Best Way to Learn Stock Trading: best way to learn stock trading for beginners

The best way to learn stock trading is to approach it like you would any other serious profession, not as a lottery ticket. It’s about methodically building a foundation in price action, getting your reps in through disciplined, simulated practice, and absolutely mastering your money management rules before a single dollar of real capital is at risk.

Your Realistic Path to Learning Stock Trading

Let's be honest. When you first dive into the stock market, it feels like chaos. You're bombarded with countless strategies, gurus promising overnight riches, and "can't-miss" alerts.

But here’s what I’ve learned over the years: lasting success in trading doesn't come from a secret indicator or a magic formula. It’s a journey of deliberate skill-building, much like learning to play an instrument or speak a new language. That's the entire philosophy behind this guide.

Instead of chasing quick profits from lagging indicators or gambling on news headlines, we’re going to focus on a clear, repeatable process built on three core pillars:

- Reading Price Action: This is about learning to interpret the story the charts are telling you, without all the clutter and noise.

- Deliberate Practice: We’ll use simulation to build rock-solid confidence and nail your execution, risk-free.

- Professional Risk Management: This is the most crucial part. You’ll learn to protect your capital so you can stay in the game long enough to actually get good.

A Sustainable Method vs. Common Traps

So many aspiring traders stumble and burn out because they focus on all the wrong things. They jump into a live account way too soon, get hooked on "hot stock" tips from social media, or completely ignore the critical job of managing their losses. This is exactly why the failure rate is so high.

The path I'm laying out here is designed to build real competence from the ground up, step-by-step. It’s about minimizing luck and emotion and instead creating a solid business plan for your trading. You'll learn to control the only things you truly can—your strategy, your risk, and your own mindset. You can get a head start on this framework in our detailed guide on how to start trading stocks.

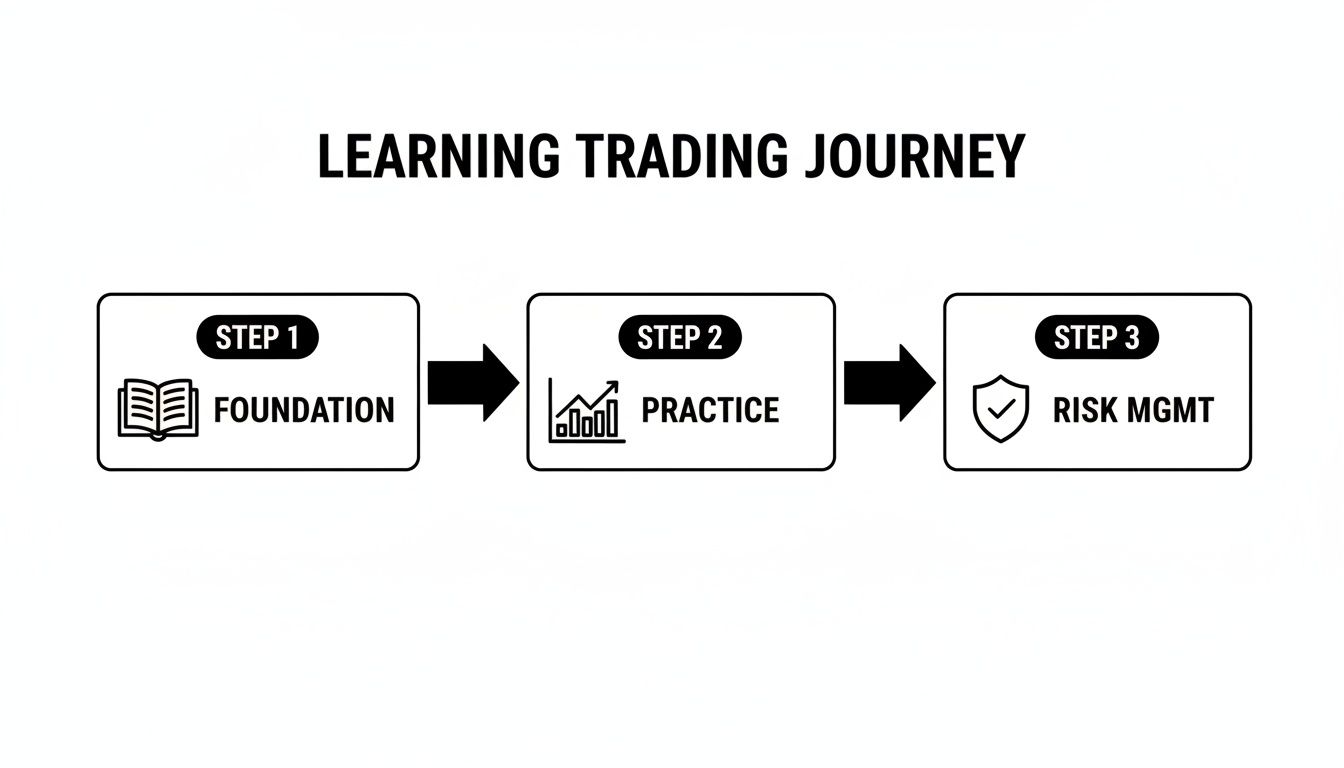

This diagram perfectly illustrates the core steps of this structured learning journey.

As you can see, a solid foundation, consistent practice, and strict risk management aren't separate ideas; they're completely interconnected. Each one supports the others. To make this crystal clear from the start, let's compare our effective approach with the common pitfalls that trap new traders.

Effective Learning Path vs Common Trading Pitfalls

This table breaks down the key differences between a professional, skill-building process and the gambling mindset that costs beginners their accounts.

| Key Area | Effective Method (Our Approach) | Common Pitfall |

|---|---|---|

| Foundation | Learning to read price action and market structure first. | Relying on lagging indicators or social media hype. |

| Practice | Using simulated trading to master a strategy without risk. | Jumping into live trading with real money too soon. |

| Risk Control | Defining risk on every trade with strict money management rules. | Trading without a stop-loss or a clear exit plan. |

| Mindset | Focusing on consistent execution and the long-term process. | Chasing quick profits and getting emotional after losses. |

Seeing it laid out like this really drives the point home. The path to consistency isn't a secret—it’s just a process that most people aren't willing to follow.

Building Your Foundation in Price Action

Before you can even think about placing a trade, you need to learn how to read the market's language. This language isn't found in some complex indicator or a breaking news headline; it’s written right on the chart through price action. The only real way to learn stock trading is to start right here, learning to interpret the raw story of supply and demand.

Price action cuts through all the noise. Instead of getting tangled up in a dozen lagging indicators that are just as likely to contradict each other, you focus on what actually matters: a stock's highs, lows, opens, and closes. This gives you a clean, real-time picture of market psychology.

Understanding Market Structure

Every chart tells a story about the constant battle between buyers and sellers. Your very first job is to figure out the plot. Is the market pushing in one direction, or is it stuck going sideways?

- Uptrends: You'll see a clear pattern of higher highs and higher lows. This is the market telling you that buyers are firmly in control, confidently pushing the price up after every small dip.

- Downtrends: This is the exact opposite, marked by a series of lower highs and lower lows. Sellers are running the show here, driving the price down, and any rallies are quickly shut down.

- Ranges (Consolidation): This is when the price is just bouncing between a well-defined high and low. It signals a stalemate between buyers and sellers, often coiling up for a big move.

Think about it this way: if you pull up a daily chart of Apple (AAPL) from a strong growth period, you'd immediately spot that classic stair-step pattern of an uptrend. Recognizing this is the foundational context you need before even considering a trade.

"At first, it's easy to become overwhelmed with the many looks and uses of technical analysis and charting. The key is to simplify and focus on what price itself is telling you about supply and demand."

This context is everything. Trying to go long in a brutal downtrend is one of the fastest ways for a new trader to blow up an account. Always identify the dominant market structure first—it’s your primary filter for making smart decisions.

Identifying Key Support and Resistance Zones

Once you've got the market's general direction down, your next task is to map out the key battlegrounds. We call these support and resistance levels. They're basically psychological price zones where the market has reversed course in the past.

Support acts like a floor under the price. It's an area where buying interest has historically been strong enough to absorb all the selling pressure, causing a downtrend to pause or reverse. Think of it as a "value zone" where buyers are waiting to step in.

Resistance is the ceiling. It’s a price level where selling pressure has previously swamped all the buying interest, stopping an uptrend dead in its tracks. Sellers see this zone as a great place to cash out or open short positions.

It's critical to see these as zones, not as razor-thin lines. For instance, if a stock like Tesla (TSLA) repeatedly bounces off the $180 area, that entire zone around $180 is a major support level. A future drop to that area will likely attract a new wave of buyers.

Even more powerful is the concept of "role reversal." When a key support level breaks, it often flips and becomes the new resistance. The opposite is also true. This is a massive tell in price action analysis.

The Psychology of Candlestick Patterns

Finally, let's zoom in on the individual "words" that make up the market's sentences: the candlesticks themselves. People get obsessed with memorizing dozens of fancy-named patterns, but it's far more important to understand the psychology behind them. For a much deeper dive, check out our comprehensive guide on price action trading.

To get you started, here are a couple of essential patterns and what they're telling you:

- Engulfing Candle: A huge candle that completely "engulfs" the body of the candle before it. A bullish engulfing (a big green candle after a small red one) signals a sudden and powerful shift to buying momentum. A bearish one shows that sellers just slammed on the brakes and took control.

- Pin Bar (or Hammer/Shooting Star): This one's easy to spot—a long wick with a tiny body. A long lower wick screams that sellers tried to force the price down, but buyers came roaring back and rejected their attempt, pushing the price all the way back up. It’s a very strong clue that a reversal might be coming.

When you start combining these three elements—market structure, support and resistance zones, and candlestick psychology—you're building a truly robust framework for analysis. You're no longer just staring at random lines on a screen. You're reading a dynamic story of human behavior, and that gives you a genuine edge.

Mastering Your Skills With Simulated Trading

Knowing price action theory is one thing. Executing trades when your heart is pounding and the market is moving against you? That’s a completely different ballgame. This is where you need to build muscle memory, and the only way to do that is through simulation.

Think of simulated trading, or paper trading, as your personal training ground. It's a risk-free environment where you can turn abstract knowledge into tangible skill.

You wouldn't want a pilot flying you across the country without them logging hundreds of hours in a simulator first. Trading is no different. It's your chance to feel the mechanics of placing orders, managing open positions, and yes, even handling the emotional rollercoaster of winning and losing—all without putting a single dollar of your capital on the line.

This "learning-by-doing" approach is incredibly powerful. A 2018 study involving 1,345 adults found that those who actively traded in a simulated environment boosted their financial literacy scores to 71.4%. This kind of hands-on practice can compress a learning curve that takes most people years into just a few intense weeks. You can dig into the full study and its findings over at Archive Market Research.

Setting Up Your Professional Practice Routine

Let's get one thing straight: the goal of paper trading isn't to make millions in fake money. It’s to forge a professional routine and prove your strategy works. Platforms like TradingView have excellent, free paper trading accounts that are perfect for this phase.

Once you’re set up, you have to treat it like it's real. I mean it. Follow your trading plan with unflinching discipline. Your entire focus should be on the process, not the imaginary profits.

Key Takeaway: Stop chasing fake gains. The real prize in simulated trading is flawless execution of your strategy. If your plan says to trade pullbacks in an uptrend, your only job is to execute that setup perfectly every single time, whether the trade wins or loses.

To make your simulation as close to the real thing as possible, you need good data. Using tools like stock ticker enrichment services can give you the comprehensive, accurate market data you'd get in a live account. This helps close the gap between practice and reality. For a deeper dive into the mechanics, check out our guide on what is paper trading.

From Practice To Performance

To make your time in the simulator count, you need to set clear, process-oriented goals. This moves your focus away from the market's outcome (which you can't control) and onto your own actions (which you can).

Here are a few examples of professional, process-driven goals you can set for yourself:

- Execution Goal: Execute 20 trades in a row that follow every single rule in your trading plan, with zero exceptions.

- Risk Management Goal: Over the next month, ensure that not a single trade risks more than your predefined 1% capital rule.

- Psychology Goal: For two weeks, document your emotional state before, during, and after every trade to spot patterns of fear, greed, or impatience.

This is the kind of structured practice that separates the hobbyists from the serious traders. It forces you to build discipline and proves you can follow your rules when nothing is on the line—a non-negotiable prerequisite for doing so when your real money is.

A Sample Practice Routine

Consistency is forged in routine. Instead of just randomly placing trades when you feel like it, dedicate specific blocks of time to your practice. This simulates the focus you'll need in a live trading environment.

Here’s a sample routine focused on the market open, which is often a time of high volatility and great opportunity:

- 30 Minutes Pre-Market: Scan for stocks that fit your specific criteria (e.g., strong pre-market volume, gapping up or down). Build your watchlist.

- First Hour of Market Open (9:30-10:30 AM EST): Your head is down. You are focused exclusively on executing your strategy on your watchlist. No distractions, no deviations.

- 30 Minutes Post-Session: Time to review. Take screenshots of your entries and exits. Journal your rationale for each trade and be brutally honest about any mistakes in execution.

By sticking to a strict routine like this, you aren't just practicing trading—you're practicing professionalism. You're taking years of potential trial-and-error and compressing it into a few focused months of deliberate, high-quality work. This is the bridge that will carry you safely from knowing the theory to being ready for the live market.

Developing Your Rules for Risk and Money Management

Forget about hitting home runs or finding some magic formula to predict the future. The real secret to successful trading—the thing that separates the pros from the gamblers—is a lot less glamorous but infinitely more important: disciplined risk and money management.

This is where you stop playing a game of chance and start running a business.

You can have the greatest price action strategy on the planet, but if you don't control your downside, one bad losing streak is all it takes to wipe you out. The game isn't just about making money; it's about protecting the capital you have so you can stay in the game long enough to become profitable.

Here, discipline and patience become your most valuable assets. Recent data shows these skills can boost success rates by up to 60%. Traders who religiously use stop-loss orders (88% of day traders) and proper position sizing (a core tool for 62%) consistently outperform those who trade on emotion.

It’s this disciplined approach that separates consistent traders from the 72% who lose money every year.

The Cornerstone: The 1 Percent Rule

If you take only one thing away from this section, let it be the 1% rule.

It’s dead simple: never risk more than 1% of your total trading capital on any single trade. If you have a $10,000 account, your maximum acceptable loss is $100. That's it. No exceptions.

This rule is your survival mechanism. It guarantees that no single trade—or even a string of five or six losers—can knock you out of the market. It keeps your losses small and mathematically manageable, which is absolutely critical for your psychological health.

Key Insight: A trader who loses 50% of their account needs a 100% gain just to get back to even. The 1% rule is designed to prevent you from ever digging a hole that deep.

Calculate Your Position Size Every Time

So, how do you actually enforce the 1% rule? Through position sizing. This isn't a guess; it's simple math you must do before every single trade to calculate exactly how many shares to buy based on your entry price and where you’ll place your stop-loss.

Here’s the formula:

Position Size (Shares) = (Total Account Size × 0.01) / (Entry Price – Stop-Loss Price)

Let's walk through a real-world scenario.

Imagine you have a $20,000 trading account and you want to buy shares of NVIDIA (NVDA).

- Your Max Risk per Trade: $20,000 x 0.01 = $200

- Your Entry Price: You decide to buy at $900 per share.

- Your Stop-Loss: Based on your price action analysis, you place your stop-loss at $890.

- Your Per-Share Risk: $900 – $890 = $10

Now, plug it into the formula:

Position Size = $200 / $10 = 20 shares.

This calculation ensures that if the trade goes against you and hits your stop, you will lose exactly $200—your predefined 1% risk—and not a penny more.

The Power of Risk-To-Reward Ratios

The final piece of this defensive puzzle is the risk-to-reward ratio (R:R). This compares how much you stand to lose if you're wrong versus how much you stand to gain if you're right. You should only take trades where your potential reward is significantly greater than your risk.

A common professional standard is to look for a minimum R:R of 1:2 or 1:3. This means for every $1 you risk, you aim to make at least $2 or $3.

Think about the math on that. If you only take trades with a 1:3 R:R, you can be wrong three times and right just once… and you'll still break even. A trader with a win rate of just 40% can be incredibly profitable with this kind of discipline. Part of building these rules also means understanding advanced concepts like the implications of a margin call, which can be devastating when trading with borrowed money.

When you combine the 1% rule, precise position sizing, and favorable risk-to-reward ratios, you've built a powerful defensive system. You’ve officially shifted from gambling on outcomes to managing probabilities like a business owner. This framework is a non-negotiable part of learning to trade the right way.

Accelerating Your Growth with Journaling and Community

The best traders on the planet are absolute masters of the feedback loop. They don't just take trades and hope for the best; they dissect their performance with brutal honesty to figure out what works and what doesn't. This is a skill you have to build from day one.

It all boils down to two things: a ridiculously detailed trading journal and a solid community to lean on.

While trading often feels like a solo mission, learning how to trade shouldn't be. The road is long and it's a psychological minefield. Going it completely alone is a classic mistake that will stall your progress faster than anything else.

Your Trading Journal Is Your Personal Coach

A trading journal isn't just a spreadsheet of your wins and losses. That’s amateur stuff. A real journal is a deep dive into the "why" behind every single click of the mouse. When done right, it becomes your personal coach, showing you patterns in your own behavior that you’d never see otherwise.

Your entries have to go way beyond the numbers. For every trade you take—even on a simulator—you need to capture the entire story. This is what builds a powerful dataset you can review each week to find your edge.

Here’s what you should be logging for every single trade:

- The Setup: Grab a screenshot of the chart before you enter. Mark up your key levels, your entry trigger, everything. This is your evidence.

- Your Rationale: In a few sentences, explain your thesis. Why this trade? What specific rules from your playbook did it check off?

- Emotional State: This is huge. Were you feeling anxious? Greedy? Bored? Be honest. Your emotions often tell a more important story than your P&L.

- The Outcome: Get another screenshot after the trade is closed. Document your exit, the final profit or loss, and—most importantly—did you follow your management rules to the letter?

This structured process transforms trading from a random gamble into a scientific process of testing, tweaking, and refining. It’s a non-negotiable step.

The Trader’s Mirror: A detailed journal doesn’t lie. After a month of diligent entries, you'll have undeniable proof of your biggest strengths (like letting winners run) and your most costly habits (like moving your stop-loss).

Finding Your Tribe and Your Mentors

Trading can be incredibly isolating. But plugging into the right community can shave years off your learning curve. Learning from people who are just a few steps ahead of you provides priceless perspective and helps you break through those frustrating plateaus.

Structured training programs, especially those that are simulator-based and mentor-led, offer a clear path forward. The stats are grim—over 90% of day traders fail. But that elusive 4% who make it? They consistently use mentors, have enough capital, and practice every single day. As detailed over at TradeThatSwing, this just hammers home how critical guided learning is.

The problem is, the online trading world is a swamp filled with gurus and scammers. You have to get good at spotting the real mentors from the fakes selling a fantasy.

How to Spot a Credible Community

| Credible Mentor or Community | Red Flag to Avoid |

|---|---|

| Focuses on teaching a process and risk management. | Sells "guaranteed profit" signals or alerts. |

| Has a transparent track record and shares losses. | Only showcases winning trades and luxury lifestyles. |

| Encourages independent thinking and strategy development. | Creates dependency on their calls and analysis. |

| Fosters a supportive environment for learning from mistakes. | Uses high-pressure sales tactics and FOMO. |

When you combine disciplined self-review through your journal with the shared wisdom of a genuine community, you create an unstoppable system for growth. You get the hard data from your own trading plus the collective experience of others. It’s one of the most powerful ways to put your journey toward consistency on the fast track.

Common Questions About Learning to Trade

As you start down this path, it's completely normal to have questions and feel a bit uncertain. Becoming a trader means you'll face practical hurdles and, more importantly, a lot of mental roadblocks.

Let's tackle some of the most common questions I hear. Getting clear, realistic answers from the get-go helps you manage expectations, avoid the usual myths, and stay locked in on what actually builds a lasting career.

How Much Money Do I Need to Start Trading?

To start learning, you don't need a single dollar. The smartest way to begin is with a free paper trading account. This lets you practice your strategy and get your execution down without putting any real money on the line.

Once you’ve proven you can be consistently profitable in a simulator for at least three to six months, then it's time to think about a small live account. Many brokers don’t have minimum deposits, but a starting bankroll of $500 to $2,000 is a pretty realistic entry point for most people.

Here's the most important rule of all: only trade with money you are fully prepared to lose. This isn't just a suggestion—it's a non-negotiable mindset for keeping your emotions in check and making rational decisions when the pressure is on.

How Long Does It Take to Become Profitable?

There's no magic number here, and anyone who promises you quick profits is selling you a fantasy. If you expect to be profitable in a few weeks, you're just setting yourself up for disappointment and the kind of reckless trading that blows up accounts.

A much more realistic timeline looks something like this:

- Foundation and Simulation (3-6 months): This is your boot camp. You're dedicated to learning price action and proving your strategy has an edge in a risk-free simulator.

- Live Trading and Psychology Mastery (6-12 months): The moment you switch to real money, the game changes. The psychological pressure is intense. This period is all about learning to manage the fear and greed that will inevitably surface while you try to execute your plan.

Most successful traders I know will tell you it took them two to three years of consistent, daily effort to finally achieve lasting profitability. You have to treat this like you're learning any other professional skill, not like some get-rich-quick hobby.

Should I Day Trade or Swing Trade?

For almost every beginner, swing trading is the way to go. Day trading is an incredibly intense, high-pressure game that demands you be glued to your screen, making split-second decisions. That's an exceptionally difficult environment for a newcomer to survive in, let alone master.

Swing trading, where you hold positions for several days or weeks, offers a much more forgiving learning environment. It’s a balanced approach that gives you plenty of time to analyze your decisions and manage your trades without being chained to your desk all day. That slower pace is absolutely crucial for building a solid analytical foundation.

Are Paid Trading Courses Worth It?

The quality of paid courses is all over the map, so you have to do your homework. Be extremely skeptical of any program that promises guaranteed profits or "secret" formulas—those are massive red flags.

A good program will teach you a repeatable process grounded in solid market analysis and, most importantly, professional risk management. It won't just sell you signals to blindly follow.

Instead, look for educators who offer:

- A transparent track record, and that includes being open about their losses.

- A strong, supportive community that's focused on learning together.

- A heavy emphasis on mentorship and helping you develop your own independent thinking.

Often, the real value isn't in the most expensive course, but in the one that gives you structured practice, real, actionable feedback, and a genuine community. Those are the things that will truly accelerate your growth and reinforce the principles behind the best way to learn stock trading.

At Colibri Trader, we provide a clear, no-nonsense path to mastering price action without relying on confusing indicators. Our action-based programs and personalized mentorship are designed to build your skills and confidence, transforming your performance into consistent results. Start your journey with our free resources and see how our proven approach can help you succeed. Learn more at https://www.colibritrader.com.