bearish pin bar: Master Reversals with High-Prob Setups

A bearish pin bar is a classic, single-candlestick pattern that screams "potential reversal." It's a powerful signal that the bears are about to take over. You can spot it by its signature long upper wick or tail, which tells a clear story: buyers tried to push prices higher, but they failed. Sellers came in and slammed the door shut.

What the Bearish Pin Bar Is Telling You

Don't just see a candlestick; see the story of a battle. A bearish pin bar is like a snapshot of a failed rally, all condensed into a single trading session. This pattern is so trusted because it leaves a huge clue on the chart: a rejection of higher prices at a critical level. That long upper wick is the footprint left behind by sellers who stepped in with enough force to completely overwhelm the bulls.

The beauty of a bearish pin bar is how it cuts through the noise. When you see one pop up after a nice uptrend, it’s a major red flag that the bullish momentum is running out of steam. Think of it as the market’s early warning system that sentiment is shifting.

Why Context Is Everything

Now, here's the secret: a bearish pin bar appearing randomly in the middle of a chart doesn't mean much. But when it shows up at a key area of market resistance? That's when you pay attention. These zones act like a ceiling, and a rejection there is far more meaningful. For a trader, seeing a pin bar at the right spot is like hearing a fire alarm—it’s a clear signal that sellers are defending their turf.

Look for these high-probability setups:

- At a Resistance Level: The pattern forms right at a known horizontal resistance or slams into a descending trendline.

- Near a Moving Average: Price rallies up to a key moving average, like the 50-day or 200-day, and gets rejected.

- Following a Strong Uptrend: It appears after a long run-up, suggesting the buyers are finally exhausted.

This is exactly why institutional traders often create these patterns. They love to sell aggressively into rallies as prices approach major resistance. The data backs this up, too. Studies on the European DAX index, for instance, showed that bearish pin bars forming near moving average confluences had a reversal success rate between 63% and 68%.

A bearish pin bar is the market’s way of saying "not so fast." It represents a sharp, decisive rejection of higher prices, often catching overly optimistic buyers off guard just before the tide turns.

While this pattern signals a potential move down, it's just as important to understand its opposite. To get the full picture, check out our guide on how to trade its bullish cousin here: https://www.colibritrader.com/bullish-pin-bar/. And to really round out your knowledge, it helps to understand other key candlestick pattern reversal signals as well.

The Psychology Behind The Pattern

Every candlestick has a story. The bearish pin bar is no exception—it unfolds like a miniature drama on your chart. At its core, it highlights the clash between bulls and bears, and the abrupt turnaround from hope to despair.

Imagine a fresh wave of buyers rushing in. Their enthusiasm first drives prices significantly above the open, sketching out that distinctive long upper wick. It almost feels like a seal of approval from the bulls, signaling more gains ahead.

Yet this rally often conceals a trap. Behind the scenes, sellers are biding their time, waiting for the right moment. Once they hit that critical resistance—maybe an old swing high or a popular moving average—the fight is over.

The Bull Trap Springs Shut

As price reaches that significant level—be it a historical resistance zone or a well-watched moving average—sellers swoop in. Their selling pressure doesn’t merely slow the bulls; it erases every ounce of their gains. In an instant, the chart flips from bullish excitement to bearish triumph.

That explosive shift carves out the long upper wick (also known as the “shadow”) of the bearish pin bar. Traders love this vivid cue because it pinpoints exactly where buyers surrendered. It’s like seeing footprints fade into the dust where they once ran unopposed.

Late-arriving bulls often find themselves on the wrong side of this reversal. They loaded up near the highs, convinced the breakout was real—only to watch price dive. This sting of disappointment is what we call a bull trap, and it’s central to the pin bar’s story.

The long upper wick is the footprint of failure, marking where bullish momentum fizzled and bears took control.

Anatomy Of Exhaustion And Rejection

Two final clues on the candle bring the bear case into focus.

- Small Real Body: Nestled at the lower end of the session’s range, the compact body highlights how buyers and sellers nearly deadlocked. Despite price swinging dramatically during the session, by the close bulls had lost their edge. It shows indecision shining through, but ultimately siding with the bears.

- Lower Body Position: When the candle’s body settles near the bottom, it tells you sellers held control as the session wrapped up. That final push down cements their victory and foreshadows further downside. It’s the last piece of evidence confirming the failed rally and potential reversal.

This pattern isn’t science fiction—it’s been used for centuries. Traders in 18th-century Japanese rice markets, led by Homma Munehisa, first spotted these telltale shapes. Known back then (and still today) as the shooting star, it remains one of the simplest yet most reliable reversal signals in price action trading.

Explore more about the history and strategy of pin bars for a deeper understanding.

Identifying High-Quality Pin Bar Setups

Just because a candlestick looks like a pin bar doesn't mean you should jump on it. The market is a noisy place, and plenty of what looks like a pattern is just random chatter. To really get ahead, you have to learn how to filter out the junk and focus only on the A-grade signals.

A top-tier bearish pin bar isn't just about its shape; it's about where it shows up on the chart and the story it's telling. The most powerful signals pop up at logical points of confluence—areas where several technical factors all line up to slam the door on higher prices.

The Anatomy of a Perfect Signal

Think of a valid bearish pin bar as having specific genetic markers. Without them, the signal is weak and you can't trust it. A true high-probability setup has a few distinct features that make it stand out from the rest of the noise.

Here are the non-negotiable traits of a powerful bearish pin bar:

- Long Upper Wick: The upper shadow, or tail, has to be at least two to three times the length of the body. That long shadow is the visual proof that a fierce price rejection just happened.

- Small Real Body: The body should be small and tucked away at the lower end of the candlestick's total range. This shows that sellers won the battle for that session, hands down.

- Minimal Lower Wick: Ideally, you want to see little to no lower wick. A long tail sticking out the bottom suggests buyers fought back, which muddies the water and weakens the bearish signal.

- Stands Out Clearly: A quality pin bar should literally "stick out" from the surrounding candles. The rejection should be so obvious you can spot it from a mile away.

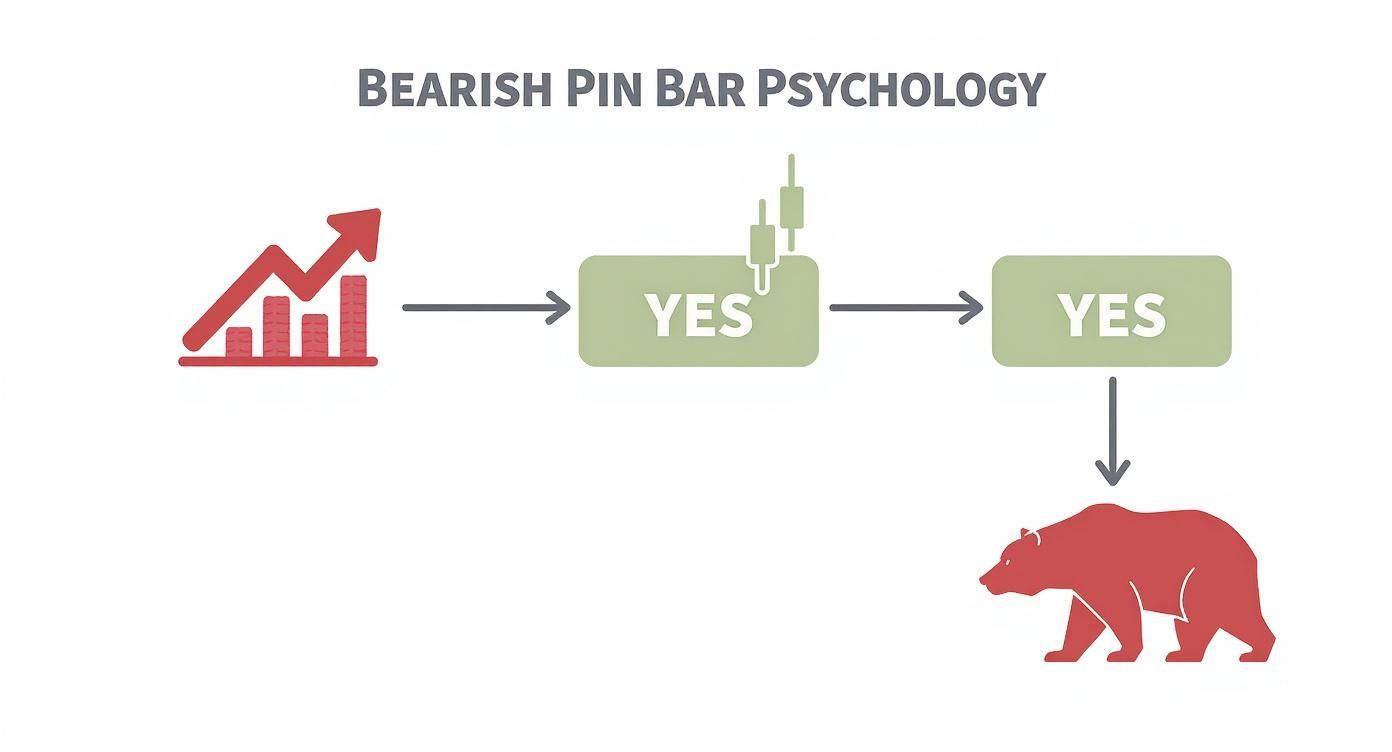

This decision tree infographic gives a great visual breakdown of the simple logic behind spotting a bearish pin bar that actually means something.

As the graphic shows, the really potent signals happen when that long wick appears after a clear move up, screaming "rejection."

Location Is Everything

Even a textbook-perfect pin bar is completely useless if it forms in the middle of nowhere. Context is, without a doubt, the single most important factor. The best setups always form at well-defined areas of market structure.

A bearish pin bar is a reaction to a price level. If you can't identify the level it's reacting to, you shouldn't be trading the signal.

Prime locations to look for these high-probability signals include:

- Key Resistance Levels: These are the horizontal price ceilings where the market has turned around before. For a deeper look, our guide explains in detail how to identify support and resistance levels.

- Major Moving Averages: Dynamic resistance from indicators like the 50 or 200 EMA can act as a powerful rejection zone.

- Trend Lines: The upper boundary of a descending channel or a broken uptrend line that's now being tested from underneath are classic spots.

Finding a valid pin bar takes practice, but it's a skill you can build by knowing exactly what to look for. The following checklist compares what makes a signal strong versus what makes it weak.

Bearish Pin Bar Identification Checklist

| Criterion | Valid Example | Invalid Example |

|---|---|---|

| Wick Length | The upper wick is at least 2x the length of the body, showing a strong rejection. | The upper wick is short, barely longer than the body, signaling weak rejection. |

| Body Position | The real body is at the very bottom 1/3 of the candle's total range. | The body is in the middle of the candle's range, showing trader indecision. |

| Lower Wick | There is little to no lower wick, indicating sellers are in full control. | A noticeable lower wick is present, suggesting buyers are still fighting back. |

| Location | Forms at a pre-identified, significant resistance level or moving average. | Appears randomly in the middle of a price range with no clear structure nearby. |

This table isn't just a set of rules; it’s a framework to help you develop a trader's eye for quality. When you see a pin bar that checks all the "valid" boxes, you've found a signal worth paying attention to. Anything else is likely just noise.

Building Your Pin Bar Trading Strategy

Spotting a great-looking bearish pin bar is one thing, but turning it into a consistently profitable trade? That's a whole different ball game. It requires a solid, repeatable strategy.

Think of it this way: the pin bar is your green light to consider a trade. Your strategy is the rulebook you follow from that moment on. It tells you exactly how to get in, where to bail if you're wrong, and where to cash in your chips if you're right. Without that rulebook, you're just gambling on a candlestick shape.

Pinpointing Your Entry Triggers

So, a perfect pin bar has formed right at a key resistance level. Now what? You can't just jump in blindly. That's a rookie mistake. Your entry needs to be just as deliberate as your signal.

Seasoned traders typically use one of a few tried-and-true methods. Each one has its own vibe—some are more conservative, others are more aggressive. The key is picking the one that fits your personality.

- Entry on the Break of the Low: This is the classic, conservative approach. You simply place a sell stop order just a few pips below the pin bar's low. Your trade only gets triggered if the market starts moving in your favor, which gives you that little bit of extra confirmation that the bears are taking control.

- The 50% Retracement Entry: For those who like a more aggressive play with a better potential payout, this is it. After the pin bar closes, you place a sell limit order right at the 50% mark of the candle's entire range (from the tip of the wick to the bottom of the body). The big win here is a much tighter stop-loss, leading to a killer risk-to-reward ratio. The catch? The price might not pull back to your level, leaving you on the sidelines.

- Entry at the Market: This is the simplest method—you hit the "sell" button the moment the next candle opens. It guarantees you're in the trade from the get-go, but it offers zero confirmation. You're fully exposed if the signal immediately fails.

A great entry strategy is all about balancing confirmation with risk. The 50% retracement offers the best potential reward but carries the risk of missing the trade, while an entry on the break of the low waits for momentum to confirm your idea.

Setting Logical Stop-Loss and Profit Targets

Your stop-loss is non-negotiable. It's your safety net, the line in the sand where you admit the trade wasn't a winner and live to fight another day.

For a bearish pin bar trade, the most logical spot for your stop-loss is just a few pips above the high of that long wick. That wick represents the absolute peak of the buying pressure before it got slammed down. If the price breaks above that high, the whole bearish story falls apart, and you need to be out.

Profit targets are just as important. A common-sense approach is to aim for the next major support level. Before you even enter the trade, scroll left on your chart. Look for previous swing lows or areas where price bounced before. You're looking for a clear path.

Always aim for a risk-to-reward ratio of at least 1:2. This simple rule ensures that your winners are big enough to more than cover your losers, which is the secret sauce to long-term profitability.

Amplifying Signals With Confirmation Tools

A bearish pin bar on its own is a strong signal. But when you combine it with other technical clues pointing in the same direction? That's when you have a truly high-probability setup.

This concept is called confluence. It’s like getting a second, third, or even fourth opinion that all say the same thing: "Sell!"

When you start layering these signals, the pin bar becomes more than just a pattern; it's a precise entry trigger within a broader market context. For example, spotting an RSI divergence—where the price makes a new high but the RSI indicator makes a lower high—is a huge tell that bullish momentum is fading. When a pin bar appears right after that, it’s a powerful one-two punch.

Other fantastic confirmation tools include:

- Moving Averages: A pin bar that rejects a key moving average, like the 50 EMA, adds a ton of weight to the bearish signal.

- Fibonacci Levels: When a pin bar's wick perfectly touches and rejects a major Fibonacci level like the 61.8% retracement, it's often a sign that smart money is stepping in.

Here’s a textbook example of a bearish pin bar setup confirmed by both a horizontal resistance level and a moving average. This is the kind of A+ setup we're looking for.

The confluence of these factors dramatically stacks the odds in your favor.

By combining a valid signal with a smart entry, a logical stop, a clear target, and confirmation from other tools, you’re no longer just trading a pattern. You’re executing a complete, professional-grade trading strategy.

To take your planning to the next level, especially with short-selling, you might want to check out the Short Genius platform for advanced short-selling strategies. Having a systematic approach is what separates the consistently profitable traders from everyone else.

Comparison Of Bearish Pin Bar Setups

To make it easier to see the differences, let's break down the common setups side-by-side. This table gives you a quick overview of how each entry method stacks up in terms of timing, risk, and what you might use to confirm it.

| Setup | Timeframe | Entry Signal | Stop-Loss | Target | Confirmation |

|---|---|---|---|---|---|

| Break of Low | 4-Hour, Daily | Sell stop order below pin bar low | Above pin bar high | Next major support | Horizontal resistance |

| 50% Retracement | 1-Hour, 4-Hour | Sell limit order at 50% of range | Above pin bar high | Next minor support (high R:R) | Moving average rejection |

| Market Entry | Any (Higher Risk) | Instant execution on next candle open | Above pin bar high | Next major support | Strong trend context |

Choosing the right setup often comes down to the specific market conditions and your personal risk tolerance. The key is to know the pros and cons of each before you put your capital on the line.

Mastering Risk and Validating Your Edge

Spotting that perfect bearish pin bar feels like a win in itself, but let’s be honest—that's only half the battle. A flawless signal doesn't mean a thing if one bad trade can blow a hole in your account. This is where the real work begins. Moving from a pattern-spotter to a professional trader means mastering disciplined risk management and knowing how to validate your strategy.

True mastery in trading isn't about finding winners; it's about managing the losers you know are coming. Your first line of defense is always the stop-loss order. For a bearish pin bar, the logic is refreshingly simple.

Your stop-loss should sit just above the high of the pin bar's long upper wick. That wick is the story of the bulls' final, failed push before sellers took control. If the price breaks above that high, the story has changed, the bearish setup is dead in the water, and you need to get out immediately to protect your capital.

The Power of Position Sizing

Once your exit point is defined, the next question is: how much are you putting on the line? This isn't a gut feeling; it’s a simple calculation. A well-established rule of thumb is to risk no more than 1% to 2% of your trading account on any single trade.

Think about it. If you have a $10,000 account, risking 1% means your maximum loss is capped at $100. You figure out your risk in dollars first, then you calculate your position size based on how far your entry is from your stop-loss. This discipline is what keeps you in the game, even through a string of losses.

Risk management is the bedrock of a successful trading career. It's the boring but essential work that keeps you solvent long enough for your profitable edge to play out over time.

Managing your risk on every trade isn't optional. It strips the emotion out of your decisions and turns trading into a business of probabilities, not a game of chance.

Validating Your Strategy with Backtesting

So, you have a set of rules for trading bearish pin bars. How do you know if they actually work? The answer is backtesting. This is where you go back in time and test your trading rules on historical price data to see how you would've performed.

Backtesting isn't about cherry-picking winning trades to make yourself feel good. It's about gathering cold, hard data on your strategy's performance. This is how you build real, statistical confidence in your approach before you risk a single dollar of real money.

To get started, you need to define your rules with absolute clarity:

- Entry Criteria: What makes a pin bar valid to you? (e.g., Wick must be 3x the body, forms at a key resistance level).

- Entry Method: How do you get in? (e.g., Place a sell stop order just below the pin bar's low).

- Stop-Loss Rule: Where is your stop? (e.g., 10 pips above the wick's high).

- Profit Target Rule: How do you take profits? (e.g., At the next major support, or a fixed 1:2 risk-to-reward ratio).

With your rules set, you can scroll back on your charts and log every single trade that meets your exact criteria. For a deep dive on this process, check out this guide on how to backtest a trading strategy properly.

After you've analyzed a decent sample size—aim for at least 100 trades—you can start crunching the numbers. These metrics will reveal the true character of your strategy.

| Performance Metric | What It Tells You | Example Calculation |

|---|---|---|

| Win Rate | The percentage of trades that were profitable. | 45 winning trades / 100 total trades = 45% |

| Risk-to-Reward Ratio | The average profit on winners versus the average loss on losers. | Average win of $200 / Average loss of $100 = 2:1 |

| Profit Factor | The gross profit divided by the gross loss. A value > 1 means the strategy is profitable. | Total profits of $9,000 / Total losses of $5,500 = 1.64 |

| Expectancy | The average amount you can expect to win or lose per trade. | (Win Rate * Avg Win) – (Loss Rate * Avg Loss) = Expectancy |

This data-driven approach pulls you out of the world of hope and guesswork and into the realm of statistical probability. It lets you fine-tune your rules, understand the inevitable drawdowns, and ultimately, trade with the unshakeable confidence that comes from knowing the numbers are on your side.

Even a perfect-looking bearish pin bar can crumble into a losing trade if you fall for a few common psychological traps. The pattern itself is just a flashing light on your dashboard; your discipline and awareness are what actually steer you away from a wreck.

One of the quickest ways to lose money is trading a pin bar in isolation. A trader spots that long upper wick, gets a jolt of excitement from the obvious rejection, and immediately hammers the sell button without a second thought for the bigger picture. That's a recipe for disaster. A pin bar without context isn't a signal, it's just noise.

Ignoring the Market Environment

Context is everything in this game. A bearish pin bar that pops up in a quiet, sleepy market is a completely different beast than one that forms during a busy session with healthy volume. A quiet market often doesn't have the juice for a real follow-through, leaving you stuck in a frustrating trade that just chops sideways.

And then there's the cardinal sin: fighting a powerful trend. Trying to short a runaway bull market with a single pin bar is like trying to stop a freight train with a fishing net. Unless that pin bar forms at a massive, multi-timeframe resistance level, you're probably just shorting a minor dip before the next leg up.

A classic rookie error is seeing the pin bar as a crystal ball that guarantees a reversal. In reality, it’s just a hint of a potential momentum shift. Your job is to weigh all the other evidence from the market structure to decide if that potential is worth your risk.

Lack of a Concrete Trading Plan

Another huge pitfall is jumping into a trade without a rock-solid plan. This means knowing your exact entry trigger, where your stop-loss will go, and where you'll take profits before you even think about clicking the mouse. Without these rules set in stone, you're not trading—you're gambling on pure emotion.

This leads to all sorts of destructive habits:

- Chasing the Market: You enter late after the move is already underway, completely wrecking your risk-to-reward ratio.

- Moving Your Stop-Loss: You nudge your stop further and further away as price moves against you, hoping for a turnaround. This turns a small, acceptable loss into a major account dent.

- Exiting Too Early: You panic and close a winning trade at the first hint of a pullback, leaving the majority of the potential profit on the table.

At the end of the day, successful pin bar trading has less to do with finding the "perfect" pattern and more about sidestepping these unforced errors. When you make sure every single trade is backed by strong market context and governed by a disciplined plan, you dramatically shift the odds in your favor. You start trading with intelligence and control, not hope.

Frequently Asked Questions

Even when you've got a solid grasp of the bearish pin bar, questions always pop up when it's time to pull the trigger in a live market. Let's tackle some of the most common ones I hear from traders to give you more clarity.

What Is the Best Timeframe for Pin Bars?

I always tell my students to stick to the higher timeframes. The 4-hour, daily, and weekly charts are where you'll find the most reliable pin bar signals. Think about it: a daily pin bar tells the story of an entire day's battle between buyers and sellers. That carries a lot more weight than a quick flicker on a 5-minute chart, which is often just market noise.

Sure, you can trade them on lower timeframes, especially if you're a day trader. Just know that the signals are far more likely to fail. For swing traders like myself who are hunting for major turning points, the daily and weekly charts are where the real magic happens.

Should I Trade Pin Bars During News Events?

Trading around major news releases is like playing with fire. Volatility goes through the roof, and you'll see wild spikes, false signals, and brutal slippage. A pin bar that forms right before a big announcement, like an interest rate decision from the Fed, is usually a trap.

The smart move is to stay on the sidelines. Wait for the dust to settle after the news hits and for the market to show its hand. A clean pin bar that forms after all that chaos has died down? Now that's a much higher-quality signal you can actually trust.

Pin bars work best in markets with a clear technical structure. High-impact news can blow that structure to pieces, making price action chaotic and patterns unreliable until things calm down.

Can I Trade a Pin Bar Without Confirmation?

You could, but you'd be taking on a lot more risk. A textbook bearish pin bar at a major resistance level is a powerful signal, no doubt. But waiting for that extra bit of proof can save you from a lot of failed trades.

My preference is always to wait for the next candle to close below the low of the pin bar. This is your confirmation that sellers are truly stepping in and taking control. Even better, look for other clues. Is there RSI divergence? Is the pin bar also rejecting a key moving average? When you stack these signals together, you're creating a high-probability setup.

How Do I Set Realistic Profit Targets?

Setting a profit target shouldn't be a guessing game. It has to be based on what the chart is telling you. Before you even think about entering a trade, look to the left and find the nearest significant support level.

This could be a previous swing low, a clear horizontal support zone, or even a major moving average sitting below the current price. That's your first logical target. And always, always make sure the distance to that target gives you a solid risk-to-reward ratio—I never take a trade unless it's at least 1:2 or better.

At Colibri Trader, we teach you how to master price action setups like the bearish pin bar with clarity and confidence. Learn more about our proven, indicator-free strategies here.