Finding the Best Forex Pair to Trade A Price Action Guide

The best forex pair to trade isn’t one-size-fits-all—it really comes down to your personal style and how much risk you’re willing to take on. For many newcomers and price action enthusiasts, EUR/USD stands out as the perfect training ground. It delivers high liquidity and low costs, so you can focus on spotting chart patterns without getting blindsided by wild swings.

Finding Your Ideal Forex Pair

Choosing the right pair doesn’t have to feel like decoding hieroglyphics. Think of currency pairs as different vehicles, each built for a specific journey. Matching your ride to the road conditions, schedule, and destination is key.

- Major Pairs: Picture a dependable sedan—smooth, predictable, and economical. EUR/USD, GBP/USD and the like offer tight spreads and clear price behavior.

- Minor Pairs: Imagine a sturdy SUV—versatile and ready for side roads, but a bit trickier to handle. These involve two non-USD currencies, so you’ll juggle more moving parts.

- Exotic Pairs: Think high-octane sports cars—fast and thrilling, yet demanding in skill and cost. Expect wider spreads and sudden bursts of volatility.

Before we dive deeper, here’s a quick snapshot:

Quick Guide to Forex Pair Types

| Pair Type | Primary Characteristic | Best Suited For |

|---|---|---|

| Major Pairs | High liquidity, tight spreads | Beginners, Day Traders |

| Minor Pairs | Moderate liquidity, wider spreads | Swing Traders |

| Exotic Pairs | Low liquidity, high volatility | Experienced, Position Traders |

This table gives you a bird’s-eye view of each category. Use it as a starting checklist to narrow down what fits your game plan.

Start With The Majors

When you’re just getting your feet wet, sticking to the majors is a smart move. Their massive trading volume means more consistent price moves and cleaner chart setups—a must for anyone sharpening their price action skills.

If you’re ready to level up your chart-reading, check out this detailed walkthrough: https://www.colibritrader.com/how-to-read-forex-charts/

“Mastering the basics in a stable market builds the confidence you need to tackle more volatile pairs down the road.”

For a deeper dive into volume and volatility, explore the world of major pairs in forex.

Ultimately, trading success comes from a repeatable, disciplined process. Starting with a major pair like EUR/USD simplifies your learning curve—letting you focus on perfecting entries, exits, and risk management before you branch out.

The Three Pillars of a Great Trading Pair

When you're hunting for the best forex pair, what are you really looking for? You want a market that's predictable, with clean price action and fair trading costs. It all boils down to three core traits: liquidity, volatility, and the spread.

Think of these as the foundation of a house. If one is weak, the whole structure becomes unstable. For a price action trader, a solid foundation means cleaner charts, more reliable signals, and fewer nasty surprises.

Pillar 1: Liquidity

Liquidity is just a fancy word for how busy a market is. Imagine a bustling city marketplace versus a quiet country road. The city is packed with buyers and sellers, making it easy to trade goods instantly at a fair price. That’s a liquid market.

Major pairs like EUR/USD are the epicentres of trading, with trillions of dollars zipping back and forth every day. This immense volume is why their charts often look smoother and why key support and resistance levels tend to hold up. You can dig deeper into how market liquidity works in our guide.

For a price action trader, high liquidity is non-negotiable. It means chart patterns are genuine reflections of market sentiment, not just random spikes caused by one big player.

Pillar 2: Volatility

If liquidity is the size of the crowd, volatility is its mood. It's the measure of how much a pair’s price jumps around. Some pairs are calm and steady, cruising along predictably. Others are wild and energetic, prone to dramatic swings.

Now, volatility isn't good or bad on its own—it's all about finding a personality that matches your trading style. A day trader might need those intraday swings to find opportunities, while a long-term position trader will prefer a pair that isn't giving them whiplash every five minutes.

- Low Volatility Pairs: These can offer clearer, more defined trends but fewer chances for a quick in-and-out trade.

- High Volatility Pairs: They serve up more opportunities to profit but crank up the risk dial significantly.

The goal is to find a rhythm you can dance to, not a chaotic mosh pit that leaves you guessing.

Pillar 3: The Spread

Finally, let's talk about the cost of doing business: the spread. It’s simply the tiny difference between the buy (ask) price and the sell (bid) price. Think of it as the toll you pay to use the trading highway—it’s how your broker makes their money.

This "toll" is always lowest on the busiest highways, the pairs with the highest liquidity. If you’re trading frequently, a tight spread is absolutely crucial. Why? Because high costs will chew away at your profits, one trade at a time.

A pair with a wide spread means the price has to move a long way in your favour just for you to break even. That’s a losing game for most short-term price action strategies.

Choosing Your Trading Playground

Now that you have a handle on liquidity, volatility, and spreads, it's time to pick your terrain. The forex market isn't just one big, uniform entity. It’s a massive landscape with different paths, and each one is suited for a different kind of journey.

Think of it like choosing a vehicle for a road trip. You wouldn't take a race car on a bumpy mountain trail, and you wouldn't take a rugged off-roader to a Formula 1 track. Your choice of currency pair needs to be just as intentional, matching your skill level, risk appetite, and trading strategy.

Understanding the three main categories—Majors, Minors, and Exotics—is the first step to finding your fit.

The Superhighways: Major Pairs

Major pairs are the six-lane interstates of the currency world. They all involve the US dollar and represent the globe's largest, most stable economies. This makes them the most heavily traded pairs on the planet.

For us as traders, that high traffic means deep liquidity and razor-thin spreads, which is exactly what a price action trader needs.

For anyone just starting out, the majors are without a doubt the best place to begin. Their price movements are generally more predictable, and the chart patterns are often clearer, providing a solid environment to learn the ropes and build confidence. The king of this category is EUR/USD, which has long held the title of the world's most traded pair, accounting for about 21.2% of the average daily forex market turnover. This dominance brings incredible liquidity and tight costs, making it a staple for traders at every level.

The Scenic Routes: Minor Pairs

Minor pairs, often called "crosses," are the scenic country roads of the market. They feature major currencies traded against each other without involving the US dollar—think EUR/GBP, GBP/JPY, or AUD/CAD.

These pairs can offer unique opportunities and sometimes present very strong, clean trends, especially when the economies behind them are heading in opposite directions.

But these routes demand a bit more from the driver. Liquidity is lower and spreads are wider than on the superhighways. Trading them well requires a deeper understanding of how different global economies interact, making them a good next step once you've gotten comfortable with the majors. This is also where aligning your activity with the best time of day to trade becomes even more critical.

The Off-Road Trails: Exotic Pairs

Finally, we have the exotic pairs. These are the rugged, unpaved off-road trails—exciting, challenging, and potentially rewarding, but also full of hidden dangers. Exotics pair a major currency with one from a smaller or emerging economy, like USD/ZAR (US Dollar vs. South African Rand) or USD/TRY (US Dollar vs. Turkish Lira).

Trading exotics requires a high level of skill and an iron-clad risk management plan. Their low liquidity and wide spreads can lead to sudden, unpredictable price gaps and significant costs.

These pairs are best left to seasoned traders who understand the specific geopolitical and economic risks involved. For anyone still honing their price action skills, the majors and minors offer a much safer and more reliable playground.

Majors vs Minors vs Exotics: A Trader's Comparison

To put it all together, let's break down the key differences between these three categories. This table should help you quickly see where each type of pair shines and where the potential pitfalls lie.

| Characteristic | Major Pairs | Minor Pairs | Exotic Pairs |

|---|---|---|---|

| Liquidity | Highest. Easy to enter and exit trades. | Moderate. Good, but less than Majors. | Lowest. Can be difficult to trade large sizes. |

| Spreads | Tightest. Very low transaction costs. | Wider. Higher costs than Majors. | Very Wide. Can be expensive to trade. |

| Volatility | Moderate. Predictable, with key news drivers. | Moderate to High. Can trend strongly. | Extremely High. Prone to gaps and sharp moves. |

| Predictability | High. Well-analyzed, clear technical patterns. | Moderate. Influenced by multiple economies. | Low. Susceptible to political and local risk. |

| Best For | Beginners, Day Traders, Scalpers | Intermediate Traders, Swing Traders | Experienced Experts, Position Traders |

Choosing the right category is the first filter. From here, you can narrow down the specific pair that aligns with your personal trading style and schedule. The goal isn't to trade everything, but to find the few pairs that give you the clearest edge.

Matching the Right Pair to Your Trading Style

Let's get one thing straight: the idea of a universal "best forex pair to trade" is a total myth. The real answer depends entirely on you—your schedule, your patience, and the strategy you’ve chosen.

A pair that’s a dream for a long-term position trader could be an absolute nightmare for a scalper. It’s all about finding the right fit for your personality.

Let's break down four common trader profiles. We'll match them with currency pairs that genuinely complement their approach, not just by picking a name from a list, but by understanding the why behind each choice.

For The Beginner Building Confidence

When you're new to the markets, your first job isn't to hit home runs. It's to survive. Your goal is to build skills in a stable, predictable environment where you can practice reading price action without the heart-pounding stress of wild volatility.

This is why the EUR/USD is the undisputed king for new traders. Its immense liquidity creates smoother price movements and razor-thin spreads, which keeps your trading costs down. More importantly, the chart patterns are often cleaner, making it easier to spot classic support and resistance levels and key candlestick formations.

By mastering one pair like EUR/USD, you build a rock-solid foundation of skill and confidence before venturing into more chaotic markets.

For The Fast-Paced Day Trader

Day traders live and breathe intraday price swings. You need a pair that moves enough to hit profit targets within a single session but is liquid enough to keep spreads tight and avoid nasty slippage on your entries and exits.

The GBP/USD, affectionately known as "Cable," is a classic choice, especially during the London and New York session overlap. It’s famous for its healthy daily range, which serves up plenty of opportunities. The secret sauce is its high volume during these peak hours; this keeps costs low and ensures price action is clean and responsive to key levels.

A day trader's edge comes from aligning their chosen pair with its most active market session. Trading a pair when its home market is "asleep" often leads to choppy, unpredictable price action.

For The Patient Swing Trader

Swing traders are in it for the bigger move, holding positions for several days or even weeks to capture a significant "swing" in the market. Your game is all about identifying clean, multi-day trends and reliable chart structures.

The AUD/USD often fits this style like a glove. As a commodity-driven currency, it can carve out powerful, directional trends based on shifts in global risk sentiment and commodity prices.

These trends can persist for days on end, offering clear entry and exit points for a patient price action trader who is willing to wait for the perfect setup to form on the daily or 4-hour charts.

For The Long-Term Position Trader

Position traders have the longest time horizon of all, holding trades for weeks, months, or sometimes even years. Your decisions are rooted in fundamental economic shifts and massive, long-term technical trends.

A pair like USD/CAD is tailor-made for this approach. Its movements are heavily influenced by long-term differences in US and Canadian interest rate policies, not to mention the price of oil—a huge driver for the Canadian economy.

These fundamental forces create powerful, sustained trends that are best viewed on the weekly and monthly charts, rewarding traders who have the patience and capital to ride them out.

Emerging Opportunities and Pairs to Watch

Once you've gotten a real feel for the major pairs and built a solid foundation, the next step is to start scanning the horizon for fresh opportunities. The forex market is always in motion, and the pairs leading the pack today might not be the same ones tomorrow. A smart trader knows this.

Keeping an eye on emerging pairs lets you diversify and potentially catch powerful, long-term trends fueled by big shifts in the global economy. This isn't about chasing every shiny new instrument that pops up. It's a strategic expansion of your watchlist, reserved for when you have the skill and discipline to handle different market personalities.

The Rise of the Yuan

One of the biggest stories in the currency world over the last decade has been the growing muscle of the Chinese yuan. As China’s economy takes on a bigger and bigger role globally, its currency is gaining serious traction. The USD/CNY (US Dollar vs. Chinese Yuan) is the perfect example of this shift in action.

The trading volume in this pair has absolutely exploded. For price action traders, that's music to our ears. Why? Because higher participation and liquidity often lead to cleaner, more defined trends. As more money flows into a pair, its price action tends to become less choppy and more respectful of key technical levels—creating fertile ground for proven strategies.

The yuan's journey is a major deal. The USD/CNY now makes up about 6.6% of global daily trading volume, turning over roughly $494 billion and making it the fourth most-traded pair. Both USD/CNY and USD/HKD have seen their volumes jump by over 50% in recent years, which is a crystal-clear signal of changing market dynamics. You can dig deeper into these volume shifts and the most traded pairs to see the full picture.

Exploring pairs like USD/CNY is a move for the trader who has already put in the time and mastered the majors. These opportunities carry unique risks, like geopolitical headlines and surprise central bank moves, that demand a more seasoned eye.

Stepping onto this less-traveled path can offer great returns and a way to get away from the crowded trades in the majors. But you have to approach it with caution. The best forex pair to trade is always the one that clicks with your strategy and risk appetite, whether that's a reliable major or a dynamic emerging pair. Always start small, and make sure you truly understand what makes any new currency you add to your portfolio tick.

A Simple Checklist For Choosing Your Next Trade

We've covered a lot of ground, but knowing the concepts is one thing; putting them into practice is where the rubber meets the road. Professional trading isn't about guesswork; it's about building a disciplined, repeatable process that stacks the odds in your favour.

This checklist is designed to help you do just that. It's a quick, logical filter to run every potential trade through, ensuring you only pick pairs that fit your specific setup.

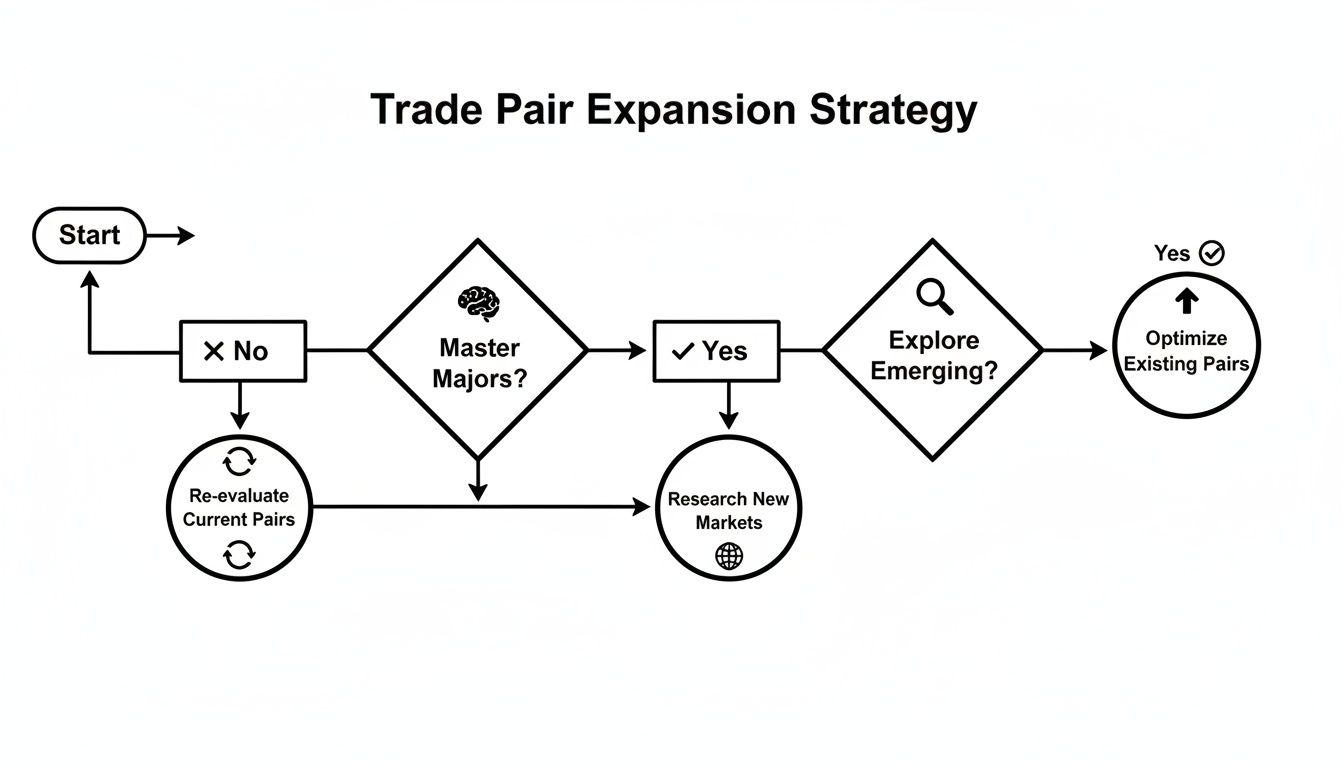

This visual shows a great way to think about expanding your trading focus once you've found your groove and achieved some consistency.

The main takeaway is simple but powerful: master the majors first. Only after you're consistently profitable there should you dedicate serious time to the more unpredictable minor or exotic pairs.

Your Pre-Trade Questions

Before you even dream of clicking the "buy" or "sell" button, you need to ask yourself these four questions. If you can't give a confident "yes" to every single one, the best trade is often no trade at all. Step away and wait for a better, higher-probability opportunity. This is the heart of effective risk management.

Does this pair's volatility match my risk tolerance? A currency pair that swings wildly might look exciting, but it can blow through your stop-loss in a heartbeat if you aren't prepared for it. You have to trade a pair whose personality you can actually handle, day in and day out.

Are the spreads low enough for my strategy? For anyone trading on the lower timeframes, like day traders and scalpers, tight spreads are absolutely non-negotiable. Wide spreads are a hidden tax on every single trade, slowly but surely eating away at your hard-earned profits.

Is this pair active during my trading hours? Trying to trade a pair when its main market is asleep is a recipe for frustration. You'll likely just see choppy, sideways, and completely unpredictable price action. Always make sure you're trading when peak liquidity is flowing.

Successful trading is about stacking probabilities in your favour. This checklist ensures you only engage when the market conditions align perfectly with your strategy, greatly improving your odds of success.

- Does the price action show clear, readable patterns? Let me be blunt: if you have to squint and stare at the chart for five minutes to convince yourself a setup is there, it's not there. The best trades are the obvious ones, with clean support and resistance levels and price action signals that jump right out at you. Never, ever force a trade on a messy chart.

A Few Final Questions

Navigating the world of forex pairs can bring up a lot of questions. It's only natural. Here are some clear, straightforward answers to the most common things I hear from traders trying to find their footing.

How Many Forex Pairs Should A Beginner Trade At Once?

Just one or two. That's it. Pick a major pair like EUR/USD or AUD/USD and commit to it. This lets you really get a feel for its unique behavior, its rhythm, and how its price action unfolds without getting pulled in a dozen different directions.

Trying to juggle too many pairs at once is a classic rookie mistake. It divides your attention and makes it nearly impossible to learn anything meaningful.

The goal isn't to be a jack-of-all-trades, but a master of one. Once you can pull consistent profits from a single pair, you can then slowly and strategically start looking at others.

Does The Best Forex Pair Change Depending On The Time Of Day?

Absolutely. The ideal pair to trade is heavily tied to which major market session is open. Different pairs wake up at different times, which has a massive impact on their liquidity and how much they move.

For example:

- GBP/USD and EUR/USD really come alive during the London and New York overlap (8 AM to 12 PM EST). This is when you'll find the most action and the tightest spreads.

- AUD/USD and USD/JPY see most of their volume and big moves happen during the Asian session.

Lining up your trading with a pair's most active session gives you a real edge, especially if you're a day trader who needs that intraday movement to find opportunities.

Can I Succeed By Only Trading Exotic Pairs?

While it’s technically possible, I wouldn't recommend it, especially if you're still developing your skills. Trading exotics is like trying to learn to drive in a blizzard—you’re just stacking the odds against yourself from the very beginning.

Their spreads are much wider, which is like paying a huge entry fee on every trade. Lower liquidity also means you can get hit with unpredictable price spikes and nasty slippage. The chart patterns can be less reliable, too. The name of the game in trading is consistency and managing risk, and that’s a much easier job with the stability you get from the major currency pairs.

Ready to stop guessing and start trading with a proven, price-action-based strategy? At Colibri Trader, we provide clear, no-nonsense guidance to help you find your edge and trade with confidence. Discover your trading potential today at https://www.colibritrader.com.