Range Trading or Trend Following – Price Action Technical Trading Strategies

Range Trading or Trend Following – Price Action Technical Trading Strategies

One of the biggest dilemmas in trading is to know in advance if the market is in a trend or a range. If it is was that easy, traders would just apply range trading or trend following strategies that everyone knows.

Yes, everyone!

Think of all the trend indicators offered by a trading platform.

And, of all the oscillators too. They all come with a default interpretation.

I mean, even if one doesn’t know how to use them, a simple Internet search solves the mystery.

But then again, most retail traders fail in applying the standard interpretation on live markets.

Why is that?

Because range trading or trend following strategies are so different. The key is to define the market first.

Because range trading or trend following strategies are so different. The key is to define the market first.

Next in line is to apply technical trading strategies for that respective market.

Finally, it is to watch for changes in market conditions (reversal patterns or anything that indicates that ranges or trends might end).

Sounds difficult?

Well, that’s the key to price action technical trading strategies.

Otherwise, traders learn a strategy. Next, they apply it on a currency pair with some success. Finally, they keep trading it on other pairs and other timeframes, only to see it fail.

The reason is that the market was in a different stance.

Some currency pairs are in trends while others consolidate, and trading strategies would differ as a consequence.

In other words, range trading won’t work in trending markets. Nor trend following in ranging ones.

With this article, we will try to set rules for distinguishing between ranging and trending markets. Also, I will try establish the best technical trading strategies in range trading or trend following.

As always by using examples.

Plenty of them.

Range Trading or Trend Following – A Currency Trader’s Dilemma

It should be clear now that the true challenge when trading is to decide whether a swing is part of a trend or a range. Armed with the right answer, traders can profit from simple price action strategies.

In a way, the decision resembles similar ones when trading. For instance, a trader can only buy or sell a currency pair.

After all, there aren’t a hundred options to choose from. Only two: where will the market go next, up or down?

There’s even a trading theory that uses the same decision. The Elliott Waves Theory claims that all market swings (all of them!) are either impulsive or corrective. Nothing in between, no grey areas, just black and white.

So, it comes as no surprise that range trading or trend following strategies succeed only if the trader identifies the environment correctly. As trading is a game of probabilities, determining the nature of a market, follows concrete steps.

So, it comes as no surprise that range trading or trend following strategies succeed only if the trader identifies the environment correctly. As trading is a game of probabilities, determining the nature of a market, follows concrete steps.

Yet, no system or setup works in every environment, currency pair and timeframe.

However, the idea is to have a disciplined approach that increases the chances to be right, rather than to be wrong.

Before going into more in-depth details, what is a trend after all? And, what is a range?

What Makes a Trend – Key to Trend Following Strategies

A trend refers to the price action of a market that rises or falls. Either bullish or bearish, trends are the bread and butter of every trader.

As always, I’ll use examples to illustrate the technical trading strategies to use in range trading and trend following.

But before that, let’s highlight what makes a trend.

Either rising or bullish, a trend is a series of new highs or new lows that the market makes.

There is no trend without a pullback, and that’s what makes the second essential element in a trend: the higher low or lower high.

Combining the new highs or lows with the pullbacks, we have the definition of a trend. As such, a bullish trend is a series of higher highs and higher lows, while a bearish trend has multiple lower lows and lower highs.

Unless the series breaks, the trend will keep going. This makes it an exciting way to delimitate ranges from trends.

If the first condition for a trend to end is the market breaking the lower highs or higher lows series then the chances increase that ranges are about to occur.

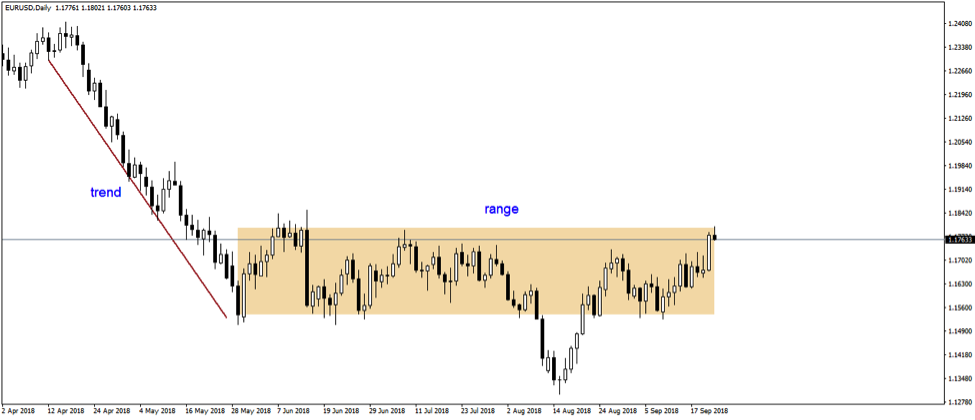

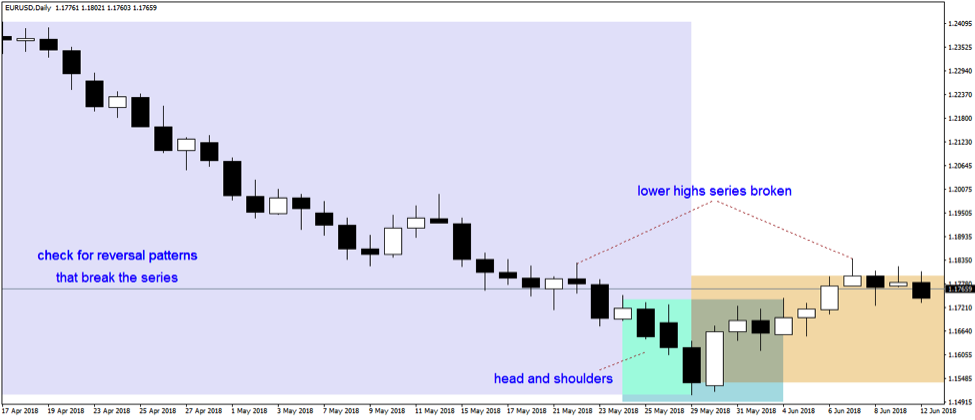

The recent EURUSD price action gives us the perfect example to use. It shows the break lower from the 1.25 area, followed by a sideways range.

Or, a bearish trend followed by ranging conditions.

Whatever the rules we’ll discuss here to illustrate range trading and trend following strategies, keep in mind that they work on all currency pairs and timeframes.

Rules for Range Trading or Trend Following

The main difference between a trend and a range, is, obviously, the price action. Or, the speed of it.

Trending markets take no prisoners. They keep tripping stops for the ones positioned on the wrong side of the market.

A market that trends is the reason why most of the traders want to trade. The easiest way to make a profit is to ride a trend and trail the stop as quick as possible.

A market that trends is the reason why most of the traders want to trade. The easiest way to make a profit is to ride a trend and trail the stop as quick as possible.

However, the problem remains with the fact that trends aren’t that common as many traders think. In fact, statistics tell us that the currency market spends a lot of time in consolidation.

In trend following, the quick price action leaves no room for error. Hence, a stop-loss order is mandatory.

As long as the series holds, the trader focuses on trailing the stop and adding to the position when the trend resumes. The easiest way to “let the profits run,” as professional traders say, is to ride the trend until exhaustion.

And, the exhaustion of it comes when the market breaks the lower highs series (in a bearish trend) or, the higher lows one (in a bullish trend). That’s the moment when the chances are that a time-consuming range will form.

In a range, the price action is often frustrating. Trend following traders have no patience and, instead of applying range trading strategies, they keep adding to a direction on any market pullback.

Naturally, this leads to overtrading, and the trading account becomes vulnerable to small changes in prices.

Insights Into Trend Following Techniques

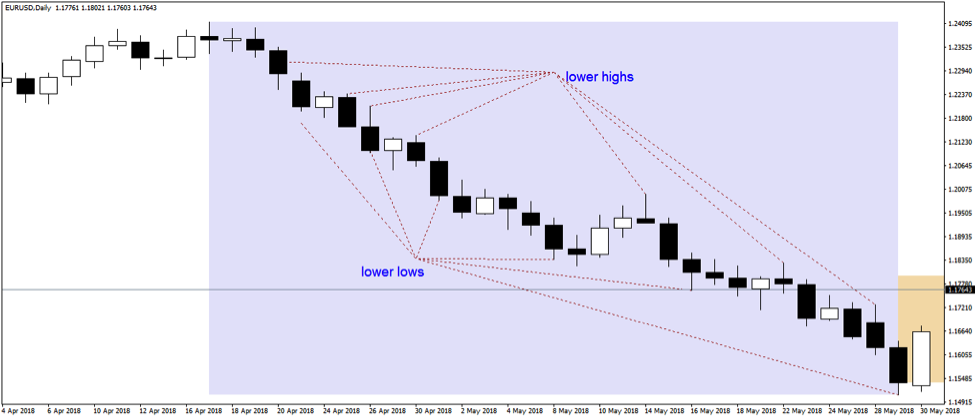

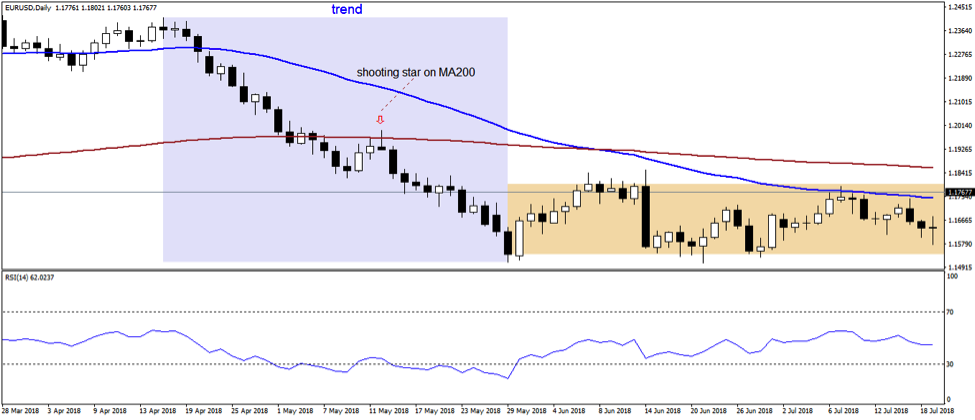

There’s no better way of illustrating a trading strategy than by using examples. By zooming in the trending area, we see the bearish trend’s characteristics.

Have a look at the price action! With every candle or group of candles, the market keeps pushing lower. On its trip, it makes a series of lower lows, characteristic of a trend.

But even more importantly, the bounces form a series of lower highs. From left to right, both series keep going, and traders merely let the profits run.

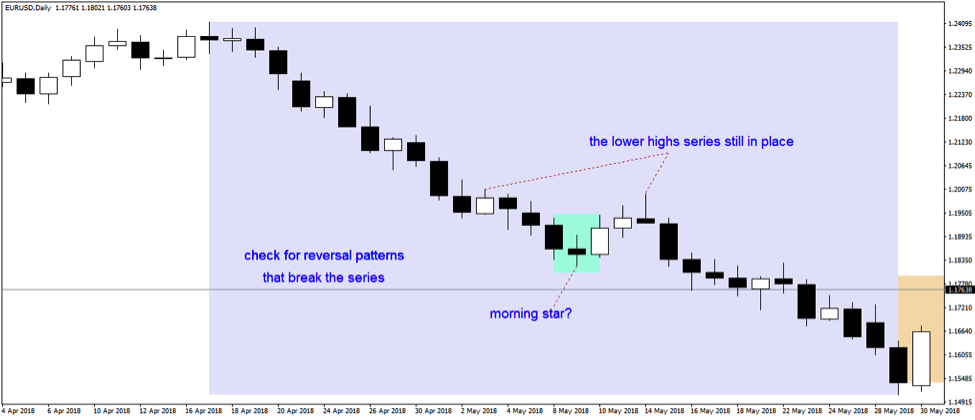

The key to trend following and range trading is to check for reversal patterns that break the series. Or, that have the potential to cause a break in the series of a trend.

For instance, right in the middle of the bearish trend, the EURUSD formed a potential reversal pattern.

A morning star is a group of three candles, with the first one forming in the direction of the trend, the second one having a small real body and the third one moving in the opposite direction.

Remember: Any Japanese reversal pattern has one necessary condition: it remains valid only if the price doesn’t break above or below its high or low.

For instance, after bullish Japanese reversal patterns like the hammer, morning star, piercing or engulfing, the price can’t break the lows in the pattern.

Or, after bearish ones, like the shooting star, dark-cloud cover, evening star or bearish engulfing, the price can’t break the highs.

If it does, the price action indicates the underlying trend’s strength. Hence, traders return to the conditions of a trend and add to the main direction.

In this case, the pair bounced, but it failed to break the lower highs series. Moreover, it broke the lows, making it a great place to add to the underlying trend’s direction.

Price Action After Trend Following Ends

One of the biggest problems when interpreting the price action is to know when market conditions end. The rules of ranging and trending markets remain the same, regardless of the currency pair and timeframe.

As such, by using a standardised approach, traders stand better chances to make a profit in the currency market.

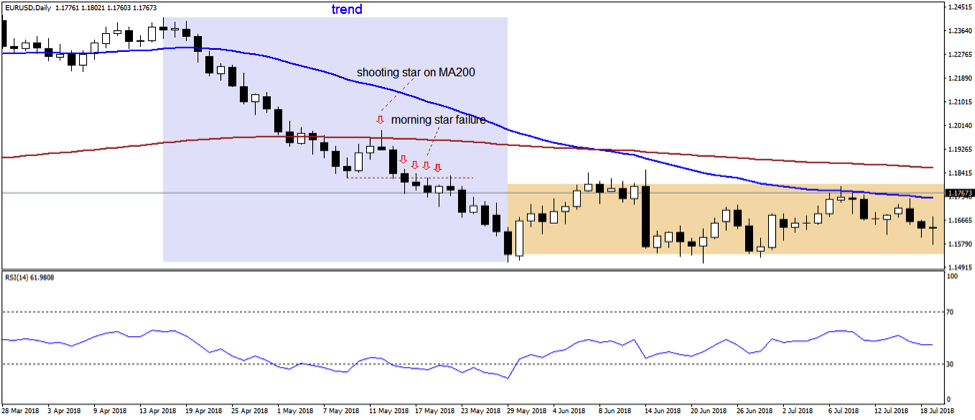

After the morning star pattern failed, the market continued to make new lows. And, at the same time, the bounces didn’t break the lower highs series.

Yet, another reversal pattern formed. This time belonging to the classic patterns, the head and shoulders took more time until completion.

The focus, as in the case of the morning star too, sits with the lower highs series.

Will the market break it?

As it turned out, the price did break the series, bringing the bearish trend to an end.

At this point in the analysis, traders still don’t know if range trading or trend following strategies work best for what’s to come on the right side of the chart.

The attention now turns to the price action immediately following the bearish trend.

A reversal pattern that holds (meaning the lows aren’t broken after a bullish pattern) implies a new trend starts. Is it possible for the market to form a bullish trend right after a bearish one?

Of course, it is!

Hence, traders look at all the possible clues to see what they’ll use next: range trading or trend following strategies.

If a new trend starts, the price action must form a series of higher highs and higher lows. That means the low in the head and shoulders pattern must hold.

Range Trading Strategies to Use

If the immediate price action to follow invalidates that low, traders’ attention turns to the nature of the candle that breaks the lows. If it is a reversal pattern, a range is expected. Hence, range trading technical strategies will yield the best results.

If not, the trend following, and riding continues.

As it happened, the EURUSD pair made a new low. The sharp, bearish decline was caused by the ECB (European Central Bank) re-instating its dovish view over the economy. And, it reassured markets that the easy monetary policy would continue for the period ahead.

The pair tanked.

All Euro pairs followed suit, and the EURUSD was no different.

As the most relevant and liquid pair, the EURUSD price action dictates the tone for the overall currency market. When it ranges, the entire market tends to hold tight level.

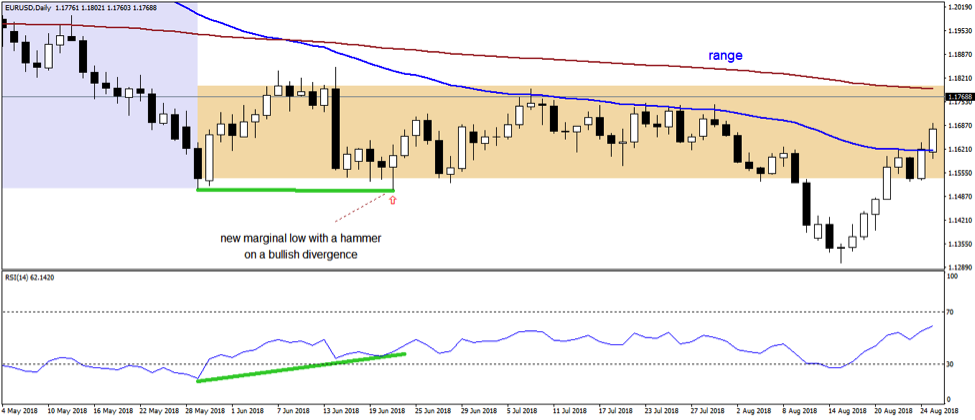

The pair broke the previous lows in the bearish trend. However, bulls quickly stepped in, and the market formed a hammer.

This reversal pattern, coupled with the fact that the pair made a new low (thus invalidating the lower highs scenario), implying range trading might follow suit. And what better way to trade a range than to using an oscillator?

Every trading platform now offers plenty of trend and range trading indicators. Either a range trading or trend following trader, anyone can pick from a variety of technical indicators to use.

Typically, oscillators are used for range trading.

Because almost all of them have an overbought and oversold area, traders use them as a trading guide.

For the sake of using the most popular and well-known indicators, we’ll pick the RSI (Relative Strength Index) for range trading, and MA (Moving Average) for trend following.

Range Trading or Trend Following Indicators?

The danger, as usual, lies with using too many indicators.

The danger, as usual, lies with using too many indicators.

For this reason, the best way to make the most of the range trading or trend following is to always have one oscillator and one trend indicator on the chart.

Coupled with pure price action strategies, it is more than enough for every trader to pick great spots for his/her trades.

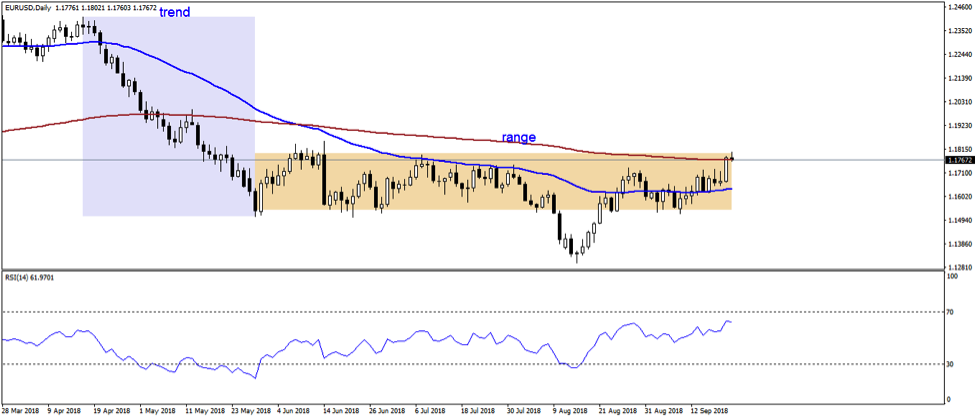

The chart above shows the RSI with the default, 14 periods, and the MA(200) and MA(50).

In technical analysis, it is said that when the two MA’s cross, the market forms a golden or death cross, signalling bullish, respectively bearish conditions.

Just analysing the trending area, we observe the market hitting the MA(200) right after the fake morning star we discussed earlier.

Moreover, it formed a shooting star, reinforcing the bearish price action nature.

As the price broke the lows in the possible morning star, it offered entry places for trend following. All the subsequent candlesticks didn’t manage to close above the morning star’s low, for instance.

Moreover, the lower highs series continued. That’s everything a trader needs to know for trend following.

Reinforcing the Range Trading Conditions

Obviously, any trader attempting to pick a top or a bottom is risky.

It is certainly more dangerous than trend following strategies.

For this reason, traders look for as many clues to support their decision. In this case, one clue that range trading follows is the hammer forming after the price action broke the previous bearish trend’s lows.

However, checking the oscillator, which works excellent in ranging conditions, traders notice a bullish divergence between the price and the RSI.

That’s the confirmation that range trading should follow, and the rules of trading the hammer pattern are enough for a profitable trade.

When the price action and the oscillator diverge, the market forms a bullish or bearish signal.

While a market may remain in a divergent mode more than a trader stays solvent, divergences are great tools to use in range trading.

As we proved beyond any doubt that the path of least resistance is a range, the bullish divergence comes to confirm it.

Even further on the right side of the chart, the RSI wasn’t able to make a new low, while the price did.

Another divergence formed, of a more significant amplitude, showing bullish market conditions.

Conclusion

Range trading or trend following strategies work only if traders can identify the range and trending markets. In the currency market, a market is a currency pair, but also a timeframe.

For instance, the EURUSD might range on the daily chart and trend on the fifteen-minute timeframe. As such, traders have a vast array of range trading or trend following techniques to use, even on the same timeframe.

In the case that hedging is allowed, traders can go long on a timeframe and short on another one. They can use simultaneously range trading and trend following strategies, depending on where the market goes.

We’ve shown in this article how to distinguish between the two market conditions. The analysis started with a trend and ended with a range.

What next? Well, there are only two market stances, and nothing in between: ranging or trending conditions.

After a range, a trend follows. However, after a trend, another one may start.

In the case of the EURUSD, for as long as ranging conditions hold, traders should use divergences. Moreover, overbought and oversold levels help too.

From the moment the pair starts making lower highs and lower lows, or higher highs and higher lows, a trend starts building. Using the approach shown here, traders use trend following strategies with MA’s and reversal patterns.

To sum up, range trading or trend following requires plenty of attention. Traders must be vigilant and have a money management system based on sound risk-reward ratios.

Because trending markets do not form that often on the foreign exchange, mixing range trading with trend following gives the best possible results.

P.S.

Check out how I use Inside Bars and Pin Bars to trade the market.

In case you have any queries, drop me a line at: admin@colibritrader.com

Happy Trading,

Colibri Trader