Best 10 Crypto Trading Strategies

From all of the crypto trading strategies, I have narrowed this article to 10 of the best.

The crypto field is broad, but let’s try to concentrate into 10 of the best ways to trade with cryptocurrencies.

Don’t forget to download the crypto trading strategies cheat sheet.

Contents in this article

- Crypto Trading Strategy #1 (Long-term trading)

- Crypto Trading Strategy #2 (Short-term trading)

- Crypto Trading Strategy #3 (Scalping)

- Crypto Trading Strategy #4 (Trading with Price Action)

- Crypto Trading Strategy #5 (Buy the Dips)

- Crypto Trading Strategy #6 (Trading with Supply and Demand)

- Crypto Trading Strategy #7 (Moving Average Crossover)

- Crypto Trading Strategy #8 (Algo Trading)

- Crypto Trading Strategy #9 (Trading with Divergences)

- Crypto Trading Strategy #10 (Fading Trading)

- Bonus: Crypto Trading Course

Crypto Trading Strategy #1 (Long-term trading)

It is hard to define what long-term crypto trading is.

For a field that has not been around for ages, long-term trading has a different meaning whatsoever.

I am not a big fan of working with precise terms when it comes to trading cryptocurrencies.

For the sake of this article, I will use long-term trading for anything above 1 month.

Usually, long-term trading is investing for years, but considering the volatile nature of crypto, I would say anything above 1 month is long-term.

The strategies explained below can all be used for long-term trading.

Crypto traders trading long-term are using anything from price action to moving averages.

Therefore, there is no rule set in stone of which long-term crypto trading strategy is the best.

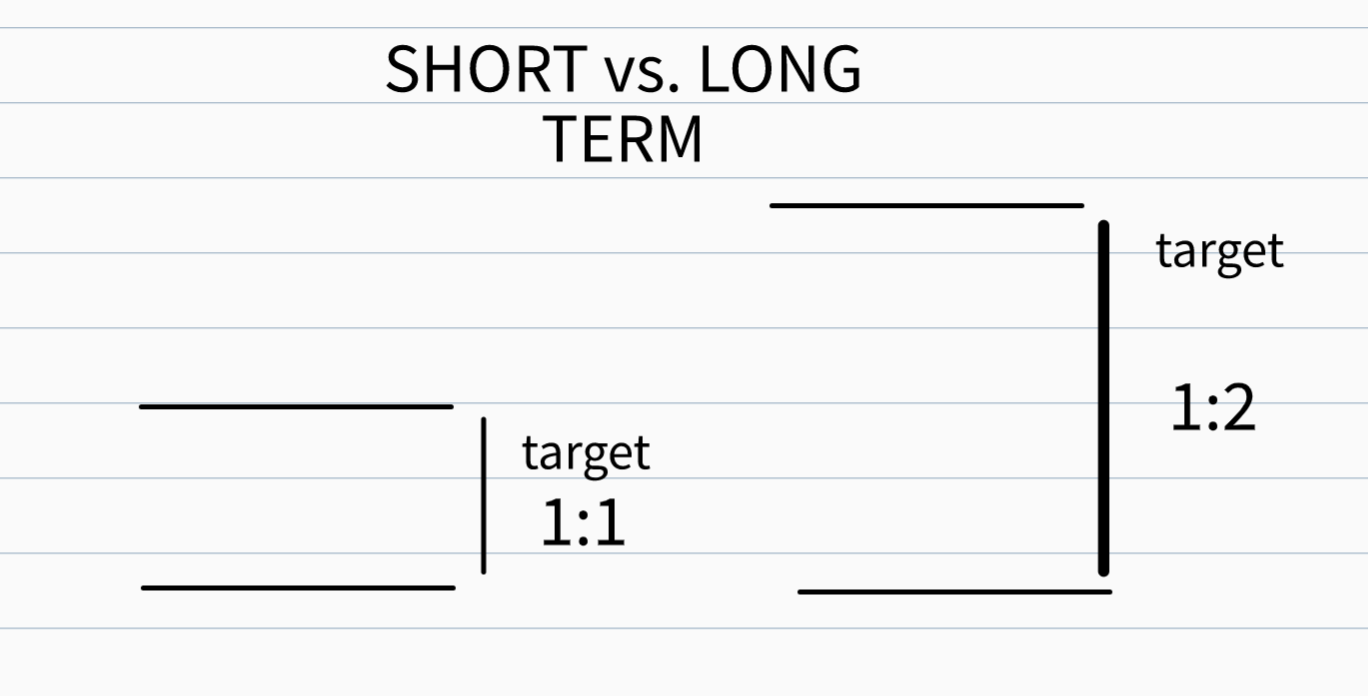

Crypto Trading Strategy #2 (Short-term trading)

Very similar to long-term trading strategies, short-term crypto trading strategies follow the same logic.

Anything below 1 month I would call short-term trading.

Usually between 1 day and 1 week is considered as an average timespan of a short-term trading strategy.

Crypto traders employ different trading approaches when it comes to short-term trading and they could be anything from price action to supply and demand trading.

The major difference between long-term and short-term crypto trading is the risk factor.

Usually long-term trading strategies might use a larger stop-loss contrarily to short-term crypto strategies.

Trading targets tend to be tighter when it comes to short-term trading.

Any cryptocurrency can be traded short-term, but the ones that are favourite amongst traders are the more liquid ones.

Reason being is that more liquidity offers better filling in rates and less slippage.

Crypto Trading Strategy #3 (Scalping)

Going one step lower, scalping strategies are day trading strategies which enable the crypto trader to go in and out of a trade quickly.

The trading timeframe here is mostly within the same day.

The trading targets are usually very small and stop losses, too.

Scalpers enter and exit their positions in a matter of minutes.

This means there’s almost no chance of a run up or down.

You’ll lose or gain small profits instead of huge sums.

With enough wins, scalpers can make significant profits over the course of a week

Crypto Trading Strategy #4 (Trading with Price Action)

I have numerous articles on price action on my blog.

They are mostly about FX and Indices, but crypto trading is not an exception.

Two of the most popular ways to see price action trading is through candlesticks and support and resistance levels.

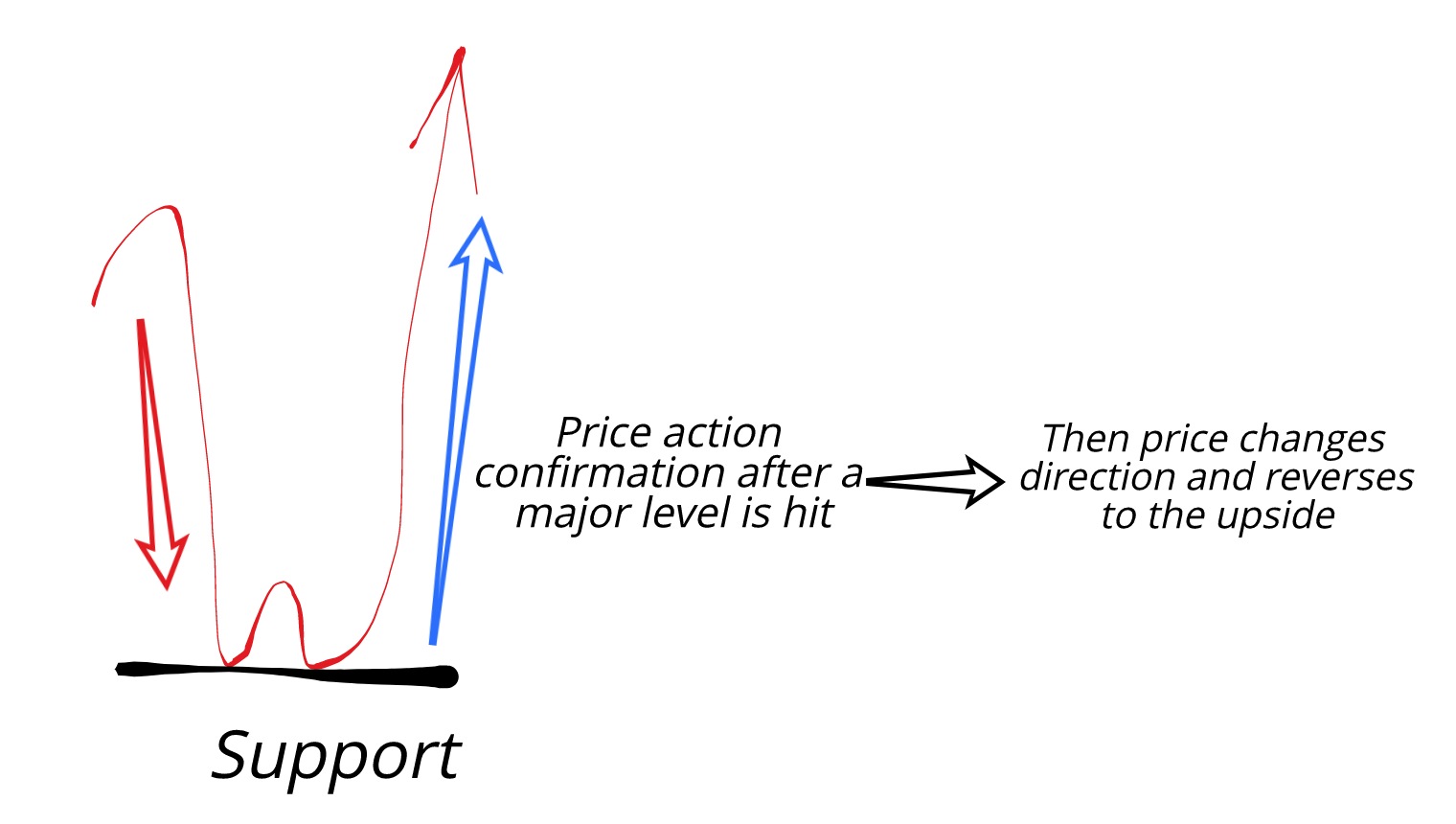

Here is an example of a pin bar on a support level.

This is considered to be one of the best candlestick patterns to go long or short.

Here is an example of a LONG setup:

Here is an example of a SHORT setup:

These is just one candlestick that traders are using.

But there are a lot of other candlesticks that price action traders do look for.

Some of the most popular candlesticks that crypto traders are looking for are:

I will not go into much details in this article, because this is not the point.

Just to recap, what price action traders are looking for are usually candlestick patterns in the context of a a support or resistance.

Here is an article that will walk you through the basics of support and resistance.

Crypto Trading Strategy #5 (Buy the Dips)

Buying the dip is one of the most popular crypto trading strategies.

It is so popular because it is:

A) Simple

B) Having a great risk profile

Usually, when buying the dip crypto traders are looking for 15-30% drop in prices or more to buy into an uptrend.

There is no set-in-stone rule and probably as many strategies as traders using them, so common sense is what most crypto traders would be using.

Usually these price drops occur after a news headline hits the wires that negatively affects cryptocurrencies.

Some of the strategies that crypto traders might use are mentioned in this article.

It is not uncommon for traders to combine a drop in price with:

1) Price Action Crypto Strategy

2) Moving Averages

3) Indicators

These are just some of the methods that cryptocurrency traders are employing to help with the timing.

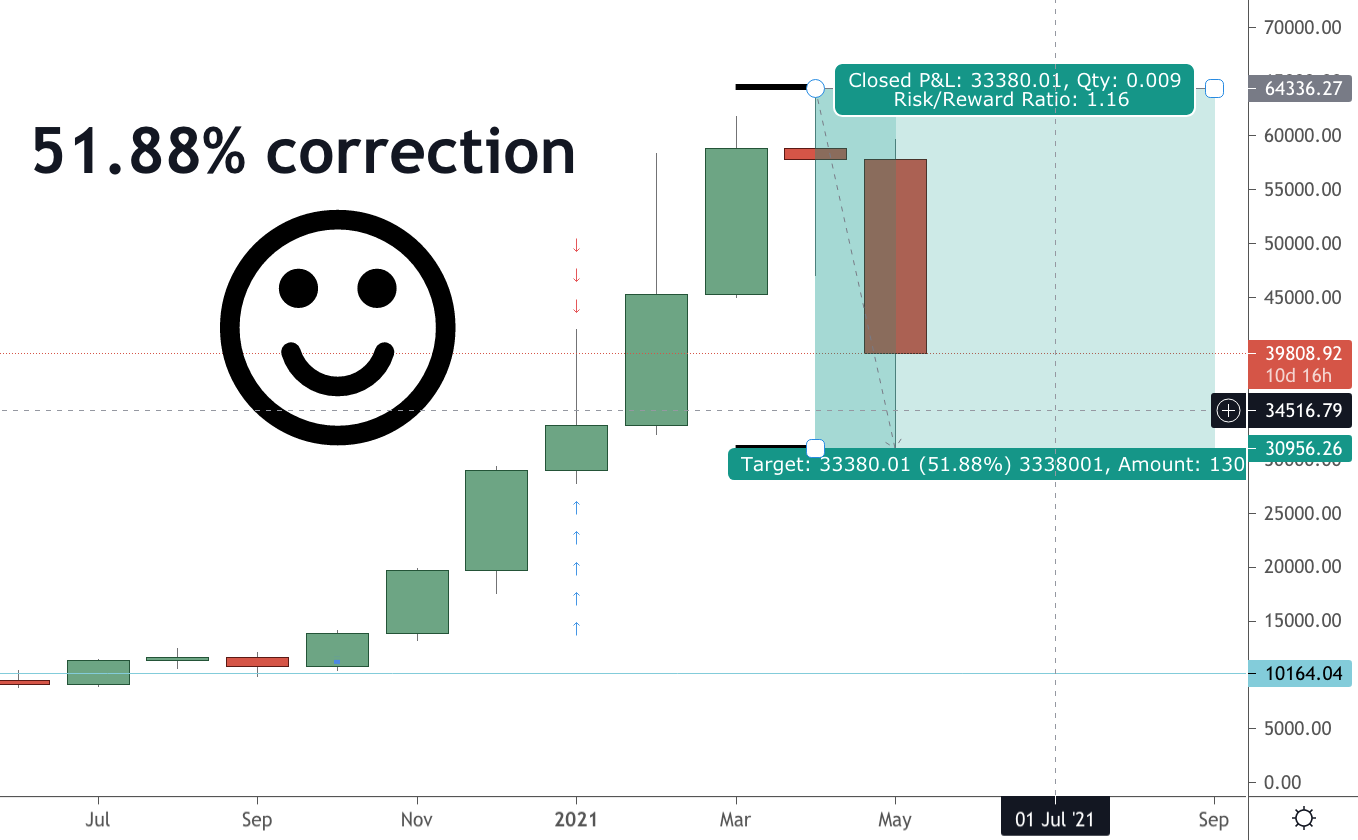

Here is an example of a recent dip in bitcoin prices (BTCUSD):

As you can see from the chart above, the price went down over 50% from top to bottom.

There is no certain way to know with how much will price drop and hence a lot of traders are using past levels of support as an indication.

Here is another example of a previous dip on Ethereum (ETHUSD)

You can never be sure how low prices will go before they turn.

So be careful!

Crypto Trading Strategy #6 (Trading with Supply and Demand)

I have written on Supply and Demand extensively.

Check out some of my past articles covering:

A crypto trading strategy using supply and demand levels is no different.

In a nutshell, supply zones are more broad than a resistance line. They are very similar to resistance zones.

On the other side, a demand zone is a broad area of support, just like the image below.

In the chart above you can see a supply zone or in other words a very broad support level.

It is also a level concentrated in buyers.

As you can see every time price approaches the supply zone it quickly jumps back up.

On the other side, here is a chart that shows both demand and supply zones:

When it comes to trading cryptocurrencies, using supply and demand zones is one of the best way to enter in a long trade if you are looking to buy the dip.

This together with moving averages is possibly one of the most widespread crypto trading strategies out there.

But let’s move on to the next strategy now.

Crypto Trading Strategy #7 (Moving Average Crossover)

Trading cryptocurrencies with moving averages is another very popular method of trading.

Two of the most popular crypto trading strategies with moving averages are the Golden Cross and the Death Cross.

Let’s have a look into those.

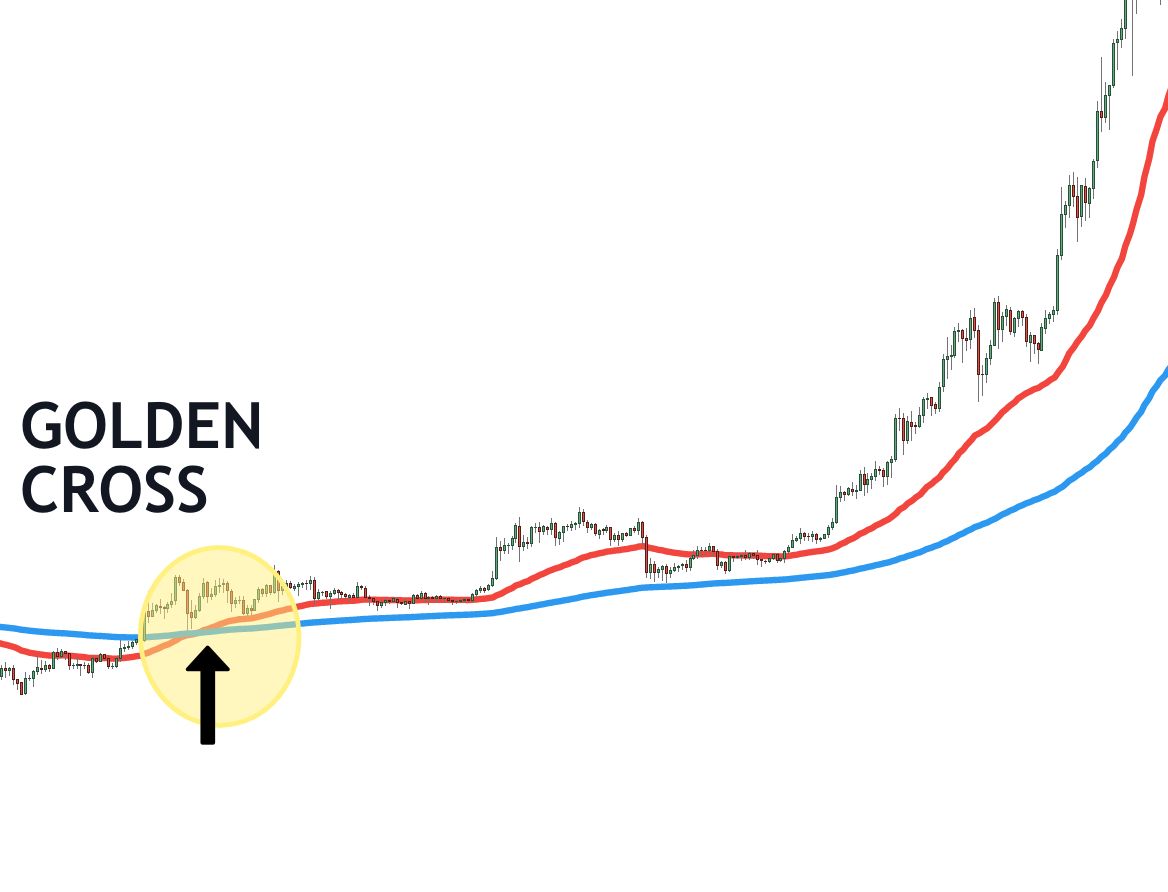

The Golden Cross

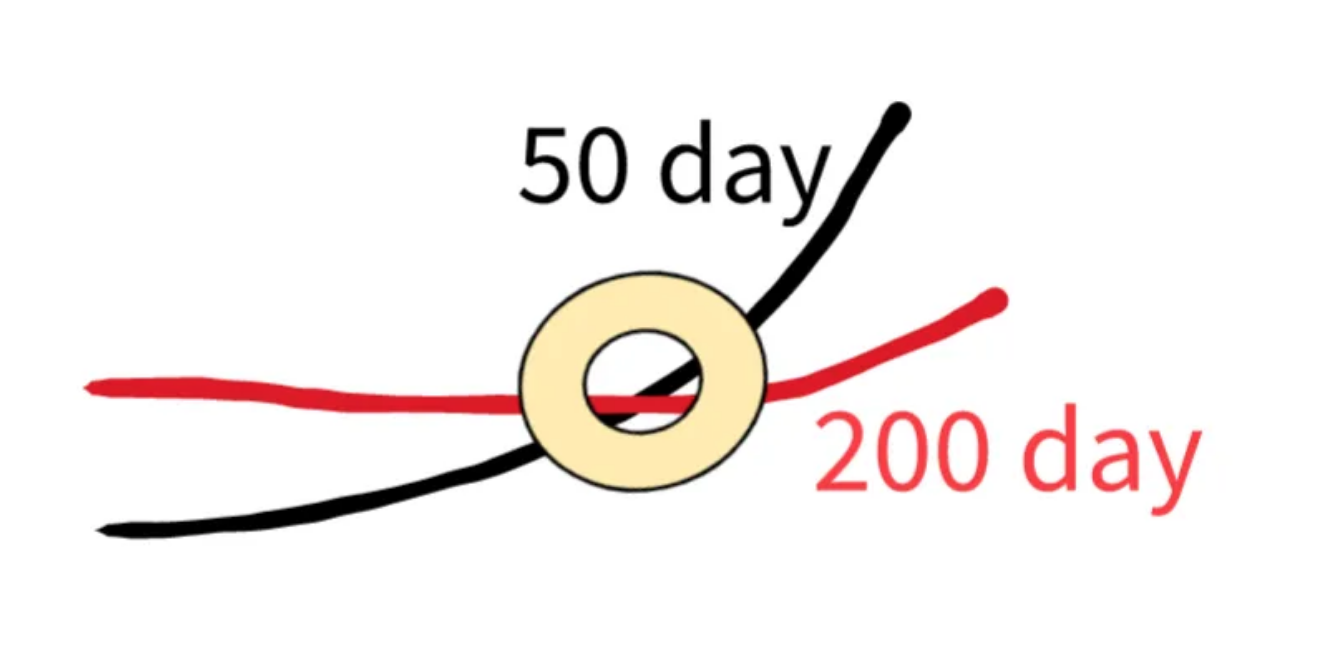

Briefly, trading golden cross patterns means buying when the short-term moving average moves above the long-term one.

A Golden Cross occurs when the 50-day crosses above the 200-day moving average.

Here is an illustration of how the golden cross looks like:

And here is how the golden cross looks in reality on a Bitcoin chart:

Ultra-long term crypto traders use the golden cross signal.

Usually, cryptocurrency traders are waiting for a golden cross to occur and then and looking for the price to make a dip and only then buying.

This aims primarily to minimise the possibility of a premature cross.

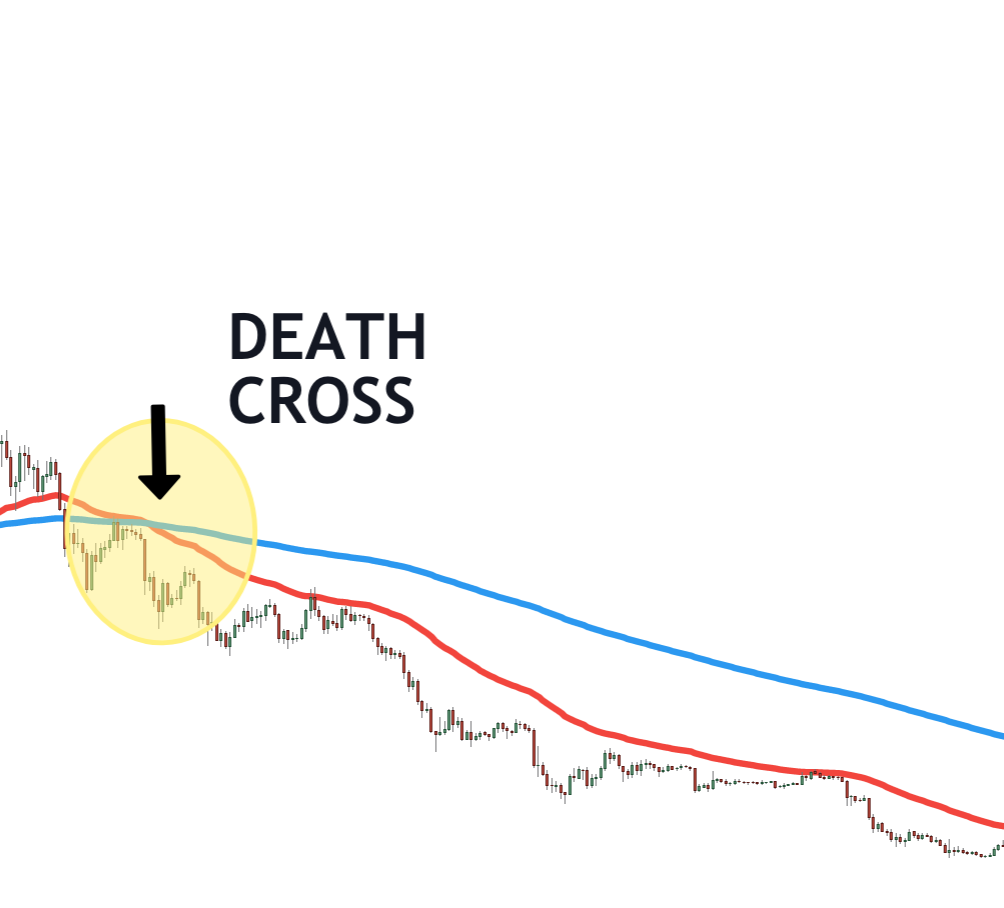

The Death Cross

The opposite of the golden cross is the death cross.

It occurs in bearish markets and in order to validate a death cross, crypto traders are looking for:

- 50-day moving average

- 200-day moving average

- 50-day crosses below the 200-day moving average

- Confirming the bearish trend

Here is an example of a death cross with Ethereum chart:

As you are already probably rightly guessing, a death cross has been definitely less popular than the golden cross trading strategy.

Crypto markets have been very bullish in recent years and trying to short them has proven a lot risker strategy than being long.

Nobody knows what the future holds, so it is good to know both strategies and employ them according to the relevant market conditions.

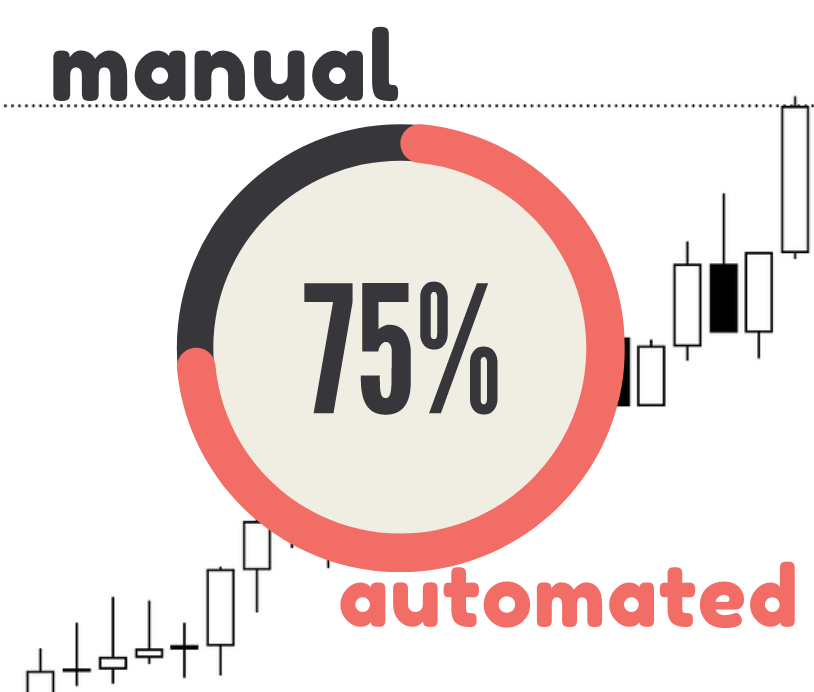

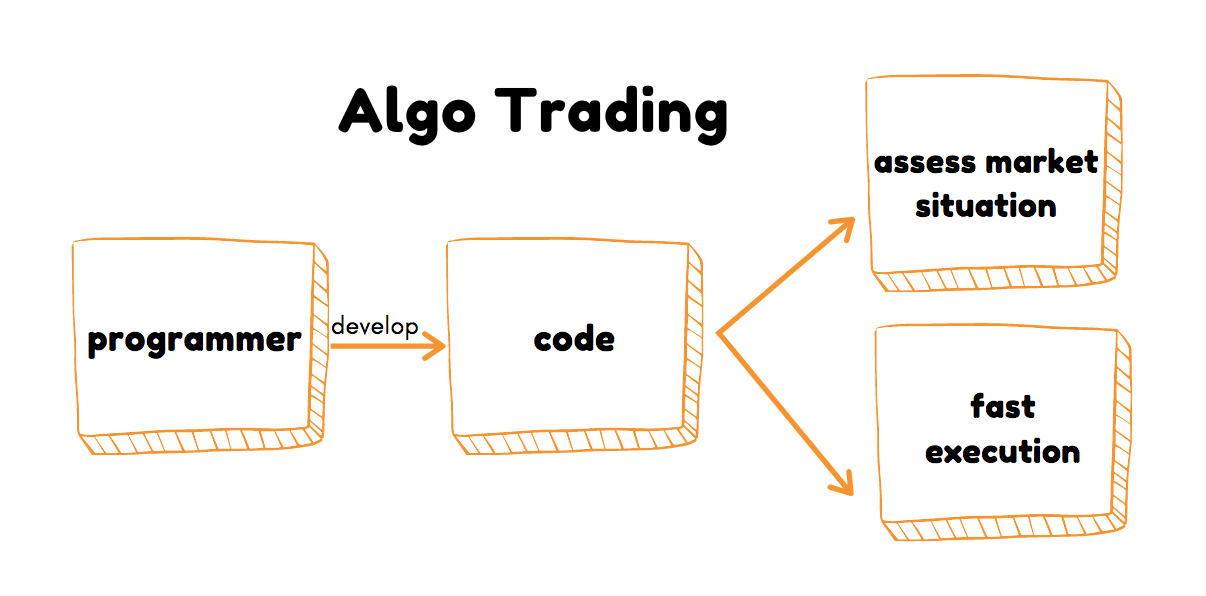

Crypto Trading Strategy #8 (Algo Trading)

Algo trading or also known as high frequency trading is one of the most complex ways to trade the cryptocurrency markets.

It requires programming skills and is employed by more sophisticated traders and investors.

Most trades last only a few seconds and this crypto trading strategy cannot be replicated by a human trader.

To fully understand its impact on the crypto markets and prices, imagine that over 75 percent of trading these days is automated.

It means, one way or the other, a robot, or computer, deals with the buying and selling of a cryptocurrency.

Usually automated trading systems are famous for great winning scores with very small profits.

Traders operating such crypto systems are betting on a large number of winners that will make up for the small profits made on each trade.

Here is a short illustration of how the process of developing such a trading system looks like:

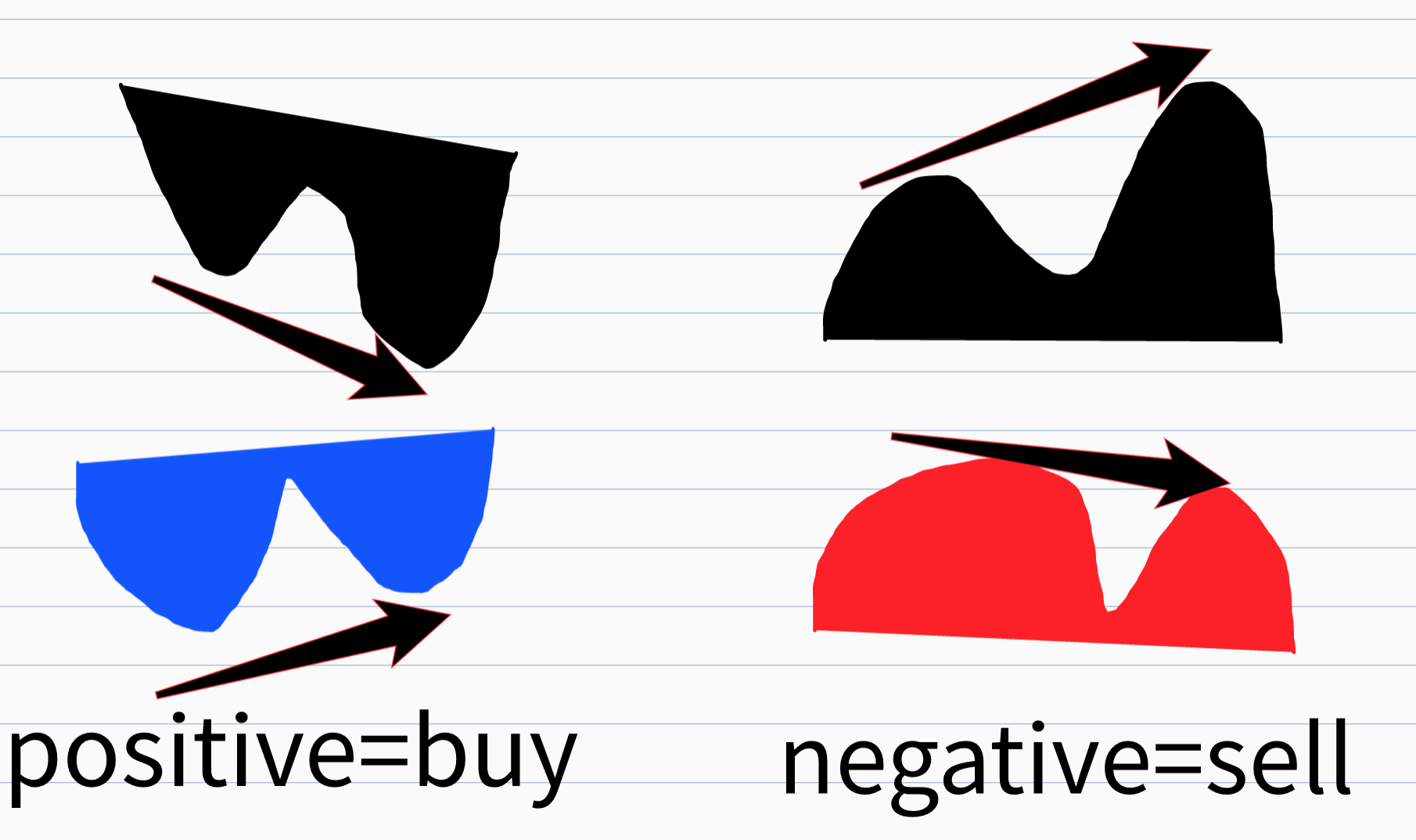

Crypto Trading Strategy #9 (Trading with Divergences)

One of the less used trading strategies with crypto is “trading with divergences”.

It is a very popular strategy in other trading realms like FX and CFDs, but I have not seen many traders employing it with crypto.

That does not make it less effective.

Quite the contrary, if less people are using it it is probably still a great niche to be filled.

Divergences is created when you see price moving in one direction and, typically an oscillating indicator, moving in a different direction.

The most used trading indicators for finding divergences are:

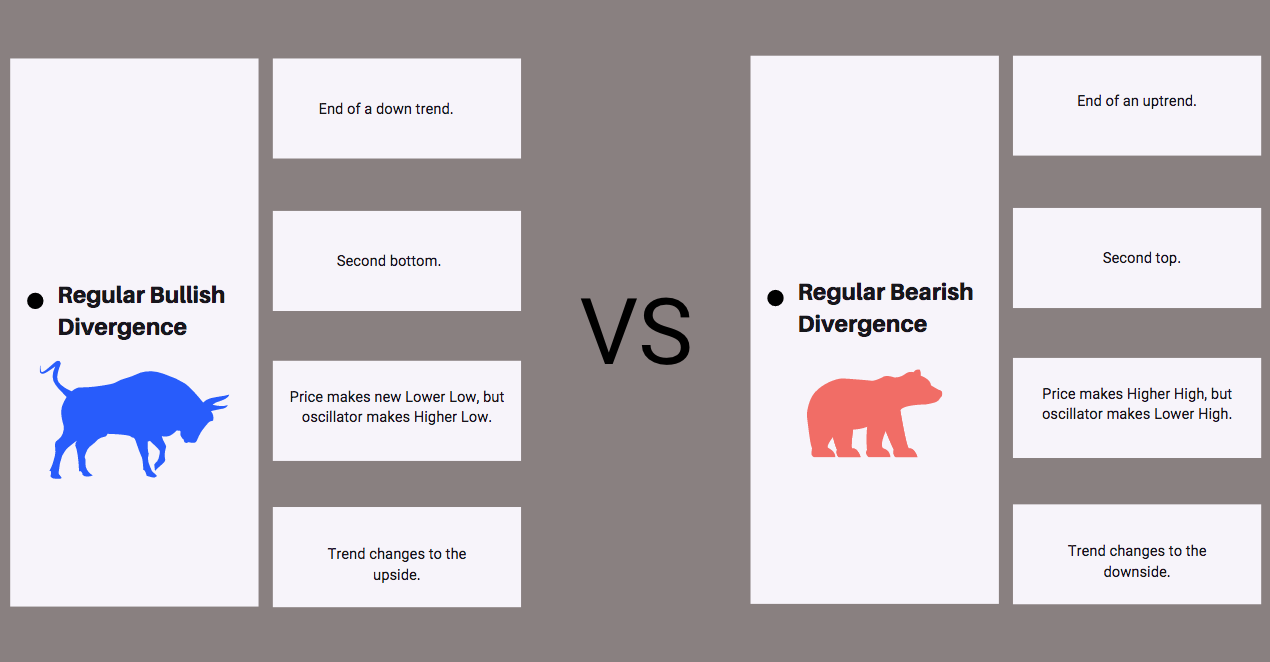

There are two types of divergences:

Positive Divergence (a.k.a. Bullish Divergence)

Negative Divergence (a.k.a. Bearish Divergence)

Here is an example of a Bullish Divergence:

Here is an example of a Bearish Divergence:

As you can see, the positive divergence is a bullish signal.

The negative divergence on the other side is a bearish signal.

There are other types of divergences such as Bullish Hidden and Bearish Hidden.

If you want to read more on trading with divergences, please visit my full article on Divergence HERE.

Just to sum up, here is a cheat sheet for trading with divergences:

Crypto Trading Strategy #10 (Fading Trading)

Fading the trade is another crypto trading strategy that a lot less traders are using.

It has its benefits but certainly drawbacks, too.

Fading the trade means trading against the trend.

This makes it one of the riskiest trading strategies.

We have two types of fading trading:

- Bullish

- Bearish

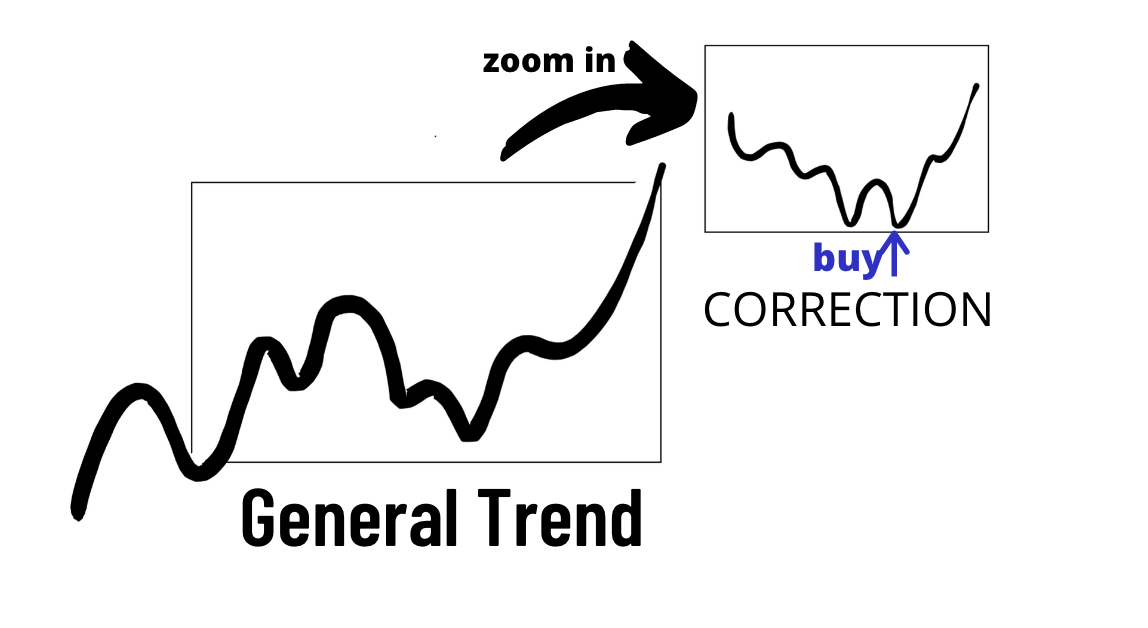

Here is an example of a bullish:

In this example, imagine a general bullish trend.

A good strategy for fading the trend is to wait for the bullish trend to make a correction (as shown above).

Then and only then open a trade in the direction of the general trend.

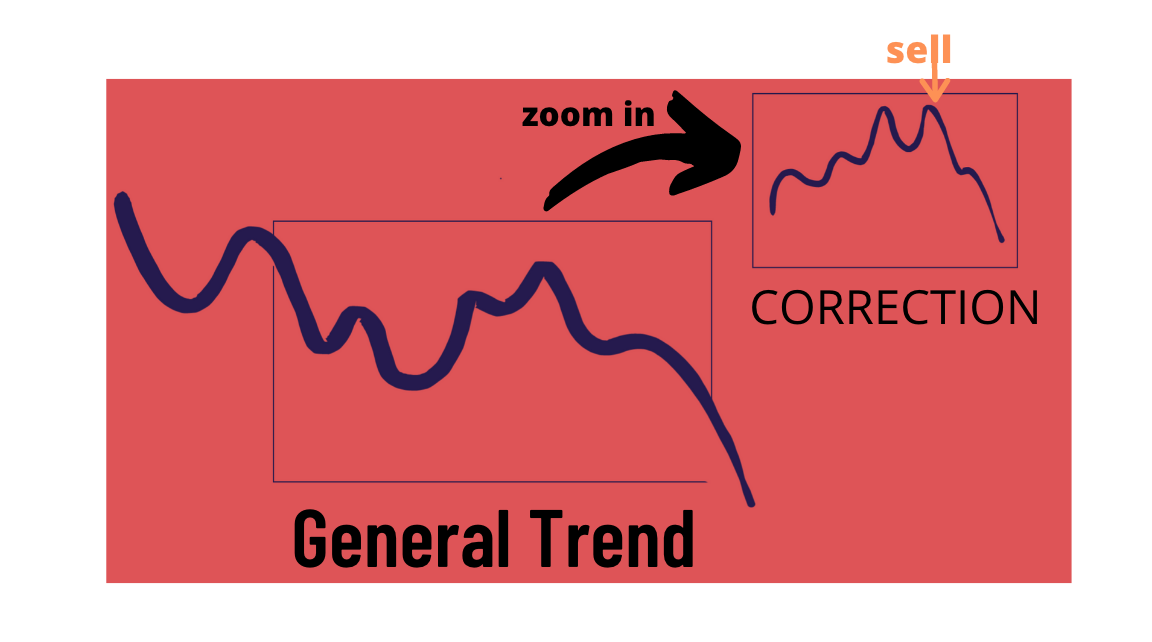

Another good crypto trading approach is to wait for a major bearish trend to get established and then sell on a pullback.

Here is an example of that scenario:

There is even a riskier approach, which is to try to short a cryptocurrency in a bullish trend.

And alternatively, trying to go long in a bearish trend.

Picking tops and bottoms has never been a great idea, even less so in crypto trading.

Conclusion

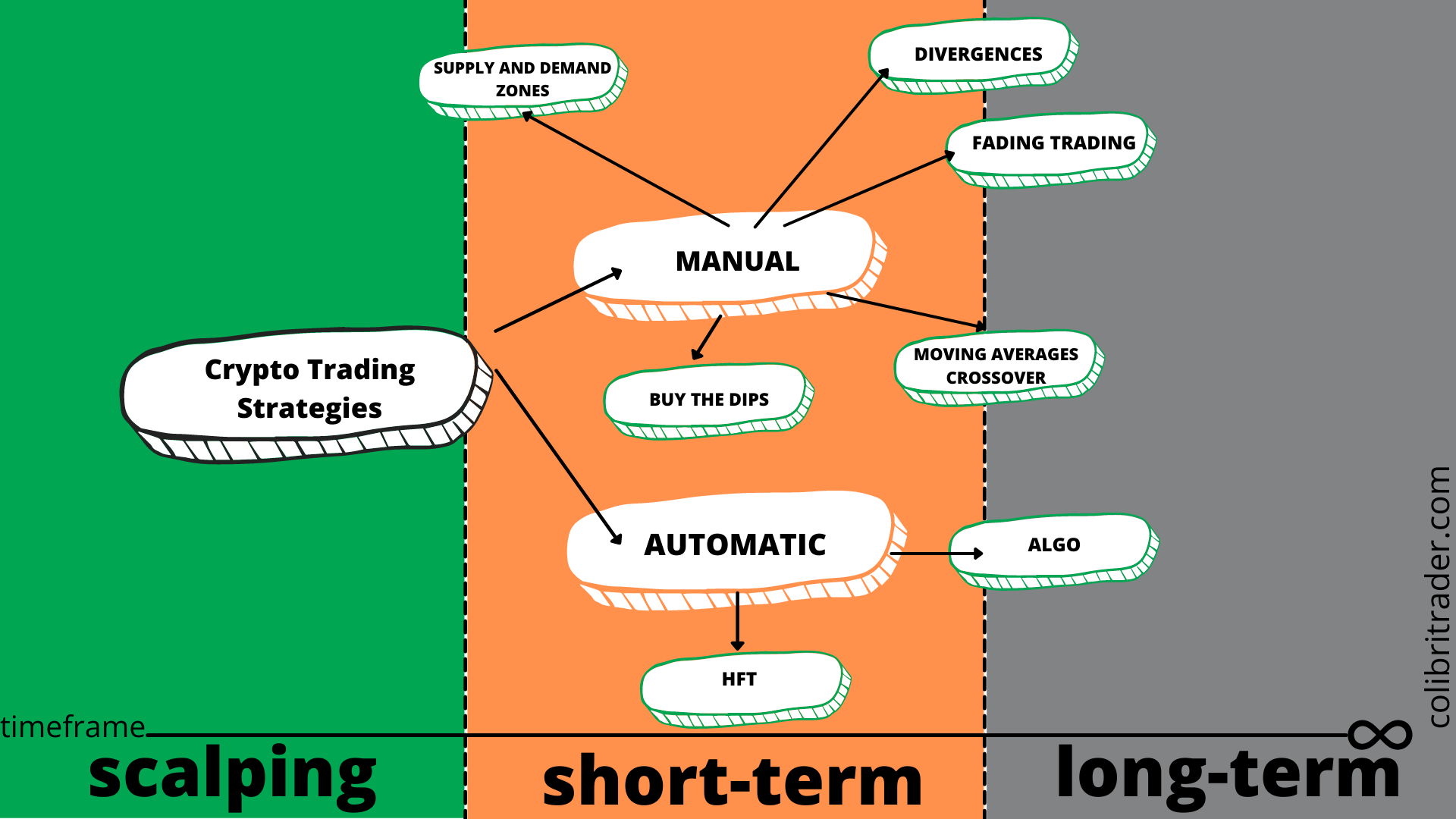

Instead of a conclusion, I would like to sum up the 10 crypto trading strategies I have covered in this article in a diagram.

You can download it and share it with other crypto trading enthusiasts or just print it off and use it as a reminder.

Bonus: Get 10% Off Our Partner’s Crypto Trading Course

Dear friends,

I have partnered with a crypto trading website and helped them create a crypto trading course.

The trading course (The Unicorn System) covers a trend-following trading system that has been tested on all major cryptocurrencies.

There is a 30-day money back guarantee and the voucher for all of my subscribers will give you an additional 10% off.

Here is the discount code: COLIBRI10

Alternatively, here is an excerpt from the Unicorn Crypto Trading System: