Trading Discipline- 5 Points To Make You Better Traders

On Trading Discipline

Let’s have a look at the chart below and analyse my trading discipline:

This is the 4 Hour chart of the GBPUSD. I wrote about this pair on the 16th of April, 2018 on my Twitter wall.

It was about 600 pips ago!

I am looking at this chart now and cannot believe it!

What I have missed!

Get The Trading Discipline Pyramid PDF

Contents in this article

- Point Nr. 1 – When everything aligns perfectly well but you still miss it…

- Point Nr. 2 – Trading discipline and FOMO

- Point Nr. 3 – Rushing too fast into a trade

- Point Nr. 4 – Never taking the trade or Fear of Losing Out (FOLO)

- Point Nr. 5 – How can I make sure that I do follow my trading plan

- Conclusion

When everything aligns perfectly well but you still miss it…

Was it the trend?

Maybe it was just bad luck…

Was it a bias?

These and many more excuses do traders that lack trading discipline use. If not one, it is the other.

How can trading discipline be so overlooked when it is so important?

- Check out the following video on trading discipline and how you can improve your trading by following these steps:

Trading Discipline Pyramid from Colibri Trader on Vimeo.

Dissecting the GBPUSD trade candle by candle

Talking about trading discipline… Let’s come back to this GBPUSD missed opportunity.

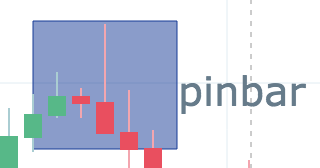

At the top of the reversal, there was a bullish rejection candle or a pin bar. I wrote about it on my Twitter page HERE.

Since then, almost everything about this trade was perfect.

There was the resistance level at 1.4350.

Also,a candlestick formation on the daily and on the 4 hour chart formed.

DAILY

4-HOUR

Nothing more a trader trading price action should have asked for!

This was probably the perfect setup for me.

Did I trade it?

NO.

The answer to the above question is way more complicated than the question itself.

Before placing a trade, I am looking at my current open positions.

I am checking the capital that I am willing to risk.

Also, I think about how comfortable I feel running multiple positions.

Did I feel comfortable with this trade?

Not really.

Did I follow my trading rules and therefore trading discipline?

YES.

What is important in trading is that you follow your pre-determined rules.

For me trading discipline is so important that even if a trade is so obviously good, I might not take it.

If my circumstances are not in line with my trading rules, I will SKIP a trade.

This is a great example of a trade in which I followed my trading discipline.

I did not listen to others including the price action signal that the market was giving me.

Instead, I did only listen to my… TRADING DISCIPLINE

Trading discipline and FOMO

In line with these thoughts, I cannot skip the topic of “Fear Of Missing Out” (FOMO).

Imagine the trade above.

GBPUSD goes down and you are too afraid that you would have missed it.

You rush in and start selling immediately.

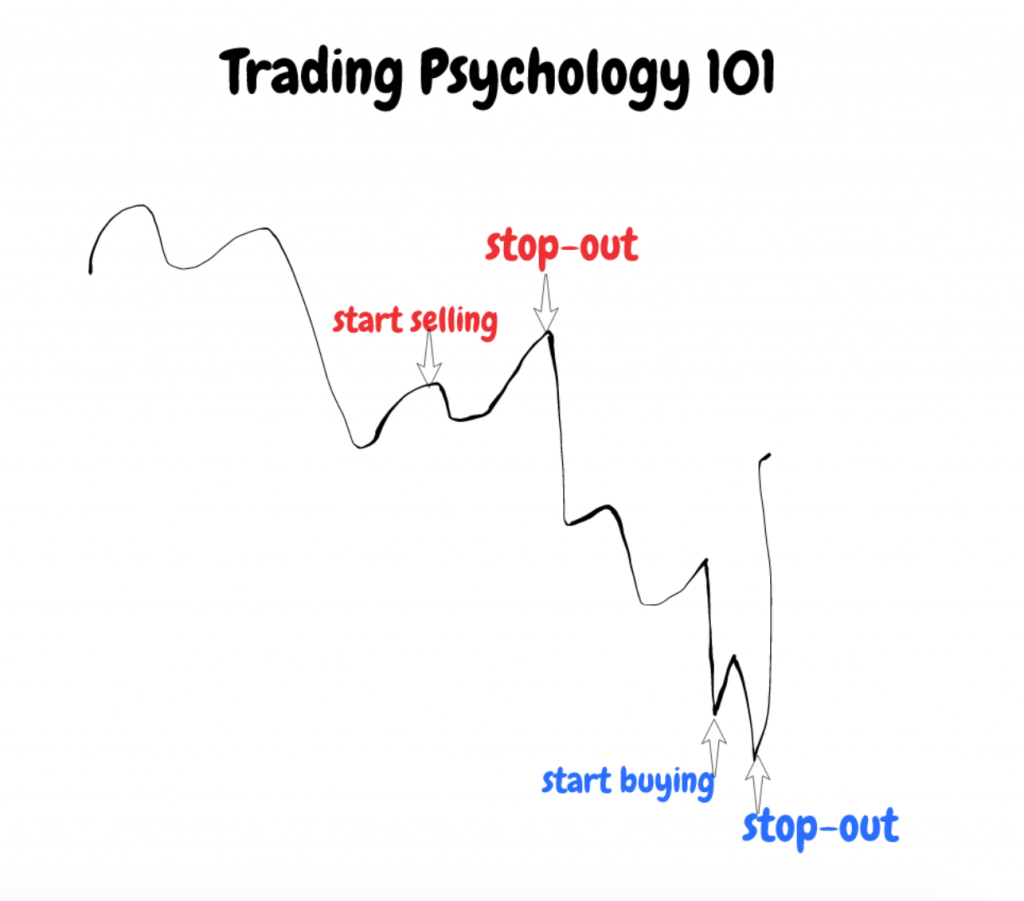

What usually happens is when you are trading only because you are scared that you might be left out is to get stopped out.

Maybe this would not have been the case in this trade since the trend is extremely strong.

Alas, in 90% of cases you will be stopped out or you will panic and exit at a loss.

For me, even though it was an obvious short, I did not short sell the cable just to strengthen my trading discipline.

This missed opportunity will stay with me longer than if I traded it.

Why?

Because the next time I decide to rush and buy or sell into another trade, I will remember this “missed opportunity”.

It will be a benchmark about my trading discipline.

I will already be stronger and won’t let go after a trade that does not look at least as promising.

In the end, what traders should know and practice more often is the ability to follow their rules no matter how tempting a trading situation appears.

Be humble.

Always be disciplined!

Rushing too fast into a trade

Talking about trading discipline and FOMO, one instinctively starts thinking about the other side of the coin, or rushing too fast into a trade.

It is equally as dangerous as FOMO.

“I am scared I will miss this move. I want to enter it even if I am too early…”

These are the words of the beginner trader.

Let’s recap the picture from above one more time:

Sometimes even experienced traders make this mistake, but you should watch out!

Rushing into a trade too quickly before you get a confirmation from price action might (and will) cost you dearly.

Being the first one in the trading queue does not necessarily mean that you will be the most profitable one.

Quite contrary!

In fact, missing a trade or two might improve your trading discipline and make you a better trader in the long-term.

Trading is not for the spontaneous or the one who is too afraid.

Just follow your trading discipline and the rest will follow!

Never taking the trade or Fear of Losing Out (FOLO)

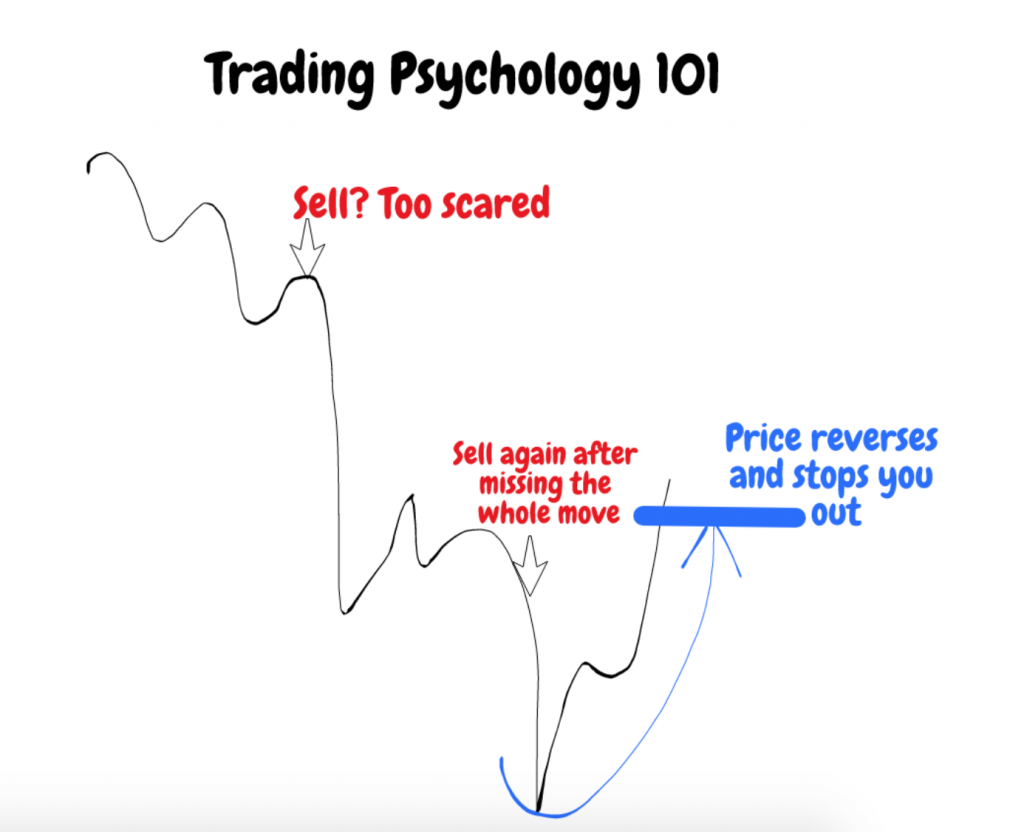

Contrary to FOMO is FOLO or Fear of Losing Out!

FOLO is usually a characteristic of new traders who are too afraid to pull the trigger.

I am not sure which one is worse- FOMO or FOLO.

In any case, they can both lead to self-destruction and losing the whole amount of your trading account.

FOLO traders are too afraid to pull the trigger and thus make costly mistakes out of panicking that they have not traded anything.

They are forgetting about their trading discipline rules and rush quickly into all sorts of trades.

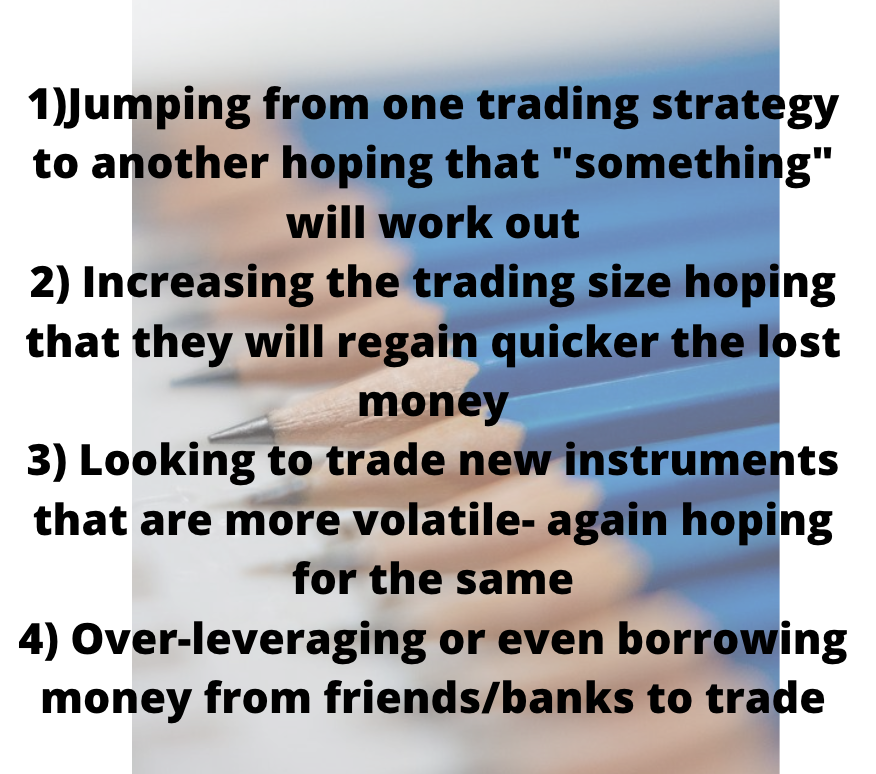

This behaviour usually leads to overtrading and a series of other trading mistakes like:

- Jumping from one trading strategy to another hoping that “something” will work out

- Increasing the trading size hoping that they will regain quicker the lost money

- Looking to trade new instruments that are more volatile- again hoping for the same

- Over-leveraging or even borrowing money from friends/banks to trade

These and many other similar trading mistakes should be avoided at all costs.

Trading should be taken as a serious business that has no room for experiments or bad gambling habits.

FOLO should not be encouraged and never accepted as part of your trading discipline plan.

Below is an example of a typical trade that a beginner trader takes when too afraid to pull the trigger initially.

Does trading discipline mean following blindly a trading plan

Yes and No.

In case that you trading plan and trading strategy work, you should blindly follow your trading discipline.

If you are not consistent enough, you should try to find a way that works for you.

Maybe your trading strategy is not optimised or it is just bad.

Or probably your money management skills are not good enough. There could be as many reasons as there are stars in the sky.

Therefore, it is crucial that you make sure that your trading plan/strategy is working before you even start thinking about trading discipline.

After a while, they should be both interlinked and work together in the long-term.

Trading discipline is that one little thing that will help you keep your humbleness even after you have reached your trading goals!

How can I make sure that I do follow my trading plan

Trading discipline will certainly be one of the leading factors here.

What I still do (and intend doing in the future) is having all my major trading rules written down and glued to my trading screens.

I do also keep a daily journal.

Even if I do not trade, I write down everything to describe how I feel about the market and what I want to achieve in trading.

Trading is not only about trading.

It is about living a better life and being able to get to places that nobody has been before.

Trading discipline is the leading factor that will shape you as a consistent trader.

Without it you will be just one of the average traders complaining that the market is against you.

Or you will be one of the traders complaining you need more money to reach your goals.

Trading is not about the money or the market- successful trading is mostly about you and learning how to be a better version of yourself.

That is probably the hardest part of trading.

Face yourselves!

Improve your trading discipline!

Trading Discipline- Conclusion

So why is it so difficult to wait for the right trading setup?

Is it about FOMO or FOLO? Could it be because of a lack of trading discipline or bad trading habits?

Is there a right trading setup or are you just missing good trading discipline.

As has been established above, the hardest thing about trading is human nature and the trader’s psychology itself.

Successful trading could be easy but it needs to be hard at first.

If you are looking for a shortcut in trading, you’d be better off with another profession.

Probably one of the hardest things in trading is that it takes time to master.

So, the question you should be asking yourselves now is: “Am I patient enough to take this route?”

If you are hesitating or you think the answer is NO, you might be better off just walking away from this field.

There are so many other things you could be doing that will bring you joy and happiness.

But if you think that you have what it takes to be a trader, then roll up your sleeves and get ready for a long and bumpy journey.

Don’t forget that trading discipline will be the one thing that you will need from now on!

Happy Trading,

Colibri Trader

p.s.

If you want to see the way I see the markets, you can check out my professional trading course page

Or if you are not sure and want to read more about trading, check out my BLOG

Thank you for your post.I am actively folowing you and also bought your book. I just wanted to ask you something hope you will reply. on the chart marked as 1 ‘your initial signal is here but you don’t take it…’ My question is why and how this candle is considered as initial signal? How would I find or spot early signal? I wish you could do more YouTube video. Thank you

This is based on a hypothetical trading strategy. This example does not want to emphasise why a trade signal might have appeared there. This is an example of a common trading fallacy or in other words a typical trading mistake. This article is to show an example of a typical trade that a beginner trader doesn’t take when too afraid to pull the trigger initially.