7 Best Online Trading Courses to Master the Markets in 2025

The financial markets are a battlefield of algorithms, institutions, and millions of retail traders all vying for an edge. In this high-stakes environment, simply having a brokerage account isn't enough. The difference between consistent profitability and frustrating losses often comes down to one thing: a structured, proven educational foundation. But with countless platforms promising instant riches, how do you find the best online trading courses that deliver real, actionable skills?

This guide cuts through the noise. We have meticulously analyzed the top platforms to help you identify a course that matches your learning style, budget, and specific trading goals. Our roundup covers everything from comprehensive, mentor-led programs like Colibri Trader to free, institutional-grade resources from brokers and industry councils. When evaluating different providers, consulting an online course platform comparison guide can also help you choose the best fit for your trading education needs.

Whether you are a novice aiming to master foundational price action, an intermediate trader frustrated with inconsistent results, or an experienced professional looking to refine your strategy, this list provides a clear path forward. Each option includes a detailed breakdown of its key features, pricing, and unique benefits, complete with direct links to get you started. Forget the hype and focus on what works. This roundup will equip you with the knowledge to make an informed choice and start building a repeatable, profitable strategy for 2025 and beyond.

1. Colibri Trader

Colibri Trader earns its place as our top choice by offering a laser-focused, practical approach to trading education that cuts through market noise. Instead of overwhelming students with complex indicators or esoteric fundamental analysis, its curriculum is built entirely on a clean, powerful price-action methodology. This makes it one of the best online trading courses for traders who want a repeatable, indicator-free strategy for navigating both bull and bear markets.

The platform is designed for self-motivated learners who prioritize actionable skills over academic credentials. Colibri Trader makes a clear promise: to transform your trading abilities and help you achieve consistent outcomes, rather than just handing you a certificate. This results-oriented philosophy is backed by substantial social proof, including over 8,000 course participants and hundreds of five-star testimonials from traders who have successfully implemented the system.

Core Philosophy: Simplicity and Action

What truly sets Colibri Trader apart is its "naked charts" approach. The core teaching is that all necessary information is already reflected in price movement. By learning to read these patterns, traders can make high-probability decisions without relying on lagging indicators or subjective news analysis. This simplifies the decision-making process, reduces analysis paralysis, and empowers traders to act with confidence.

The curriculum is structured to build skills progressively, with a strong emphasis on risk management and trading psychology. This holistic approach ensures students learn not only what to trade but also how to manage their capital and mindset for long-term success.

Key Features and Course Offerings

Colibri Trader provides a tiered learning path suitable for various experience levels:

- Free Introductory Content: Prospective students can take a Trading Potential Quiz and gain instant access to the first two chapters of an Amazon best-selling book on price action, offering a risk-free way to sample the methodology.

- Structured Curriculum: The core program is divided into accessible tiers (Basic and Premium plans), along with specialized advanced courses like the award-winning Ultimate Supply & Demand and an exclusive Day Trading Programme.

- Practical Mentorship: The program isn't just a set of videos; it includes hands-on guidance and support to help traders apply concepts in live market conditions. The focus is on building practical skills, not just theoretical knowledge.

- Strong Community and Recognition: Colibri Trader has been featured on respected platforms like FX Empire, Forex Factory, and StockTwits, reinforcing its credibility within the trading community.

To get a better sense of their teaching style, you can explore sample videos from their price action course to see the methodology in action.

Pricing and Access

Colibri Trader maintains a degree of exclusivity with its pricing and program access. Full costs are not always listed publicly on the main site, and certain advanced programs, like the Day Trading Programme, are available only to subscribers. This model encourages serious inquiries and ensures that new students are a good fit for the community. Prospective learners should expect to subscribe to the email list or contact the platform directly for detailed pricing information and enrollment options.

| Feature | Colibri Trader |

|---|---|

| Primary Method | Price Action (Naked Chart Trading) |

| Best For | Self-motivated learners seeking practical, repeatable skills |

| Key Courses | Price Action, Ultimate Supply & Demand, Day Trading |

| Social Proof | 8,000+ students, numerous testimonials, industry features |

| Unique Selling Point | Focus on skill transformation over formal certification |

| Introductory Offer | Free quiz and two free book chapters |

Pros and Cons

Pros:

- Simple, high-impact method: The price-action approach eliminates reliance on confusing indicators.

- Proven, action-based curriculum: Tiered courses are supplemented with hands-on mentorship and a strong focus on discipline.

- Strong social proof: Features on reputable trading sites and thousands of positive reviews build confidence.

- Low-friction entry points: Free resources allow you to sample the teaching style before committing financially.

- Designed for flexible trading: The methodology is geared toward building consistent results that fit any schedule.

Cons:

- No formal certification: This program may not suit those seeking academic credentials or diplomas for professional purposes.

- Opaque pricing: You must subscribe or inquire to get full details on costs and access to certain advanced courses.

2. Udemy

Udemy is a massive online learning marketplace, a digital library where independent instructors offer courses on virtually any topic, including a vast selection dedicated to trading. Instead of subscribing to a single curriculum, Udemy allows you to purchase individual courses, giving you lifetime access to the material. This model is perfect for traders who want to explore specific niches without a long-term commitment.

The platform's sheer scale is its primary differentiator. You can find highly focused courses on everything from algorithmic trading with Python to advanced options strategies and beginner-level technical analysis. This variety makes it one of the best online trading courses platforms for learners who prefer to handpick their instructors and build a personalized curriculum from diverse sources.

Key Features and Offerings

Udemy’s strength lies in its user-centric features that help you navigate its extensive catalog. Before committing, you can watch preview videos, read detailed course outlines, and, most importantly, sift through hundreds or even thousands of user reviews and ratings. This transparency is crucial for vetting instructor quality.

- Vast Course Selection: Access thousands of courses covering day trading, swing trading, forex, stocks, options, futures, and cryptocurrency.

- One-Time Purchase Model: Buy a course once and get lifetime access, including any future updates the instructor adds.

- User-Driven Vetting: Rely on community ratings, detailed reviews, and Q&A sections to gauge a course's effectiveness.

- Frequent Promotions: Udemy is famous for its sitewide sales, where premium courses are often available at a steep discount.

How to Get the Most Out of Udemy

Success on Udemy requires a proactive approach to finding quality content. Start by filtering searches by "Highest Rated" and look for courses with a large number of recent, positive reviews. Pay close attention to the instructor's background and responsiveness in the Q&A section. Many self-paced online courses provide a structured, singular path, which can be highly effective. In contrast, Udemy empowers you to mix and match different perspectives to build a unique trading education.

Expert Tip: Never pay full price. Add courses you're interested in to your wishlist and wait for one of Udemy's frequent sales events. You can often purchase top-rated courses for a fraction of their list price.

| Feature | Udemy |

|---|---|

| Primary Focus | Broad marketplace for all trading styles and asset classes |

| Pricing Model | One-time purchase per course; occasional subscription plans |

| Best For | Traders seeking specialized knowledge or diverse instructor styles |

| Key Advantage | Massive selection and frequent discounts |

| Main Drawback | Inconsistent quality requires careful vetting by the user |

Website: https://www.udemy.com/

3. Coursera

Coursera brings the academic rigor of university-level education to the world of online trading and finance. Unlike marketplaces focused on individual creators, Coursera partners directly with prestigious universities and leading companies like Interactive Brokers to offer structured courses, professional certificates, and even full degrees. This approach provides a more formal and credential-focused learning path.

This platform is ideal for traders who value a structured, curriculum-driven education with verifiable credentials. If you want to build a deep, foundational understanding of financial markets, investment theories, and quantitative analysis from recognized institutions, Coursera offers some of the best online trading courses for that purpose. The emphasis is less on quick-fix trading strategies and more on comprehensive market knowledge.

Key Features and Offerings

Coursera’s platform is designed to mirror a formal academic experience, complete with lectures, readings, and graded assignments that reinforce learning. The specialization programs, which bundle several related courses together, offer a comprehensive deep-dive into specific financial topics.

- University and Industry-Backed Courses: Learn from professors at top universities and experts from industry leaders, ensuring high production quality and credible content.

- Structured Programs: Enroll in multi-course "Specializations" that provide a complete learning path from beginner to advanced on a specific topic.

- Verifiable Certificates: Earn shareable certificates upon completion to add to your LinkedIn profile or resume, demonstrating your commitment to professional development.

- Coursera Plus Subscription: Gain unlimited access to the majority of the course catalog with a single annual subscription, perfect for dedicated learners.

How to Get the Most Out of Coursera

To maximize your experience on Coursera, treat the courses like a real academic commitment. Actively participate in the forums, complete all graded quizzes and peer-reviewed assignments, and take advantage of the structured deadlines to stay on track. If you plan to take multiple courses, the Coursera Plus subscription often provides the best value. Look for specializations that combine financial theory with practical skills, such as "Python for Finance," to build a well-rounded and marketable skill set.

Expert Tip: Audit a course for free before committing to the paid version. Auditing gives you access to most of the video lectures and readings, allowing you to vet the content and instructor's teaching style before paying for the certificate and graded assignments.

| Feature | Coursera |

|---|---|

| Primary Focus | University-level finance, investment, and quantitative analysis |

| Pricing Model | Per-course fee, monthly subscription for Specializations, or annual Plus |

| Best For | Learners seeking structured, credential-backed financial education |

| Key Advantage | High-quality content from prestigious institutions and companies |

| Main Drawback | Content is often more theoretical than focused on live trading tactics |

Website: https://www.coursera.org/

4. Interactive Brokers Traders' Academy (IBKR Campus)

Interactive Brokers (IBKR) is renowned for its powerful trading platform, and its educational arm, the Traders' Academy, offers a similarly professional-grade experience, entirely for free. The IBKR Campus is a comprehensive learning hub designed to elevate traders' knowledge, from foundational concepts to complex instrument mechanics. It functions as a self-paced university for traders, accessible to everyone, not just IBKR clients.

This free-access model from a leading U.S. broker is its defining characteristic. The curriculum is meticulously structured, offering courses on options, futures, stocks, and bonds, often with integrated quizzes to test comprehension. This makes it one of the best online trading courses for traders who want a rigorous, broker-backed education without the high cost of premium programs. The content is directly tied to real-world trading applications, especially for those using or considering the IBKR platform.

Key Features and Offerings

The IBKR Campus is more than just a collection of articles; it is a structured academic environment. Its courses are organized into clear learning paths with progress tracking, allowing users to methodically build their expertise. The content goes beyond theory, with detailed walkthroughs of sophisticated trading tools like the IBKR Probability Lab and market scanners.

- Structured, Free Courses: Access dozens of in-depth courses complete with lessons, video tutorials, quizzes, and notes at zero cost.

- Deep Platform Education: Learn to master advanced tools and analytics directly from the broker that created them.

- Broad Learning Hub: Beyond courses, the campus includes webinars, podcasts, market commentary, and a trading glossary.

- Publicly Accessible: A significant portion of the educational material is available to the public, with no IBKR account required for access.

How to Get the Most Out of IBKR Campus

To maximize your learning, treat the Traders' Academy like a formal curriculum. Start with the "Beginner" courses to ensure you have a solid foundation before moving to "Intermediate" or "Advanced" topics like options combos or futures spreads. Pay special attention to the platform-specific tutorials; even if you don't use IBKR, understanding how a professional-grade tool works provides invaluable insight into market mechanics. The value here is in its professional, direct-from-the-source approach.

Expert Tip: Use the "Courses by Asset Class" filter to create a specialized learning path. If your goal is to master options, you can work through every options-related course from beginner to advanced to gain a truly comprehensive understanding.

| Feature | Interactive Brokers Traders' Academy |

|---|---|

| Primary Focus | Structured courses on trading mechanics, instruments, and platform tools |

| Pricing Model | Completely free |

| Best For | Self-directed learners seeking a professional, no-cost education |

| Key Advantage | High-quality, in-depth content from a reputable U.S. broker |

| Main Drawback | Content and examples are heavily focused on the IBKR platform |

Website: https://www.interactivebrokers.com/campus/academy

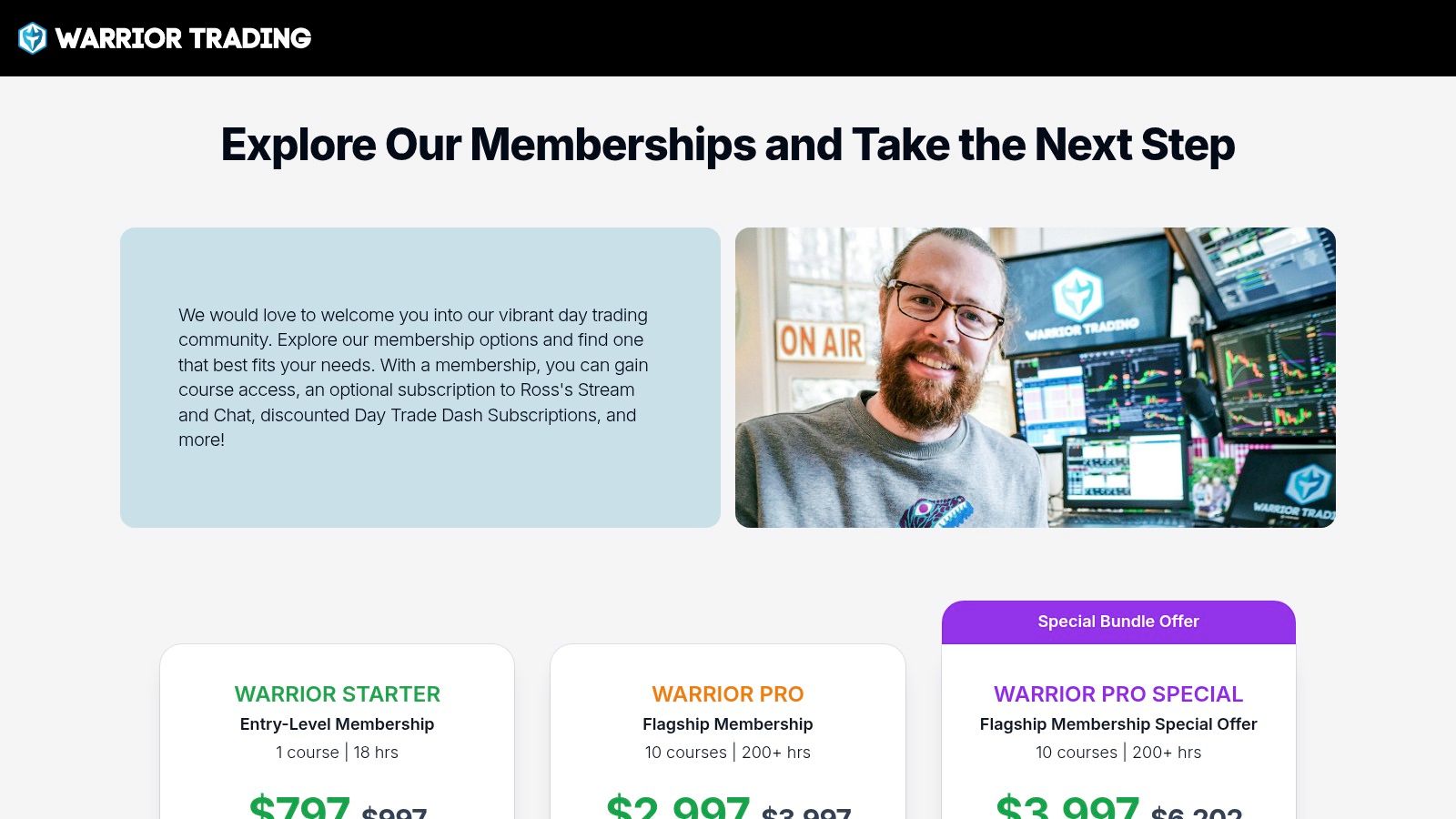

5. Warrior Trading

Warrior Trading is a comprehensive educational platform primarily focused on the fast-paced world of day trading. It offers a structured ecosystem that combines in-depth courses, a powerful trading simulator, and access to a large, active community of fellow traders. Instead of offering one-off courses, Warrior Trading provides tiered membership packages, guiding students through a complete learning progression from foundational knowledge to advanced strategies.

The platform’s key differentiator is its all-in-one approach. It doesn't just teach theory; it provides the tools and live environment to apply it. Members gain access to an extensive library of educational content, live trading chat rooms, and a real-time data simulator. This holistic system makes it one of the best online trading courses for aspiring day traders who want a complete, immersive training experience that bridges the gap between learning and doing.

Key Features and Offerings

Warrior Trading is built to provide a supportive and practical learning environment. Its flagship Warrior Pro membership is an end-to-end program that includes core strategy courses, advanced modules, and tools designed to accelerate a trader’s development. The platform is transparent about the risks of trading and sets clear expectations for its students.

- Structured Curriculum: Multi-course tracks cover day trading, swing trading, options, and trader psychology, offering a clear, progressive learning path.

- Real-Time Trading Simulator: Practice strategies with real-time market data without risking actual capital, a crucial tool for building confidence and skill.

- Active Trading Community: Access to live trading chat rooms, mentorship sessions, and archived trade reviews provides real-world context and peer support.

- Transparent Memberships: Offers clear membership tiers (like Starter and Warrior Pro) with well-defined features and money-back guarantees on certain bundles.

How to Get the Most Out of Warrior Trading

To maximize the value of Warrior Trading, a new member should fully commit to the structured curriculum before diving into live trading or even the simulator. Complete the foundational courses first to understand the core strategies. Engage actively in the chat rooms by observing experienced traders and asking questions, but avoid the temptation to blindly copy trades. Use the simulator extensively to test the strategies learned in the courses until you achieve consistent, positive results. This disciplined approach ensures you build a solid foundation before putting real money on theline.

Expert Tip: Treat the simulator like a real trading account. Follow your trading plan, practice risk management, and analyze your performance. The habits you build in the simulator will directly translate to your live trading results.

| Feature | Warrior Trading |

|---|---|

| Primary Focus | Comprehensive day trading education and community |

| Pricing Model | Tiered membership packages (one-time or annual fees) |

| Best For | Aspiring and intermediate day traders seeking an all-in-one system |

| Key Advantage | Integration of curriculum, simulator, and live trading community |

| Main Drawback | Premium pricing and a narrow focus on short-term trading |

Website: https://www.warriortrading.com/

6. tastylive / tastytrade Learn Center

Tastylive, formerly known as tastytrade, offers a completely free educational platform called the Learn Center, which is laser-focused on options and futures trading. Unlike broad marketplaces, tastylive provides a structured, in-house curriculum built around its core philosophy of trading with high probability and managing implied volatility. This makes it an invaluable resource for anyone serious about moving beyond basic stock picking and into the world of derivatives.

The platform’s primary differentiator is its practical, strategy-driven approach, offered at zero cost. It bridges the critical gap between understanding options theory and actually executing trades. The content is designed to get retail traders comfortable with concepts like implied volatility rank, defined-risk strategies (like iron condors and credit spreads), and portfolio management, making it one of the best online trading courses for aspiring options traders who want a cohesive, step-by-step learning path.

Key Features and Offerings

The tastylive Learn Center is built to be an accessible, comprehensive resource that combines video, text, and interactive elements. It demystifies complex topics by breaking them down into digestible modules, ensuring learners can build a solid foundation before moving on to more advanced concepts. The direct integration with its brokerage platform provides a seamless transition from learning to application.

- Completely Free Courses: Access structured learning paths like "Beginner Options," "Implied Volatility," and "Beginner Futures" without any cost.

- Multimedia Learning: Content is delivered through a mix of engaging video lessons, detailed written modules, and progress-tracking quizzes.

- Strategy-Oriented Approach: The curriculum emphasizes trading based on probability and implied volatility, teaching specific, actionable strategies.

- Practical Execution Guidance: Includes platform walk-throughs and clear instructions on how to set up and manage trades, connecting theory directly to practice.

How to Get the Most Out of tastylive

To maximize your learning, follow the courses in their intended order, starting with the beginner options path. The content is designed to be cumulative, so mastering the fundamentals of volatility and probability first will make advanced strategies much easier to grasp. Use the quizzes to test your understanding and don't hesitate to re-watch videos on complex topics like delta, theta, and vega.

Expert Tip: Watch the "Market Measures" segment on the tastylive network alongside the Learn Center courses. This daily show tests trading theories with real back-tested data, providing invaluable context and validating the strategies you are learning.

| Feature | tastylive / tastytrade Learn Center |

|---|---|

| Primary Focus | Options and futures trading with a focus on volatility & probability |

| Pricing Model | Completely free |

| Best For | Beginner to intermediate traders specializing in options |

| Key Advantage | Zero-cost, structured curriculum with a consistent methodology |

| Main Drawback | Heavily options-centric and closely tied to the tastytrade platform |

Website: https://learn.tastylive.com/

7. Options Industry Council (OIC) / OCC Learning

For traders looking to build a rock-solid foundation in options, the Options Industry Council (OIC) offers an unparalleled resource. As the educational arm of The Options Clearing Corporation (OCC), the world's largest equity derivatives clearing organization, its content is authoritative, unbiased, and completely free. Instead of promoting a specific trading style, the OIC’s e-learning portal, OCC Learning, focuses on delivering institutional-grade knowledge on the mechanics, risks, and strategies of exchange-listed options.

This industry backing is its key differentiator. While many courses are run by individual traders, the OIC provides curriculum straight from the source, ensuring the information is accurate, compliant, and focused on responsible trading. This makes it one of the best online trading courses for anyone, from complete beginners to experienced investors, who wants to master the core principles of options without the sales pitch.

Key Features and Offerings

The OCC Learning platform is designed as a self-guided university for options traders. It provides a structured path from foundational concepts to complex strategies, complete with progress tracking and assessments to test your knowledge along the way. The emphasis is always on understanding both the potential rewards and the inherent risks.

- Self-Paced Curriculum: Engage with multi-course learning paths covering Options 101, the Greeks, volatility, and various strategies.

- Live and On-Demand Webinars: Access a deep archive of webinars hosted by industry professionals and join live sessions to stay current.

- Authoritative, Unbiased Content: Learn directly from the organization that clears every U.S. options trade, with a strong focus on risk management.

- Completely Free Access: All educational materials, including courses, quizzes, videos, and webinars, are available at no cost.

How to Get the Most Out of OIC

To maximize your learning, start with the foundational "Options 101" curriculum and work through it sequentially. Use the quizzes at the end of each module to confirm your understanding before moving on. The true value of the OIC is in building a correct and deep understanding of how options work, which is critical before you risk capital. Once you have the basics down, you can explore their resources on 8 common options trading strategies with the confidence that you understand the underlying mechanics.

Expert Tip: Don't just watch the on-demand webinars. Register for the live events. This gives you the opportunity to ask questions directly to industry experts and hear what other traders are focused on in the current market.

| Feature | Options Industry Council (OIC) |

|---|---|

| Primary Focus | Foundational, unbiased education on U.S. exchange-listed options |

| Pricing Model | Completely free |

| Best For | Beginners and experienced traders seeking authoritative options knowledge |

| Key Advantage | Highly credible, industry-backed content from the OCC |

| Main Drawback | Narrow focus on options; no community or direct mentorship |

Website: https://www.optionseducation.org/

Top 7 Online Trading Courses Comparison

| Platform | 🔄 Implementation complexity | ⚡ Resource requirements | ⭐ Expected outcomes | 💡 Ideal use cases | 📊 Key advantages |

|---|---|---|---|---|---|

| Colibri Trader | Moderate — structured curriculum with mentor-led elements | Paid (pricing often requires inquiry), time & practice | High — practical price‑action skill-building (⭐⭐⭐⭐) | Self‑motivated traders seeking hands‑on price‑action and discipline | Practical mentorship, price‑action focus, free sampler (quiz + chapters) |

| Udemy | Low to variable — single courses by independent instructors | Low cost per course (frequent discounts), lifetime access | Variable — depends on instructor quality (⭐–⭐⭐⭐⭐) | Learners comparing many topics or trying niche skills cheaply | Massive catalog, lifetime access, reviews & refund window |

| Coursera | Moderate — structured university/industry programs with assessments | Paid per course or subscription (Coursera Plus), time commitment | Good — recognized certificates and structured learning (⭐⭐⭐) | Career learners wanting credentials or multi‑course specializations | University/industry backing, graded assessments, resume value |

| Interactive Brokers Traders' Academy (IBKR) | Low — self‑paced modules with quizzes | Free, time for study; IBKR-centric examples | Good — strong platform/tool and product knowledge (⭐⭐⭐) | Traders wanting broker‑level tool training and options/futures mechanics | Zero cost, professional depth, regularly updated webinars |

| Warrior Trading | High — multi‑course tracks plus live community and simulators | Premium pricing, simulator access, active community engagement | Strong for active day traders who engage (⭐⭐⭐–⭐⭐⭐⭐) | Aspiring day traders needing simulator, live chat and trade walkthroughs | Comprehensive curriculum + simulator + active live community |

| tastylive / tastytrade Learn Center | Moderate — structured, strategy‑focused courses | Free, video modules and quizzes | Good — practical options strategies focused on IV/probability (⭐⭐⭐) | Retail options traders wanting strategy + execution guidance | Free, strategy‑oriented, bridges theory to execution |

| Options Industry Council (OIC) / OCC Learning | Low to moderate — self‑paced curriculum on options mechanics | Free, time for study; authoritative materials | High for fundamentals — authoritative options knowledge (⭐⭐⭐⭐) | Traders needing unbiased, industry‑backed options education | Industry‑backed, comprehensive options mechanics & risk guidance |

From Learning to Earning: Your Next Step Toward Trading Mastery

Navigating the landscape of the best online trading courses can feel overwhelming, but making an informed choice is the foundational step toward a successful trading career. This guide has dissected some of the top platforms available, from the comprehensive academic structures of Coursera to the free, invaluable resources offered by the Interactive Brokers Traders' Academy and the OCC's Options Industry Council. Each option presents a unique pathway to understanding the markets.

Whether you are drawn to the high-energy, day-trading community at Warrior Trading or the specialized, derivative-focused content at tastylive, the most crucial takeaway is that education is not a one-time event; it's an ongoing process. Your learning journey must align with your personal trading style, risk tolerance, and long-term financial goals.

How to Choose Your Ideal Trading Course

Selecting the right course isn't just about picking the most popular name. It's about finding a methodology that resonates with you and a support system that fosters growth. Consider these factors when making your final decision:

- Learning Style: Do you thrive in a structured, academic setting like Coursera, or do you prefer a hands-on, community-driven approach like Warrior Trading? Perhaps a self-paced, mentor-led program like Colibri Trader is more your speed.

- Trading Focus: Are you interested in the fast-paced world of day trading, the strategic depth of options, or a universal approach like price action? Define your niche to narrow your choices.

- Budget and Commitment: Free resources from IBKR and the OIC are excellent starting points. However, a paid course often provides a structured curriculum, direct mentorship, and a dedicated community, which can significantly accelerate your progress.

Key Insight: The best course for you is the one you will actually complete and apply. A sophisticated strategy is useless if it doesn't fit your psychology or lifestyle. Prioritize clarity, practicality, and a system you can execute with confidence.

Turning Knowledge into Consistent Profit

Once you've chosen your educational path, the real work begins. True mastery is forged through disciplined application, not just passive learning. The transition from theory to practice requires a clear, systematic approach. Here are actionable steps to take:

- Start with a Demo Account: Before risking real capital, apply the strategies you've learned in a simulated environment. This allows you to build confidence and iron out execution errors without financial penalty.

- Develop a Trading Plan: Your plan is your business blueprint. It should explicitly define your strategy, entry/exit criteria, risk management rules (e.g., position sizing, stop-loss placement), and trading schedule.

- Specialize Before Diversifying: Master one strategy or market first. For example, if you choose Colibri Trader's price action methodology, focus solely on identifying supply and demand zones on a few currency pairs until you achieve consistency.

- Explore Niche Markets: As you transition from learning to earning, exploring specific market segments can be highly beneficial. For instance, understanding tools for optimizing your DeFi trades with stablecoin aggregators is key to capitalizing on opportunities within the decentralized finance space.

Ultimately, the goal of any of the best online trading courses is to empower you to think for yourself and make independent, high-probability decisions. For traders seeking to cut through the noise of complex indicators and build an intuitive, sustainable skill, Colibri Trader stands out. Its focus on pure price action and supply and demand principles equips you with a timeless framework for analyzing any market, on any timeframe. Your education is the most critical investment you will make. Choose wisely, commit fully, and begin your journey from a dedicated learner to a confident, profitable trader.

Ready to master the markets with a clear, proven strategy? The Colibri Trader program is designed to transform your understanding of price action and build the skills needed for consistent profitability. Explore the Colibri Trader course today and take the definitive step toward trading mastery.