4H EURUSD Post-Analysis

4H EURUSD Post-Analysis

by: Colibri Trader

Dear Friends,

It was a quiet end of the week and a similar beginning. That is why I have decided to utilise the time and sum-up my last trade’s steps.

If you remember, I wrote about a potential EURUSD setup on the 20th of August (check HERE).

The daily chart was printing an inside day, which gave me a great reason to think of going long. What followed confirmed my initial plan and I did entered into a few long positions.

The ones amongst you that have taken my professional trading course would know why I have taken those trades. For the rest of you, they might be slightly unknown, but that’s why I will walk you through my last trades.

I hope you will appreciate the fact that I cannot go into as many details as I wish due to the inability to give you as many details as I have given you in my trading course. I hope this will still make you see the picture better than before.

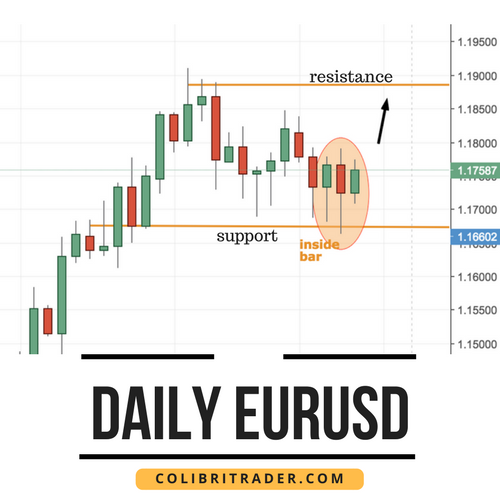

The Daily Picture

As you can see from the Daily screenshot above taken on the 20th of August, there was an inside day on a support level. This was a great starting point for a deeper analysis.

After zooming in on the 4H chart, I had a few great opportunities for long trades. Below you will find the 4H chart dissected into a few possible setups for long trades.

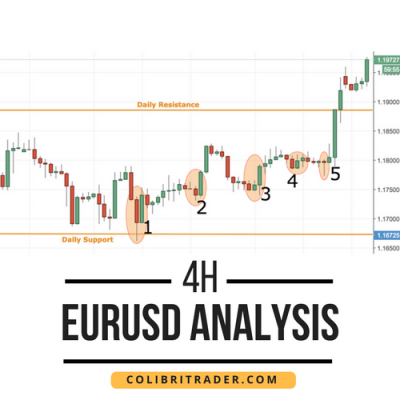

4 Hour Chart

After the inside bar on the daily chart the following 5 candlestick patterns formed on the 4H chart.

Pattern #1 Bullish Engulfing

The bullish engulfing candlestick pattern was the first one to set off a sequence of bullish candlestick patterns

Pattern #2 Bullish Engulfing

The second candlestick pattern is another bullish engulfing. This was the first one I took and it proved to be a successful one.

Pattern #3 Double Bullish Engulfing

This pattern is formed by three candles. The second and third candles are engulfing the first one leading to more buyers entering the buying spree. I missed this trade since I was not able to monitor at this time.

Pattern #4 Double Bullish Engulfing

This pattern followed a brief raise of EURUSD. It is the same as pattern #3 and indicated bullishness. Depending on where you have placed your stops here, you might get stopped out. I did take this pattern and got stopped out for a few pips.

Pattern #5 Pinbar

This candlestick is a pinbar. I did manage to take it, as well and it proved quite reliable. A lot more buyers joined the price rally and pushed EURUSD to a new high.

Sum-Up

From those 5 intraday formations I managed to take 3. Two resulted in great winners and one lost me a few pips. One trade was missed. All in all, a great sequence of trades that are running a cumulative of around 350 pips so far. There is no sign of weakness for the time being and I am letting them run.

Happy Trading,

Colibri Trader

p.s.

Don’t forget to check out my recent article on Fibonacci

or how Weaknesses Can Help You Make Money Trading