How to Come Back After a Losing Streak- 7 Proven Strategies to Take You Back In Profitability

When trading, there are always going to be losing positions.

While this is common knowledge, in the heat of the moment, we often forget this.

Because of this, we sometimes trade poorly, as we allow the emotions to take over.

Emotion is one of the biggest pitfalls of trading.

If left unchecked, it will destroy your account.

Can you Avoid Losing Streaks?

Unfortunately, it is very easy to have a “bad streak” in trading.

Quite often, it is even self-induced, which is particularly painful to the trader.

In this article, I will explore how to come back after a losing streak, and not only that, but how to avoid them in the first place.

You will find over time that this is the key to becoming a consistent and successful trader.

Contents in this article

- Losing streaks #1: The first thing to understand about how to come back from a losing streak

- Losing streak #2: Why Confidence is Paramount and How to Build It

- Losing streaks #3: Notice what’s working and what is not

- Losing streak #4: Do some “grunt work”

- Losing streak #5: Focus on funding

- Losing streak #6: Some General Thoughts About How to Come Back From a Losing Streak

Losing streak #7: The first thing to understand about how to come back from a losing streak

A) Probability

The first thing you should understand is that the streak of losing trades that you might be dealing with is something that everyone has.

Even the pros, they have losing streaks.

Simple probability dictates that there will be losing trades, and sometimes more than a few.

After all, each time you place a trade, there is a 50% chance that it will move with you, and of course the same can be said about it moving against you.

B) Risk Managers

While professional traders have risk managers, keeping them from blowing up their accounts.

Each firm or prop shop will have its own limits, but as an example, they may enforce a maximum loss of 2% for each trading day.

By doing so, they limit the overall damage that can be done.

The biggest issue you will face and is a major component of how to come back after a losing streak is that nobody will stop you from blowing up your account.

If you are losing a lot, you must step away.

I believe this is the biggest determination as to who is profitable in the end, and who is not.

C) Time is the Healer

Unfortunately, this is probably the hardest part of how to come back after a losing streak, simply walking away.

Unfortunately, this is probably the hardest part of how to come back after a losing streak, simply walking away.

The amount of time is going to be different for everyone but sitting there and placing further orders will more than likely only offer more pain.

Get up.

Get away from the desk if you are losing several trades in a row, and reset somewhere by talking a walk, playing music, or simply doing anything else.

In fact, almost every blown account starts with sticking around when things are bad.

Why Confidence is Paramount and How to Build It

The biggest thing that will be missing at this point is confidence.

Beyond that, you can’t necessarily trust your own judgement, because “getting all my money back” is the first thought.

This is not the way to trade, and clouds judgement.

This then leads to more losses in a death spiral.

So, how to come back after a losing streak? Trade smaller?

Trade smaller and get some small gains behind you.

Simply put, if you are used to making $100 per trade, maybe you will be better off trading a much smaller position.

Try gaining something like $10.

It’s okay, because there will always be plenty of time to build up your confidence and position size as you get back to normal results.

This of course assumes that you haven’t blown it by sticking to the monitor and blowing up the account.

By having several smaller trades go your way, it does two important things.

- It helps build your confidence in a low pressure situation

- it also can point you in the right direction when it comes to market behaviour.

As you are doing better, you can gradually add to your position size.

Notice what’s working and what is not

Heat of The Moment

One of the easiest ways to come back from a losing streak is to make sure you understand what is going on.

I know this seems that it would be obvious, but in the end, there is a lot of confusion and “noise” in the heat of the moment.

Studies show that memory can be distorted when there is a lot of emotion attached to an event.

In fact, there is a good rule of thumb that a fellow trader once told me: “When I find myself getting angry about a position, I exit immediately.”

He also stated: “I know I can always get back in if it makes sense.”

Journaling

By journaling your trades, you have an idea as to what has happened as far as price action, the reasons why you got into the trade, and how you felt about.

It’s important to understand why you did the trade, and whether or not it makes sense later on, when you aren’t emotionally involved.

As an example, you might just notice that you have a poor track record trading rangebound markets.

If that’s the case, then you have learned something important: you shouldn’t be trading consolidation plays.

That’s fine, and the avoidance of losses will greatly improve your results.

You can think of this as “preventative medicine” for those losing streaks.

What is the Best Setup for You

Another benefit of the journal is that you can understand what the best set ups for you are.

This is where you should be looking for ideas and plays to get your mojo back.

By only trading the best set ups, you know how to come back from a losing streak.

Unfortunately, far too many retail traders don’t even keep a journal, let alone know what the best trades they do are.

Professional Trading Firms

By understanding the “internals” of your results, you have a good chance of being a better trader.

Most professional trading firms demand that their traders keep a journal, and many of them even have automatic journaling programs to keep track of what is going on during each day.

There is a reason for this.

If the pros do this, you can bet it works over the long-term.

Do some “grunt work”

This isn’t going to be an exciting suggestion, but it is a great idea.

When you look at the situation, you should know that there isn’t much point in trying to jump right back into the markets.

The Mental Game

After all, there is a reason you are losing.

(It is almost always due to the mental game, which as time goes by you will understand is the key to profits longer-term.)

Sometimes, you need to do a little “housekeeping.”

In fact, I submit that it’s the details that make the difference in the end between a good trader, and a great one.

Always Invest in Research and Education

This can be a lot of different things.

As a trader, your education never ends.

Perhaps you should take a day or two to do research.

It could be building a system, back testing your favourite set ups again, in a way to build that confidence.

The ability to statistically see the results that you can expect over time is going to be a great salve for what ails you.

The markets are a statistical game.

Reset the Charts

Another idea is going to be resetting your charts.

Look at them with “fresh eyes.”

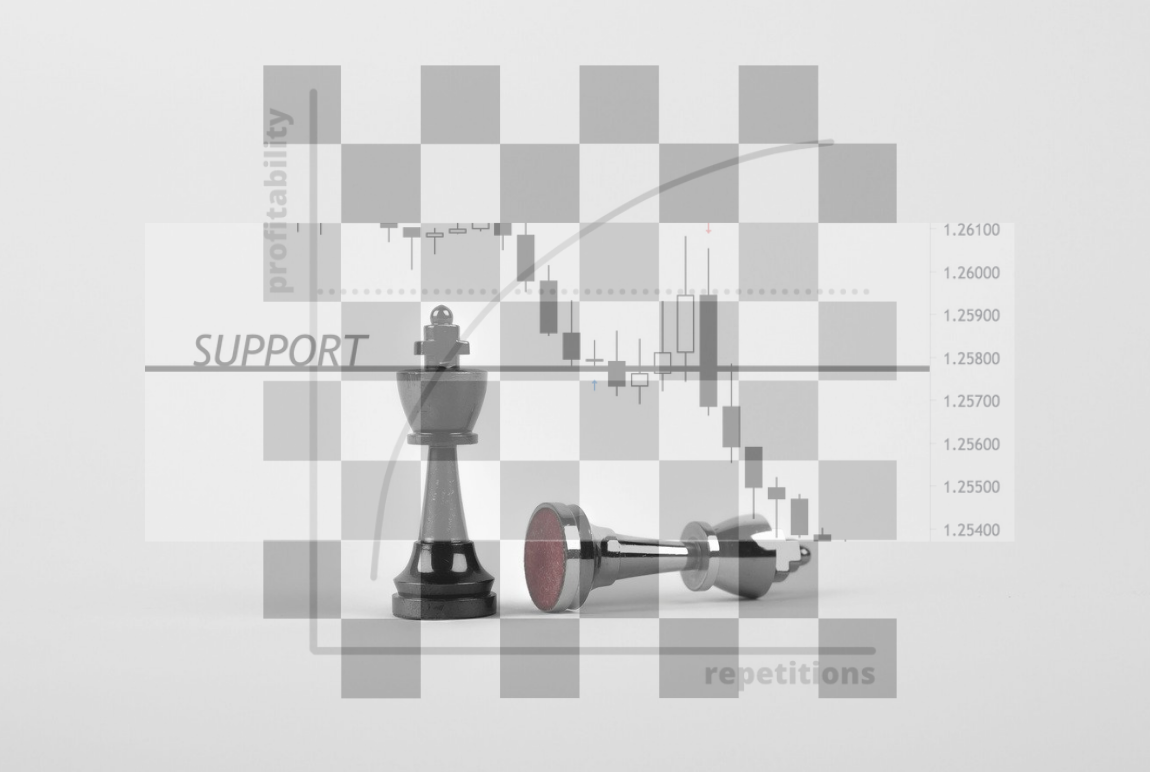

The thing that most traders do is set their lines of support and resistance on a chart and leave them there.

At this point you should take a look at these lines and markings on your platform and redo them.

This allows you to look at the market with a fresh perspective.

This can be crucial as you may find your previous analysis to be moot.

Markets will change behaviour quite often, and various support/resistance levels will become less important.

Do Some Reading

Another great idea is to do some reading.

Education for traders never ends.

Sometimes you are going to be more productive, at least for a time, reading about trading ideas, research, systems, and psychology.

This will be more productive than risking any money.

It does a couple of things for you

- It allows you to get away from an emotional situation.

- Secondly, it allows you to get some things done that can help you longer-term.

It allows you to get a bit of traction for your own benefit, without any risk.

It is a good start.

Do it!

Focus on funding

One of the biggest determinations of success is funding.

While you can certainly have success with a smaller account, the reality is that a 20% return on a $50,000 account is much better than a $2,000 account.

The idea of compounding interest will of course continue to add up.

The ability to withstand a lot of volatility can be built up by having “extra padding” in the form of more underlying capital.

This is where a lot of traders get it wrong.

If It is Too Good to Believe It, It is Probably Too Good to Believe It

Traders read an advert, think that depositing a few thousand dollars into an account and simply buying and selling currencies will make them rich.

The reality is that a lot of professional funds are still looking to increase the assets under control.

The fund has the ability to take on more risk, but in a more controlled manner with more capital under management.

Retail Traders

As a retail trader, you should be looking to increase your funding, as the same applies to you.

Yes, we all go into trading with the idea of retiring on a beach or something like that.

However, the reality is that most traders don’t have the necessary capital to do so right away. (If fact, if they did, they probably won’t be looking to risk it trading.)

This is where a little ingenuity comes into play.

You need to find more money.

Do More Side Work

Perhaps you can add more to your account each pay check, or even look to do some side work in order to build that account up.

Much like the “grunt work”, this is something that eventually will pay off.

The reality is that you need to be able to know how to come back from a losing streak, but you also need to be able to do so financially.

The more money you have in the account, the better off you will be, as the percentage risked on each trade can be relatively smaller.

This is of course presuming you know what you are doing.

Otherwise, you should not be trading at all!

Some General Thoughts About How to Come Back From a Losing Streak

No Universal Solution

While there is no “be all, end all” when it comes to a solution, there are a few things that will always be true.

Getting away from the markets for a few hours/days/weeks is without a doubt the most important thing.

When you are emotional about trading, nothing good can come of it.

The reality is that the trading can be erratic afterwards, and even if you do make your money back, it only sets you up for a bigger loss the next time.

Treat Trading as a Business

The business of trading, and it is a business, is one that takes a lot of work.

In fact, a lot of what happens as a result is whether or not you treat it as such.

A lot of the dreams of trading don’t match up with the reality.

There is a reason why so many people wash out, they aren’t willing to put in the work.

The losing streak is just a part of the business.

In the end, it comes down to whether or not you can make more on the whole than you lose.

That’s it, that’s the secret to trading.

While it sounds a bit curt, it’s the truth.

Treat Trading Like You Were Running a Restaurant

The markets are always going to be hard to navigate.

However, the mental game is something that makes all the difference.

The ability to understand what is going on through a losing streak is crucial, and you need to have a statistical advantage over the longer-term.

The knowledge of expectancy is crucial, just as all of the other “peripherals” that you can do to increase your business and strengthen it.

Think of it this way: If you owned a restaurant, and had a week where you lost money, would you throw it all away?

No, you would not.

This same restaurant might make money 90% of the year.

You understand that over the longer-term, the restaurant makes money.

You need to understand your trading business in the same manner.