Day Trading vs Swing Trading A Strategic Guide

At its core, the main difference between day trading and swing trading comes down to one thing: time. Day traders live in the world of minutes and hours, buying and selling assets within a single day to bank small, quick profits. Swing traders play a longer game, holding positions for several days or weeks to ride out larger market swings.

Choosing Your Trading Style

Picking between these two popular approaches isn't just a technical decision—it's about finding a rhythm that fits your life. Your personality, your schedule, and the amount of capital you have will all point you in one direction or the other. There’s no right or wrong answer here, only what's right for you.

To figure that out, you need to look past the textbook definitions and understand what each style feels like in practice. Let's break down the realities of both so you can see which one aligns with your goals.

Day Trading vs Swing Trading At a Glance

Before we get into the nitty-gritty, this quick table lays out the fundamental differences. It's a high-level look at how day trading and swing trading stack up against each other on the most critical points.

| Attribute | Day Trading | Swing Trading |

|---|---|---|

| Holding Period | Minutes to hours (positions closed daily) | Several days to a few weeks |

| Time Commitment | High (requires full daily attention) | Moderate (can be done part-time) |

| Risk Exposure | High intraday risk, no overnight risk | Lower intraday risk, high overnight risk |

| Profit Potential | Smaller gains on frequent trades | Larger gains on fewer trades |

| Capital Minimum | High (>$25,000 in the US) | Low (no specific minimum) |

As you can see, the short-term nature of day trading has a massive ripple effect, influencing everything from the time you'll spend in front of the screen to the money you need just to get started.

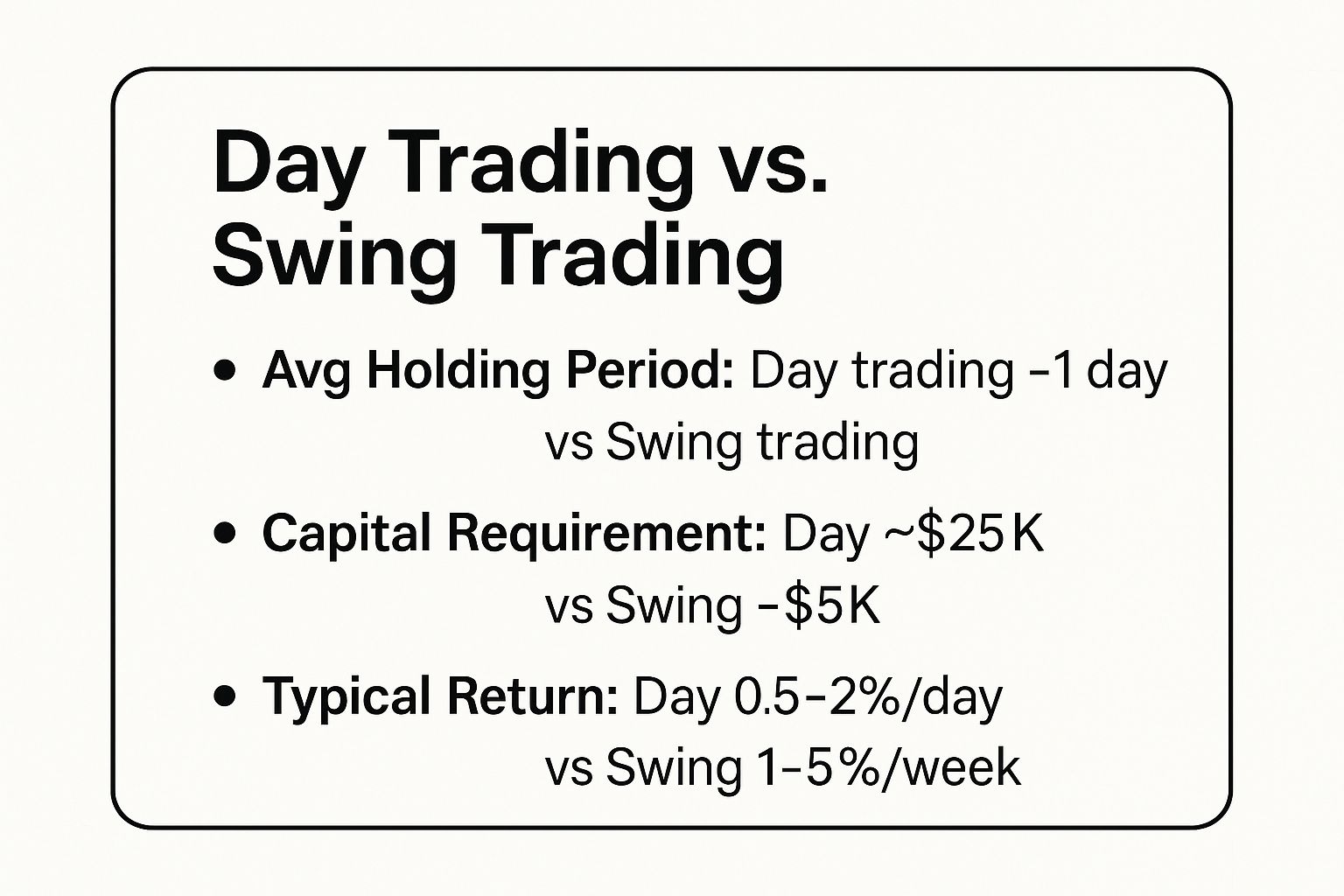

This visual also does a great job of summarizing the core distinctions.

The data makes it clear: day trading is an intense, capital-heavy activity. Swing trading, on the other hand, offers more breathing room and a lower barrier to entry, which is often the deciding factor for traders who are just starting out or can't be glued to their charts all day.

Understanding the Time Commitment and Market Approach

The biggest difference in the day trading vs swing trading debate isn't just about how long you hold a trade. It’s about how each style completely dictates your relationship with the market and, as a result, your entire daily schedule.

This choice is huge. It shapes your entire trading routine, from when you wake up to when you can switch off.

Day trading is total immersion. It demands you be glued to your screens for hours, often from the opening bell right to the close. You're making decisions in minutes, sometimes even seconds. It’s all about nailing tiny, intraday price moves with unwavering focus. Think of it like being a sprinter, making dozens of lightning-fast dashes all day long.

Swing trading, on the other hand, is a game of patience and bigger-picture strategy. You aren't shackled to your desk all day. Instead, you might spend your evenings or weekends poring over charts, looking for setups that could play out over several days or even weeks. It’s more like being a marathon runner who prepares meticulously, executes the plan, and then knows when to rest.

Daily Life and Mental Stamina

The impact on your lifestyle is profound. A day trader has to build their entire day around market hours, which can feel incredibly restrictive. The relentless pressure of making one rapid-fire decision after another leads to serious stress and mental burnout for many. To succeed here, you need exceptional discipline and iron-clad emotional control.

If you are leaning this way, you absolutely must check out these essential day trading strategies to understand what you're getting into.

A day trader's success is often measured by their ability to remain disciplined under constant pressure, while a swing trader's success hinges on their patience and ability to let a trade play out.

Swing trading gives you a lot more breathing room. Because your trades last for days or weeks, it's something you can realistically manage alongside a full-time job or other parts of your life. The pace is slower, which usually means less stress.

But don't mistake slower for easier. This style requires a different kind of mental grit—the patience to sit through minor pullbacks without panicking and the discipline to stop yourself from messing with your trades based on daily market "noise."

A Closer Look at Trading Frequency

The time horizon of each style directly shapes how often you trade and the kind of risk you take on.

Day traders are in and out of multiple positions within a single session, hunting for small profits. By closing everything before the market shuts, they smartly sidestep the risk of overnight gaps. The trade-off? Higher transaction costs from the sheer volume of trades.

Swing traders hold positions for days or weeks, trying to capture the larger market 'swings.' This can lead to much bigger profits per trade, but it also exposes them to overnight risk—the danger of the market gapping against them while they sleep. This is a fundamental difference you have to be comfortable with when choosing your path.

Comparing Risk Exposure and Profit Potential

Alright, let's get to the heart of the matter. Beyond the time commitment and daily routines, the real difference between day trading and swing trading comes down to how you handle risk and where your profits come from.

These two styles have completely different risk-reward profiles. It's a fundamental trade-off: are you aiming for a steady stream of small wins, or are you willing to wait for a handful of much larger gains? Getting this right is crucial before you put any real capital on the line.

Day trading is a game of high frequency and tight margins. The goal is to scalp small profits over and over, compounding them throughout the day. A successful day trader might be targeting a 0.5% to 2% return on their capital each day.

But this approach is a double-edged sword. Trading a lot means transaction costs can eat into your profits quickly. It also opens the door to "over-trading"—letting emotions like greed or fear of missing out drive your decisions when you're under pressure. That psychological grind is a real risk that many new traders underestimate. A few bad decisions can burn you out and hurt your confidence just as much as your account balance.

The Great Divide: Overnight Risk

The single biggest difference in risk between these two styles is what happens when the market closes.

A day trader's biggest advantage is ending the day "flat," with no open positions. This simple act completely insulates them from overnight risk. They don't have to worry about a surprise news event or a bad earnings report causing a stock to gap down violently at the next morning's open.

A day trader sleeps soundly knowing their capital is safe from after-hours market shocks. A swing trader accepts overnight risk in exchange for the chance to capture a much larger portion of a stock's move.

Swing traders, on the other hand, intentionally embrace this risk. Their whole strategy depends on holding a position for several days or even weeks. They are trying to capture a much bigger "swing" in price, potentially aiming for a 5% to 20% gain from a single trade.

The danger, of course, is that a surprise announcement or a shift in market sentiment can happen while they're asleep, turning a winning trade into a significant loss before they can react. Understanding this fundamental difference is probably the most important factor in deciding which style suits your personality and risk tolerance.

Risk and Reward Profile Comparison

To make this crystal clear, let's break down the key differences in how each style handles risk and generates returns. This table should give you a quick, at-a-glance view of the trade-offs involved.

| Factor | Day Trading | Swing Trading |

|---|---|---|

| Primary Risk | High trade frequency, leverage risk, psychological burnout | Overnight/weekend gap risk, exposure to major news events |

| Typical Gain Per Trade | Small, often 0.5% – 2% | Larger, often 5% – 20% or more |

| Loss Potential | Amplified by leverage; small losses can compound quickly | Can be significant if a stock gaps against the position |

| Transaction Costs | High due to the volume of trades | Low due to infrequent trading |

| Leverage Impact | Essential for meaningful gains, but dramatically increases risk | Used more moderately, less central to the strategy |

As you can see, there's no "better" option—only the one that aligns with your capital, your temperament, and the amount of risk you're willing to stomach for a potential reward.

Profit Potential and Sustainability

Day trading certainly has the allure of fast money. But its heavy reliance on leverage to make tiny price movements profitable also means that losses are magnified. A mere 1% price move against a highly leveraged position can be absolutely devastating. This is the main reason why so few day traders find long-term, consistent profitability.

For many people, swing trading proves to be a more sustainable path, especially for those who can't be glued to a screen all day. With fewer trades, the transaction costs are much lower.

The slower pace also allows for more thoughtful, well-researched decisions instead of gut reactions. While the profits don't come every day, the potential for larger individual wins can make the strategy more forgiving. This often makes it a more practical and accessible starting point for many aspiring traders.

Decoding Capital and Regulatory Requirements

The debate between day trading and swing trading often boils down to a very real, practical question: how much money do you actually need to start? Your starting capital and the regulatory rules don't just shape your strategy; they can decide which style of trading is even an option for you.

For a lot of aspiring traders in the United States, the single biggest roadblock to day trading is the Pattern Day Trader (PDT) rule. This is a big one. Enforced by FINRA, this regulation says that if you make four or more "day trades" in a margin account within five business days, you must keep at least $25,000 in that account. Period. Drop below that, and your day trading is frozen until you bring the balance back up.

This rule is often the deciding factor. It creates a high financial barrier to entry, making day trading inaccessible for those starting with smaller accounts.

There's a reason for this rule. Day trading exploded in the 1990s during the dot-com bubble, as new electronic platforms suddenly gave the public access to rapid-fire trading. To protect traders from the wild volatility of that era, regulators introduced the PDT rule in 2001, effectively raising the stakes for anyone wanting to trade at high frequency. You can dive deeper into the history of these kinds of regulations on Britannica.

The Swing Trading Advantage for New Traders

This is where swing trading presents a huge advantage. It offers a much more accessible path because it is not subject to the Pattern Day Trader rule. Think about it: since swing traders hold their positions overnight or longer, those trades don't get tallied as "day trades."

What does this mean for you? You can start swing trading with a much smaller account—often just a few thousand dollars, depending on what your broker requires.

This lower capital requirement is a game-changer. It lets new traders get their feet wet and learn the markets with real money on the line, but without needing a massive initial investment.

Of course, your account size always plays a critical role in how you manage risk.

- For Day Traders: A bigger account isn't just about meeting the PDT rule. You need a buffer to absorb the inevitable small losses and the cost of commissions from frequent trading. Without enough capital, a bad streak can wipe out a small account fast.

- For Swing Traders: Even with a lower starting point, you still need enough capital to ride out the waves. A trade might move against you for a few days before it turns in your favor. Your account has to be big enough to handle that temporary dip without triggering a margin call or forcing you to sell at a loss.

Matching Trading Style to Your Personality and Lifestyle

Here's the truth most trading courses won't tell you: the day trading vs. swing trading debate has very little to do with charts and everything to do with you. The best trading style—the one that will actually make you money—is the one that aligns with your personality and your real-world schedule. Get this wrong, and you're on a fast track to burnout and an empty account.

This isn't about which style is technically "superior." It's about taking an honest look in the mirror. Do you thrive under pressure and have the discipline to make lightning-fast decisions without getting emotional? Or are you more of a patient, analytical thinker who prefers to make a few well-researched moves each week?

The Day Trader Profile

The ideal day trader is a master of emotional control and unwavering discipline. You have to be okay with sitting at your desk for hours, completely focused, ready to execute trades based on a strict set of rules. This kind of person handles stress well and sees small, frequent losses as nothing more than the cost of doing business. They can take a hit and immediately shift their focus to the next opportunity without hesitation.

Think of the "Full-Time Market Analyst" type. This person dedicates their entire workday to the markets. They have the time, the focus, and the mental horsepower to stare at intraday charts, manage multiple positions, and stay locked in from the opening bell to the close. Their lifestyle is literally built around the trading day.

The Swing Trader Profile

The classic swing trader, on the other hand, is patient and methodical. They genuinely enjoy the process of deep analysis, and they're perfectly comfortable waiting days—or even weeks—for the right trade setup to appear. They aren't rattled by the market's daily noise and have the conviction to hold a position through minor pullbacks because they trust their initial research.

This is a perfect match for the "Part-Time Trader with a 9-to-5" scenario. This individual simply can't watch the market all day. Instead, they use their evenings and weekends to hunt for promising setups, place their orders with clear entry and exit points, and then let the trade play out over time. Swing trading fits into their existing lifestyle instead of forcing a complete overhaul. You can check out some of the powerful methods they might use by exploring these five swing trading strategies that work.

Your trading style must be an extension of who you are, not a constant battle against your natural tendencies. Forcing a fit leads to indecision, emotional mistakes, and ultimately, an empty account.

Choosing the right path means being brutally honest about your own psychology and daily limitations. Do you need the adrenaline rush and instant feedback of day trading, or does the more strategic, less time-intensive approach of swing trading just feel right? Your answer to that question is the single most important factor for your long-term success.

Essential Strategies and Technical Tools for Each Approach

Your choice between day trading and swing trading bleeds directly into the strategies you'll use and the tools in your arsenal. The two styles are worlds apart, each relying on a specific set of technical indicators and chart timeframes.

A successful day trader's toolkit looks almost alien to a swing trader, and for good reason.

The Day Trader's Playbook

For a day trader, everything comes down to speed and precision. They live on short-term charts, mainly the 1-minute and 5-minute charts, hunting for opportunities that might only exist for a few moments.

Their core strategies are built for this fast-paced environment:

- Scalping: This is an incredibly active style. A scalper might execute dozens, even hundreds, of trades a day just to skim a few cents off each price move. Volume and speed are everything.

- Momentum Trading: This involves spotting stocks that are already making a big move on high volume. The goal is to jump on board and ride that wave of momentum for a short burst before it fizzles out.

To make these plays, day traders rely on specialized tools. Level 2 quotes are essential, showing the depth of buy and sell orders to gauge immediate supply and demand. Real-time volume analysis is just as critical to confirm that a price move has real conviction behind it.

How Swing Traders See the Market

Swing traders operate on a completely different analytical plane. They aren’t chasing tiny, fleeting moves; they're trying to capture the larger "swings" in price that unfold over several days or even weeks.

This means their focus shifts to identifying broader trends and more significant market patterns. They primarily use daily and weekly charts to get a bird's-eye view of the market's bigger picture.

Their go-to indicators are designed to measure the strength and durability of a trend, not just a momentary flicker. You'll find their charts loaded with tools like the 50-day and 200-day moving averages, the Relative Strength Index (RSI), and the MACD.

A day trader sees a bullish flag pattern on a 5-minute chart as a signal for a quick pop lasting a few minutes. A swing trader sees the same pattern on a daily chart as a potential multi-day upward move.

This difference in perspective is everything. The exact same chart pattern carries a completely different meaning depending on the timeframe, which is why your tools must align with your trading style.

The hard truth is that most day traders don't make it. Research suggests only about 10% remain profitable long-term, crushed by high transaction costs and the sheer difficulty of correctly timing intraday noise. Swing trading's longer holding period often filters out this market chaos, which can lead to higher consistency. You can discover more insights about trading success rates on CenterPointSecurities.com.

Answering Your Top Trading Questions

I get a lot of questions from traders trying to figure out where they fit in the day trading versus swing trading debate. Let's tackle some of the most common ones I hear.

Can You Do Both Day Trading and Swing Trading?

Yes, you absolutely can, but I would strongly advise against it if you're just starting out. It's a classic case of trying to walk before you can crawl.

A seasoned trader might run a core portfolio of longer-term swing trades while using a separate, much smaller account to pounce on quick day trading opportunities. This works only because they have exceptional discipline. They know how to keep the two strategies completely separate in their minds and avoid letting the emotions from one spill over into the other.

For a newer trader, mixing styles is a recipe for confusion and losses. You might panic and close a perfectly good swing trade because of some meaningless intraday noise, or you could try to day trade a setup that really needs several days to play out properly. Master one approach first. Get good at it. Only then should you even consider adding another layer of complexity.

Which Trading Style Is Realistically More Profitable?

Neither one guarantees you a single dollar. Your success comes down to your skill, your strategy, and how you manage risk—period. Day trading dangles the carrot of small, frequent gains that can compound quickly, but the reality is high transaction costs and a brutally steep learning curve.

The most profitable trading style is the one that fits your personality, lifestyle, and capital like a glove. Forcing a fit will only lead to failure.

Swing trading, on the other hand, aims for larger profits on each position and tends to be more forgiving for beginners. The trade-off is that you're exposed to overnight and weekend market risk, which can be significant. True, lasting profitability comes from consistency, and you can only be consistent when your trading style aligns with who you are.

What Market Is Best for Beginners to Start In?

The stock market is generally the best place to cut your teeth. It’s transparent, liquid, and has a mountain of educational resources available.

- For Swing Traders: I’d point you toward large-cap stocks. They usually have more predictable, established trends, lower volatility, and plenty of professional analysis you can learn from.

- For Day Traders: You need to live where the high-volume is. Liquidity is everything. You must be able to get in and out of your trades in a split second without the price slipping away from you.

While markets like forex and futures are incredibly popular, they bring a lot more leverage and complexity to the table. It's much wiser to build a solid foundation and develop strong trading discipline in the stock market before stepping into those more advanced arenas.