A Trader’s Guide to Bullish Engulfing Patterns

The bullish engulfing pattern is a simple, yet powerful, two-candle formation that flags a potential bottom in the market. It shows up after a downtrend and signals that buyers have just wrestled control away from sellers, potentially kicking off a new move higher.

Essentially, it's a large bullish (green) candle that completely swallows the body of the smaller bearish (red) candle that came right before it.

Decoding the Psychology Behind Bullish Engulfing Patterns

To really trade this pattern well, you have to look past the candles and see the human story playing out. A chart isn’t just lines and colors; it’s a battlefield of fear and greed, a visual record of the fight between buyers and sellers.

Picture a market that’s been sliding. Sellers are feeling pretty good, pushing prices down day after day. This is our first candle in the pattern—a small, red, bearish candle. It shows sellers were in charge, but the small body hints they might be running out of steam. This exhaustion is a critical clue.

Then, the next trading session opens. Instead of another slide, a wave of buying crashes into the market. This isn't just a trickle; it's a flood. The resulting green candle is so big it doesn't just erase the previous day's losses—it closes way above where it started. Its real body completely engulfs the prior red candle's body.

The Power Shift Explained

This engulfing action is a massive tell. It’s the market screaming that the entire mood has changed. Here’s what it’s telling us:

- Sellers Are Tapped Out: The little red candle suggests the selling pressure is fading fast.

- Buyers Are Back With a Vengeance: That huge green candle is proof that buyers have stormed the field with overwhelming force, seizing control.

- Lower Prices Are Off the Table: The market took a look at those lower prices and said, "No, thanks." The rejection is decisive.

This sudden, violent flip from bearish gloom to bullish optimism is what gives the bullish engulfing pattern its punch. It’s a strong hint that the downtrend has hit a wall and a new uptrend is trying to form.

Think of it like a tug-of-war. The sellers have been slowly, painstakingly dragging the rope their way. Then, out of nowhere, the buyers dig in their heels and give one enormous, coordinated heave. They don't just stop the sellers; they yank the rope so far in their direction that the other team is left sprawling in the mud.

That’s the essence of the bullish engulfing pattern. It captures that exact moment of reversal, that sudden change in the dynamic of the fight, and sets the stage for a potential buying opportunity.

For a clearer picture, here’s a quick breakdown of what makes this pattern tick.

Bullish Engulfing Pattern At a Glance

This table sums up the key components of the pattern and the market psychology they represent.

| Characteristic | Description | What It Signals |

|---|---|---|

| Prior Trend | The pattern must appear after a clear downtrend or a pullback in an uptrend. | Context is everything. It signals a potential reversal from something. |

| First Candle (Bearish) | A smaller red (bearish) candle, showing sellers were in control but with waning momentum. | Seller exhaustion or indecision. The selling pressure is drying up. |

| Second Candle (Bullish) | A large green (bullish) candle whose real body completely "engulfs" the real body of the first candle. | An aggressive and decisive takeover by buyers, rejecting lower prices. |

| Volume (Optional) | Ideally, the volume on the second candle is higher than the first. | Strong conviction. More market participants are backing the bullish move. |

| Location | Most reliable when it forms at a key support level, trendline, or moving average. | Confirmation. The pattern occurring at a logical turning point adds to its strength. |

Understanding these individual parts helps you see the complete story the pattern is telling, moving you from just spotting shapes to truly reading the market's intent.

Identifying a High-Probability Engulfing Pattern

It’s one thing to spot two candles on a chart that kind of, sort of, look like a bullish engulfing pattern. It's another thing entirely to identify a genuine, high-probability setup that actually signals a market reversal.

So many new traders fall into this trap. They see what they want to see, jump on any pattern that appears, and get stopped out on a false signal. The secret is to trade with a strict, rule-based framework that cuts through the noise and spotlights only the most promising opportunities.

Think of it like being a detective. You don’t make an arrest based on a single, flimsy piece of evidence. You build a case by gathering multiple clues that, when put together, tell a convincing story. For a bullish engulfing pattern, there are three non-negotiable criteria that absolutely must be met before you should even think about taking the trade.

The Three Core Rules for Identification

To confidently say you've found a valid bullish engulfing pattern, you have to tick these three boxes. If you ignore even one, the pattern's reliability drops dramatically.

- There Must Be a Preceding Downtrend: This is a reversal pattern. That means it needs something to reverse. The pattern is only meaningful if it shows up after a clear series of lower lows and lower highs. A bullish engulfing pattern floating in the middle of a choppy, sideways market is just noise—ignore it.

- The First Candle Must Be Bearish: The first candle in the two-bar pattern has to be red (bearish). Its size matters, too. Ideally, it should be a relatively small candle, which hints that the sellers are already running out of steam. This sets the stage for the buyers to make their move.

- The Second Candle Is Bullish and Engulfs: The second candle has to be green (bullish), and its real body must completely swallow, or "engulf," the entire real body of the first candle. This is the knockout punch. It shows a powerful and decisive shift in control, as buyers not only wiped out all of the previous day's losses but also drove the price significantly higher.

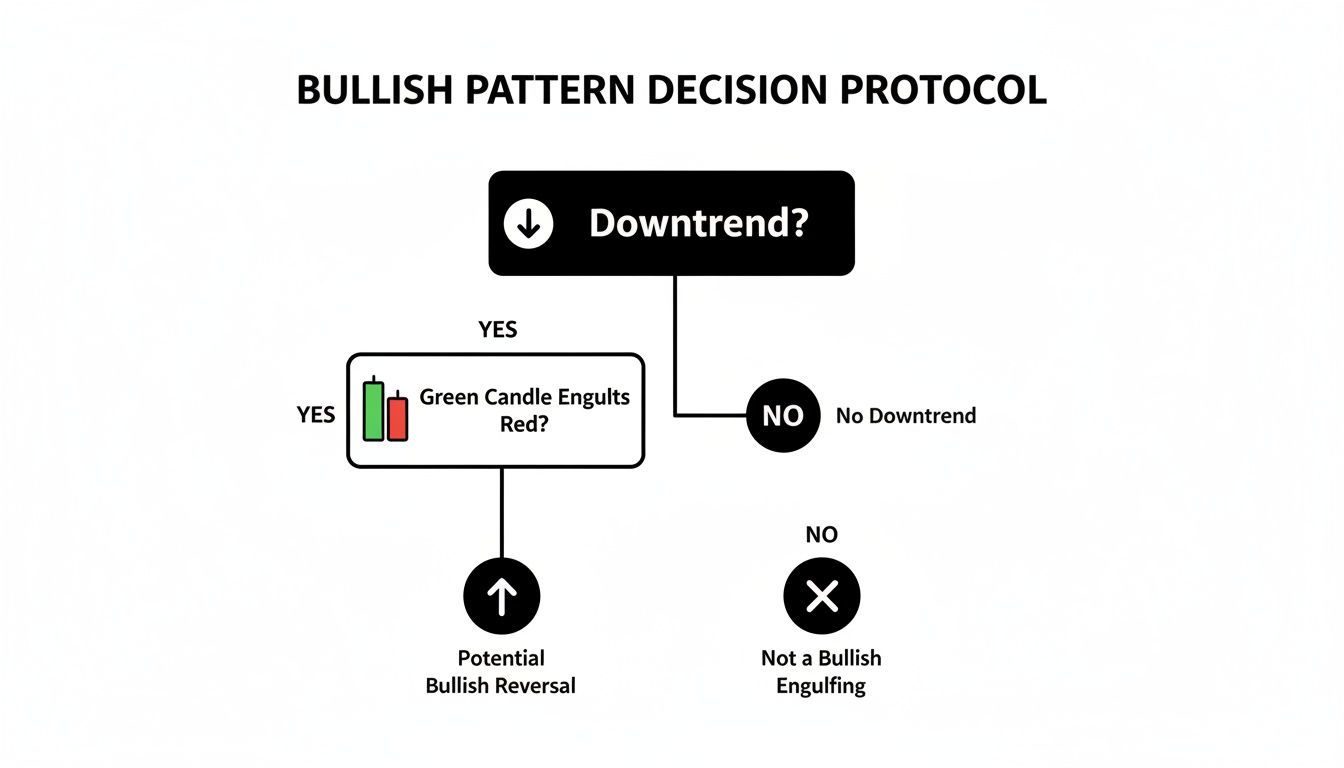

This flowchart gives you a simple way to visualize the process for spotting a valid bullish engulfing pattern.

As you can see, the whole process starts with context (the downtrend) and is confirmed by the structure (the engulfing action).

Why These Rules Matter

Following this checklist transforms your trading from a guessing game into a methodical process. Each rule adds another layer of confirmation, stacking the odds of a successful outcome in your favour. And the pattern's historical performance backs this up.

The bullish engulfing pattern is a cornerstone of price action trading, signalling a powerful shift from bearish to bullish control. Research has shown the pattern's success rate is roughly 65% in predicting price rises. For traders who want even better odds, combining it with higher volume on the green candle can boost reliability to over 70%.

By demanding a clear downtrend, you ensure you're not just trading random market chatter. By requiring the specific candle structure, you're waiting for hard proof that buyers have taken over from sellers. This disciplined approach is what separates consistently profitable traders from those who are always chasing false signals.

If you want to go deeper on various candle formations, our comprehensive candlestick patterns cheat sheet is a fantastic resource to continue your studies.

Using Context and Confirmation to Avoid Bad Trades

Spotting a bullish engulfing pattern is just the first step. Honestly, it’s the easy part. The real skill lies in knowing when that pattern actually means something.

Think of it this way: a single pattern appearing in the middle of nowhere is like a lone voice shouting in a massive, empty stadium. It makes a sound, but does it have an impact? Probably not. The pros know that where a pattern forms is everything.

A pattern showing up at a random price level is weak, unpredictable. But that same pattern at a major support level? Now we’re talking. It’s like that same voice now has a massive choir backing it up. This is where the magic happens.

This idea of stacking signals together is a game-changer for most traders. It’s what we call confluence in trading, and it's the core of separating high-probability setups from market noise.

Stacking the Odds with Market Context

So, before you even think about placing a trade, you have to ask one question: "Where is this pattern happening?" A-grade setups almost always form at logical turning points.

Look for bullish engulfing patterns in these key areas:

- At a Major Support Level: This is an area where price has bounced before. A bullish engulfing here signals that buyers are stepping in to defend that line in the sand once again.

- Near a Previous Demand Zone: Demand zones are pockets of unfilled buy orders from big institutions. When price dips back into that zone and an engulfing pattern prints, it’s a huge clue that those large orders are getting triggered.

- After a Significant Price Drop: A pattern is much more powerful after a sustained, sharp sell-off. It often signals that the sellers have run out of steam, and the market is finally ready to breathe.

These locations give the pattern its power. It’s the difference between a random guess and a calculated trading decision.

A pattern is a question, not an answer. The market context provides the crucial information needed to interpret it correctly. Waiting for a pattern to form at a significant level is the ultimate form of trading patience.

The Power of Confirmation

Even with the perfect location, jumping the gun is a classic rookie mistake. A great-looking signal can fall flat on its face without follow-through. That’s why we always wait for confirmation. It’s the market’s way of telling us, “Yes, this move is for real.”

I primarily look for confirmation in two ways.

1. The Next Candle Close

This is my favorite and one of the simplest, most effective filters you can use. Instead of buying immediately, just wait for the next candle to close.

Does the candle following the pattern close above the high of the bullish engulfing candle? If yes, that’s your green light. It proves the initial burst of buying wasn’t a fluke; it had enough momentum to carry into the next session. This simple act of patience will save you from so many false starts.

2. A Spike in Trading Volume

Volume is the market’s truth serum. It shows you the conviction behind a move. A bullish engulfing pattern on wimpy, below-average volume is suspicious. It could just be a temporary blip.

But a bullish engulfing that forms on a massive spike in volume? That’s a whole different ballgame. That tells you a flood of market participants are all piling into the long side. This is institutional buying. This is what real, sustainable reversals are made of. When you see big volume backing up a pattern, pay very close attention.

Signal Strength Checklist

To help you put it all together, I use a mental checklist to quickly gauge how strong a potential setup is. It helps you stay objective and avoid getting tricked by less-than-ideal patterns.

Here's a simple way to think about it:

| Confirmation Factor | Weak Signal | Strong Signal |

|---|---|---|

| Location | Appears in the middle of a range, "no man's land" | Forms at a key support level or demand zone |

| Prior Trend | Forms after a shallow, choppy pullback | Forms after a steep and extended downtrend |

| Follow-Through | The next candle fails to break the pattern's high | The next candle closes decisively above the high |

| Volume | Average or below-average trading volume | A clear and significant spike in volume |

By using this checklist, you train your eye to focus only on the setups that have the highest probability of working out, which is what professional trading is all about.

Executing Your Trade Step by Step

Spotting a great-looking bullish engulfing pattern is one thing; trading it profitably is another. This is where your analysis ends and your execution begins—the moment you have to pull the trigger. Without a solid plan, it’s easy to let emotion take over.

A professional trader’s plan for any setup has three non-negotiable parts: the entry trigger, the stop-loss, and the profit target. Anything less is just guesswork.

Pinpointing Your Entry Trigger

So you’ve found a valid bullish engulfing pattern at a key support level. Now what? You have two main ways to get into the trade. Neither is right or wrong, they just fit different personalities.

The Aggressive Entry: You jump in the moment the bullish engulfing candle closes. The big plus here is that you’re in the trade early, so you won’t miss the boat if the price explodes higher right away. The downside? You might get caught in a small, immediate pullback.

The Conservative Entry: This approach calls for a bit of patience. Instead of buying immediately, you wait for the price to dip slightly. Many traders look for a retest of the halfway point of the big green candle, or maybe the high of the previous red candle. This often gets you a better price and improves your risk-to-reward, but you run the risk of the market taking off without you.

Which one is for you? It really comes down to whether you hate missing a move more than you hate a bit of initial drawdown.

Setting Your Protective Stop-Loss

Your stop-loss is the single most important part of your trade. It’s your safety net, the one thing that prevents a bad trade from wiping out your account. Thankfully, with the bullish engulfing pattern, placing it is pretty logical.

The most effective place to set your stop-loss is just a few pips or cents below the absolute low of the bullish engulfing candle.

Why there? Because that low is the line in the sand. If the price breaks below it, the entire bullish argument for the pattern is shattered. The buyers have officially lost control.

Placing it any tighter risks getting shaken out by random noise. Any wider, and you’re just risking more money than you need to. If you want to dive deeper into this, check out our guide on how to set a stop-loss effectively.

Defining Realistic Profit Targets

Knowing where to get out of a winning trade is just as crucial as knowing where to get in. You need to bank those profits before the market turns. Your take-profit should always be at a logical area of resistance where sellers might show up again.

Here’s how to think about it:

- Look Left to Find Resistance: Scan your chart to the left of the pattern. Is there a recent swing high? A major moving average? These are the natural speed bumps where the rally could hit a wall.

- Check Your Risk-to-Reward: Pros don't take trades unless the potential reward is worth the risk. A good rule of thumb is to aim for at least a 1:2 risk-to-reward ratio. If you’re risking 50 pips with your stop-loss, your first target should be at least 100 pips away.

This isn’t just theory. Data shows the bullish engulfing pattern is a solid performer, especially as a reversal signal. One analysis of over 3,700 trades found a 55% success rate with an average profit of 0.46% per trade. When you combine that with disciplined money management, you have a powerful tool in your arsenal. You can dig into more of those stats over at The Pattern Site.

How to Navigate False Signals and Common Mistakes

Let's be brutally honest: no trading pattern works 100% of the time. The bullish engulfing pattern is no exception, and pretending otherwise is a one-way ticket to a blown account. Too many traders learn to spot the pattern but completely miss the common traps that lead to nasty losses.

You’ve seen it happen. A picture-perfect bullish engulfing pattern forms, you get excited, you jump in… and the market keeps cratering. Why? The answer is almost always context. A signal that pops up in a weak, choppy market just doesn't have the same horsepower as one that prints after a deep, sustained sell-off. Learning to tell the difference is what separates the pros from the crowd.

The Runaway Train Mistake

One of the quickest ways to lose money is trying to catch a falling knife. A trader sees a bullish engulfing candle in the middle of a screaming downtrend and goes all-in, hoping to be the hero who caught the exact bottom.

This is like trying to stop a freight train with your bare hands. A single bullish candle, no matter how beefy it looks, often isn't enough to halt a market with that much bearish momentum. More often than not, the pattern is just a temporary breather—a quick gasp for air before the sellers take control again.

- What it is: Trading a bullish engulfing pattern that forms during a very strong, nearly vertical downtrend.

- Why it fails: The bearish momentum is just too overwhelming. It's a classic case of trying to fight the tape.

- How to avoid it: Look for signs that the selling is losing steam first. Wait for the market to consolidate or form a base before you even think about trusting a reversal signal.

Ignoring the Volume Story

Volume is the market’s lie detector. It tells you how much conviction is behind a move. A beautiful-looking bullish engulfing pattern that forms on pathetic, below-average volume is a massive red flag. It’s a sign that there's no real firepower behind the buyers.

Imagine a few people trying to start a wave in a giant football stadium. They might get a little section going, but without the rest of the crowd joining in, it dies out instantly. That’s a low-volume reversal—a "false bottom" just waiting to be broken.

The most reliable bullish engulfing patterns are always backed by a serious spike in trading volume. This is your confirmation that big money is stepping in, giving the move a much better shot at succeeding.

The Confirmation Bias Trap

This last mistake is all in your head. Confirmation bias is our natural tendency to see what we want to see, especially when we're desperate for a win. A trader on a losing streak might start seeing bullish engulfing patterns everywhere, bending the rules to fit their hopes.

They’ll accept a pattern where the green candle doesn't quite engulf the red one, or one that appears without any real downtrend before it. That’s not trading; that’s just gambling. Your strict, predefined rules are the only thing protecting you from your own emotions.

The bullish engulfing pattern isn't new; it traces back to 18th-century Japanese rice traders like Munehisa Homma who used it to nail reversals. Modern data confirms its edge, ranking it 12th in frequency and showing it hits price targets 67% of the time under the right conditions. For a recent example, the Nasdaq formed a bullish engulfing on October 11, 2024, after a 5% drop, leading into a 12% rally by the end of the quarter. For more on the numbers, check out the great research from Quantified Strategies.

Mastering Price Action Trading

We've just walked through the entire story of the bullish engulfing pattern, from the psychology driving it to the nuts and bolts of trading it. But here’s the most important takeaway: a pattern is never just a pattern. Its real power comes from context, confirmation, and a rock-solid trading plan.

True mastery isn't about memorizing a hundred candlestick formations. It’s about building a complete price action trader's toolbox, where each pattern is just one of many tools you can pull out for the right job.

Success comes when you finally learn to read the market’s story right off the chart, without the distraction and lag of indicators. It’s about understanding the raw tug-of-war between buyers and sellers. This is the skill that builds real confidence and, ultimately, consistent results.

Building a Trader's Mindset

Developing a professional trading mindset means you stop looking at isolated signals and start seeing the bigger picture.

- See the Forest, Not Just the Trees: Always start with the broader market trend and structure. Only then should you zoom in on individual patterns like the bullish engulfing.

- Patience is Your Edge: The trades that make your month (or year) are the A+ setups. These are the ones where the pattern, location, and volume all scream "go." Learn to wait for them.

- Discipline Over Emotion: Your trading plan—with its strict entry, stop, and exit rules—is the only thing standing between you and the destructive emotions of fear and greed.

When you internalize these principles, something clicks. You start trading proactively based on hard evidence from the chart, instead of reacting emotionally to every little market wiggle. This is the bedrock of professional price action trading.

The goal is to develop a deep, almost intuitive feel for market dynamics. You stop chasing signals and start reading the language of the market itself. That's when you start making decisions with confidence and precision.

This whole journey is about building a process you can repeat, day in and day out. You learn to spot the high-probability moments when a bullish engulfing signals a genuine reversal, not just a sucker's rally. It's this blend of technical skill and mental discipline that creates lasting success.

To go even deeper into reading market signals directly from the charts, check out this fantastic guide on Mastering Price Action Trading. Embracing this complete approach will give you a clear, strategic edge, no matter what the market throws at you.

Frequently Asked Questions

Even with the best trading plan, you're going to have questions. Let's tackle some of the most common ones I hear from traders about the bullish engulfing pattern. My goal here is to clear things up so you can trade with more confidence.

How Reliable Is the Bullish Engulfing Pattern on Its Own?

This is the big one. While some studies toss around reliability numbers like 63-65%, I'll tell you straight up: you should never trade this pattern in a vacuum. Its real power isn't as a standalone signal, but as a crucial piece of evidence in a larger trading puzzle.

Think of it this way: a bullish engulfing pattern that pops up at a major support level, backed by a spike in volume, and followed by a solid confirmation candle is a world away from one that appears in the middle of nowhere. The best traders use it as part of a confluence of factors to build a strong case for taking a trade.

Does This Pattern Work in All Markets and Timeframes?

Absolutely. The bullish engulfing pattern shows up everywhere—forex, stocks, crypto, commodities—because it reflects raw human psychology, and that's universal. But, and this is a big but, its reliability definitely changes depending on the timeframe you’re watching.

In my experience, it’s far more dependable on higher timeframes like the daily or weekly charts. The signals on these charts just carry more weight and are less prone to the "noise" and fake-outs you see on shorter-term charts. You can certainly use it for day trading, but it demands much stricter confirmation and lightning-fast execution.

The core story of a bullish engulfing—a sudden, aggressive shift in power from sellers to buyers—is always the same. But its predictive power grows immensely on charts that capture a longer slice of market action.

What Is the Difference Between a Bullish Engulfing and a Piercing Pattern?

Both are two-candle bullish reversal patterns that show up after a downtrend, but they tell slightly different stories about the intensity of the buying pressure. Getting this distinction right is key to judging the strength of a potential reversal.

- Bullish Engulfing Pattern: This is the heavyweight. The body of the second candle completely swallows the body of the first. It's a sign of an aggressive, almost violent, takeover by the bulls.

- Piercing Pattern: This one is a bit more subtle. The second bullish candle opens below the prior low but only manages to close more than halfway up the first candle's body.

While both are signals that the bears might be losing control, the bullish engulfing pattern is the stronger, more decisive of the two. It screams that buyers didn't just halt the slide—they completely steamrolled the sellers in a single session.

At Colibri Trader, we teach you to stop just spotting patterns and start reading the story the market is telling you. Our training is built around mastering pure price action, helping you trade with discipline and confidence, without the clutter of indicators. Ready to see the charts with new eyes? Explore our price action courses today.