A Trader’s Guide to the 3 White Soldiers Candlestick Pattern

Of all the shapes and signals you'll see on a chart, the 3 white soldiers candlestick pattern is one of the most powerful bullish reversal signals out there. Simply put, it’s a formation of three consecutive, long-bodied green candles that march upwards after a downtrend.

It’s a clear visual cue that the market's momentum is shifting, with buyers decisively taking control from sellers. For traders who value simplicity and clarity, this pattern is a gem because it tells a straightforward story of strengthening conviction.

Decoding the 3 White Soldiers Pattern

Picture a market that's been stuck in a downtrend. Pessimism is high, and prices just keep grinding lower. Then, something changes. Three strong bullish candles appear, one after the other, reclaiming lost territory like soldiers on a mission. That's the story the 3 white soldiers pattern is telling you.

This isn't just a random squiggle on your screen; it’s a narrative of shifting market psychology. It points to a potential bottom where selling pressure has finally dried up. More importantly, it shows that confident buyers are stepping in with enough force to push the price higher for three straight sessions.

For price action traders like myself, focusing on raw chart data is far more effective than getting bogged down by lagging indicators. While indicators are busy calculating the past, a pattern like the 3 white soldiers shows you what’s happening right now. It gives you a real-time peek into the ongoing battle between buyers and sellers.

The Core Message of the Pattern

The strength of this pattern lies in its logical progression. It communicates a few critical pieces of information about the market's current state:

- Seller Exhaustion: Its appearance after a downtrend suggests the bears have finally run out of steam.

- Decisive Buyer Control: The three straight bullish closes show that buyers have wrestled control and are now in the driver's seat.

- Building Momentum: Each candle closing higher than the last signals that bullish conviction is not just present, but actually growing stronger.

The three soldiers, aptly named, represent a crucial turning point. They suggest that bullish forces are gaining the upper hand, potentially heralding the start of a new uptrend.

To help you quickly reference the key details, here's a simple breakdown of the pattern's characteristics.

3 White Soldiers Pattern At a Glance

This table provides a quick summary of the key characteristics and implications of the 3 White Soldiers pattern for easy reference.

| Characteristic | Description | What It Means for Traders |

|---|---|---|

| Pattern Type | Bullish Reversal | Signals a potential end to a downtrend and the start of an uptrend. |

| Structure | Three consecutive long-bodied green (bullish) candles. | Each candle opens within the previous candle's body and closes higher. |

| Preceding Trend | A clear downtrend is necessary for the pattern to be valid. | This provides the context for the reversal. |

| Psychology | A decisive shift from bearish to bullish market sentiment. | Shows growing buyer confidence and control over three sessions. |

Remember, this is just a starting point. The real skill is in applying this knowledge in a live market environment.

Why Price Action Matters

Pure price action gives you direct clues about market sentiment without the lag or complexity of most technical indicators. Understanding formations like the 3 white soldiers is a foundational skill for any serious trader. It’s like learning to read the market’s own language, straight from the chart.

For a deeper dive into chart formations, you can learn more about Japanese candlestick patterns and see how they form the backbone of so many winning strategies.

By the end of this guide, you won't just know how to spot this pattern. You'll have a complete framework for validating and trading it, turning the simple story it tells into an actionable trading plan.

How to Identify the 3 White Soldiers Pattern Correctly

Spotting a genuine 3 White Soldiers pattern isn't as simple as finding three green candles marching up a chart. To really nail it—and avoid the traps—you need to be a bit of a detective. Think of it like a checklist: if you can't tick every box, the odds of the pattern working out drop like a stone.

The first and most critical rule is context. This pattern must show up after a clear, established downtrend. If you see it forming in a messy, sideways market or halfway through an existing rally, it’s not a reversal signal. Its entire power comes from signaling a decisive shift in control from the bears to the bulls.

The Anatomy of a Valid Pattern

Once you've confirmed it's ending a downtrend, it's time to put the candles themselves under the microscope. For a pattern to be a high-probability setup, it needs to meet some strict structural rules.

Here’s the essential checklist every trader should burn into their memory:

- Three Consecutive Bullish Candles: You need three long-bodied, bullish (green or white) candles, one right after the other. No bearish interruptions allowed.

- Progressive Higher Closes: Each candle has to close higher than the one before it. This shows a steady, deliberate climb and proves bullish momentum is building.

- Opening Within the Previous Body: The second and third candles must open inside the real body of the candle that came before it. If it gaps up or opens below the prior low, you're looking at a different beast entirely.

The emphasis on long bodies is crucial here. Long bodies with tiny (or non-existent) wicks tell you that buyers were in the driver's seat for the entire session, from open to close. This is the visual proof of sustained buying pressure, which is exactly what you want to see in a strong reversal.

A true 3 White Soldiers pattern tells a story of escalating bullish commitment. Each candle is a chapter in that story. If you miss a detail, you might completely misread the ending.

Distinguishing Soldiers from Imposters

Here's where many traders get tripped up. Not all sets of three green candles are created equal. The market loves to throw out lookalikes that mean the exact opposite of what you're expecting. Learning to spot these imposters is key to avoiding failed trades.

Keep an eye out for these cautionary variations—they often signal that the rally is running out of steam:

- Advanced Block: This is when you see the bodies of the second and third candles getting smaller while their upper wicks get longer. This is a massive red flag. It shows buyers are struggling to push higher and are hitting a wall of selling pressure. The bullish momentum is fading, fast.

- Stalled Pattern (or Deliberation): This variation shows up when the third candle is tiny—think a spinning top or even a doji—after two strong bullish candles. It screams indecision. The buyers have lost their nerve, and the bears might be about to jump back in.

This table breaks down the difference between the real deal and its weaker cousins.

| Feature | Strong 3 White Soldiers | Weak Variation (e.g., Advanced Block) |

|---|---|---|

| Candle Bodies | Consistently long, showing sustained buying pressure. | Bodies get progressively smaller, indicating weakening momentum. |

| Upper Wicks | Very short or non-existent, showing a close near the high. | Long upper wicks emerge, showing sellers are pushing back. |

| Market Signal | Strong potential for a continued bullish reversal. | High probability of a stall, pullback, or failed reversal. |

By really internalizing this checklist, you stop being a pattern-spotter and start becoming a price action reader. A valid 3 White Soldiers pattern is a fantastic signal, but only when you can confidently tell it apart from the fakes the market throws at you.

The Psychology Behind the Bullish March

To really trade the 3 White Soldiers pattern well, you have to see beyond the three green bars on your screen. What you're actually looking at is a story—a fierce psychological battle where the market's mood flips from fear to greed.

Think about it. The market has been in a downtrend. Sellers are firmly in charge, pessimism is everywhere, and most traders wouldn't dare click the buy button. This is where our pattern begins its story.

The First Soldier: The Initial Challenge

The first candle is the bravest one of the bunch. It's the first real push from the buyers—the contrarians, the value hunters—who think the sell-off has gone too far. They see an opportunity and are willing to step in and challenge the bears.

This first green candle is like a small flicker of light in a sea of red. It closes higher, grabbing the attention of traders sitting on the sidelines and forcing sellers to take notice. It's a test, a probe to see if the bears still have the same conviction.

The Second Soldier: Growing Conviction

The second soldier is where the shift in sentiment really starts to gain traction. After seeing the success of the first candle, more buyers feel confident enough to jump in. This isn't just the contrarians anymore; momentum traders are now starting to believe the tide is turning.

This candle opens inside the body of the first and pushes to a new high, proving the initial buying pressure wasn't a one-off fluke. The bears, who might have dismissed the first candle as a minor pullback, are now getting nervous. Their grip is clearly loosening as a new wave of demand hits the market.

This progression from a single brave candle to a unified front is the essence of a market reversal. It's the point where collective belief begins to overpower doubt, laying the groundwork for a new trend.

The Third Soldier: Widespread Belief and FOMO

The third and final soldier is the moment of mass acceptance. The new upward direction is now obvious to almost everyone. The fear of missing out (FOMO) kicks in hard for traders who were sitting on the fence.

This final candle's strong close often triggers a flood of buy orders. Short-sellers are forced to cover their positions, which just adds more fuel to the fire. The march of the three soldiers is complete. What began as a quiet challenge has become a loud and clear declaration that the bulls are back in control. Understanding the nuances of mastering trading psychology is absolutely critical for reading these shifts in real-time.

Volume is what confirms this entire story. Ideally, you want to see trading volume increase with each of the three candles. Rising volume shows that more money and commitment are backing the move, which is a strong sign of institutional participation. This adds serious weight to the reversal signal. In fact, studies show the Three White Soldiers pattern is a highly reliable signal, with impressive performance metrics on Strike.money, especially in forex markets like the EUR/USD where it often signals that the bears have run out of steam.

A Step-by-Step Plan for Trading the Pattern

Spotting the 3 White Soldiers is one thing; actually making money from it is a completely different ballgame. To turn this powerful signal from a chart observation into a real trade, you need a disciplined, step-by-step approach. This is the blueprint I use to guide my entry, set my stop-loss, and take profits, ensuring every trade is managed with precision.

A solid trading plan is what separates consistent traders from the crowd. It pulls emotion and guesswork out of the equation and gives you a clear framework for every decision. Without one, even the most reliable pattern can lead to messy, inconsistent results.

Choosing Your Entry Strategy

Once a valid 3 White Soldiers pattern has formed and closed, you’ve got two main ways to get into a long position. The one you choose often comes down to your personal risk tolerance and how the market is behaving at that moment.

The Aggressive Entry: This is for traders who don't want to miss the boat. You jump in either near the close of that third soldier or right as the next candle opens. This gets you into the move quickly if momentum is strong, but it also means you're buying at a relatively high price. If the market pulls back, you could be looking at a larger initial drawdown.

The Conservative Entry: This approach requires a bit more patience. Instead of chasing the price, you wait for a small pullback. I often look for the price to dip back to around the midpoint of the third candle's body before I consider entering. This strategy usually gets you a much better entry price and improves your risk-to-reward ratio, but it comes with a catch—if the market is really strong, it might just take off without you.

Whichever entry you pick, the most important thing is to be consistent. A well-executed plan with a slightly less-than-perfect entry is always better than randomly switching between strategies.

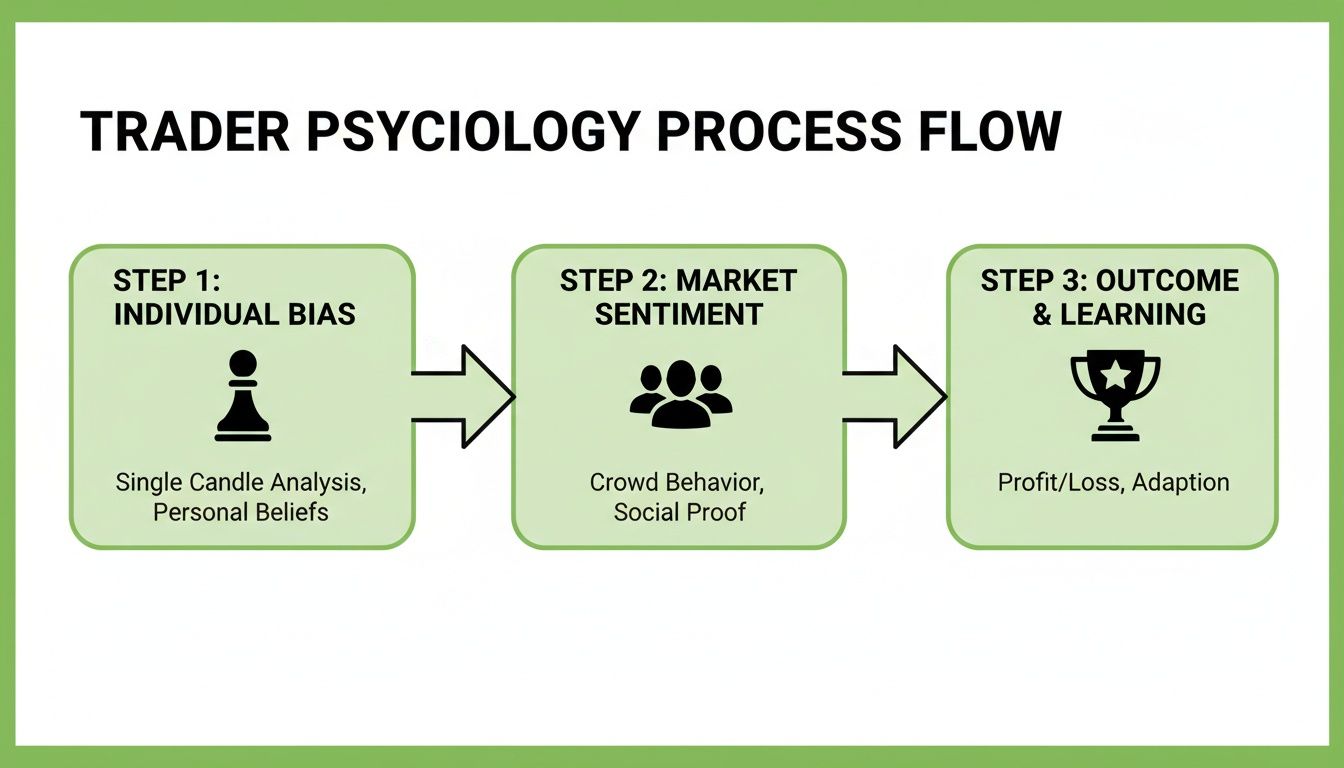

The image below gives you a great visual of the psychology driving this pattern, showing how a few early buyers can snowball into a market-wide conviction.

As you can see, the first candle represents the early bulls testing the waters. The second shows that more traders are buying into the idea, and the third candle signifies a powerful, widespread belief that the trend has turned.

Defining Your Risk with a Stop-Loss

Your stop-loss is your safety net. It's the line in the sand where you admit the trade idea was wrong and get out to protect your capital. For the 3 White Soldiers pattern, the most logical and battle-tested spot for a stop-loss is just below the low of the first soldier.

Placing your stop here gives the trade room to breathe. It helps you avoid getting knocked out by minor market noise but provides a clear exit if the bullish reversal completely falls apart. If the price breaks below the entire formation, the pattern’s bullish story is over.

Setting Clear Profit Targets

Knowing when to take your profits is just as critical as knowing when to enter. A trade isn't a winner until the profits are locked in. Here are a couple of reliable methods I use to decide where to get out.

- Previous Resistance Levels: This is my go-to. Just look to the left on your chart. Find previous swing highs or areas where the price has stalled out in the past. These historical resistance zones act like magnets for price and make for excellent, logical profit targets.

- Fixed Risk-to-Reward Ratio: A more systematic way is to use a fixed risk-to-reward (R:R) ratio. For instance, if your stop-loss is 50 pips from your entry, you could set your target at 100 pips (a 2:1 R:R) or 150 pips (a 3:1 R:R). I always aim for a minimum of 2:1 to make sure my winning trades are meaningfully larger than my losers.

The Cornerstone of Success: Money Management

No trading plan is complete without rock-solid money management. This is the final, and most important, piece of the puzzle. It means calculating your position size for every single trade so that a potential loss never costs you more than a small, predetermined percentage of your account—typically 1-2%.

This discipline is what keeps you in the game. It ensures that one bad trade, or even a string of them, can't wipe you out. It gives you the longevity to let your trading edge play out over the long run.

From what I've seen and from the data, the Three White Soldiers pattern performs best on the daily and 4-hour charts, especially when markets are moving. Research points to a 75-82% bullish continuation rate when confirmed by rising volume. For day traders on indices like the Nikkei 225, entering on the third candle's close with a 1-2% stop below the pattern's low has hit a 4:1 reward potential in 68% of observed cases. You can dig deeper into these findings on Altfins.com. By marrying these statistical insights with a robust plan, you can start trading this pattern with real confidence.

Using Confluence to Confirm the Signal

Spotting a 3 White Soldiers pattern by itself is a good start, but it's not enough to risk your hard-earned capital. Think of it like a scout reporting a potential shift in enemy lines—it’s interesting information, but you wouldn’t launch a full-scale attack based on one report.

To trade with real confidence, we need more evidence. This is where the power of confluence comes into play. It’s simply the art of finding several independent signals that all point to the same conclusion.

A pattern with strong confirmation is a high-probability setup. Without it, you’re just trading on hope. For a much deeper dive into this essential skill, our complete guide on using confluence in trading is a must-read for any serious trader.

The Most Powerful Confirmation Signals

To turn a decent setup into a great one, you need to look for a few key allies on the chart. The more of these you can find lining up with your 3 White Soldiers pattern, the stronger your trade becomes.

A Surge in Trading Volume: This is a huge one. Ideally, you want to see volume climbing with each of the three candles. Rising volume is your proof that big money and widespread conviction are fueling the move, making it far more likely to have staying power.

Formation at a Key Support Level: Context is everything in trading. When the 3 White Soldiers appear right at a major support level, a demand zone, or a critical trendline, its power is magnified immensely. It tells you that a historically important price floor has held firm and is now acting as a launchpad.

Confirmation on a Higher Timeframe: Always zoom out for the bigger picture. If you spot a great-looking pattern on a 4-hour chart, what does the daily chart say? If the daily also shows bullish momentum or a clear bounce from support, the signal carries far more weight. It's less likely to be just a short-term fake-out.

Historically, this pattern has been a reliable omen. First identified in 18th-century Japanese rice trading, it was brought to the West by Steve Nison. His backtesting on Dow Jones data from 1897-1990 showed an impressive 82% reversal success rate following downtrends of over 10%. More recent analysis shows it often precedes moves of 15-25% in major indices within six months. You can explore more on these historical findings at Alchemy Markets.

Anatomy of a Failed Pattern

Even the strongest patterns can and do fail. Learning to spot the red flags of a potential failure is just as critical as finding a good setup in the first place. A failed pattern is its own signal—it’s telling you to stay away or get out fast.

Here’s what a failing pattern often looks like:

Declining Volume: If volume is flat or, even worse, shrinking as the three candles form, it’s a major warning. This suggests a lack of genuine buying pressure and raises the odds of a "bull trap," where the price sucks you in before snapping right back down.

Formation into Strong Resistance: A pattern that marches directly into a major resistance level is like an army marching toward a fortified wall. All that bullish momentum can grind to a halt and reverse as a wave of sellers steps in.

A Weak Third Candle: Pay close attention to that final soldier. If its body is noticeably smaller than the first two, or if it has a long upper wick, it’s a sign that buyers are losing their nerve. The momentum is fading before the rally truly begins.

A failed 3 White Soldiers pattern is not a personal failure; it's valuable market feedback. It tells you the bullish story you were expecting did not get the confirmation it needed from the broader market. Heed that warning.

By demanding confluence and learning to spot these signs of weakness, you shift the odds dramatically in your favor. You stop being a simple pattern-spotter and become a strategic price action trader who makes decisions based on a weight of evidence.

Your Top 3 White Soldiers Questions Answered

Even when you have a solid game plan, some questions always pop up when you're trying a new pattern in the live market. Let's tackle the most common ones I hear from traders about the 3 White Soldiers.

Think of this as your final pre-flight check before you risk real capital. It's about making sure you've covered all the angles.

How Reliable Is This Pattern, Really?

The 3 White Soldiers pattern is definitely one of the more dependable bullish reversal signals out there. Some studies even claim success rates north of 75%. But here's the catch: that reliability is not a given. It's completely dependent on context.

Its power skyrockets under the right conditions:

- It has to show up after a real, sustained downtrend. No choppy markets.

- It's strongest when it forms right on a major support level or a clear demand zone.

- Rising volume across the three candles is a huge validator. I can't stress this enough.

If you spot this pattern in a sideways, messy market, its reliability plummets, and you're likely looking at a false signal. No pattern is a crystal ball, which is why your risk management has to be locked in every single time.

A pattern's reliability is never an absolute number. It is a probability that you enhance by trading only the highest-quality setups that are confirmed by confluence and strong market context.

What's the Opposite of the 3 White Soldiers?

The mirror image, or the bearish counterpart, is the Three Black Crows pattern. As you can probably guess, it signals the exact opposite market sentiment.

It’s made up of three long, consecutive bearish candles that appear after a solid uptrend. Each new candle opens inside the body of the one before it and pushes down to a new low. It's a powerful visual of sellers wrestling control away from the buyers.

Can I Use Indicators with the 3 White Soldiers?

Yes, you can—but only for confirmation. Never, ever use an indicator as your primary reason to take a trade. The pure price action of the pattern itself has to be the star of the show.

Good indicators can add that extra layer of confidence, or confluence, to your trade idea. For example, seeing the RSI climbing out of oversold territory or getting a bullish MACD crossover just as the third soldier closes can strengthen your conviction.

The goal is to use indicators to confirm what the price is already screaming at you, not to go hunting for signals with them. That just leads to "analysis paralysis."

At Colibri Trader, we teach you to master price action so you can read the market's story directly from the chart, without relying on lagging indicators. Transform your trading with clear, proven strategies by exploring our programs at https://www.colibritrader.com.