A Modern Beginner Trading Course Guide

So you want to learn how to trade. Where do you even begin?

A beginner trading course is a structured program that walks you through the essential principles, hands-on skills, and risk management tactics you absolutely need to survive in the financial markets. Honestly, it's the only reliable place to start if you're serious about this.

Your First Step Into The Trading World

Jumping into trading can feel like trying to learn a new language. You're bombarded with weird jargon and charts that look like a mess of lines and colors. A lot of new traders just dive in headfirst without a clue, and predictably, they lose money—money they didn't have to lose.

A good beginner trading course is your guide through that initial chaos. It's what stops you from getting completely overwhelmed.

Think of the market as a massive, unpredictable ocean. Trying to trade without any real knowledge is like paddling out on a raft with no map and no compass. You're just asking for trouble, at the mercy of every wave and storm.

A great course is your navigational toolkit. It doesn't just point to a destination; it teaches you how to read the weather (market volatility), understand the currents (price trends), and actually steer your ship (manage your capital) to get to shore in one piece.

This is what separates disciplined traders from pure gamblers. Instead of just guessing and hoping, you start making informed decisions based on a proven methodology.

The Modern Way to Learn Trading

Forget any old-school ideas you might have about learning from a dry, dusty textbook. The best courses today are dynamic, hands-on programs built for the real world. They focus on building your skills one step at a time, making sure you actually understand the "why" behind every move you make.

The goal isn't to have you memorize a bunch of definitions; it's to build a set of skills that will stick with you. This is the structured path that helps you dodge the classic mistakes that wipe out 90% of new traders—things like using way too much leverage, "revenge trading" after a loss, and completely ignoring risk. A solid program gives you a clear roadmap from being a total novice to a competent decision-maker.

What to Expect from a Quality Program

A proper beginner trading course should be incredibly thorough. Trading education has come a long way, and modern programs pack in a ton of detail to cover everything a new trader needs.

For instance, it’s not uncommon for top-tier courses to offer more than 10 hours of deep-dive training. They'll start you with the absolute basics of forex and then methodically guide you into more complex topics like institutional supply and demand, order flow analysis, and professional-grade risk management. You can explore a full beginner-to-advanced curriculum to see just how this kind of in-depth content is structured.

Ultimately, a course is an investment in your own competence and confidence. It gives you the tools, and more importantly, the strategic mindset you need to approach the markets like a professional. It's your first—and most critical—step toward trading with skill, not luck.

What Every Great Trading Course Should Teach You

A top-tier trading course is so much more than just a playlist of videos. It needs to be a properly structured curriculum, built on a few non-negotiable pillars. Without these core pieces, you're just learning random facts, not building a real, cohesive skill that you can actually use in the markets. A great program will walk you through each essential area, one by one, so you don't just know what to do, but why you're doing it.

So, let's break down the absolute must-haves. If a beginner course doesn't cover these topics in depth, you're not getting the full picture.

Understanding Market Fundamentals

Before you can even think about reading a chart, you have to get a feel for what makes prices move in the first place. At its core, any financial market is just a massive, non-stop auction. Buyers (demand) and sellers (supply) are in a constant tug-of-war, and the price you see on your screen is simply the last spot where they agreed to a deal.

A solid course will hammer home this fundamental concept of supply and demand. When you have more aggressive buyers piling in than sellers, the price has to go up to find people willing to sell. On the flip side, when sellers are desperate to get out and overwhelm the buyers, the price has to drop to entice new buyers to step in. Grasping this simple auction dynamic is the bedrock of everything else you'll learn.

Learning Technical Analysis

If the market fundamentals are the "why," then technical analysis is the "what." This is the actual skill of reading the market's own language, straight from a price chart. Think of a chart as a visual story of that ongoing battle between the bulls and the bears. Technical analysis is what gives you the tools to read that story.

This is where you learn to spot the patterns, trends, and key price levels that act as clues, hinting at potential shifts in the auction. It’s not about some crystal ball that predicts the future; it's about spotting high-probability setups based on how the market has behaved in the past. A good course turns a confusing jumble of lines into a clear map of possibilities.

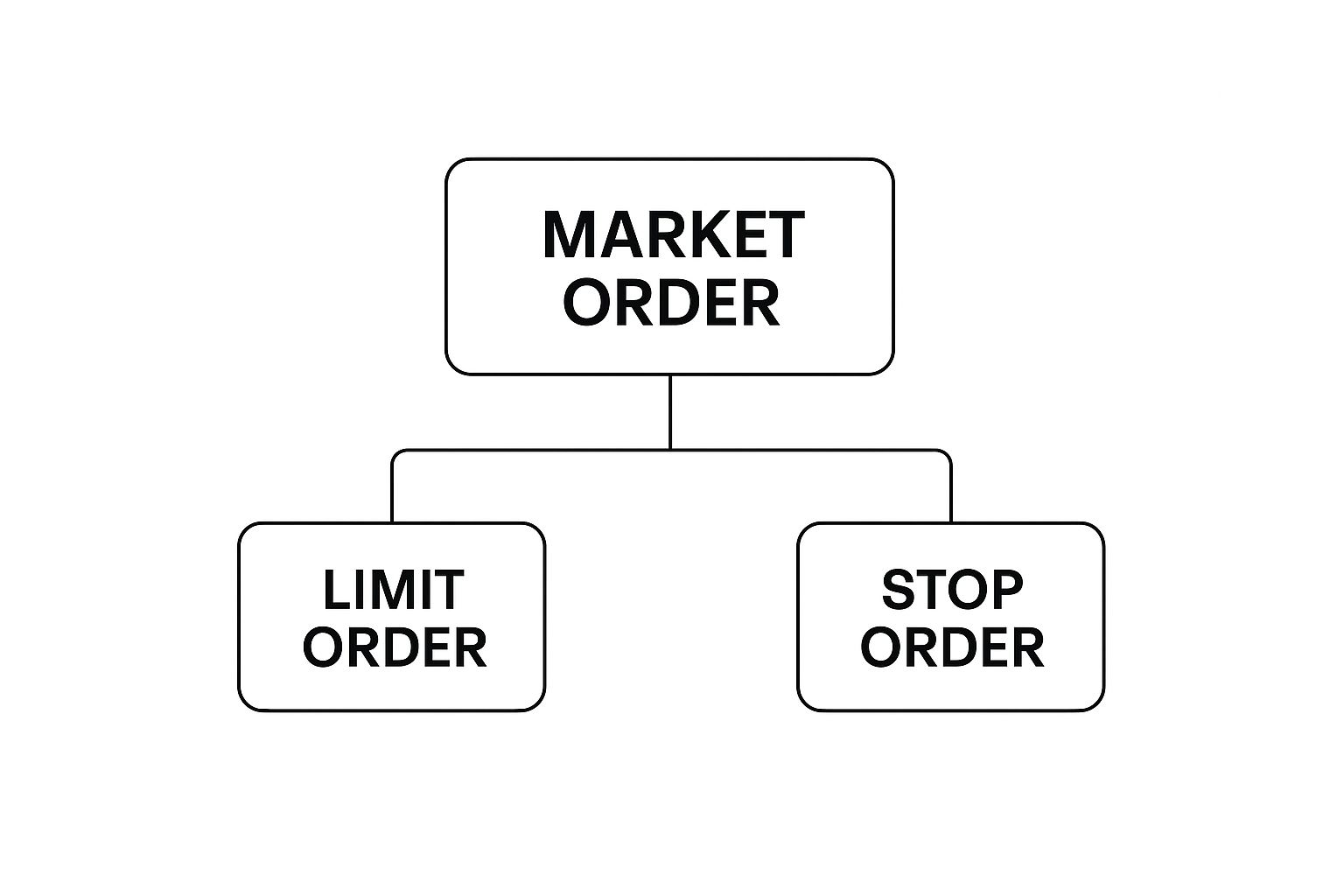

Here’s a quick look at the hierarchy of the most common order types you’ll use to act on your analysis.

As you can see, basic market orders get you in or out immediately, while limit and stop orders give you far more control over your exact entry and exit prices.

Mastering Price Action

The single most effective form of technical analysis, in my experience, is price action. This is the art and science of making all your trading decisions based on the raw movement of price over time. You learn to trade with clean charts, free from the clutter of a dozen lagging indicators all telling you different things. A truly superior beginner trading course will put a massive emphasis on this approach.

Instead of trying to decipher a mess of indicators, price action teaches you to read the story the candlesticks are telling you directly. You learn to spot:

- Key Candlestick Patterns that show you when buyers or sellers are running out of steam.

- Support and Resistance Zones where the market has turned around before.

- Market Structure so you can tell if the market is trending up, down, or just chopping sideways.

This method cuts through the noise and forces you to focus on the only thing that truly matters: the price itself. For anyone wanting to really cement these ideas, exploring the best beginner trading books can be a fantastic supplement to a structured course.

To give you a clearer picture, here's a breakdown of the foundational topics that any serious trading education must cover.

Fundamental Pillars of a Beginner Trading Education

| Core Concept | What It Teaches You | Real-World Analogy |

|---|---|---|

| Market Fundamentals | The core engine of price movement (supply and demand). | A global auction where price is the result of a constant tug-of-war between buyers and sellers. |

| Technical Analysis | How to read the story of the market from a price chart. | Learning to read the market's "sign language" to identify patterns and potential opportunities. |

| Price Action | A clean, minimalist approach to trading based only on price. | Reading a book in its original language instead of relying on a flawed translation (indicators). |

| Risk Management | The crucial rules for survival and capital preservation. | The safety harness for a rock climber; it won't make you climb faster, but it will save you from a fatal fall. |

| Trading Psychology | How to manage your own emotions to maintain discipline. | The mental conditioning an athlete undergoes to perform under pressure without making emotional mistakes. |

These pillars work together to build a complete trading methodology, turning you from a passive observer into an active and informed market participant.

The Survival Skill Of Risk Management

You can have the greatest trading strategy on the planet, but if you don't have rock-solid risk management, you will fail. It's not a matter of if, but when. This is, without a doubt, the most important pillar of your entire trading education.

Think of it like a safety harness for a rock climber. It doesn't help you climb any higher or faster, but it ensures that one small slip doesn't turn into a catastrophic fall.

A professional trader is, first and foremost, a professional risk manager. They focus more on how much they could lose on a trade than on how much they could win.

Any course worth its salt must dedicate a huge chunk of time to this. It has to teach you practical, hard-and-fast rules like the 1% rule (never risking more than 1% of your account on a single trade) and exactly how to calculate your position size on every trade. It might not be the sexiest part of trading, but it’s what separates the pros from the gamblers and it’s the absolute key to staying in the game long enough to succeed.

Developing Trading Psychology

Finally, a great course has to tackle the elephant in the room: your own mind. Trading is one of the most psychologically brutal professions out there because every single decision has your hard-earned money on the line. Fear and greed are incredibly powerful forces, and they will absolutely wreck even the most perfect trading plan if you let them.

A comprehensive course will introduce you to the core ideas of trading psychology. It will teach you how to spot your own emotional triggers, how to stay disciplined when you're on a losing streak, and how to stick to your strategy even when every fiber of your being is screaming at you to do the opposite. Mastering your own mind is every bit as critical as mastering the charts.

Choosing A Course That Matches Your Learning Style

Just like there's no single "correct" way to trade, there's certainly no one-size-fits-all beginner trading course. The world of trading education is massive and packed with different philosophies. Trying to force yourself into a course that doesn't fit your personality is like trying to learn a new language with a textbook written for someone else—it's frustrating and you'll probably quit.

The trick is to understand the main teaching approaches out there and, just as importantly, get honest about your own learning preferences before you pull out your credit card. This little bit of self-awareness up front makes all the difference. It ensures you pick a program that clicks with you, making it far more likely you'll absorb the material and actually use it.

What Kind of Learner Are You?

Before you even look at a course syllabus, take a minute for some honest self-reflection. How do you really learn new, complicated stuff? Your answer here is your compass.

-

Visual Learners: Do you get it faster when you see it? You probably need a course built around video lessons, detailed chart walkthroughs, and plenty of visual examples of trade setups. A program heavy on live demonstrations and graphics will be your best bet.

-

Structured/Text-Based Learners: Do you prefer to read and digest information at your own speed? Look for courses with in-depth written modules, downloadable PDFs, and detailed notes you can mark up and review whenever you want.

-

Kinesthetic/Practical Learners: Do you learn by doing? You'll want a course that throws you into the action with simulation software, paper trading exercises, and a buzzing community where you can kick around real-time trade ideas.

Most of us are a mix, but one style usually stands out. Nailing down your dominant style is the first step to finding a course that feels intuitive, not like a chore.

The world of trading education is like a vast ocean with thousands of beaches leading into it. You don't need to know everything about all of them. You just need to find the beach that's right for you and start there.

Comparing Course Methodologies

Once you know how you learn, the next step is figuring out what you'll be learning. Most beginner trading courses fall into a few main camps, each with its own core philosophy.

1. Pure Price Action Courses

This approach is all about learning to read the market's story directly from a clean price chart. It focuses on decoding candlestick patterns, market structure, and key support and resistance levels without a bunch of lagging indicators cluttering things up. You're learning to understand the raw psychology of buyers and sellers.

2. Indicator-Based Systems

These courses teach you to use a specific cocktail of technical indicators—like RSI, MACD, or Moving Averages—to generate buy and sell signals. While some traders like the clear rules this provides, it can easily become a crutch. Over-reliance on indicators can stop you from learning to read what the price itself is actually telling you.

3. Gamified & Simulated Learning

This newer style uses trading simulators and game-like challenges to teach you the ropes in a totally risk-free zone. It’s fantastic for hands-on, kinesthetic learners who need to practice the mechanics of placing trades and managing risk without the heart-pounding pressure of real money on the line.

This variety in teaching methods is a direct response to what traders around the world are asking for. As of 2025, you can find everything from gamified apps to deep-dive institutional analysis. For example, the stock trading beginner course on the Colibri Trader platform is known for its laser focus on pure price action. It’s designed to guide students in interpreting market behavior straight from the charts, rather than depending on algorithms or indicators. You can discover more about this pure price action approach and see how it's structured for those just starting out.

At the end of the day, the best course for you is the one that lines up your personal learning style with a trading methodology that just plain makes sense to you. Get those two things right, and you’re setting yourself up for a much smoother and more rewarding journey into trading.

What A Modern Price Action Curriculum Looks Like

Let's pull back the curtain on a modern, price-action-focused beginner trading course. A high-quality program isn’t just a random playlist of videos; it’s a carefully structured curriculum where every lesson builds on the last. Knowing what this structure looks like gives you a powerful benchmark to measure any course against.

A great curriculum guides you from the absolute basics to complex strategies in a way that just makes sense. It starts with the building blocks and progressively adds layers of skill. This is how you move from just memorizing patterns to truly understanding the market dynamics behind them.

Module 1: The Absolute Essentials

The journey always begins with learning the language of the market. Before you can analyze anything, you have to learn how to read what’s right in front of you. This first phase is all about getting your chart literacy down and building a rock-solid foundation.

-

Reading Candlestick Charts: Think of this as learning your ABCs. Every single candlestick tells a small story of the battle between buyers and sellers over a specific time. You'll learn to spot bullish and bearish sentiment at a glance.

-

Identifying Support and Resistance: These are the most critical levels on any chart, period. A good course will teach you to see them not as thin little lines, but as broad zones where price has reacted in the past. This is where you can see the market's memory, and it's where the big decisions get made.

A price chart is a visual record of human emotion—fear, greed, and uncertainty. Learning to read price action is like learning to read the collective mind of the market without any distracting noise.

Understanding these two elements is non-negotiable. They create the context for every single trade you will ever think about taking. Everything else you learn about price action gets applied at or around these key areas. For a deeper dive into this foundational skill, check out our detailed guide on how to read price action.

Module 2: Understanding Market Dynamics

Once you can read the basic language, the next step is to understand the grammar—how all those individual pieces fit together to tell a story. This is where you learn to see the bigger picture, looking beyond just single candlesticks or price levels.

The core concept here is market structure. Is the market making a series of higher highs and higher lows (an uptrend)? Or is it making lower lows and lower highs (a downtrend)? Or is it just chopping sideways in a range?

Answering that question is arguably the most important skill in trading. It tells you which direction you should be looking to trade in, or if you should even be trading at all. Any quality beginner trading course will spend a lot of time making sure you can spot the prevailing trend with real confidence.

Module 3: Advanced Pattern Recognition

With a firm grip on the market's structure, you can now learn to spot specific, high-probability entry signals. This is where you start mixing your knowledge of candlesticks, support and resistance, and market structure to pinpoint key turning points.

This module is all about repeatable patterns that signal a potential change in momentum. It’s not about memorizing dozens of obscure formations. It's about mastering a few powerful ones that show up time and time again.

Key Reversal Patterns You Will Learn:

- The Engulfing Pattern: A powerful signal where one candle completely swallows the previous one. It shows a strong and sudden shift in who's in control.

- The Pin Bar (or Hammer/Shooting Star): This pattern has a long "tail" or "wick," showing that one side tried to push the price but was forcefully rejected by the other.

- Inside Bar: A candle that forms entirely within the range of the one before it. This signals consolidation and a potential breakout brewing.

Each of these patterns tells a story of the ongoing fight between buyers and sellers. By learning to recognize them within the context of the overall market structure, you start to build a complete, cohesive trading strategy. You're no longer a spectator; you're becoming an informed participant.

How To Spot Red Flags And Avoid Common Traps

The world of trading education is packed with slick marketing and promises that are simply too good to be true. If you're looking for a great beginner trading course, your first job is to learn how to filter out all that noise. You need to tell the difference between legitimate educators and the get-rich-quick artists.

It takes a healthy dose of skepticism and a clear checklist of what to look for—and what to run away from.

Trust me, investing in the wrong program isn't just a waste of money. It can drill bad habits and a destructive mindset into you that are incredibly difficult to unlearn later. Your goal is to find real, solid education, not a lottery ticket.

The Over-the-Top Promises Trap

This is the biggest and most common red flag I see. You must be extremely wary of any course or instructor that talks about guaranteed or easy profits. Real trading is a skill-based profession. It involves risk, and there are absolutely no guarantees. Period.

Watch out for these specific warning signs:

- Promises of "Guaranteed Profits": Nobody can guarantee returns in the market. If you see this, it's an immediate deal-breaker. Just walk away.

- "Secret" or "Holy Grail" Indicators: There are no secret formulas out there. I can tell you from experience that successful trading is about a solid methodology, not some magical indicator that prints money.

- High-Pressure Sales Tactics: Phrases like "only 3 spots left!" or aggressive countdown timers are just there to trigger your FOMO (fear of missing out). They want to rush you into making a bad decision.

These tactics are designed to prey on the excitement and impatience of new traders. A credible educator will always focus on the process of learning and managing risk, not on pie-in-the-sky outcomes.

Trading is a marathon, not a sprint. Any course promising a shortcut to the finish line is likely leading you right off a cliff. True education empowers you with skills for the long haul.

A massive part of this journey is getting your emotions under control. Promises of easy money are designed to exploit greed, which is a huge psychological hurdle for traders. Mastering your mindset is non-negotiable, and you can get a head start by understanding some key trading psychology tips to help you beat the market.

Evaluating Instructor Credibility

Beyond the flashy sales pitch, you need to find out who is actually teaching you. Don't just take their word for it; you have to do your own digging. A credible instructor will have a transparent and verifiable track record built over years, not just a few weeks.

Also, look for a clear and transparent curriculum. A legitimate course will be proud to show you what you're going to learn, often with a detailed syllabus. If the course content is vague or hidden behind a paywall, that's another red flag. They should be selling you on the quality of their education, not on some mystery box.

Finally, look for genuine student testimonials and, more importantly, a supportive community. Hype-filled reviews on a sales page are one thing. But an active community forum, a Discord server, or a group where students are actually discussing trades and asking real questions? That's a sign of a healthy, engaged learning environment. It shows the instructor is committed to helping their students long after they’ve made the sale.

From Learning The Rules To Playing The Game

So you’ve finished a great beginner trading course. That's a massive accomplishment, but you need to see it for what it truly is: the starting line, not the finish line.

Think of it like this: you've learned the rules of the road and how to operate a car. Now it’s time to actually get behind the wheel. You wouldn't take a new car straight onto the freeway for your first drive, would you? Of course not.

This is where you bridge the gap between classroom theory and the messy reality of the live markets. The next step is absolutely not to fund a live account with your hard-earned money. Your journey should begin in a completely risk-free environment.

Your First Step Is Paper Trading

Paper trading, often called demo trading, is your driving range. It’s where you get to test your new strategies in a live market simulation without risking a single penny.

I can't stress this enough: this phase is non-negotiable. It’s where you build muscle memory, confirm your strategy has a genuine edge, and make all the inevitable rookie mistakes without paying a financial price for them.

The goal here is simple: prove to yourself that your system works and that you have the discipline to follow it religiously. This isn't about making imaginary millions; it's about forging consistent habits and gathering cold, hard data on your performance. Track every single trade as if real money were on the line.

Trading is a performance-based skill, much like playing a sport or a musical instrument. You can read every book on how to play the piano, but you only get better by actually sitting down and practicing the keys. Paper trading is your practice.

Creating Your Personal Trading Plan

While you're practicing in your demo account, your other critical task is to forge a formal trading plan. This is a written document that governs every single decision you make in the market. It's your business plan, your rulebook, and your psychological anchor all rolled into one.

Your trading plan must clearly define:

- Your Strategy: What specific price action setups will you trade?

- Your Entry Criteria: What exact conditions must be met before you even think about entering a trade?

- Your Risk Management Rules: How much capital will you risk per trade? How will you calculate your position size?

- Your Exit Strategy: Where will you take profits, and more importantly, where will you cut your losses?

A solid plan removes emotion and haphazard decisions from your trading, forcing you to operate like a disciplined professional.

Going Live With Real Capital

Only after you've achieved consistent profitability in your paper account for at least a few months—and have a rock-solid trading plan—should you even consider trading with real money.

When you do go live, start small. Use an amount of capital you are genuinely okay with losing. The psychological shift when real money is on the line is immense, and it will test your discipline in ways you can't even imagine yet.

The demand for this kind of foundational trading knowledge is exploding. We're seeing a massive rise in people looking for a good beginner trading course, fueled by a surge in retail market participation. Just look at a platform like Coursera; some of their beginner courses have thousands of reviews, with one popular option attracting around 1,800 reviews alone.

You can see the variety of beginner trading courses available to get a sense of this trend. The path from a course to the live market is a well-trodden one, but it's a journey that demands patience, practice, and unwavering discipline.

Your Top Questions About Trading Courses Answered

Diving into the world of trading can kick up a lot of questions. It's totally normal to feel a mix of excitement and maybe a little bit of "where do I even start?" To cut through the noise, I've put together some straight answers to the questions I hear most often from new traders thinking about a beginner course.

Think of this as your personal cheat sheet. It’s here to help you get clear on the common sticking points so you can move forward with confidence.

How Long Does It Take to Learn Trading With a Course?

You can probably work through the videos and materials of a solid beginner course in a few weeks or a couple of months. But let's be crystal clear: that's just step one. Finishing the course isn't the finish line.

Learning to trade profitably is a marathon, not a sprint. The course gives you the map, but you still have to drive the car and learn the roads yourself. Most traders I know who are serious about this spent at least 6 to 12 months practicing on a demo account (paper trading) before they felt truly confident in their strategy. Real mastery doesn't come from watching someone else trade; it comes from doing it yourself, tracking your results, and learning from every single mistake in a completely risk-free space.

Are Free Beginner Trading Courses Worth It?

Look, free courses can be a decent place to start. They’re great for picking up the absolute basics, like what a candlestick is or the lingo traders use. They let you dip your toes in the water without spending a dime.

But they almost always miss the key ingredients you need to actually succeed. A quality paid course isn't just an expense; it's an investment in yourself. Here's what you're really paying for:

- A structured path that builds your skills logically, one on top of the other.

- Deep-dive strategies covering the stuff that really matters, like risk management and the psychology of trading.

- A community of other students and mentors to bounce ideas off of and get support.

- Real accountability and a clear roadmap from A to Z.

By all means, use free content to get your bearings. But when you're ready to get serious, a comprehensive paid course is the next logical step.

Do I Need a Lot of Money to Start Trading After a Course?

Absolutely not. This is probably the biggest and most damaging myth in trading. After you finish a course, your very first—and most important—job is to paper trade. This is done on a demo account and costs exactly zero dollars.

The goal isn't to get rich quick; it's to get competent first. Your entire focus should be on protecting your capital and executing your plan consistently, not the size of your wins.

When you do feel ready to use real money, many good brokers will let you open an account with as little as $100. Starting small is the smart move. It lets you feel the very real psychological punch of having money on the line without risking anything that would hurt you financially. This is where the real learning begins.

Ready to stop guessing and start learning a real, professional trading methodology? At Colibri Trader, we provide a clear, no-nonsense path to mastering price action without confusing indicators. Our action-based programs are designed to give you the skills and confidence to trade effectively in any market. Discover your trading potential with us today.