8 Price Action Setups for the Best Strategy in Forex 2025

The forex market offers immense opportunities, but navigating its complexities without a robust plan is a recipe for disaster. Many traders waste valuable time and capital searching for a single, holy-grail "best strategy in forex," but such a thing doesn't exist. The optimal approach is deeply personal, depending entirely on your personality, risk tolerance, and time commitment. The key to success is not finding a universal secret but mastering a proven strategy that aligns perfectly with your individual trading style.

This guide is your roadmap. We will demystify 8 powerful and distinct trading strategies, from the high-frequency action of scalping to the patient, long-term approach of position trading. Forget confusing indicators and complex algorithms; our focus is on pure price action, empowering you to read market sentiment directly from the charts.

For each strategy, we will break down the core mechanics, providing you with a clear framework that includes:

- Actionable Entry and Exit Rules: Know precisely when to get in and out of a trade.

- Practical Risk Management: Learn how to protect your capital effectively.

- Real-World Chart Examples: See how these concepts apply to actual market scenarios.

By understanding these proven methods, you can confidently identify the approach that best fits your goals and begin building a solid foundation for consistent profitability.

1. Trend Following Strategy

The Trend Following Strategy is arguably one of the most foundational and enduring approaches to the market, making it a strong contender for the best strategy in forex for both new and experienced traders. The core principle is simple yet powerful: "the trend is your friend." Instead of predicting market reversals, traders identify an established directional move, either up or down, and place trades that align with that momentum. The goal is to capture the majority of a major market swing, holding positions until indicators suggest the trend is losing steam or reversing.

How It Works and When to Use It

This strategy thrives in markets with clear, sustained directional momentum. Traders use technical indicators like Moving Averages (e.g., the 50-day and 200-day crossover), the Moving Average Convergence Divergence (MACD), or simple trend lines to confirm a trend's existence and strength. For example, a currency pair trading consistently above its 200-day moving average is in a clear long-term uptrend, presenting buy opportunities on minor dips.

The key is patience; this isn't a strategy for scalping quick profits. It’s most effective during periods driven by strong fundamental factors, such as the USD/JPY uptrend during the 2012-2015 "Abenomics" period, where monetary policy created a multi-year directional bias.

Actionable Tips for Implementation

To effectively implement trend following, consider these rules:

- Confirm with Multiple Timeframes: A daily uptrend confirmed by a weekly uptrend is a much higher-probability signal.

- Strategic Stop-Loss Placement: Place stop losses below recent swing lows in an uptrend (or above swing highs in a downtrend) to avoid being stopped out by normal market volatility.

- Scale Into Positions: Instead of entering with your full position size at once, consider entering with a partial position and adding more as the trend continues in your favor.

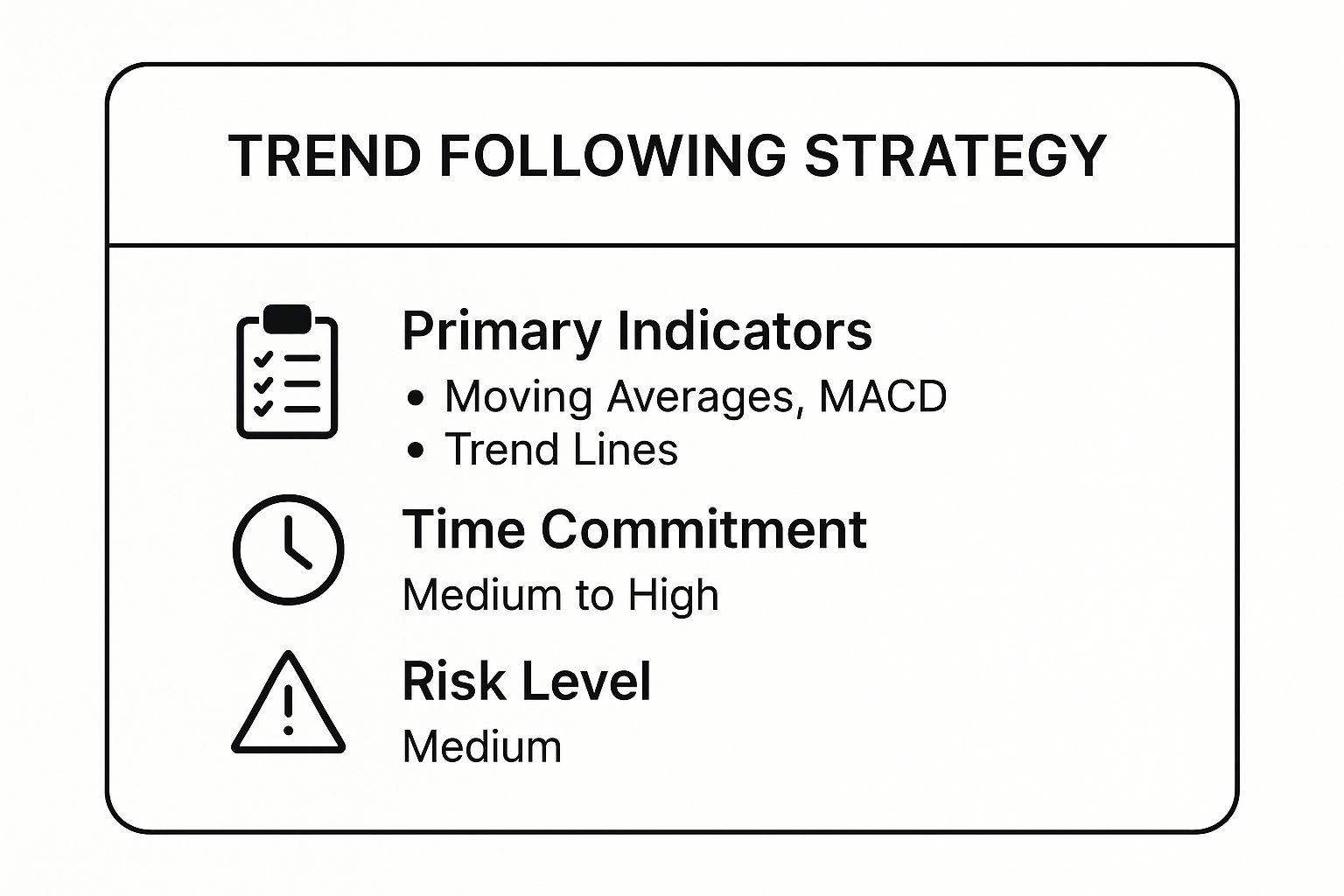

To help you grasp the core components of this strategy, the summary box below outlines its key characteristics.

This quick reference highlights that trend following is a systematic approach that balances a moderate risk level with a significant time commitment, as holding trades for weeks or months is common. For those looking to master this approach, you can learn more about trading the trend at Colibri Trader.

2. Carry Trade Strategy

The Carry Trade Strategy stands out as a unique, fundamental-driven approach that many consider a candidate for the best strategy in forex for long-term investors. Unlike strategies focused on short-term price movements, the carry trade is built on interest rate differentials. The core concept involves borrowing a currency with a low interest rate (the "funding currency") and using those funds to buy a currency with a high interest rate (the "investment currency"). Traders aim to profit from the interest rate differential, often called "swap" or "rollover," which is paid daily, as well as potential appreciation of the high-yielding currency.

How It Works and When to Use It

This strategy is most effective in a low-volatility, risk-on market environment where investors are comfortable seeking higher yields. Traders profit as long as the high-yielding currency does not depreciate against the funding currency by more than the interest rate differential. Central bank monetary policies are the primary drivers. For example, the AUD/JPY pair was a classic carry trade during the 2003-2007 commodities boom, as the Bank of Japan maintained ultra-low rates while the Reserve Bank of Australia raised its rates amid economic growth.

The key to a successful carry trade is stability. It performs poorly during periods of global economic uncertainty or "risk-off" sentiment, as investors flock to safe-haven currencies like the JPY and CHF, causing high-yielding currencies to fall sharply.

Actionable Tips for Implementation

To implement a carry trade strategy effectively, consider these guidelines:

- Monitor Central Bank Policy: Pay close attention to central bank statements, meeting minutes, and economic projections. A change in monetary policy outlook is the biggest risk to a carry trade.

- Use Prudent Leverage: Due to the long-term nature and potential for volatility, using lower leverage is crucial to avoid being forced out of a position during a temporary market correction.

- Diversify Your Pairs: Instead of concentrating all your capital on a single carry trade, diversify across several pairs with favorable interest rate differentials to spread your risk.

3. Scalping Strategy

The Scalping Strategy is a high-octane approach favored by traders who thrive on speed and precision, positioning it as a contender for the best strategy in forex for those seeking immediate results. Instead of waiting for long-term trends to develop, scalpers aim to capture small, incremental profits from fleeting price changes. This method involves executing a high volume of trades throughout the day, with positions lasting anywhere from a few seconds to several minutes, thereby minimizing exposure to prolonged market risk.

How It Works and When to Use It

This strategy is built on exploiting the most liquid and volatile periods of the trading day. Scalpers use one-minute or five-minute charts and rely on technical indicators like the Relative Strength Index (RSI) for overbought/oversold signals or Bollinger Bands to identify price breakouts. The goal is to enter and exit the market quickly, often for just a few pips of profit per trade.

Scalping is most effective during high-volume trading sessions, such as the London-New York overlap, when spreads are tightest and liquidity is at its peak. For instance, a trader might scalp EUR/USD during this period, capitalizing on the small, rapid price fluctuations driven by heavy order flow from two major financial centers.

Actionable Tips for Implementation

To implement a scalping strategy successfully, discipline is paramount:

- Prioritize Low Spreads: Choose a broker with the tightest possible spreads and fastest execution speeds, as transaction costs can quickly erode small profits.

- Focus on Major Pairs: Stick to highly liquid currency pairs like EUR/USD or GBP/USD, which offer better pricing and more reliable trade execution.

- Define Strict Exit Rules: You must have a predetermined profit target and stop-loss for every trade. The high frequency of trading leaves no room for emotional decision-making.

The intense focus and rapid execution required for this strategy demand significant screen time and concentration. If you are interested in this high-paced approach, you can learn more about how to start day trading on Colibri Trader.

4. Range Trading Strategy

The Range Trading Strategy operates on the principle of mean reversion, a stark contrast to trend-following. This approach is highly effective in markets that are consolidating rather than trending. Traders identify a currency pair oscillating between consistent high (resistance) and low (support) price levels. The core idea is that prices will continue to bounce between these established boundaries, creating predictable opportunities to buy low and sell high.

How It Works and When to Use It

This strategy is best suited for markets with low volatility and a lack of clear directional drivers. Traders use technical tools to define the range, such as drawing horizontal lines connecting multiple price peaks (resistance) and troughs (support). Indicators like the Relative Strength Index (RSI) or Stochastic Oscillator can help identify overbought conditions near the top of the range (a sell signal) and oversold conditions near the bottom (a buy signal).

For example, the EUR/USD pair often enters prolonged ranges during quiet summer trading months when market participation is lower. Similarly, a pair like USD/CAD might range if oil prices, a key influencer, remain stable. The strategy involves buying near the support level and selling near the resistance level, capturing profits from the predictable oscillations.

Actionable Tips for Implementation

To effectively implement a range trading strategy, consider these rules:

- Confirm the Range: Wait for at least two validated touches of both the support and resistance levels before considering the range reliable. The more touches, the stronger the range.

- Time Entries with Oscillators: Use indicators like the RSI or Stochastics to confirm entry signals. An overbought reading near resistance adds confidence to a short position, just as an oversold reading near support strengthens a long entry.

- Place Stops Strategically: Set your stop-loss orders just outside the established range. For a buy order at support, the stop should go slightly below the support line; for a sell order at resistance, place it just above. This protects you from a potential breakout.

- Prepare for Breakouts: No range lasts forever. Have a plan for when the price breaks decisively out of the established boundaries. This could mean closing your position and switching to a trend-following mindset.

5. Breakout Trading Strategy

The Breakout Trading Strategy is a momentum-based approach that capitalizes on sudden, powerful price movements. It’s a top contender for the best strategy in forex because it allows traders to enter the market just as a new trend is potentially beginning. The core idea is to identify key levels of support and resistance or chart patterns where price has been contained and then place a trade when the price "breaks out" through that barrier, anticipating that the momentum will carry the position into profit.

How It Works and When to Use It

This strategy works best in volatile markets or during major news events that can act as catalysts for strong directional moves. Traders identify significant price levels, such as multi-day highs or lows, trend lines, or chart formations like triangles and rectangles. When the price decisively moves past one of these levels, a breakout trader enters a position in the direction of the break.

For instance, the massive EUR/CHF breakout in 2015 when the Swiss National Bank removed its currency floor, or the GBP/USD volatility during the 2016 Brexit referendum, created once-in-a-lifetime opportunities for breakout traders. The strategy is designed to capture the explosive start of a major market re-pricing.

Actionable Tips for Implementation

To effectively trade breakouts and avoid "false breakouts" or fakeouts, consider these rules:

- Wait for Confirmation: Don’t enter the second a level is breached. Wait for the candle to close beyond the breakout level on your chosen timeframe to confirm the move has genuine momentum.

- Validate with Volume: A true breakout is often accompanied by a significant increase in trading volume. Use volume indicators to help validate the strength behind the price movement.

- Set Stops Strategically: Place your initial stop-loss just on the other side of the breakout level. If the price breaks a resistance level, your stop-loss should be just below that old resistance line. This minimizes losses if the breakout fails.

- Define Profit Targets: Look for the next significant support or resistance level as a logical place to take profit, ensuring a favorable risk-to-reward ratio.

6. News Trading Strategy

The News Trading Strategy is an event-driven approach that focuses on profiting from the volatility surrounding major economic announcements and geopolitical events. Instead of relying solely on technical chart patterns, news traders analyze how fundamental data can cause rapid and significant price swings. This method is a strong contender for the best strategy in forex for those who can remain disciplined and act decisively in fast-moving market conditions. The core principle is to capitalize on the market's immediate reaction to new information, which can create powerful, short-term trends.

How It Works and When to Use It

This strategy is built around a pre-planned schedule of high-impact economic releases. Traders use an economic calendar to identify key events like Non-Farm Payrolls (NFP) in the U.S., central bank interest rate decisions, or GDP announcements. They then form a hypothesis about the market's likely reaction and place trades just before or immediately after the news is released to catch the resulting momentum.

For example, if the European Central Bank (ECB) signals a more hawkish stance than anticipated, traders might quickly buy the EUR against other currencies, expecting it to strengthen. The strategy is most effective during these specific, high-volatility windows and is less suitable for quiet, range-bound market conditions.

Actionable Tips for Implementation

To effectively implement a news trading strategy, consider these rules:

- Focus on High-Impact Events: Prioritize Tier-1 news releases like central bank meetings and major employment reports, as these create the most reliable and significant market moves.

- Plan Your Trade: Have a clear plan before the news release, including entry points, stop-loss levels, and take-profit targets. The market moves too fast to make decisions on the fly.

- Manage Your Risk: Due to extreme volatility, it's wise to use smaller position sizes than you normally would. Consider using pending orders (buy stops and sell stops) to enter the market once momentum is confirmed.

To help you understand how to navigate these volatile market events, the video below offers valuable insights into trading news releases.

This video provides a practical look at preparing for and executing trades during high-impact news. Mastering this approach requires practice, but it can be a highly effective way to capture quick profits from predictable market catalysts.

7. Position Trading Strategy

Position Trading is a long-term strategy where traders hold positions for extended periods, ranging from weeks to months, or even years. This approach is often considered the best strategy in forex for those who prefer a "set and forget" style, focusing on the big picture rather than daily market noise. The core philosophy is to capitalize on major macroeconomic trends and fundamental shifts, such as changes in interest rates, political stability, and economic growth trajectories.

How It Works and When to Use It

This strategy is fundamentally driven, relying on in-depth analysis of economic data and central bank policies. Position traders identify long-term market biases and enter trades that align with these broad themes. For instance, a trader might take a long USD position if the Federal Reserve is entering a sustained rate-hiking cycle while other major central banks remain dovish. This divergence in monetary policy can create a powerful, multi-year trend.

Position trading works best in environments where strong, clear fundamental drivers are in play. It is less concerned with short-term chart patterns and more focused on the overarching economic narrative. A prime example was shorting the EUR/USD during the European sovereign debt crisis from 2010 to 2012, as fundamental weakness plagued the Eurozone.

Actionable Tips for Implementation

To successfully implement a position trading strategy, consider these guidelines:

- Master Fundamental Analysis: Your primary focus should be on central bank statements, economic data releases (like GDP and inflation), and geopolitical events.

- Use Wider Stop Losses: Given the long-term nature of these trades, stops must be placed far enough away to withstand normal market volatility without prematurely closing your position.

- Manage Swap Costs: Be mindful of overnight swap fees (or earnings), as they can significantly impact profitability over months or years.

- Regularly Re-evaluate Your Thesis: While you ignore short-term noise, you must periodically review the core fundamental reasons for your trade to ensure they remain valid.

8. Swing Trading Strategy

The Swing Trading Strategy strikes a balance between the rapid pace of day trading and the long-term commitment of position trading, making it a compelling candidate for the best strategy in forex. This medium-term approach focuses on capturing "swings" in price, which are significant upward or downward moves that occur within a larger overall trend. Traders hold positions for several days to a few weeks, aiming to profit from the market's natural ebb and flow.

How It Works and When to Use It

Swing trading thrives on volatility and clear market structure. Practitioners use technical analysis, including support and resistance levels, candlestick patterns, and oscillators like the Relative Strength Index (RSI), to identify potential turning points where a swing is likely to begin or end. The goal is to enter a trade near the start of a swing and exit before the opposing momentum takes over.

This strategy is particularly effective in markets with distinct trends interspersed with corrections. For example, during the Brexit negotiations, the GBP/USD pair exhibited significant volatility with clear multi-day swings, offering numerous opportunities for swing traders to capitalize on both up and down movements driven by political news and market sentiment.

Actionable Tips for Implementation

To implement swing trading effectively, follow these core principles:

- Use Confluence for Confirmation: Do not rely on a single indicator. A high-probability setup occurs when multiple factors align, such as price bouncing off a key support level that coincides with a bullish candlestick pattern and an oversold RSI reading.

- Set Realistic Profit Targets: Analyze previous price swings to set logical take-profit levels. If past upward swings in a pair averaged 200 pips, setting a target at 180-200 pips is a data-driven decision.

- Monitor the Fundamental Landscape: While technically driven, swing trades can be derailed by major economic news. Keep an eye on the economic calendar for events like central bank meetings or key data releases that could impact your position. For those interested in intermediate-term trading, exploring the best swing trading strategies can offer additional perspectives on market movements.

This strategy offers a flexible approach that doesn't require constant screen monitoring, making it suitable for many traders. To delve deeper into its mechanics, you can learn more about swing trading at Colibri Trader.

Top 8 Forex Strategies Comparison

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Trend Following Strategy | Medium (uses multiple indicators and timeframes) | Medium to High (requires analysis and possible automation) | Captures large profits in trending markets; medium risk | Volatile markets with clear trends; medium to long-term trades | Simple to understand; good for riding strong trends; automatable |

| Carry Trade Strategy | Medium (fundamental focus, monitoring policies) | Low to Medium (capital intensive) | Generates passive income via interest differential; high risk | Stable, low volatility environments; longer holding periods | Earns interest and possible currency appreciation; effective in stable markets |

| Scalping Strategy | High (requires intense focus and fast execution) | Very High (fast execution, tight spreads) | Small consistent profits; very high risk | Highly liquid markets; intraday trades needing quick decisions | Limits overnight risk; quick profit realization; less fundamental dependence |

| Range Trading Strategy | Medium (identifying range and oscillators) | Medium (monitor support/resistance levels) | Profits from price oscillations in range-bound markets; medium risk | Sideways or consolidating markets; medium-term trades | Clear entry/exit points; good risk-reward in low volatility |

| Breakout Trading Strategy | High (requires quick decisions, volume analysis) | High (fast execution, monitoring key levels) | Large profit potential from momentum moves; high risk | High-impact news events; volatile breakout conditions | Clear objective signals; well-suited for automation; captures explosive moves |

| News Trading Strategy | Very High (requires real-time data and rapid reaction) | High (real-time news feeds and execution speed) | Potentially large profits from single events; extremely high risk | High-impact economic releases; short-term volatility exploitation | Numerous weekly opportunities; profits from unexpected moves |

| Position Trading Strategy | Medium (fundamental research intensive) | Low (minimal monitoring) | Captures long-term trends; medium to high risk | Long-term macroeconomic trends; low time commitment | Low transaction costs; less influenced by short-term noise |

| Swing Trading Strategy | Medium (technical analysis on daily/4h charts) | Medium (time for analysis and monitoring) | Balanced gains from medium-term swings; medium risk | Part-time traders; adaptable to trending or ranging markets | Good risk-reward balance; less stressful than day trading |

Choosing Your Path: How to Implement and Master Your Chosen Strategy

You have now journeyed through a comprehensive collection of powerful forex strategies, from the long-term vision of Position Trading to the rapid-fire precision of Scalping. Each method offers a distinct lens through which to view and engage with the market's dynamic price action. The single most important takeaway is that the best strategy in forex is not a universal secret formula but a deeply personal fit between your psychology, lifestyle, and financial goals.

The path from knowledge to consistent profitability is paved with deliberate practice and specialization. Hopping from one strategy to the next after a few losses is a recipe for frustration and a depleted account. True mastery comes from selecting a single approach that resonates with you and committing to it.

From Theory to Execution: Your Actionable Roadmap

To transform these concepts into a tangible trading edge, you must build a systematic process for implementation and refinement. Chasing perfection is futile; striving for disciplined execution is paramount. Here is a step-by-step guide to get started:

-

Identify Your Trader Profile: First, perform an honest self-assessment. Are you a patient observer who can hold positions for weeks (Position/Swing Trader)? Or do you thrive on quick, decisive action and can dedicate hours of focused attention daily (Scalper/Day Trader)? Your personality and daily schedule are the most critical filters for choosing a strategy.

-

Select and Specialize: Based on your profile, choose one strategy from this article to master. Whether it's the logic of Range Trading or the excitement of a Breakout, focus all your energy on understanding its intricacies. Learn its ideal market conditions, its weaknesses, and its specific entry and exit triggers.

-

Practice in a Risk-Free Arena: Open a demo account. This is your training ground, a place to apply your chosen strategy without financial consequence. The goal here is not to make fantasy profits but to internalize the process, test your rules, and build unshakable discipline under live market conditions.

-

Maintain a Detailed Trading Journal: Document every single trade. Record the currency pair, entry/exit prices, your rationale for taking the trade (citing your strategy rules), and the final outcome. A journal is your most powerful feedback tool; it will reveal your strengths, weaknesses, and recurring mistakes with unfiltered clarity.

Ultimately, success in the forex market is not about finding an infallible system. It is about developing an unwavering commitment to a system that works for you. By dedicating yourself to this structured process of selection, practice, and analysis, you move beyond the theoretical and begin the real work of building a professional trading career. You are no longer just searching for the best strategy in forex; you are building it.

Ready to accelerate your learning curve with professional guidance and a proven price action framework? Explore the comprehensive trading courses at Colibri Trader, designed to provide the in-depth knowledge and structured mentorship needed to master the markets. Start your journey toward consistent profitability today.