Backtesting Trading Strategies: Boost Your Performance

The Science Behind Successful Backtesting Trading Strategies

Backtesting trading strategies is essential for successful trading. It acts like a flight simulator, allowing traders to practice and refine their approaches using historical market data without risking real capital. This preparation builds confidence before entering live markets.

To grasp the core principles, consider exploring resources like Master Backtesting Trading Strategies. Backtesting transforms theoretical concepts into data-driven decisions. It's not just for beginners; seasoned professionals on Wall Street rely on it as a key risk management tool.

Backtesting has evolved from simple spreadsheets to sophisticated algorithms and platforms. These tools analyze massive datasets and simulate complex market conditions, offering a more robust and nuanced understanding of a strategy's potential.

Beyond optimizing profits, backtesting offers psychological advantages. Objective performance data provides stability during market volatility, enabling traders to remain disciplined and avoid emotional decisions driven by fear or greed.

Understanding Backtesting in Practice

Backtesting involves applying a trading strategy to historical data to evaluate its past performance. This allows traders to assess effectiveness under different market conditions without risking capital. A backtest, for example, might cover a decade of market data, revealing key metrics like total profits, maximum drawdowns, win rates, and the number of trades executed.

This process helps determine whether a strategy is consistently robust or simply benefited from short-term favorable conditions. By simulating trades with transaction costs and potential slippage, backtesting provides a realistic performance estimate. This helps traders avoid impulsive, emotional decisions that can negatively impact returns.

Backtesting is crucial in modern trading, particularly for quantitative strategies. In major markets, like U.S. equities, decades of historical price data inform decisions. Learn more about the power of backtesting with resources like Backtesting Investment Strategies with Historical Data.

Ultimately, backtesting empowers informed, data-backed decisions, increasing the chances of long-term success.

Building Your Backtesting Arsenal: Tools and Techniques

Selecting the right backtesting platform is crucial for improving trading performance. Professional traders carefully choose and customize their platforms to match their specific trading styles and preferred asset classes. This means building testing environments that accurately reflect real-world market conditions.

For example, a day trader focused on futures contracts requires a platform capable of handling high-frequency data and simulating millisecond execution speeds. In contrast, a long-term investor analyzing stock portfolios might prioritize a system that can backtest decades of historical data.

Choosing the Right Backtesting Platform

Several factors influence platform selection, including cost, programming requirements, available data sources, and specific features. Some platforms cater to beginners with user-friendly interfaces and pre-built strategies. Others offer advanced capabilities for experienced traders who want to code their own algorithms using languages like Python with libraries such as Backtrader. Finding the right balance between complexity and usability is key; unnecessary features can be a waste of time and resources.

Let's take a look at some of the popular backtesting platforms available.

To help you choose the right platform, we've compiled a comparison table:

Comparison of Popular Backtesting Software Platforms

| Platform | Cost | Programming Required | Data Sources | Best For | Limitations |

|---|---|---|---|---|---|

| TradingView | Freemium (Paid plans available) | Pine Script (optional) | Built-in, some external integrations | Beginners and intermediate traders | Limited customization for complex strategies |

| MetaTrader 5 | Free (Broker dependent) | MQL5 | Broker data | Forex and CFD traders | Limited historical data availability |

| Backtrader | Free (Open Source) | Python | Various (User configurable) | Experienced programmers, algorithmic traders | Steep learning curve for non-programmers |

| NinjaTrader 8 | Freemium (Paid plans for live trading) | NinjaScript (C#) | Broker and third-party integrations | Futures and forex traders | Can be complex for beginners |

| Bloomberg Terminal | Subscription (Expensive) | No (GUI based, some scripting available) | Extensive, proprietary data | Professional traders, institutional investors | Very high cost |

As you can see, there's a platform for every level of trader. Consider your needs carefully before committing to a particular solution.

Data Quality: The Foundation of Reliable Results

The accuracy of your backtesting results hinges on the quality of your data. The granularity of historical data directly impacts the accuracy of the results. High-frequency traders, for instance, rely on tick-level data—recording every single transaction—to backtest intraday strategies. Swing traders, on the other hand, might use daily or weekly price data.

Reliable sources of historical data are crucial, as incomplete or low-quality data can skew backtest results. For example, backtesting a strategy on a dataset missing crucial market events like crashes or price spikes could artificially inflate expected returns or underestimate potential risks. In global markets, comprehensive datasets covering extensive timelines, sometimes over 20 years, help traders assess how strategies perform through various cycles, including bull, bear, and volatile markets. Incorporating realistic trading conditions, including commissions, spreads, and slippage, further refines backtest accuracy. Explore this topic further.

Visualizing Backtesting Results

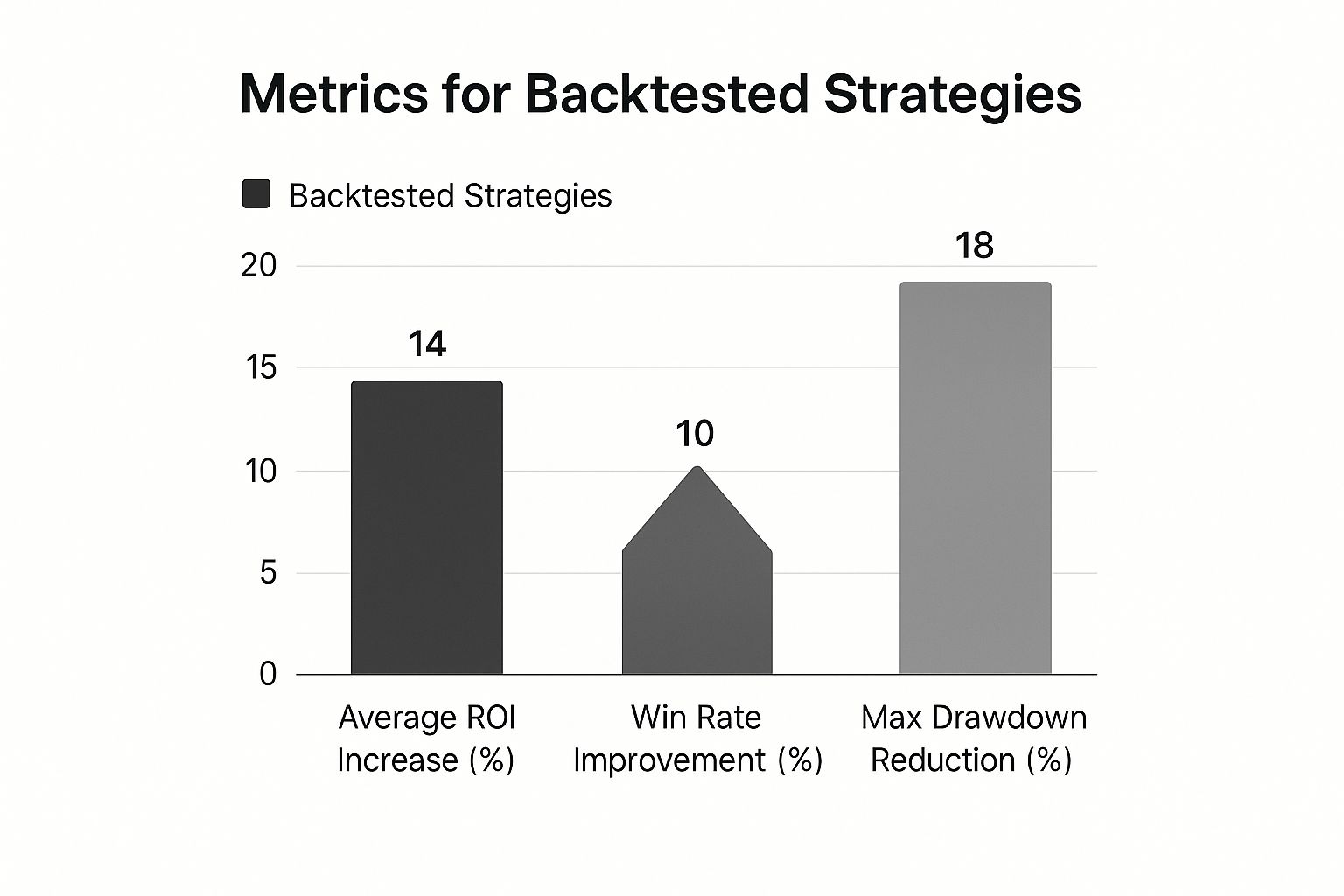

Visualizing backtesting data provides valuable insights into a strategy's potential. The infographic below compares three key metrics—Average ROI Increase, Win Rate Improvement, and Max Drawdown Reduction—across different backtested strategies.

As the infographic shows, Strategy B offers the most balanced improvement across all three metrics. This suggests a potentially robust and well-rounded approach. While Strategy A demonstrates a high ROI increase, its larger drawdown indicates greater risk. Strategy C, while providing the lowest drawdown, lags in ROI and win rate. These visual comparisons enable traders to assess the strengths and weaknesses of different strategies.

Building a Robust Testing Environment

Building a robust testing environment goes beyond simply selecting a platform and finding data. It requires careful consideration of factors like slippage, commissions, and other real-world trading costs. Accurately simulating these elements is essential for setting realistic performance expectations. This also helps avoid surprises when transitioning to live trading. This attention to detail distinguishes effective backtesting from overly optimistic simulations. Ultimately, this detailed approach leads to more informed decisions and a higher likelihood of developing successful trading strategies.

Validating Your Edge: Statistical Methods That Actually Work

Beyond basic performance metrics lies the real test of a trading strategy. This is where professional traders separate genuinely profitable strategies from statistical mirages that disappear in live trading. This section explores how to rigorously test your approach, going beyond simple profit calculations to robust statistical analysis.

Beyond Basic Metrics: Unveiling True Performance

Conventional performance measures, like win rate or profit factor, can be misleading. For example, a strategy with a high win rate might still lose money if the losses on losing trades are greater than the gains on winning trades. This highlights the need for more sophisticated evaluation methods. It means looking past surface-level numbers and digging deeper into the statistical characteristics of your strategy’s returns. One such method is analyzing the distribution of returns, looking not just at the average, but also the variability and the chance of extreme outcomes. This helps understand the potential risks and rewards.

Traders often focus on maximum drawdown, which is the largest peak-to-trough decline during the backtesting period. While important, maximum drawdown alone doesn't tell the whole story about risk. Examining metrics like the Calmar ratio, which compares the average annual return to the maximum drawdown, provides a more complete risk-adjusted performance assessment.

Walk-Forward Analysis: Testing Strategy Robustness

Walk-forward analysis is a powerful technique for evaluating how well a strategy adapts to changing market conditions. It involves splitting the historical data into different time periods. The strategy is optimized on one period (the "in-sample" period) and then tested on the following period (the "out-of-sample" period).

This process is repeated multiple times, effectively simulating how the strategy would have performed in real-time as new market data emerged. This iterative process shows whether a strategy's performance is consistent or just a result of overfitting to a specific historical period.

Monte Carlo Simulations: Embracing Uncertainty

Monte Carlo simulations add randomness to backtesting. They involve running thousands of simulated trials of the strategy, each with slightly varied market conditions. Imagine flipping a weighted coin. You might know it lands heads 60% of the time, but you’re still uncertain about each individual flip. Similarly, Monte Carlo methods account for market uncertainties. This technique provides a range of possible outcomes, including best-case and worst-case scenarios, helping traders assess the impact of random market fluctuations on their strategy. To effectively build your backtesting arsenal, consider using a dedicated backtesting tool.

Real-World Examples: When Backtests Fail

Statistically, backtesting has become crucial for quantitative and algorithmic trading. Traders and hedge funds that use robust backtesting tend to achieve higher consistency and risk-adjusted returns than those relying on intuition. For example, quantitative funds employing strong backtesting frameworks reported average annual returns over 10-15% across various market cycles, with maximum drawdowns often below 20%. Conversely, untested strategies often suffer from overfitting, performing well on historical data but failing in live trading. Explore this topic further here.

There are real-world cases where seemingly profitable strategies failed statistical scrutiny. One example involves a mean-reversion strategy that appeared successful in backtests but quickly deteriorated in live trading due to unexpected market volatility. Another case involved a trend-following strategy that performed exceptionally well during a specific historical period but failed to adapt to a subsequent shift in the market. These examples emphasize the importance of robust statistical validation beyond simple performance metrics.

Avoiding the Backtesting Traps That Destroy Trading Accounts

Even seasoned traders sometimes stumble into hidden backtesting pitfalls. These traps can transform seemingly profitable strategies into account-draining disasters. We'll explore common backtesting biases and how they create a false sense of security before real money is risked, using insights gleaned from professional traders.

Survivorship Bias: The Illusion of Inflated Performance

Survivorship bias happens when backtests only use data from currently surviving assets or markets. Imagine backtesting a stock market strategy using only companies currently listed on the exchange. This excludes companies that went bankrupt or were delisted, creating an overly optimistic view of past performance. The backtest wrongly assumes these failed companies wouldn't have affected the strategy's results. This bias inflates performance expectations and underestimates the real risks. For example, a strategy backtested only on thriving tech companies might appear very profitable, but would likely show different results if applied to a dataset including companies that failed during the dot-com bubble.

Data-Snooping: Finding Patterns Where None Exist

Data-snooping, also known as overfitting, involves adjusting a strategy until it perfectly matches historical data. This is like drawing a bullseye around an arrow after it lands. It creates the illusion of a perfect shot but doesn't predict future accuracy. Traders often unintentionally data-snoop by testing numerous parameters and rules until they find a combination that maximizes historical profits. However, these "optimized" strategies often fail in live trading because they’ve simply learned the noise in the historical data, not real predictive patterns. This means the strategy is likely to underperform when encountering new, unseen market data.

Look-Ahead Bias: Peeking into the Future

Look-ahead bias occurs when a backtest includes information not available at the time of the simulated trades. This is like using tomorrow's newspaper to predict today's stock prices. For instance, using end-of-day data to simulate intraday trades introduces look-ahead bias because the end-of-day price isn't known during the trading day. Another example is using revised economic data not initially available. This creates an unrealistic advantage and leads to overly optimistic backtest results. The strategy appears more successful than it would have been in real time.

Over-Optimization: A Recipe for Disaster

Over-optimization is a form of data-snooping where a strategy is excessively customized to a specific historical dataset. This can create complex and inflexible systems that perform poorly when market conditions change. Think of it as a highly specialized race car built for a particular track. It might set records on that track but struggle on any other. Similarly, an over-optimized trading strategy might excel in the backtested period but fail when market dynamics shift. This highlights the importance of simplicity and robustness in strategy design.

Practical Solutions: Maintaining Objectivity

To avoid these pitfalls, stay objective throughout the backtesting process. Use out-of-sample testing, applying your strategy to historical data not used in optimization, to evaluate its real-world potential. Walk-forward analysis, where the strategy is repeatedly tested on new data, helps determine if its performance is consistent or a product of overfitting. Adopting robust statistical measures beyond simple profit metrics provides a more realistic performance assessment.

To help illustrate these points, let's look at the following table summarizing these biases:

Common Backtesting Biases and Their Solutions

| Bias Type | Description | Impact on Results | Detection Methods | Mitigation Strategies |

|---|---|---|---|---|

| Survivorship Bias | Using data only from surviving entities. | Inflated returns, underestimated risk. | Comparing results with a broader market index. | Include delisted or failed entities in the dataset. |

| Data-Snooping | Overfitting the strategy to historical data. | Excellent backtest results, poor live trading. | Out-of-sample testing, walk-forward analysis. | Simplify the strategy, limit parameter optimization. |

| Look-Ahead Bias | Using future information in past simulations. | Unrealistically high performance. | Careful data selection and scrubbing. | Ensure data aligns with the timeframe of the simulated trades. |

| Over-Optimization | Excessively tweaking parameters. | Brittle strategy, poor adaptability. | Walk-forward analysis, stress testing. | Focus on robust, simpler strategies. |

By understanding and mitigating these biases, you can transform backtesting from a potential pitfall into a valuable tool for building robust and profitable trading strategies. This approach allows for a more realistic evaluation of your strategy's actual potential and boosts the likelihood of success in live trading.

Bridging the Gap: From Perfect Backtest to Profitable Trading

The journey from a successful backtest to consistent trading profits is often a stumbling block for many. This section explores the crucial shift from simulated trading to navigating the complexities of real market conditions. We'll examine how seasoned traders gradually introduce their strategies into live markets while meticulously monitoring performance.

From Simulation to Reality: Scaling Your Strategy

A profitable backtest doesn't guarantee future success. It's a starting point, a foundation upon which to build, not the final destination. Experienced traders understand this and approach live trading with a healthy dose of caution, even after rigorous backtesting. They often start by deploying a smaller fraction of their capital, perhaps 10-20%. They then gradually increase their position size as the strategy demonstrates consistent profitability under real market conditions. This measured approach allows for effective risk management. It also provides a valuable opportunity to further validate the strategy and make any necessary adjustments before fully committing the entire capital.

The Power of Paper Trading: Validating Your Edge

Paper trading offers a critical bridge between the theoretical world of backtesting and the real-world pressures of live trading. It involves simulating trades in real-time using current market data, but without risking actual capital. Effective paper trading, however, demands discipline. It’s not about generating imaginary profits; it’s about diligently following the rules of your strategy, recording every simulated trade, and analyzing the results with the same seriousness as if it were real money. This process not only validates the findings of your backtest, but also helps refine your execution skills and cultivate the psychological discipline necessary for successful live trading. It’s a crucial dress rehearsal before the main event.

Navigating Psychological Challenges: Staying the Course

Even with a thoroughly backtested strategy, live trading presents unique psychological challenges. There will inevitably be periods of drawdown, where the strategy experiences losses. These dips can be emotionally challenging and often tempt traders to abandon otherwise profitable strategies prematurely. Understanding the difference between normal market fluctuations and a true strategy failure is essential. A well-designed backtest should include an estimate of the maximum drawdown, the largest expected decline in portfolio value. This metric provides a benchmark for assessing whether current losses are within the acceptable range or signal a fundamental problem with the strategy. Having this objective measure can help traders maintain discipline during challenging periods.

Adapting and Refining: Responding to Market Dynamics

Markets are in constant flux, and strategies that performed well in the past might lose their effectiveness over time. This means backtesting isn’t a one-time activity. It requires continuous monitoring and adaptation. Professional traders regularly review their strategy’s performance, comparing live trading results to backtest expectations. They carefully analyze any significant deviations, searching for clues that indicate a need for adjustments. This might involve fine-tuning parameters, incorporating new rules, or even discarding the strategy entirely if it consistently underperforms. This iterative process of refinement is essential for long-term trading success.

Objective Decision-Making: Knowing When to Fold

Knowing when to modify, abandon, or scale a strategy is a key element of profitable trading. This requires establishing objective criteria for making these decisions. A predefined performance threshold, such as a minimum acceptable return or a maximum drawdown limit, can provide a clear signal for action. For example, a trader might decide to reduce position size if the strategy’s drawdown exceeds a predetermined level, say 20%. Or they might choose to abandon the strategy altogether if it fails to generate a minimum return of 10% over a specified period, perhaps a year. Having these objective guidelines helps remove emotion from the decision-making process, protecting traders from impulsive actions driven by fear or greed.

Case Studies: Learning From Success

Examining how experienced traders have successfully implemented their backtested strategies provides valuable insights. Consider a trader who developed a swing trading strategy based on identifying specific price patterns. After thorough backtesting, they paper traded the strategy for three months, meticulously documenting their simulated trades. Satisfied with the paper trading results, they transitioned to live trading with a small account, gradually increasing their position size over six months as the strategy continued to perform as expected. This cautious approach allowed them to manage risk effectively and build confidence in their strategy before fully scaling up. This example illustrates how careful progression from backtesting to live trading, combined with ongoing monitoring and adaptation, can pave the way to sustainable profits. This disciplined, measured approach is a hallmark of successful traders.

Advanced Backtesting Frameworks: How the Professionals Gain an Edge

Beyond basic backtesting strategies, sophisticated traders leverage advanced tools and techniques to achieve significant market advantages. This involves moving past simple historical data simulations and embracing more complex methodologies.

Machine Learning: Unveiling Hidden Patterns

Institutional traders increasingly rely on machine learning algorithms like those found in TensorFlow to identify intricate market patterns often missed by traditional analysis. These algorithms process vast amounts of data, uncovering subtle connections between price fluctuations, trading volume, and other market indicators.

For example, a machine learning model could detect recurring candlestick patterns that predict significant price shifts. This allows traders to anticipate and capitalize on these movements, representing a major advancement from traditional rule-based backtesting to a data-driven, adaptive approach.

Regime Detection: Adapting to Changing Markets

Market dynamics constantly evolve. A successful strategy in one market environment might falter in another. Regime detection addresses this challenge by classifying distinct market "regimes," such as trending, range-bound, or volatile periods.

Sophisticated backtesting frameworks use algorithms to automatically identify these shifts and adjust trading strategies accordingly. A strategy might switch from a trend-following approach during a trending regime to a mean-reversion approach in a range-bound market. This dynamic adaptation substantially enhances performance across various conditions.

Multi-Asset Backtesting: True Diversification

Diversification is key to risk management. However, traditional diversification based on asset class correlations can prove ineffective during market crises. Multi-asset backtesting offers a more robust solution by testing strategies across multiple asset classes concurrently, such as stocks, bonds, currencies, and commodities.

This allows traders to evaluate the real diversification benefits of their strategy, observing performance under different inter-asset correlations and revealing resilience to systemic shocks. The result is often more stable returns and mitigated impact from unexpected market events.

Alternative Data: Early Predictive Signals

Traditional backtesting relies heavily on price and volume data. The information age has brought about the rise of alternative data, which encompasses sources like social media sentiment, satellite imagery, consumer spending, and even weather patterns.

Advanced backtesting frameworks increasingly integrate alternative data to discover predictive signals before they manifest in price movements. For instance, analyzing social media sentiment toward a company might reveal changing consumer preferences before impacting stock price. This early insight offers a distinct edge over traditional market analysis.

Implementing Advanced Techniques: Practical Approaches

While these advanced techniques might appear complex, various platforms and tools make them accessible to traders without extensive technical expertise. Several cloud-based backtesting platforms offer pre-built machine learning algorithms and regime detection models for easy integration into existing strategies. Additionally, some brokers provide alternative data feeds that can be integrated into backtesting and live trading systems.

This democratization of advanced techniques allows individual traders to compete more effectively with institutional players. Regardless of your technical skill level, you can implement these concepts to refine your backtesting, improve trading performance, and achieve consistent, data-driven results, transforming backtesting into a powerful tool for uncovering genuine market advantages.

Your Backtesting Trading Strategies Roadmap

This roadmap breaks down the key practices of successful traders into a workable process you can use right away. It will guide you in developing, testing, and implementing trading strategies with more confidence.

Define Your Trading Objectives and Risk Tolerance

Before you start backtesting trading strategies, clearly define your goals. Are you looking for slow, steady growth over the long term, or are you hoping for faster, short-term gains? Your goals will shape the strategies and settings you choose. Equally important is knowing your risk tolerance. How much are you comfortable losing on a single trade or across a certain time frame? This understanding informs your position sizing and stop-loss orders, preventing emotional reactions when the market moves.

Create Your Backtesting Environment

Your backtesting setup should fit your specific needs. Choose a platform that works with your trading style, the time you have available, and your technical skills. Someone new to trading might prefer a user-friendly platform with pre-built strategies, while a seasoned programmer might create a custom setup using languages like Python.

-

Select a suitable platform: Look into various platforms and compare their features, data sources, and costs. Make sure the platform can handle how complex your chosen strategies are.

-

Gather high-quality data: Accurate historical data is essential. Find reliable market data that covers the relevant timeframe and the types of assets you want to trade.

-

Incorporate realistic conditions: Include things like transaction costs, slippage (the difference between the expected price and the actual execution price), and any other fees that could affect your real-world results.

Develop and Refine Your Trading Strategy

Backtesting isn’t something you do just once. It’s a continuous process of improvement.

-

Start with a hypothesis: Develop a clear idea for your trading strategy based on what you’ve observed in the market or on recognized patterns.

-

Test and evaluate: Run the backtest and look at key performance metrics like win rate (the percentage of winning trades), profit factor (the ratio of gross profit to gross loss), and maximum drawdown (the peak-to-trough decline during a specific period).

-

Iterate and improve: Change your strategy based on the results of the backtest. This might mean adjusting the settings, adding filters to refine your entry and exit points, or even going back to the drawing board.

Validate Your Strategy With Statistical Rigor

Don't fall into the trap of overfitting, where your strategy performs well on past data but poorly on new data. Validate your strategy's reliability.

-

Out-of-sample testing: Try the strategy on a new set of historical data that wasn't used while you were developing it.

-

Walk-forward analysis: Test the strategy's performance over different periods to make sure it can adjust to changing market conditions.

-

Monte Carlo simulations: Run thousands of simulations with random market variations to assess the strategy's resilience to unpredictable events.

Transition to Live Trading With a Measured Approach

Once you’re happy with your backtested strategy, start live trading with caution.

-

Start small: Begin with a small amount of your capital to limit potential losses while you get real-world experience.

-

Monitor performance closely: Keep track of your results and compare them to what you expected based on your backtests. See if there are any differences and adjust as necessary.

-

Maintain discipline: Stick to your trading plan and avoid emotional decisions driven by fear or greed.

Ready to enhance your trading with a tested, price-action focused method? Explore Colibri Trader and transform your trading potential.