Futures Trading Strategies- The Ultimate Guide

In this article I will introduce you to the peculiarities of futures trading before we move on to the futures trading strategies part.

Understanding what futures trading strategies are will give you an idea of the various ways they are used.

Futures markets are liquid which makes them a good trading choice for beginners.

There are definitions of what the futures are, but I will explain their purpose in details.

No need to burden yourself with definitions, we are traders after all.

And traders are ultimately interested in learning the best ways to extract profits from financial markets not just dry theories.

Contents in this article

- Why Are Futures Contracts So Useful?

- Futures Trading Market Types

- Futures Contracts – Things That Matter

- Futures Trading Strategies #1: The Butterfly Futures Strategy

- Futures Trading Strategies #2: NIFTY Breakout Trading Strategy

- Futures Trading Strategies #3: Wyckoff Market Structure Strategy

- Futures Trading Strategies #4: Busy People Daily Timeframe Strategy

- Futures Trading Strategies #5: Adapted Moving Average Strategy

- Futures Trading Strategies Conclusion

Why Are Futures Contracts So Useful?

For example, I have a warehouse full of firewood and I want to sell it.

However, heating season is not yet underway and I do not want to sell it at the current, low price.

But I am neither Nostradamus nor I have a time machine.

What if the price is not high enough in the future to have any profits.

Now I can offer a futures contract where the exact price is negotiated with some other buyer.

This buyer will take the firewood at the time and price specified.

Now, with a futures contract, I do not have any market price risks.

I know the exact price I am selling at.

The buyer also hedges against possible insane price surges and benefits from the future contract.

Therefore we all hedge against uncertainties that the future always carries.

Before we proceed to the futures trading strategies, let’s have a look at the futures market types.

Futures Trading Market Types

Selecting the asset under the futures contract is a very important decision.

The assets behave differently and will require you to adapt your strategy accordingly.

Futures are mostly found on two types of broad markets:

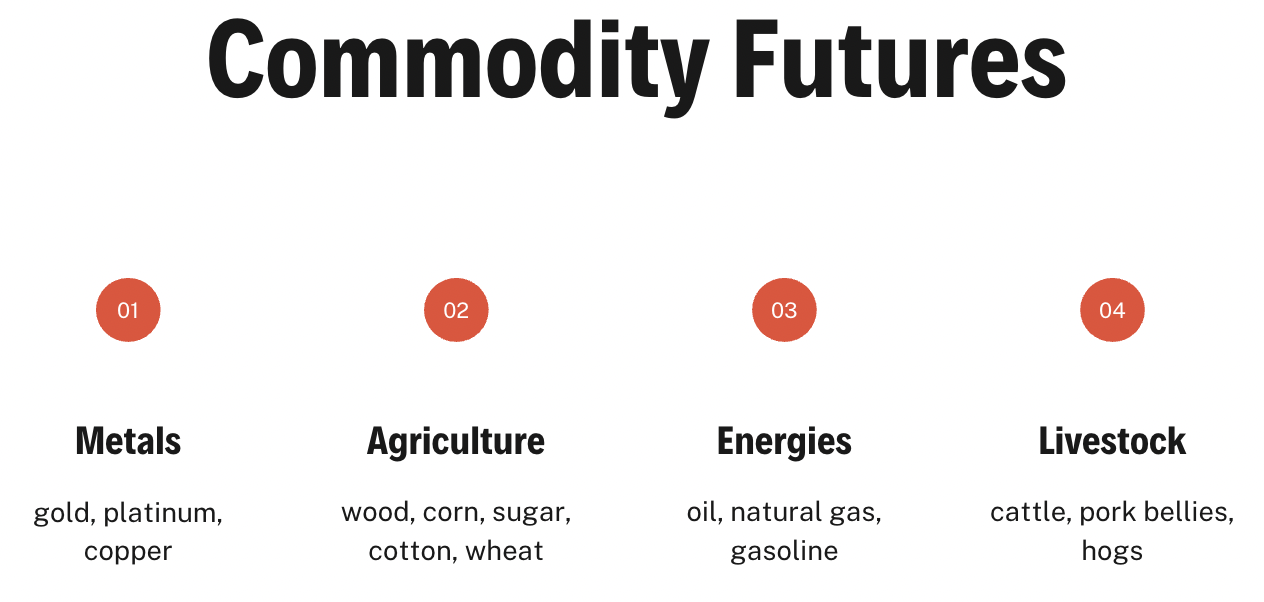

Commodity Futures

- Metals like gold, platinum, copper

- Agriculture products like wood, corn, sugar, cotton, wheat, etc

- Energies (oil, natural gas, gasoline…)

- Livestock (cattle, pork bellies, hogs…)

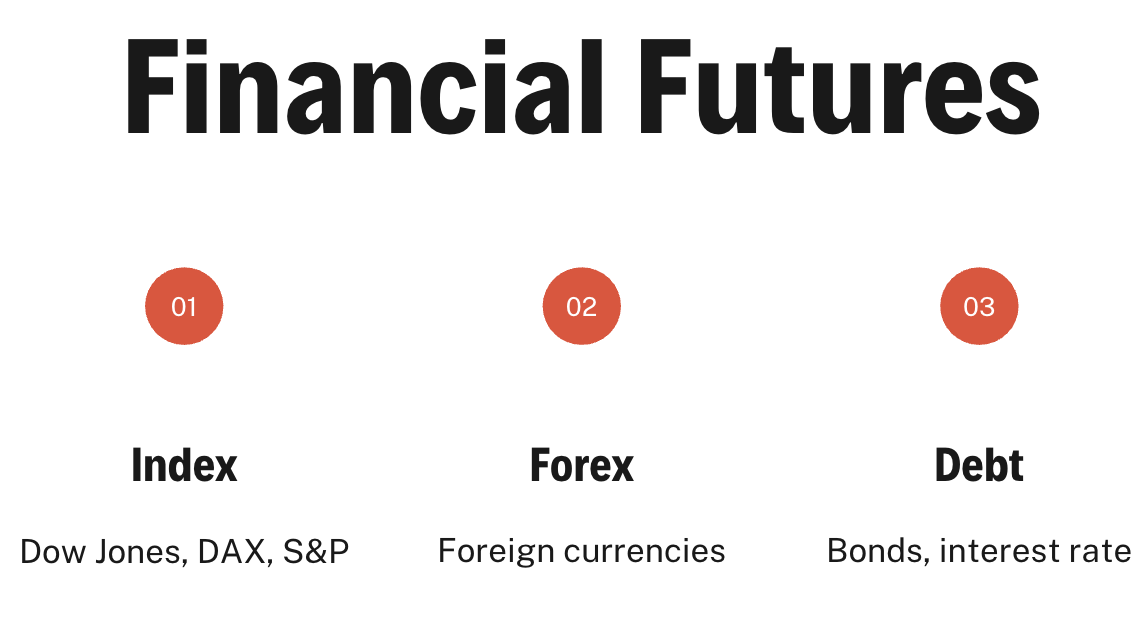

Financial Futures

- Index Futures like ES (S&P 500)

- Forex Futures

- Debt related like Bonds, interest rate

Now, all these assets can have seasonalities, react differently to each other, to news, policy changes, world events, etc.

Just knowing your assets can set your futures trading strategy right up fundamentally.

Be aware that not all parties using futures contracts are manufacturers.

Most of the time speculators, investors, and other parties not holding the goods add more liquidity in the futures market.

They all make or lose money when the spot market price changes.

Choosing CFDs or Futures

To most retail traders CFDs are the prime choice.

If you are not familiar with CFDs, they are just enabling you to trade any assets in small quantities.

They also give you the ability to trade with higher leverage and to go short (unlike stocks).

Since many brokers offer CFDs, finding one with vanilla futures is not very common.

Incorporating futures contracts in your futures trading strategy can also be done through a CFD.

Here are things to consider when choosing between the two:

CFDs

- Do not have settlement date or price

- Broker made conditions

- Wider spreads

- Better for small value trades

- Smaller contract sizes

Futures

- Traded on exchanges with more transparent information

- A broker is just an intermediary

- Higher fees and commissions

- More liquid for commodities

- More assets to choose

- Tax benefits

Futures Contracts – Things That Matter

Before we move on with strategies, be sure you are familiar with the broker and the exchange margin requirements.

These can influence the strategy you want to employ.

- Symbols like ES represent S&P 500 index futures market- understand what the symbol covers.

- Initial margin – how much money you need to trade 1 futures contract.

- Maintenance margin – how much do you need to keep the contract after the day session ends.

- Intraday margin – how much money you need for 1 contract before the day session ends.

- Value of a tick – every futures has a tick (the smallest price change possible) value specifications.

- Your broker of choice trading costs such as commissions.

- Trading sessions – when the market opens and closes.

Now, on to the futures trading strategies!

Futures Trading Strategies #1: The Butterfly Futures Strategy (Advanced)

This is one of the most used futures trading strategies

It is with integrated hedging.

Sounds cool and it could work great, but we need to understand how to set it up.

When we long one asset and short another we call that spreading, or spread trading.

We know futures have expiry dates.

Longing and shorting a single futures contract at different expiry dates is called a Calendar Spread.

Spreading can be done in many ways, but we will stay with a single asset for the Butterfly.

The Butterfly Preparation

For this example, use the TradingView platform.

Type “I” symbol in the futures category.

The “I” represent EURIBOR 3 month futures on the ICE exchange.

EURIBOR is the interbank interest rate, so we are trading financial futures.

The European interest rate is negative now so we see an above 100 level rate (100.550 in Oct 2021).

The price will go up if the interest rate falls and vice versa.

Now, if we combine different expirations and trade directions we can create a very different chart.

The Butterfly Hedge

Add current contract in front (symbol I1!).

Then short (minus) two next contracts and then long (plus) one but two months after (December or IZ2021).

Now the chart looks like this:

With COVID-19 in place we have a perfect ranging strategy setup and we are hedged against many risks.

We are hedged against country risks, events, stock market shocks, currency devaluation, tweets, etc.

Butterfly Trading

Of course, when we have ranging price action we employ a mean reversion futures trading strategy.

Or, in other words, buy on the low (green line) and sell on a high (the red line).

You want to bet the price will come back at the mean level.

Make sure to use a lower timeframe to pinpoint a better price.

You can combine more expiration dates and put more weight (short or long two times) on certain futures.

Futures Trading Strategies #2: NIFTY Breakout Trading Strategy – Holy Grail

With this futures trading strategy, I will use a few indicators.

Essentially this is a purely technical analysis strategy commonly used and fine-tuned by many professionals.

The timeframe will be intraday, so we close all trades before the session ends.

This also means we pay attention to the intraday margins.

Holy Grail Setup

Open your TradingView and add ADX (14 default) and 20 periods Simple Moving Average so it looks like this:

We will use the ADX to filter our entries and the 20 SMA to gauge where we enter after a pullback.

Execution Example

As you can see, our first trade failed soon after we had opened it.

Since our take profit target is 1.5 times the stop loss (risk), we had to take the loss.

The second long trade condition match happened on 27th September marked with a green circle:

We immediately place a pending buy order above this candle

After a small drawdown, we reached our 1.5 take profit target.

Futures Trading Strategies #3: Wyckoff Market Structure Strategies

This is a famous set of strategies that involves supply and demand levels.

Shortly a supply zone is defined by the last bullish candle before a major price drop.

It looks like this:

The blue arrows mark the open price of the last bullish (small green) candle and the wick of the red candle.

Using these levels we can define the supply zone (red zone).

The demand zone is defined using the same logic, we mark the last bearish candle open and lowest low.

To learn more about supply and demand zones, check out one of my Supply and Demand articles.

There are 4 segments of this futures trading strategy that can give you many combined ways to trade.

Actually, it is 4 strategies in one.

Supply and Demand Continuation Patterns

I will give you an example of a continuation trade on an already established trend.

Let’s call this a Rally-Base-Rally structure pattern.

Rally-Base-Rally

The pattern emerges on all assets except unlikely with the ranging Euribor butterfly we presented earlier.

After all, this futures trading strategy works when the asset is trending.

This trend has two bases marked with two arrows and 3 rallies (rockets).

The demand zone is formed on the bases, telling us the price will continue back up from the demand zone.

Following this logic place your stop Loss below the demand zone and trade the breakout.

Supply and Demand Reversal Patterns

These reversal patterns do not happen in trending markets.

You can always check a higher timeframe if the market is ranging or trending.

Let’s start with the Drop-Base-Rally pattern.

Drop-Base-Rally

After a sharp drop, look for a base or small consolidation area.

Check if a higher timeframe show ranging conditions.

BTC on hourly timeframe:

- Check if a higher timeframe does not show trending conditions.

- Is there a strong rally after a base? If yes then,

- Draw a demand zone

Bitcoin on M15:

Here we have a drop (lightning), then a base that formed a demand zone (sideways arrow), and then the rally (rocket).

This is a reversal pattern, so enter when the price is going out of the demand zone (rectangle).

Keep your stop loss below the zone

Another example:

Again, always wait for a sharp drop followed by a base and a strong rally before you draw the zone.

Rally-Base-Drop

Similar to the above drop-base rally pattern, we use a supply zone and expect a reversal.

Again, we look for a ranging market on a higher timeframe.

If you want to use a 15-minute timeframe, check the how M30 looks like.

Then:

- Look for a sharp upward move that is met with resistance.

- Wait for a drop after a base

- Form your supply zone

- Wait for the reversal

Here is how it looks like on a 15-minute chart on current Gold futures:

Pay attention to the mirror zones that could pinball the price back and up.

Here is an example where we got a rally-base-drop setup, but only one trade got to the target (take profit):

This is because there is a demand zone formed.

The zone pushed back our trade just shy of take-profit level.

In such conditions, place your take profit before the zone.

Also, shorten your stop loss, you need to have a 1.5 RR (risk to reward).

This completes the Supply Demand zone strategies and we move on to one that is very easy.

Futures Trading Strategies #4: Busy People Daily Timeframe Strategy

As the name applies, this is on of those futures trading strategies that does not require you to sit in front of the charts.

It is also completely driven by indicators so every signal is objective.

You will need just a few seconds per asset you trade to manage this strategy.

Every day before a day session close, look at your charts and you are good to go.

Therefore, this futures trading strategy uses a daily timeframe and three indicators you can easily find on TradingView.

Before we move on, there is one crucial ingredient you need to have.

It is a boring one, but part of wisdom – patience.

The daily timeframe (1D) requires you to wait maybe even months before the system lines up for a signal.

Of course, If you trade multiple markets, you will have multiple signals.

Indicators setup

- The first indicator will be a 200 period EMA, my favorite general trend filter.

The price can be above or below the line, and we will trade only in one direction based on that condition.

Later on, I will tell you the rules.

- Next, add the Supertrend indicator.

You can easily find it in the TradingView built-in indicators list now.

Leave it to the default values, it should be 10 ATR length and 3 Factor.

- The final component is well known Stochastic indicator.

The stochastic oscillator will be used to generate signals but also to manage where we put stop loss.

Change the settings on the Stoch to 14,3,3.

The layout should be like this:

Futures Trading Strategy Rules

This is essentially a trend buyback futures trading strategy.

Since we follow the main trend, the 200 EMA will divide downtrends and uptrends.

- When the price is above the 200 EMA open only long trades and vice versa.

- Also, follow the Supertrend signal direction in the same way.

Buy when Supertrend has switched green and only short when it switches red.

- Finally, the Stochastic oscillator generates a short signal when the line cross down and the opposite for long.

Now here are examples of how this futures trading strategy generates signals on the EuroFX futures market:

Note that there is one trade that failed, can you spot it?

In the next section, I will explain where to put stop loss.

Risk Management

Trade 1% per trade of your balance relative to your stop loss.

Now, to find an adequate long trade stop loss level, find the lowest level of the stochastic before the crossover.

Then, use the lowest low of the candle that aligns with that stochastic low.

This is your stop loss level.

Here is how it looks in practice:

If the previous candle low (wick) is too high to have a reasonable stop loss, use the lowest low before the crossover:

Use the candle marked with a check symbol.

However, even this trade was an unlucky loss, keep repeating this method.

Feel free to refine this futures strategy using different stop-loss levels.

One interesting idea could be to avoid trade signals in the overbought or oversold area of the stochastic.

Futures Trading Strategies #5: Adapted Moving Average Strategy

Certain markets do not respect the Moving Average futures trading strategy you have adjusted on other assets.

Sometimes even your favourite asset starts to misbehave.

While those times will test you and your strategy’s resilience, it can be very easy to adapt when that happens.

I present you with an easy trend-following strategy that works on any market, including futures.

The concept uses engulfing candle patterns and price action patterns to spot continuations after a pullback.

Now, let’s see what indicators you need to mix up.

Indicators Setup

Moving average is the only indicator you need if you want to spot engulfing pattern yourself.

If not, there is an indicator plugin in the TradingView platform.

Just do not expect it to work perfectly.

Now, set your target timeframe, it can be anything you like.

Lower timeframes will generate more signals of course.

You can choose 50-period EMA and start from there.

Adapt the period settings so the EMA acts as a support/resistance in a trending market of your choice.

Here is an example, this is 36 period EMA (blue line) on Copper futures:

I have added engulfing pattern recognition too (arrows).

Now the 36 EMA is better than 50 EMA because it follows the pullbacks closer and acts as a support line.

Here is the same chart with 50 EMA:

Notice that the right part of this trend does not come close to the line for the pullbacks to be valid signals.

Futures Trading Strategy Rules

- Visually adapt your EMA period to reject the pullbacks as precisely as possible.

- Enter after engulfing candle pattern in a pullback closest to the moving average.

- Only long on an uptrend and only short on a downtrend.

Here are examples of a long and short entry pullback series:

Notice that we have only picked the entries closest to the moving average as possible.

Risk Management

Placing your stop loss and take profit is defined by the price action levels.

Unlike previous strategies, where you place them is subjective.

Still, make sure you follow these rules:

- Do not place take profit above the previous resistance/support level.

- Do not place stop loss too far away from the MA.

- Aim to have a reward to risk ratio above 1 and not above 1.5.

Applying the Risk rules, out of those 3 short entries, only one had a reasonable RR.

It is because support levels are too close:

Also, from those 3 long entries, only 2 had a reasonable RR.

Futures Trading Strategies Conclusion

Futures markets have specifics that make them very good assets you can combine.

On of those futures trading strategies presented in this article- the Butterfly strategy is just one example of how they can be combined.

Options are another derivative instrument that can offer similar strategies and endless variety.

However, CFD trading is directional, you do not have much room to make hedging strategies.

In other words, in directional trading, you have to be right.

Futures are probably easier to comprehend than options, and that is why beginner traders like them too.

This said, use the above strategies to create even better trading systems.

Start with the one you like and build from there.

With a strong will to learn and test, making it to the top of this game is quite probable.

Happy trading,

Colibri Trader