7 Best Books on Trading for Beginners in 2025

Jumping into trading without a solid foundation is like sailing without a map. The allure of quick profits often leads to costly, avoidable mistakes, but the structured wisdom from seasoned experts can set you on a path toward consistent success. This guide bypasses dense academic theory and focuses on the most essential books on trading for beginners that provide actionable, real-world strategies. We have carefully curated a list that covers the critical pillars of successful trading: foundational market knowledge, practical technical analysis, and the disciplined psychology required to navigate market volatility.

This is not just a simple reading list. For each book, we'll break down exactly what makes it essential, who it's best suited for, and how to apply its core lessons directly to a modern, price-action-focused trading approach. Whether you are just starting and want to understand how markets truly work, or you are looking to build a more robust and disciplined mindset, this curated collection is your first strategic step. Consider this your roadmap to becoming a more knowledgeable and confident trader, built on principles that have stood the test of time.

1. A Random Walk Down Wall Street by Burton G. Malkiel

While it might seem counterintuitive to start a list of books on trading for beginners with a text that champions passive investing, Burton G. Malkiel’s classic is essential foundational reading. Before you can effectively trade or "beat" the market, you must first understand the powerful argument for why it's so difficult to do so consistently. This book introduces the "efficient market hypothesis," which suggests that asset prices fully reflect all available information.

The core idea is that any predictable price movements are almost instantly arbitraged away, making the market’s short-term path a "random walk." For a novice trader, this concept is a crucial reality check. It grounds you in the understanding that consistent profits require a genuine edge, not just a simple pattern-following system. Malkiel uses decades of data to show how low-cost index funds often outperform the majority of professional, actively managed funds, making a compelling case for a passive approach.

Why It's a Must-Read for Aspiring Traders

Even if your goal is active trading, this book provides the intellectual framework necessary to approach the markets with healthy skepticism and robust risk management. It forces you to question the validity of your strategies and to seek a true, demonstrable advantage.

- Builds a Strong Foundation: Learn fundamental concepts like asset valuation, portfolio theory, and the history of market bubbles without the hype of "get-rich-quick" schemes.

- Encourages Critical Thinking: Understanding the efficient market hypothesis helps you evaluate trading strategies more critically. You’ll learn to ask, "Why should this work if markets are efficient?"

- Promotes Risk Management: Its emphasis on diversification and long-term perspective provides risk management principles that are transferable to any active trading strategy.

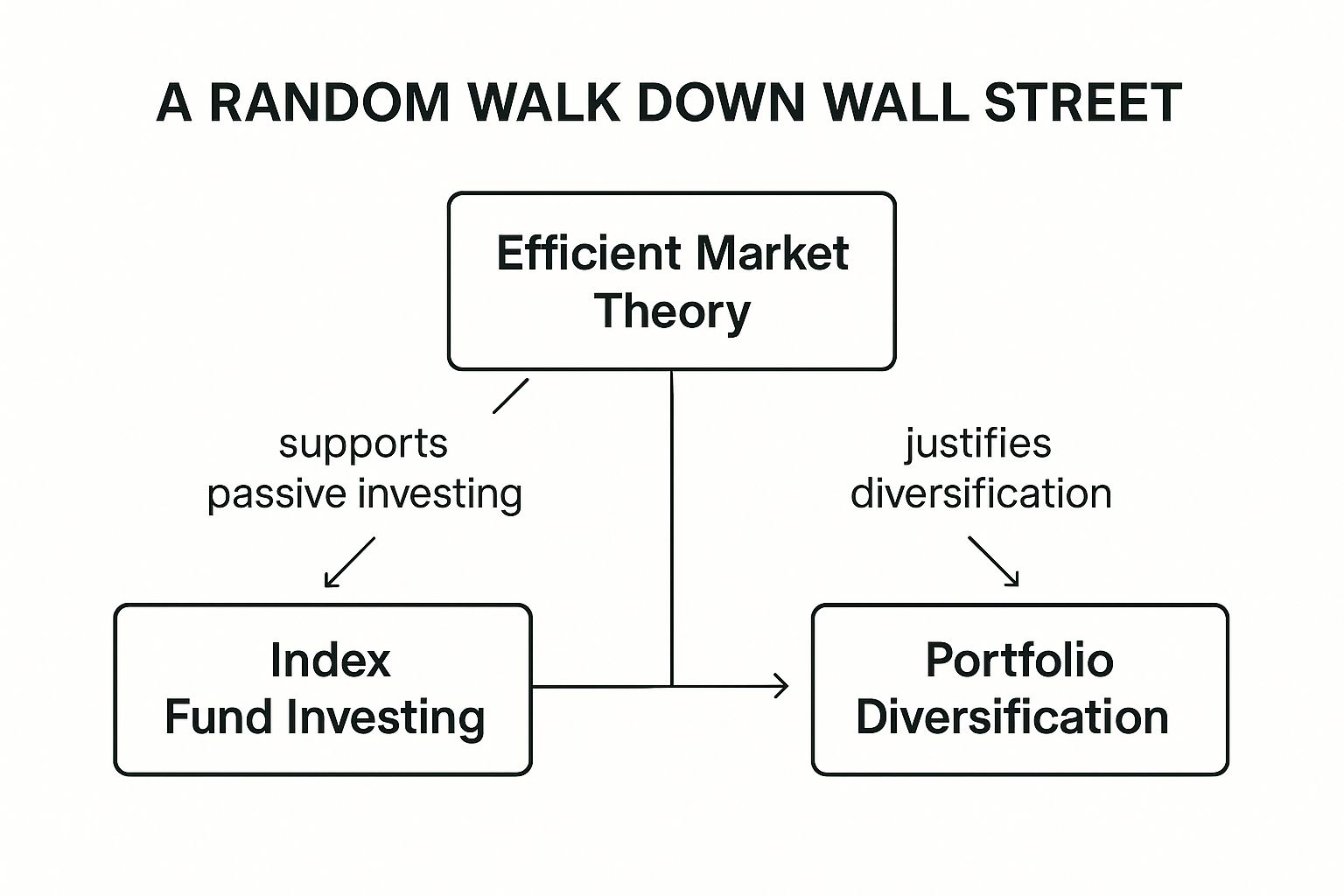

This infographic illustrates the core relationship between the Efficient Market Theory, the strategy of Index Fund Investing it supports, and the risk-mitigating principle of Portfolio Diversification.

As the visualization shows, the theory that markets are efficient directly leads to the conclusion that passive strategies like index fund investing, combined with broad diversification, are the most logical approach for most investors. By mastering these foundational ideas first, you'll be far better equipped to develop a trading style that has a realistic chance of succeeding.

2. The Intelligent Investor by Benjamin Graham

Often hailed as the bible of value investing, Benjamin Graham's masterpiece is a foundational text that every aspiring trader or investor must read. It establishes a clear, critical distinction between "investing" and "speculating," providing a philosophical framework to protect beginners from reckless behavior. Graham's core thesis revolves around the principle of "margin of safety," a concept designed to protect capital by purchasing assets for significantly less than their calculated intrinsic value.

This book is less about short-term trading charts and more about cultivating a disciplined, business-like mindset. Graham teaches you how to perform fundamental analysis to determine what a company is truly worth, independent of its fluctuating market price. He introduces the allegorical "Mr. Market," a manic-depressive business partner whose irrational mood swings offer opportunities for the rational investor to buy low and sell high. For beginners, this is a powerful lesson in emotional control and patience, which is directly applicable to trading.

Why It's a Must-Read for Aspiring Traders

While its focus is on long-term value investing, the principles Graham lays out are universal for anyone who wants to operate in the financial markets. It provides the intellectual armor needed to withstand market volatility and make decisions based on logic rather than fear or greed. Understanding these concepts is essential for those exploring the best books on trading for beginners because it sets a standard for rational analysis.

- Teaches Emotional Discipline: The "Mr. Market" analogy is one of the most powerful tools for learning to detach emotionally from short-term market noise.

- Builds Analytical Skills: It introduces the fundamentals of valuing an asset, a skill that is crucial whether you are holding for ten years or ten days.

- Instills a Risk-First Mindset: The "margin of safety" concept is the ultimate risk management tool. It forces you to always consider the downside before thinking about potential profits.

By internalizing Graham’s wisdom, you learn to see the market not as a casino but as a venue of opportunity for the patient and disciplined participant. This perspective is invaluable, regardless of the specific trading strategy you ultimately choose to pursue.

3. Technical Analysis of the Financial Markets by John J. Murphy

Often referred to as the "bible" of technical analysis, this comprehensive guide by John J. Murphy is an indispensable resource for any aspiring trader. While other books provide theories or specific strategies, this one serves as a complete textbook on the language of charts. It systematically breaks down the tools and techniques used to analyze price action, identify trends, and forecast future market movements based on historical data.

Murphy’s work covers everything from foundational concepts like Dow Theory and chart construction to intricate details on candlestick patterns, moving averages, and momentum indicators. He provides clear, real-world chart examples that illustrate how patterns like "head and shoulders" or "double tops" signal potential market reversals. For beginners, this book methodically builds the knowledge required to interpret what a price chart is actually communicating about market psychology and supply-demand dynamics.

Why It's a Must-Read for Aspiring Traders

This book isn't just a one-time read; it’s a reference manual you'll return to throughout your trading career. It teaches you the how and why behind price movements, providing the technical vocabulary and skills needed to develop and test your own trading strategies. It’s one of the most essential books on trading for beginners because it provides the operational framework for most price action-based trading.

- Creates a Comprehensive Skillset: Learn to identify chart patterns, understand trend lines, and effectively use dozens of technical indicators and oscillators to inform your decisions.

- Provides a Reference Framework: The book is structured to be an ongoing resource. When you encounter a new indicator or pattern, you can quickly find a detailed, unbiased explanation within its pages.

- Connects Theory with Practice: Murphy excels at showing how different tools work in conjunction. For instance, he demonstrates how to confirm a candlestick reversal pattern using a momentum indicator like the RSI, adding layers of confirmation to a trade idea.

By mastering the principles in this guide, you move from guessing at market direction to making informed decisions based on a structured, analytical approach to price charts. It provides the essential technical toolkit for building a robust trading system from the ground up.

4. Market Wizards by Jack Schwager

Instead of teaching a specific system, Jack Schwager's Market Wizards offers something arguably more valuable: a look inside the minds of the world’s most successful traders. The book is a compelling collection of interviews with trading legends, each sharing the philosophies, strategies, and painful lessons that shaped their careers. It reveals that there is no single holy grail, but rather a set of common principles that underpin consistent profitability.

From Ed Seykota's rigid trend-following systems in commodities to Paul Tudor Jones's masterful market timing and risk control, the book covers a vast spectrum of approaches. Schwager skillfully extracts the golden threads connecting them all: discipline, meticulous risk management, and the development of a trading style that fits one's own personality. For a beginner, this is a crucial lesson that success comes from self-mastery, not from copying someone else’s trades.

Why It's a Must-Read for Aspiring Traders

Market Wizards is one of the best books on trading for beginners because it focuses on the psychology and discipline required to succeed, which are often more important than any single technical setup. It provides motivation and a realistic blueprint for developing a professional mindset.

- Learn from the Best: Gain direct insights into the thought processes of elite traders like Bruce Kovner, who turned a small loan into a multi-billion dollar hedge fund.

- Focus on Psychology: The book overwhelmingly emphasizes that a trader's mental state and emotional control are paramount. This is a lesson many beginners learn the hard way.

- Understand Diverse Strategies: By seeing that wildly different methods can all lead to success, you are encouraged to find an approach that truly resonates with you, rather than chasing a "perfect" system.

5. Trading for a Living by Dr. Alexander Elder

Dr. Alexander Elder's Trading for a Living is a foundational text that uniquely integrates the three crucial pillars of trading success: psychology, market analysis, and risk management. As a professional trader who was also a practicing psychiatrist, Elder brings a vital perspective to the mental discipline required to succeed in the markets. This book goes beyond simple chart patterns and introduces a holistic framework for making trading decisions.

The core of Elder's approach is the "Three Ms": Mind, Method, and Money. He argues that your psychological state (Mind) is the most important factor, followed by your trading strategy (Method) and your risk management plan (Money). For beginners, this framework is invaluable as it immediately highlights that successful trading is not just about finding the right indicator. It introduces practical techniques like the Triple Screen trading system, which uses multiple timeframes to filter trades and improve entry timing.

Why It's a Must-Read for Aspiring Traders

This book serves as a complete blueprint for developing a professional trading mindset and a robust system. It treats trading as a serious business, providing the tools needed to manage emotions, analyze markets methodically, and protect capital rigorously. For those looking for comprehensive trading strategies for beginners, Elder’s work provides a structured and disciplined starting point.

- Integrates Psychology and Strategy: It's one of the best books on trading for beginners because it directly addresses the psychological hurdles that cause most novices to fail.

- Provides a Complete System: The book outlines a full trading plan, from market analysis with the Triple Screen method to setting stops and keeping detailed records.

- Emphasizes Professional Discipline: Elder's focus on meticulous record-keeping and disciplined execution teaches you to treat trading as a professional endeavor, not a hobby or a gamble.

6. Japanese Candlestick Charting Techniques by Steve Nison

Before Steve Nison introduced this centuries-old Eastern technique to the West, traders relied almost exclusively on bar charts. Japanese Candlestick Charting Techniques fundamentally changed technical analysis by providing a visually intuitive way to interpret price action and market psychology. It’s one of the essential books on trading for beginners because it decodes the language of the market itself.

Each candlestick tells a story of the battle between buyers and sellers over a specific period. Nison masterfully breaks down how individual candle shapes and multi-candle patterns can signal market sentiment, indecision, and potential reversals with remarkable clarity. For example, he explains how a simple "Doji" pattern can reveal a market in equilibrium, often preceding a significant breakout, while powerful patterns like the "Bullish Engulfing" can signal a strong shift in momentum from sellers to buyers. This book moves beyond theory and teaches you to read the emotional state of the market directly from your charts.

Why It's a Must-Read for Aspiring Traders

For any trader focused on price action, this book isn't just recommended; it's required reading. It provides the visual vocabulary needed to understand market dynamics without relying solely on lagging indicators. Mastering these techniques is a foundational step toward making informed, real-time trading decisions.

- Builds a Visual Foundation: Learn to instantly recognize key patterns like Hammers, Hanging Man, and Morning Stars, which provide clues about potential market turning points.

- Focuses on Market Psychology: Nison doesn’t just show you patterns; he explains the psychology behind them, helping you understand why they are predictive.

- Universally Applicable: The principles of candlestick analysis apply to any market, including stocks, forex, and commodities, making this skill set incredibly versatile. For more information, you can explore this detailed guide on how to read candlestick charts.

By internalizing the lessons in this book, you transition from simply looking at a price chart to truly understanding the narrative it is telling. This skill is indispensable for developing a discretionary trading edge.

7. The Little Book of Common Sense Investing by John C. Bogle

Similar to A Random Walk Down Wall Street, this entry from the legendary founder of Vanguard, John C. Bogle, makes a powerful argument for passive investing. It might seem out of place in a list of books on trading for beginners, but its core message is an indispensable lesson in market realities. The book systematically dismantles the illusion that most active traders can consistently outperform the market average over the long run.

Bogle presents a simple yet profound thesis: instead of trying to pick winning stocks, investors are better off buying a low-cost fund that holds every stock in the market. He uses decades of historical performance data to show how the relentless drag of fees, commissions, and taxes erodes the returns of even the most skilled active managers. Understanding this "loser's game," as Bogle calls it, provides a critical perspective for anyone looking to enter the trading arena.

Why It's a Must-Read for Aspiring Traders

Even if your ultimate ambition is to be a successful active trader, this book instills the discipline and realistic expectations necessary for survival. It forces you to confront the real-world costs of trading and provides a benchmark against which you must measure your own performance.

- Establishes a Performance Baseline: The book teaches you that your active trading strategy must consistently outperform a simple, low-cost index fund after all fees and taxes to be considered successful.

- Drills Down on the Importance of Costs: Bogle's relentless focus on minimizing fees is a lesson every trader must internalize. High commissions and expense ratios are a significant, often overlooked, hurdle to profitability.

- Advocates for a Core-Satellite Strategy: The principles in this book are perfect for structuring a "core-satellite" portfolio. You can hold the bulk of your capital in stable, low-cost index funds (the core) while using a smaller portion for active trading (the satellite), thus managing risk effectively.

7-Book Comparison: Trading for Beginners

| Title | Core Features / Focus | User Experience / Quality ★ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| A Random Walk Down Wall Street | Market theory, passive investing, risk management | ★★★★☆ Comprehensive & clear | 💰 Affordable classic, long-term focus | 👥 Beginners & passive investors | 🏆 Efficient Market Theory advocate |

| The Intelligent Investor | Value investing, margin of safety, fundamental analysis | ★★★★★ Timeless, disciplined teaching | 💰 High value for long-term investors | 👥 Investors seeking value & safety | 🏆 Graham's legacy, Buffett’s mentor |

| Technical Analysis of the Financial Markets | Chart patterns, indicators, technical tools | ★★★★☆ Detailed, practical examples | 💰 Comprehensive reference manual | 👥 Traders wanting technical mastery | ✨ Wide scope, multi-asset coverage |

| Market Wizards | Trader interviews, psychology, varied strategies | ★★★★☆ Inspirational and insightful | 💰 Motivational with practical wisdom | 👥 Intermediate traders & enthusiasts | ✨ Real trader insights and stories |

| Trading for a Living | Trading psychology, risk management, trading system | ★★★★☆ Holistic approach | 💰 Balanced cost, practical system | 👥 Beginners & intermediate traders | ✨ Triple Screen method, psychology focus |

| Japanese Candlestick Charting Techniques | Candlestick patterns, market sentiment analysis | ★★★★☆ Visual and focused | 💰 Niche, essential for pattern mastery | 👥 Technical traders & chart analysts | 🏆 Introduced candlesticks to the West |

| The Little Book of Common Sense Investing | Index fund investing, cost efficiency, long term | ★★★★☆ Simple and accessible | 💰 Cost-effective, research-backed | 👥 Passive investors & beginners | 🏆 Vanguard founder’s investing philosophy |

From Page to Price Chart: Turning Knowledge into Profit

You have now explored a foundational library of some of the best books on trading for beginners, each offering a unique lens through which to view the markets. From the timeless wisdom of Graham's value investing and Malkiel's market efficiency theories to the practical charting techniques of Nison and Murphy, this collection provides the essential building blocks for a successful trading career. The journey, however, does not end with the final page of a book.

The true challenge and reward lie in the application of this knowledge. Reading about risk management in Trading for a Living is one thing; cutting a losing trade without hesitation in a live market is another entirely. Similarly, understanding candlestick patterns from Steve Nison’s work is useless until you can identify and act upon them in real-time price action. The ultimate goal is not to memorize every concept but to synthesize the most critical lessons into a cohesive, personalized trading plan.

Weaving Theory into a Coherent Strategy

Your next step is to bridge the gap between theory and execution. The most effective way to do this is incrementally. Do not try to implement everything at once. Instead, focus on building a robust framework piece by piece.

Here is a practical roadmap to get you started:

- Build Your Philosophical Base: Internalize the core principles from Bogle and Malkiel. Understanding market realities and the importance of a long-term perspective will ground you, even as you pursue short-term trading opportunities. This foundation prevents you from falling for "get rich quick" schemes.

- Master Your Charting Tools: Dedicate time to applying the lessons from Technical Analysis of the Financial Markets and Japanese Candlestick Charting Techniques. Open a demo account and practice identifying trends, support/resistance levels, and key candlestick formations without risking capital.

- Integrate Psychology and Risk Management: Use the insights from Dr. Alexander Elder and Jack Schwager to build your trading rules. Define your maximum risk per trade, establish your entry and exit criteria, and start a trading journal to track your psychological state alongside your performance.

From Beginner Knowledge to Confident Execution

The transition from a reader to a trader is a process of deliberate practice. The most successful traders do not just consume information; they filter it, test it, and forge it into a system that fits their personality and risk tolerance. The books on trading for beginners we have covered are your raw materials. Your job is to become the craftsman who shapes them into a profitable and sustainable trading methodology.

Ultimately, this journey is about moving from a state of passive learning to active, confident decision-making. It is about transforming abstract concepts into tangible skills that allow you to read the story of the market through price action. This is where a structured, mentored approach can make all the difference, providing the guardrails necessary to apply these timeless principles effectively and avoid costly beginner mistakes.

Ready to translate these foundational concepts into a practical, price-action-based strategy without relying on confusing indicators? At Colibri Trader, we specialize in helping you apply the core principles from these classic texts through hands-on mentorship and proven systems. Join our community to build the skills and confidence required to trade effectively in any market condition. Learn more and get started at Colibri Trader.