dense fog. You know where you want to go, but the path ahead is invisible. All you have is a compass and a few torn pieces of a map. That’s trading in a nutshell. It’s not about having a crystal ball; it’s about learning to navigate with the tools you’ve got.

Most traditional decision-making models fall apart here. They're built for a world of clarity, where you can assign hard numbers to outcomes—like the 1 in 6 chance of rolling a specific number on a die. That's what we call decision making under risk.

But the choices that really matter, especially in the markets, are a different beast entirely.

From Known Risks to True Ambiguity

True uncertainty, or what some call ambiguity, is a much tougher problem to solve. It's a situation where you don't just lack the probabilities; you might not even know all the possible outcomes. The rules of the game can shift under your feet without any warning. This is exactly why so many rigid, analytical models fail miserably when you try to apply them to a dynamic environment like trading.

The real challenge isn't trying to eliminate uncertainty—you can't. The goal is to build powerful mental models and frameworks to manage it. That’s where you find your edge.

To do this, you have to shift your entire mindset. Stop searching for certainty and start building resilience and adaptability. It means accepting that perfect information is a fantasy and that making progress is all about making solid judgments with what you actually know.

Why This Matters for You

Getting good at making decisions in the fog isn't just some academic exercise. It pays off in real, practical ways that can make or break your trading career:

- Improved Strategic Thinking: You start thinking in terms of multiple possible futures instead of betting the farm on a single prediction.

- Enhanced Resilience: You get much better at taking a punch when the market does something unexpected and adapting on the fly.

- Greater Confidence: When you have a process for dealing with the unknown, you can act decisively instead of getting stuck in "analysis paralysis."

This guide is about moving past the theory. We're going to dive into actionable frameworks that will help you navigate that fog and learn how to turn all that ambiguity into real opportunity.

Why Our Brains Struggle with Ambiguity

Before you can master decision making under uncertainty, you have to understand why it feels so unnatural. It’s not a personal flaw. Our brains are hard-wired for certainty and quick mental shortcuts, which is great for day-to-day survival but can be a huge handicap in the markets.

Economists have been trying to figure out how we make choices for ages. One classic idea is the Subjective Expected Utility (SEU) theory. It sounds complex, but the idea is simple: when we have a choice, we're supposed to logically weigh the odds and pick the option that gives us the most "utility" or value.

It's a neat theory on paper. The problem is, it rarely matches what people actually do when things get fuzzy. Our brains simply don't treat all types of uncertainty the same way. We have a powerful, almost primal, preference for known risks over unknown ones.

The Pull of Known Probabilities

This bias is laid bare in a famous thought experiment called the Ellsberg Paradox. Picture this: you're faced with two urns, each holding 100 balls.

- Urn A has exactly 50 red balls and 50 black balls.

- Urn B has an unknown mix of 100 red and black balls.

You win a prize if you draw a red ball. Which urn do you pick?

If you're like most people, you'll choose Urn A without much hesitation. The odds are crystal clear—a 50% shot. Urn B feels like a total gamble. The chance of picking a red ball could be anything from 1% to 99%. Even though the odds in Urn B could be dramatically better, we instinctively shy away from the ambiguity.

This is a classic example of ambiguity aversion—our deep-seated tendency to pick options with known probabilities over those where the odds are a mystery. It shows that while models like SEU provide a logical framework, our real-world behaviour often deviates from pure rationality.

Why We Avoid Ambiguity

This isn't just a psychological quirk; it's an evolutionary hangover. Back when our ancestors were dodging predators, sticking with the "known" was a solid survival tactic. A guaranteed small meal was almost always a better bet than risking starvation for a potential big feast.

This built-in preference for clarity means that when we make decisions under uncertainty, we are constantly fighting against our own brain's desire for a simple, clear-cut answer.

This mental shortcut saves brainpower, but it’s a massive liability in an environment like trading. The market is the ultimate "Urn B"—a giant container of unknowns and constantly shifting probabilities.

A trader who waits for the picture to be perfectly clear will miss almost every great opportunity. Profitable setups rarely, if ever, come with guaranteed odds. This is a core concept in developing a solid trading psychology. Simply recognizing that you are wired to avoid ambiguity is the first step toward consciously overriding that instinct when a calculated risk is on the table.

Turning Ambuity into Strategic Advantage

As humans, we crave certainty. Our brains are practically wired to seek out clear-cut choices. But the real world of trading and strategic planning? It’s rarely that simple. To get good at decision making under uncertainty, you first have to get crystal clear on two different ideas: risk and true uncertainty.

Getting this distinction right is what separates amateur guesswork from high-level strategic thinking.

Risk is the stuff you can measure. Think of a roulette wheel. You have a 1 in 37 chance of the ball hitting your number. The odds are known, and the outcomes are defined. You can calculate it. Many business decisions, like setting insurance premiums, operate in this world.

True uncertainty—what we often call ambiguity—is a different beast entirely. It's when you don't just lack clear probabilities; you might not even know all the possible outcomes. It’s like playing a game where the rules can change halfway through without any warning. Your old models become useless.

When the Rules of the Game Change

This isn't just some abstract theory; it's a force that has shaped economic history. Take the massive policy pivot in the United Kingdom back in the 1970s. For years, Keynesian economics, which centered on managing demand, was the standard playbook. Then, in 1979, Margaret Thatcher's government ushered in monetarist policies—a completely different way of seeing the world.

The debate wasn't just about which policy was "better." It was about a profound uncertainty over the fundamental economic laws that actually governed the country. This shows how the toughest challenges don't come from bad bets, but from having a flawed or incomplete map of how the world works. You can read more about these kinds of massive economic shifts on Imperial College London’s website.

The most resilient leaders and traders don’t waste energy chasing perfect predictions. Instead, they build agility and create systems that can adapt when the underlying rules of the game change.

This is the secret sauce. You stop trying to guess the one "right" future and start preparing for multiple possible futures.

Building Resilience with Adaptable Strategies

Forget those rigid, five-year plans that shatter at the first sign of trouble. The best strategists use flexible tools designed to navigate the fog of uncertainty, not pretend it doesn't exist.

Here are a couple of powerful concepts to start with:

-

Scenario Planning: This isn't about predicting the future. It's about imagining several plausible ones. You create a "best case," a "worst case," and maybe a "most likely" case. Then you develop strategies that are robust enough to hold up reasonably well across all of them, instead of being perfectly optimized for just one.

-

Adaptable Roadmaps: Ditch the static plan. An adaptable roadmap is a living document. It sets a clear direction but has built-in checkpoints for re-evaluation. At each point, you check your assumptions against new information and adjust your course, just like a sailor using changing winds to reach a destination.

When you embrace these kinds of approaches, your focus shifts from forecasting to preparing. You build a business, a portfolio, or a personal strategy that doesn't just survive shocks but can actually find opportunity in them. This mindset turns decision making under uncertainty from a source of anxiety into a framework for finding an edge where everyone else just sees chaos.

Frameworks For Structuring Tough Decisions

Moving from mindset to mechanics, we get to the practical tools for decision making under uncertainty. Understanding your own psychology is a huge piece of the puzzle, but having a structured framework gives you a scaffold to build better, more consistent choices. These aren't magic formulas, but they are organized ways of thinking that can bring much-needed clarity to the chaos.

The goal isn't to turn you into a statistician overnight. Instead, it's about learning to think in probabilities and adapt on the fly. By using established frameworks, we can keep our emotional reactions in check and make smarter, data-informed decisions, especially when the stakes are high.

Updating Beliefs With Bayes' Decision Rule

One of the most powerful concepts you can add to your toolkit is Bayes' Decision Rule. At its heart, the idea is refreshingly simple: you should update your beliefs as new information comes in. It’s a formal way of saying, “Don’t be stubborn; learn from what’s happening.”

Think of a startup that launches with a specific business plan. That initial strategy is really just a hypothesis—an educated guess about what the market wants. But as the first wave of user data arrives, the team starts to see what's actually working and what isn't.

Instead of clinging to the original plan, they use this new evidence to pivot. That’s Bayesian thinking in action. You start with a belief, you gather evidence, and you adjust your belief accordingly. It transforms decision-making from a single event into a continuous learning process. For a closer look at the statistical nuts and bolts, you can explore detailed research on various decision-making models from EBSCO.

Modeling Sequential Events With Markov Chains

Another incredibly useful framework is the Markov Chain. This model is perfect for situations where what happens next depends almost entirely on the present state, not the distant past. It’s a way of simplifying what would otherwise be an overwhelmingly complex sequence of events.

Imagine you're tracking a customer moving through your sales funnel. A Markov model assumes their chance of moving from the "Awareness" stage to the "Consideration" stage only depends on their current position (Awareness). It doesn't care how they first heard about your brand six months ago.

This "memoryless" property is the real magic of Markov Chains. It allows you to focus your analytical energy on the most immediate and influential factors, preventing you from getting lost in a sea of historical data that no longer matters.

This approach helps you zero in on the most critical transition points in any process—the moments where a single decision has the most leverage.

So, how do these two frameworks stack up? While they're both used to navigate uncertainty, they serve different purposes. Here's a quick comparison.

Comparing Decision Frameworks for Uncertainty

| Framework | Core Principle | Best Used For | Key Requirement |

|---|---|---|---|

| Bayes' Decision Rule | Systematically updating your beliefs (hypotheses) as you gather new evidence. | Iterative development, dynamic markets, and situations where you are constantly learning. | An initial belief (prior probability) and a way to collect new, relevant data. |

| Markov Chains | Modeling sequential events where the future state depends only on the current state. | Analyzing multi-step processes like customer journeys, supply chains, or user funnels. | A process with distinct states and observable transitions between them. |

Ultimately, Bayes helps you refine your understanding of a situation, while Markov Chains help you model the flow of a situation.

Choosing Your Decision Criteria

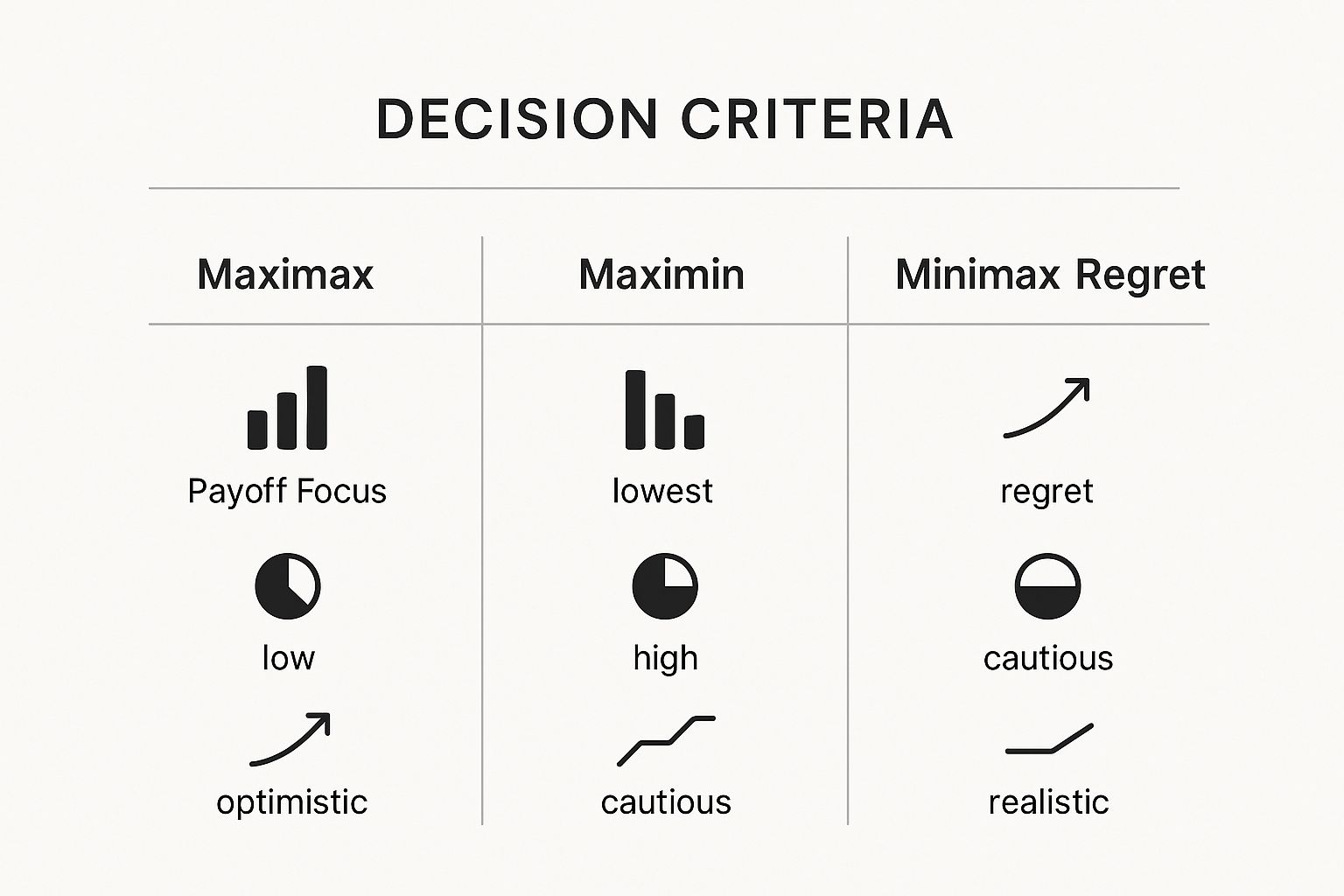

What happens when you're faced with several possible futures but have no clear probabilities to guide you? This is where decision theory offers a few classic criteria to help you choose a path. Each one reflects a different attitude toward risk and reward.

The infographic below breaks down three of the most common approaches: Maximax (the eternal optimist), Maximin (the cautious pessimist), and Minimax Regret (the balanced strategist).

This really highlights that there is no single "correct" way to decide. The best choice depends entirely on your risk tolerance and what you’re trying to achieve. A hungry startup with nothing to lose might go all-in with a Maximax approach, while a huge, established corporation would likely favor the risk-averse Maximin strategy to protect its downside.

Let's break these down with a practical lens:

- Maximax (Criterion of Optimism): You look at the absolute best possible outcome for each of your options and then choose the one with the highest potential payoff. It's a pure high-risk, high-reward strategy that's all about maximizing potential gains.

- Maximin (Criterion of Pessimism): Here, you identify the worst possible outcome for each option and choose the one with the "best" worst-case scenario. This is a defensive, almost paranoid strategy focused on damage control and survival.

- Minimax Regret (Criterion of Regret): This one is a bit more nuanced. You think about the "regret" or opportunity cost you'd feel for making the wrong choice for each possible future. The goal is to pick the option that minimizes your maximum potential regret, ensuring you never miss out too badly, no matter what happens.

By consciously selecting a criterion like one of these, you add a vital layer of rational structure to your decision. It forces you to align your choice with your overarching strategy, not just a fleeting emotion.

Actionable Strategies for Daily Business Challenges

Theory and frameworks are important, but great decision making under uncertainty comes down to what you do when you’re actually in the hot seat. This is where we stop talking about abstract concepts and start using a practical toolkit to manage risk.

These aren’t complex, ivory-tower models. They are simple but powerful habits and exercises you can use with your team to stress-test your plans and find the hidden cracks before they turn into major problems. It’s all about learning to navigate the fog with more confidence.

Run a Pre-Mortem Before You Begin

One of the most effective strategies I’ve ever used is the pre-mortem. It’s a beautifully simple, counterintuitive idea. A post-mortem looks at why a project failed after the fact. A pre-mortem does the exact opposite.

Before a big project kicks off, you get your team in a room and ask them to imagine one thing: the project has already launched and it was a complete, spectacular failure. Then, each person has to write down every possible reason why it went so wrong.

This shift in perspective is magical. It bypasses the usual corporate cheerleading and gives everyone the psychological safety to voice real concerns without feeling like they’re being negative. You'll be amazed at what comes out—flawed assumptions, market timing risks, or internal communication issues that nobody would have mentioned otherwise.

The pre-mortem forces you to face those ugly potential realities head-on. By spotting the most likely failure points in advance, you can build safeguards directly into your plan.

Set Tripwires to Force Re-evaluation

As humans, we are wired for escalation of commitment. We hate admitting we were wrong, so we double down on a losing bet because we’ve already invested so much time, money, or ego. It’s an emotional trap.

To fight this, you need to set "tripwires."

A tripwire is a pre-defined trigger that forces you to stop, take a breath, and re-evaluate your decision. It’s a rule you create for your future, emotional self while you are still calm and rational.

Here are a few examples of what business tripwires can look like:

- Financial Trigger: "If we spend $50,000 on this marketing campaign and don’t hit at least a 5% conversion rate, we will pause all spending and rethink the entire strategy."

- Time-Based Trigger: "If our new feature doesn't get 1,000 active users within 90 days of launch, the team meets to decide whether to pivot or pull the plug."

- Market Trigger: "If a major competitor launches a similar product before our beta is finished, we will halt development to analyze their offer and figure out if our value proposition is still strong enough."

By setting these clear, objective lines in the sand beforehand, you take your future ego out of the equation. The decision to reassess isn't a judgment call anymore; it’s just a rule you already agreed to follow.

Make Small, Reversible Choices

When you’re staring into a massive cloud of uncertainty, the worst thing you can do is make a huge, irreversible decision. It’s far smarter to break the problem down and make a series of smaller choices that let you gather real-world data. Think of it like a trader placing small bets to test the market's reaction before going all-in.

This approach is fundamental to managing risk, whether in business or finance. You can dive deeper into this concept by reading this essential guide to taming uncertainty in the market.

Instead of committing to a massive product launch in a new country, for example, why not run a small, targeted digital ad campaign there first? For a tiny fraction of the cost, you can see if anyone is even interested, test your messaging, and get hard data on customer demand.

This small, reversible experiment gives you invaluable information. It helps you make the next decision—the bigger one about market entry—with much more clarity and a much lower chance of failure. This is the heart of agile and effective decision-making.

Building an Antifragile Decision-Making Mindset

So far, we’ve dug into the psychology, frameworks, and raw strategies for making calls under pressure. Now it’s time to tie it all together. The real goal isn't just to survive market chaos but to become antifragile—to actually get stronger from shocks and disorder.

This isn't about finding a crystal ball or pretending you can predict the future. Real trading mastery comes from building rock-solid personal habits and systems that don't just tolerate change, but actually feed on it. It’s about fully accepting you can't control the market. What you can control is your process.

Lasting success is born from discipline. It's about looking your own biases in the eye, using frameworks to cut through the noise, and deploying practical strategies like pre-mortems to see trouble before it arrives. Every piece of the puzzle supports the others, building a foundation that won't crack under pressure.

Cultivating Your Antifragile Edge

This kind of mindset doesn't just happen; you have to build it, brick by brick. It’s a conscious choice to stop reacting to the market and start proactively preparing for it.

It all rests on a few core pillars:

- Embrace Ambiguity: You have to stop seeing incomplete information as a threat. Start looking at it as an opportunity. The best setups are often hiding in that fog of uncertainty where most traders are too afraid to even look.

- Systemize Your Choices: In the heat of the moment, your gut is your enemy. Lean on your frameworks and checklists instead. This disciplined, systematic approach is the bedrock of what it takes to become more disciplined in your trading.

- Focus on Process Over Outcome: You can make a brilliant, well-reasoned decision and still lose the trade. That’s just part of the game. Judge yourself on the quality of your process, not the random result of any single trade.

Antifragility is the ultimate edge in a world you can't predict. It guarantees that every challenge—win or lose—leaves you smarter, stronger, and more prepared for whatever comes next.

Your journey to mastering uncertainty starts right now. The single most powerful thing you can do is shift from learning to doing. Pick just one strategy from this guide—whether it's setting a simple tripwire or running a full pre-mortem on your next trade idea—and put it into action this week.

That first small, deliberate step is the beginning of a truly resilient trading career.

Frequently Asked Questions

When you start digging into making better decisions under pressure, a few practical questions always pop up. Let's tackle some of the most common ones I hear from traders. My goal here is to help you move these ideas from the textbook to your trading platform.

What Is the Difference Between Risk and Uncertainty?

A lot of traders use these words like they mean the same thing, but they're worlds apart. Getting this difference is the first step to picking the right tool for the job.

-

Risk is what you have when the odds are known. Think of a casino game like roulette. You know all the possible outcomes and the exact probability for each. You can calculate your chances. For a trader, this might look like a setup where you have a clear 1-in-6 chance based on historical data. It's a measurable world.

-

Uncertainty is a completely different beast. This is where the real world of trading lives. In a state of uncertainty, you might not even know all the possible outcomes, let alone the chances of them happening. The future is fundamentally a mystery. This is the fog we're trying to navigate.

How Can I Start Using These Frameworks Without a Statistics Background?

Don't worry, you absolutely do not need to be a math whiz to get huge value from these ways of thinking. The real power isn't in the fancy formulas; it's in forcing your brain to think in a more structured and less emotional way.

For example, you can use the core idea of Bayes' Rule just by constantly asking yourself, "Okay, this new piece of information just came in. How does it change my original thesis?" That's it. No calculator needed. A pre-mortem is even simpler—it's just a structured thought experiment.

The point isn't to turn you into a statistician. The point is to give you a repeatable process that stops your gut feelings and mental shortcuts from wrecking your account when things get messy. That's how you build real consistency.

Which Strategy Is Best for a Team Decision?

If you're making decisions with a group, the pre-mortem is hands-down one of the most powerful tools you can use. It's brilliant because it gives everyone permission to be critical without feeling like they're being negative or difficult.

By starting with the assumption that the plan has already failed, you change the dynamic completely. People aren't attacking the plan; they're praised for finding the hidden traps and landmines. It's a fantastic way to tap into the group's collective experience to build a much stronger, more bulletproof strategy.

Ready to stop guessing and start trading with a clear, repeatable process? At Colibri Trader, we teach you how to master price action and make confident decisions without relying on confusing indicators. Take the first step and learn more at https://www.colibritrader.com.