My Trading Journey As a Beginner Trader- A Real Story

My Trading Journey As a Beginner Trader- A Real Story

Bonus Material: Get the Free E-book on Candlesticks

***This is a guest article written by a beginner trader and one of my latest students, too.

I believe that the best way to show a beginner trader’s journey is by showing it from first person perspective. Here is a real journey from a real person, who took the courage to share it with the trading world. No one has done that before, so hats down to the courage of this trader and his inspirational story!

Many thanks for sharing your experiences with us Gialli. I am wishing you all the best with your trading in the future!

A beginner trader’s story- who I am and why I’m writing this article

I never thought about writing an article, especially an article that concerns me and my trading journey as a beginner trader. Why would anyone be interested in knowing something about me?

I’m not an influencer, nor a great trader, well actually I’m not even a proper trader, I mean professional. I am not consistent over time, including the short term. I have been trading with passion and dedication in a conscious way for about a year and a half.

And while I do not win consistently, it is also true that I do not lose a lot. This is the basis that will allow me to continue to engage in trading. It will also allow me to continue my trading journey towards professional trading.

One beginner trader’s story untold

I am a mechanical engineer and I am 49 years old. There is possibly nothing more difficult and far from trading than mechanical engineering is.

I am a middle-aged male, who has approached a completely new discipline. Above all I am mentally used to rely on certainties that do not exist in trading. It seems like that there is nothing certain about trading.

After this introduction, let me answer to the initial question: “who could be interested in knowing something about me and my trading?”

After this introduction, let me answer to the initial question: “who could be interested in knowing something about me and my trading?”

Although this could seem obvious to everyone, for me I will need to write it in order to materialise it. It will help me to make sense out of the words of Colibri Trader who advised me the following:

“You should write an article to describe your trading journey and inner struggles as a trader!”

Colibri trader made me realise that such an act would be very useful for myself. It would also be useful for other traders, who will recognise themselves in at least a part of it.

So here’s the answer:

It has been useful for ME, and hopefully for others who will have the patience to read this personal diary. I hope you will enjoy it!

The beginning of my trading journey

“Hey bro” told me one day many years ago my brother who graduated in economics and business, “do you know that there is a bank that gives you the possibility to trade online? You connect to the internet and buy shares on the stock market. It’s that easy. And then you just read some news and they will help you to arrive at a trading decision. You can make a lot of money “.

That very day the trading train left the station with me on board and my journey started.

At that time I worked in the family business, things were going well and fortunately I did not need money. What I lacked was a minimum of knowledge of what I was going to do. I also lacked a plan to follow and an expert person to teach me.

As you can imagine, I lost a lot of money. Sometimes some trades went fine (unfortunately) then I raised the size but obviously price started coming against me.

The gambler inside of me started talking and I continued to buy stocks. I was thinking that this time it was the right time and I kept on waiting for the big winner that never came.

Indeed when things went wrong and the price of my shares went down, I continued to buy, “it can not go down forever” I was telling to myself. What I was doing was buying at the highest point like a total newbie.

And just when my equity line had reached the level of earthy magma, one day I had to choose a mandatory course called “technical analysis of financial instruments for beginner traders”. That day the train on which I had climbed and that was going to crash began to slow down.

My beginner trader’s journey was about to move to another level.

Do beginner traders ever stop losing money? Towards a conscious trading

During that course I began to understand what I was doing wrong. It showed me how to better know the financial markets and also the various financial instruments including FOREX.

This course also walked me through the history of the markets and the men who have shone in the past years. I get to know who moves the markets and who are the participants in the market.

Above all I started learning what a beginner trader should be careful about. I also learnt that I do not have to place an order in the market without first setting the stop loss because the market could be your friend sometimes but in the majority of times it is not.

Regarding your emotions- I learnt that they are always your enemy number 1.

The Automated Trading Part

In order to protect ourselves from ourselves the teacher advised us to switch to automated trading but if I needed to do that it was better investing my money through a financial advisor who would have more experience that I did back then.

I have always followed a mathematical approach in my trading and some indicators. There were pros and cons in my strategy, but still I was not profitable enough as a beginner trader. I was in a stage in which I was fascinated by everything.

In that sense I was a real beginner. I was telling myself “Now that I know everything”; I thought, “I can’t wait to put it into practice and start making money”.

The personal side of starting out as a beginner trader

At that time I had a girlfriend who needed money so I told her that from that moment I started making money I would help her.

Unfortunately, it did not go as I thought. My trading journey as a beginner trader deviated from the path I wanted to take to a completely new ground.

In fact, even if I did not pay much attention to it (actually for quite some time). My trading mentor was completely right. He taught us about the importance of discipline, respect for the rules, trading plan, trading journal, etc…

I did not follow any of his rules and teachings….

On books and trading discipline as a beginner

I was also advised to read books like “Trading in the Zone” (Mark Douglas) that talks about the psychology in trading.

I was also advised to read “Master Trader” (Capra and Velez), a mix between trading techniques and market psychology…

I bought them all and read them, but I was not yet at this stage to really understand them because I was still a beginner trader and too inexperienced to properly understand their true meaning.

Fortunately, I started to lose a lot less and not only because I started using the stop loss but because I started to know myself better through trading.

That is how my trading journey started to shape and from a beginner trader I continued on to a journey of self-discovery.

Trading Courses- the path from beginner to intermediate trader. The journey finally starts to take shape

At that point of my beginner trader’s journey I started to trade the strategies that were taught to me in the last trading course.

Unfortunately, the lack of discipline combined with my fears made me fail again. So I went on the internet looking for new strategies that would work without understanding that it was not strategy that did not work, but my inability to cope with drawdowns.

Every time that I failed I threw myself deeper underground. My passion was enormous and so were my determination and desire to succeed.

So I spent all my free time studying everything related to trading researching one strategy after another without any tangible results.

This process made me feel like a small boat in the middle of the sea. I had oars and the strength to  row but in my trading journey I was without a compass and without a map that would give me the direction in which to direct my strengths.

row but in my trading journey I was without a compass and without a map that would give me the direction in which to direct my strengths.

My first mentor during my beginner trader’s journey

I started realising that I needed a mentor. Someone with more experience than myself who can tell me what I was doing wrong.

At a certain point in my beginner’s journey I became more aware of myself and started to admit that it was me who was to blame and not the various strategies that made me keep rowing in circles.

While browsing, I was fascinated by the articles of the technical analysis of a trader who in the trading environment was known as one of the best mentors. In half an hour over the phone with him I realised that to become a trader it would take a lot more time and dedication than I initially thought.

I also had to figure out what my personality was in order to know what kind of trader I am. To do this I would have to acknowledge my fears and take responsibility for my mistakes in order to move forward with my journey.

My mentor told me: “if you are willing to do all this then I can teach you but I warn you that it will not be easy”. I had no other choice, but I finally had a guide, a beacon that will illuminate my trading journey.

My mentor told me: “if you are willing to do all this then I can teach you but I warn you that it will not be easy”. I had no other choice, but I finally had a guide, a beacon that will illuminate my trading journey.

I accepted his proposal.

The course was not easy. Before I had time to realise, I was trading futures using exchange volume as an indicator.

I devoured this new approach in a short time using all the free time I had available including my lunch breaks (I was still working full time at this time).

Demo trading, tick charts and a full-time job

When the time came to apply the trading strategy in a Demo mode, the results were not as good as I expected. The strategy was based on lower time frames (actually using tick charts). That did not fit with my full-time job.

expected. The strategy was based on lower time frames (actually using tick charts). That did not fit with my full-time job.

I kept on wondering whether it was the strategy or myself, but I was almost certain it was me again.

Being in a hurry to make money I did not have the patience to be disciplined. I was still a beginner trader and was unable understand that money goes to the one that is patient and disciplined enough.

Another mentor, another trading strategy- coming closer to consistency

As I had done before, I set out again to look not only for a new trading strategy, but for a new mentor with a different strategy. My attention was attracted by an Australian trader who traded FOREX.

His strategy incorporated using only a 21 period MA and the 4H timeframe. It was a completely different approach to the markets.

The trading course was good. A trading plan was also provided, but the content was not great for a beginner trader. My mentor, I am sure today, was not a great trader or at least he kept some of the trading rules for himself.

I was disheartened by the course’s content but through that course I finally realised that my trading journey as a beginner trader was pointing towards price action using time frames higher than 4 hours.

My experience with the trading course mentioned above was a quantum leap forward.

Still a beginner trader? Chat rooms, private traders’ rooms and trading based on other traders’ advice

Now that I knew what to look for and after having gained more practice, it was not difficult to find a new price action course. This time was different. The mentor shared all his deepest trading experiences in the course.

Chat room for beginner traders- first disappointment

He also provided a video with an overview of the markets for beginner traders and every day there was a chart of the day with a trading idea. In addition, there was a chat room for all members where everyone could post their trading ideas and the mentor gave advice to those who needed it.

Many times in this chat room experienced traders placed their trade without explanation and without reason but only to show off themselves. This behavior was often detrimental to trading neophytes like myself because it was frustrating to see how easily they could trade while we trudged up the hill without receiving help from them.

Many times in this chat room experienced traders placed their trade without explanation and without reason but only to show off themselves. This behavior was often detrimental to trading neophytes like myself because it was frustrating to see how easily they could trade while we trudged up the hill without receiving help from them.

Sometimes I analysed a chart then I entered the chat room and I saw that others had opposite ideas. At that point I was stuck without knowing what to do. My fears began to surface. I was asking myself if I was wrong or are they were wrong? Every time the output was more confusion and a missed trading opportunity.

This course was so complete from the technical point of view that there were two complete trading plans provided: for aggressive traders and for conservative traders. But it did not help me to improve my results even if my technical background was complete.

What is important to notice is that I managed to limit my losses to only a few. I had good risk management and money management and enough discipline to never move my stop loss even an inch.

So what was I still missing?

The private chat room for beginner traders- another disappointment

I chatted to one of the very few seasoned traders that helped beginners in the chat room. On my birthday (by the way a great birthday present) he invited me to join him and a few other traders to teach us his strategy.

I followed him step by step and as soon as there was a good trading setup we immediately started discussing whether to enter the market or stay out.

The good news was that my equity line has risen in a short period of time and I have recovered all the losses I had in the past year and half. My mentor occasionally introduced some changes to the strategy.

It was during those times that I struggled to follow him sometimes.

The outcome or why the private trading room was not a good option for a beginner trader or any other trader

Even though I had written down the rules, it was difficult to follow them, because I was not paying attention to the details that invalidated the trades.

So why did all of this happen to me?

Because of those three things:

- the rules were not mine

- the strategy was a bit cumbersome

- the mentor was changing the rules frequently

Also when I found a setup, if my mentor did not give me thumbs up, I was always afraid that it was not a good setup and then I did not trade it. On the contrary, if I entered a trade, I was being stopped out….

Again the same song kept on playing on my mind:

“Was I right or was I wrong” and so ad infinitum…

The psychological evolution of a beginner trader

The next stop of my trading journey came naturally.

After learning and testing the technical aspects of the markets with poor results, I had only to start again to explore the psychological part- the one for which I was entirely responsible.

So, what were my emotions like when I was trading.

Fo the n-th time, after surfing the internet, I found a brand new mentor who mainly focused on the methods necessary to keep a trader’s emotions and fears at bay using a very simple strategy.

I came to realise that successful trading is 70% psychology and 30% trading strategy.

So I resumed my old trading plan and started keeping a trading journal. I called my journal “The Beginner Trader’s Journey” and that was another very important stepping stone in my trading journey.

I did everything in a simple and methodical way so that before entering each trade I can check my trading plan quickly. The purpose was to eliminate any doubts and emotions and stick to my trading rules.

Imagine the efforts I spent on following all these steps…

A LOT!

I was feeling I was finally on the way to financial freedom. I do not have the freedom to enter into any trade I want, but only in those that are ticking all the boxes from my trading plan.

Initially, it feels like being in prison. But now I’m aware that those bars, rather than limiting my freedom, act like a protection from myself.

AND IT STARTED WORKING!

A real trading example- from a beginner trader to an expert

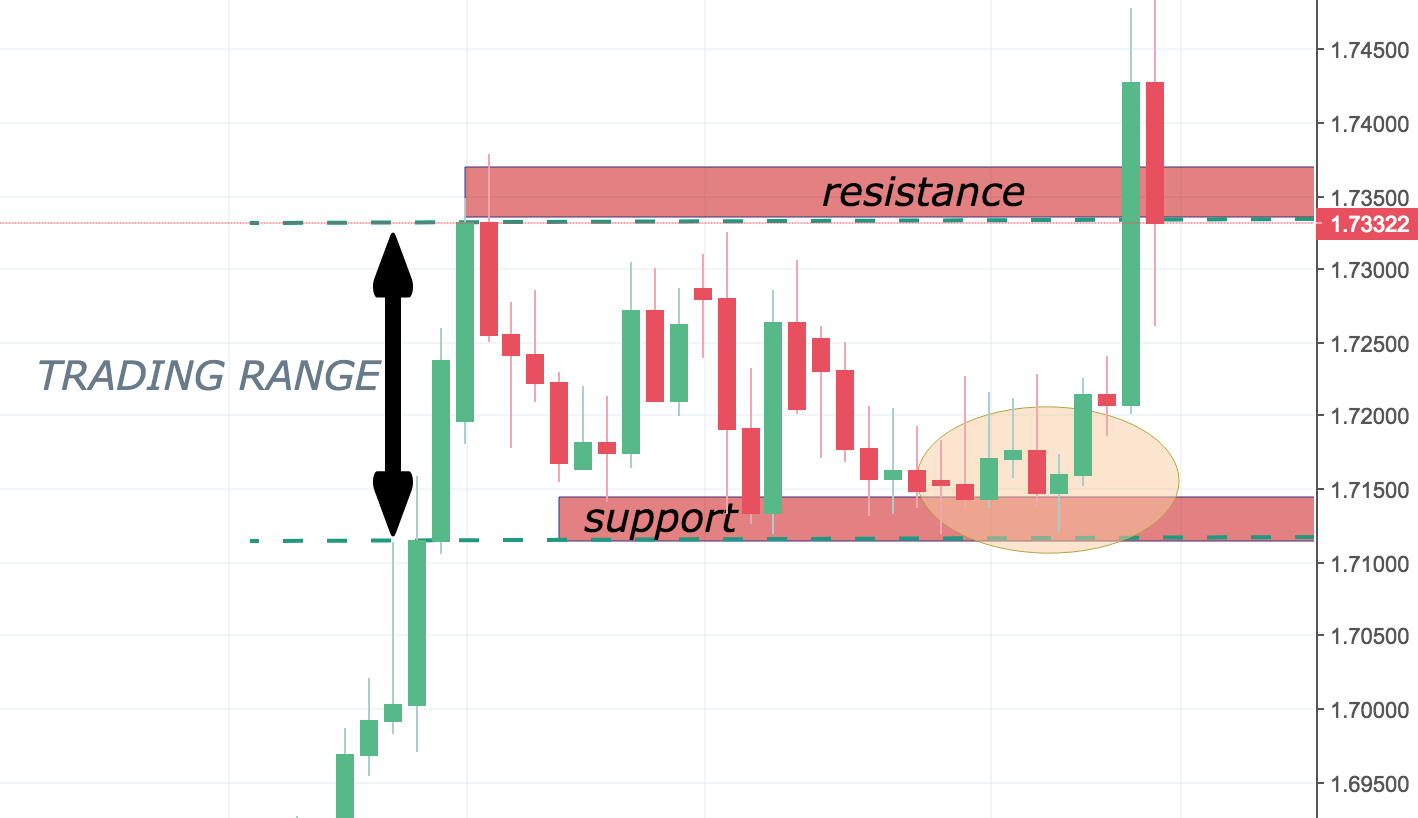

During my weekly analysis I saw that EURNZD was in a trading range and there was a lot of pressure on the lower range due to some bearish pin bars.

I decided to wait for a re-test and a potential pullback to enter a short trade. Instead, on the H4 appeared a succulent bullish engulfing reversal off the support and without consulting my trading plan I went long.

Only after a few hours did I realise my lack of discipline. But this was a good example.

I have finally started to notice my mistakes. I can proudly say I do not consider myself a beginner trader any longer.

Immediately the market came against me on the H4, and I felt frightened, then when price was close to the stop loss it reversed again until it almost reached 1:1 risk:reward ratio.

Then, the pair went down again towards the previous swing, drawing a new bearish and bigger pinbar just above the support level on the daily chart.

For me it was a new bearish signal and I decided to move my target to breakeven waiting for either the stop loss or the target to be hit.

THE TARGET WAS HIT FIRST.

Price continued moving in my direction (as you can see in the 4H chart above) but the nice thing about this trade was that I did not feel I was wrong. I had no regrets whatsoever and even better- I followed my trading plan and managed to get a winner.

Price continued moving in my direction (as you can see in the 4H chart above) but the nice thing about this trade was that I did not feel I was wrong. I had no regrets whatsoever and even better- I followed my trading plan and managed to get a winner.

That’s the power of having and following a trading plan. It helps you to immediately realise if you’re in or outside of your trading edge and the predetermined plan helps you to stay within your comfort zone.

I also took notice of it in my trading journal so I will always be on top of my game.

Possible trading distractions

Another thing is that during my weekly analysis of the markets I found some currency pairs that could have had a potential setup during the week. There were a couple of other trading setups (trading distractions) but I did not take any of those trades.

EURNZD was my only trade that week. I sticked to my rules and did well!

There was no one to compare with; no one told me what to do!

If things went wrong I would have been the one responsible. In this way I was able to isolate and analyse my fear.

My fear is the fear of missing out, as well. Don’t forget that I’m a mechanical engineer and I am used  to thinking in terms of certainties.

to thinking in terms of certainties.

In the past I’ve been a very rigid person. Now I have changed. It took me a lot of time and mentors, but after all those years of practice I have finally found a trading edge.

Colibri Trader advised me to open my trading diary and write down everything that was on my mind:

– every trade is unique,

– trading is a probability game not a certainty game

– Losses are not so critical; what matters is your long-term equity line

– a lost trade can teach you much more than a won trade or a no trade at all

We learn by making mistakes and doing nothing means not making any mistakes and therefore not learning anything practical.

Back to Demo trading- NO WAY

When I told my mentor about my latest trades and some of my trading hesitations, he advised me to start from scratch.

He told me to trade in demo mode.

My mentor also helped me to continue writing down my trading plan.

He told me to always aim at cutting losses quick and running profits run as long as possible.

Initially, I felt totally upset by these words. I wanted to continue profiting from the markets. One thing that he has helped me realise is that there will always be another opportunity.

If I want to stay away form my “beginner trader’s journey” I need to have the patience and desire to stick to only the best of trading opportunities.

Only one trade he said! Stick to it, as long as it is a winner!

I’ve already started to see the first results after being methodical with my trading plan so I trust that Demo trading will soon show me another side of trading before I decide to switch back to a live account.

Nobody said that you should be constantly trading on a live account. Maybe switching between live and demo (when you are in a losing streak) is the best way to go…

Final Words- Where is my journey as a beginner trader going to lead me now

Here my story ends but not my trading journey.

I can summarise it as follows:

– One needs to lose money to learn in trading (so make sure to lose as little as possible)

– Even if you are still a beginner trader, you must have a great passion, stubbornness, persistence, commitment, tenacity and patience to improve your trading skills

– It is not enough to just have a good knowledge of technical analysis

– We need to get involved, experience the market, have the courage and sometimes do mistakes in order to change our mentality and make it fit for trading

– find a good mentor (a really good mentor) and follow his advice; avoid all other people’s advice at all costs.

I don’t know where this journey will take me. I hope one day to get to be able to achieve my financial independence through trading but for now I will try to take one step at a time.

Patience, discipline and not jumping from one trading strategy to another are my mantra.

Maybe one day I will take another path and my journey will continue on another track different from trading. Who knows…

The only certain thing is that trading has changed me and will continue changing me because I am willing to do it for myself and the journey itself.

This reinforces the famous saying even more: we must travel not for the destination but for the journey itself.

P.S. Check out these 5 trading strategies with the inside bar

or just e-mail me at: admin@colibritrader.com if you have any questions. I would love to help 🙂

Good luck with your trading!

Colibri Trader

Nicely Articulated.. Learnt a lot from you Thank you Colibritrader for Getting such nice experience from your mentee.

Thanks for the kind words. Do let me know if you want to learn about anything else trading related

I would love to know more about Rubia your strategy.